Home » Battery Materials » Pouch solid state battery becomes megatrends, aluminum plastic film demand increased

Pouch solid state battery becomes megatrends, aluminum plastic film demand increased

- The choice of pouch battery technology route

- Basic requirements for building aluminum-plastic film for consumer electronics

- Pouch power battery is the core driving force for aluminum-plastic film industry

- The pouch process is the best matching solution

- Calculation of space required for aluminum plastic film

As the last gold mine of the lithium battery industry, aluminum-plastic film is the key factor for the technical route of lithium power battery from hard shell to pouchage. This article will describe how the pouch battery, the downstream application of aluminum-plastic film, will boost the explosion of the aluminum-plastic film industry.

The choice of pouch battery technology route

Lithium-ion batteries can be divided into three types: cylindrical, square, and polymer pouchs according to their shape and packaging materials. Due to political factors, high cost and long research and development cycle, cylindrical and square batteries are the mainstream of power batteries in my country.

At the same time, a large number of spontaneous combustion incidents of electric vehicles have caused more or less psychological shadows for the public. Taking a cylindrical battery as an example, since the main heat source of the battery is located in the tab.

It is difficult for the cooling circuit laid under the battery pack to balance the temperature difference above and below the battery, so the cylindrical battery pack inherently has the disadvantage of being difficult to manage the thermal management of the BMS.

Coupled with the aging of the battery after years of use, the diaphragm of a battery is punctured under the influence of lithium dendrites, resulting in an internal short circuit, which is prone to domino-like thermal runaway, causing a chain reaction of the battery pack.

Now, in order to ensure the energy density of the battery pack, the arrangement between the cells is also very close, which once again increases the risk of thermal runaway. From this, we know that in addition to the safety of the single battery, the safety measures between the battery and the battery, that is, the overall battery pack, are also particularly important.

Since square and cylindrical batteries are packaged in a sealed hard shell, the accumulated heat cannot be released. Once the pressure inside the battery is too large, it will quickly cause an explosion.

The pouch battery is encapsulated in aluminum-plastic film, if the thermal runaway of the battery energy occurs, the pouch battery will deflate to form a battery bulge, reduce the internal pressure, and prevent the battery from exploding.

In addition to high safety, pouch lithium-ion batteries have comprehensive advantages in terms of energy density, cycle life, and flexibility:

Low internal resistance and high cycle life: The lamination process of the pouch battery is equivalent to the parallel connection of multi-pole pieces, and the internal resistance is significantly lower than that of other shapes of batteries, which can significantly reduce the self-consumption of the battery.

And make the battery have good cycle life and rate characteristics. The pouch battery has a 4%-7% decrease in decay per 100 cycles compared with the aluminum shell square battery.

Large battery capacity: The use of aluminum-plastic film for pouch lithium batteries reduces the application of structural parts, thus reducing the weight by about 40% compared to steel-shell lithium batteries. Under the same size, the capacity of the pouch battery is 10%-15% higher than that of the steel case battery, and 5%-10% higher than that of the aluminum case battery.

High design flexibility: thickness, shape, etc. can be customized according to customer needs. pouch batteries have shortcomings in terms of consistency and group efficiency, but the shortcomings are gradually being filled.

pouch batteries have no rigid shell protection, and external pressure can easily affect their electrochemical state, resulting in poor consistency. Due to the low strength of the aluminum-plastic film, a certain protective layer needs to be added, which makes the grouping efficiency lower than that of the square battery.

In recent years, the capacity increase of pouched single cells and the application of lightweight materials have further improved the grouping efficiency of pouched batteries. According to Chery New Energy’s data, its pouch group efficiency is expected to reach about 80%.

Basic requirements for building aluminum-plastic film for consumer electronics

The market demand for aluminum-plastic film is directly related to the demand for lithium batteries. The main downstream applications include 3C consumer goods, new energy vehicle power batteries and energy storage.

Smartphones are one of the main directions of 3C batteries. Combined with global mobile phone sales and single-unit battery capacity, the battery in the mobile phone field is about 30Gwh. As the penetration rate of smartphones has stabilized, the demand for aluminum-plastic films in this field has grown steadily.

The 5G era promotes the growth of smart wearables and various smart terminal products. Products such as TWS, tablet computers, notebook computers, and smart speakers have become the driving force for the growth of 3C batteries. In addition, products such as power tools, small household appliances, and electric two-wheelers further increased market demand.

With the expansion of functions, performance improvement and portability requirements of products such as mobile phones and notebook computers, downstream customers have put forward higher requirements for battery capacity, flexibility and cycle life, and pouchs have achieved rapid increase in penetration due to their performance advantages. .

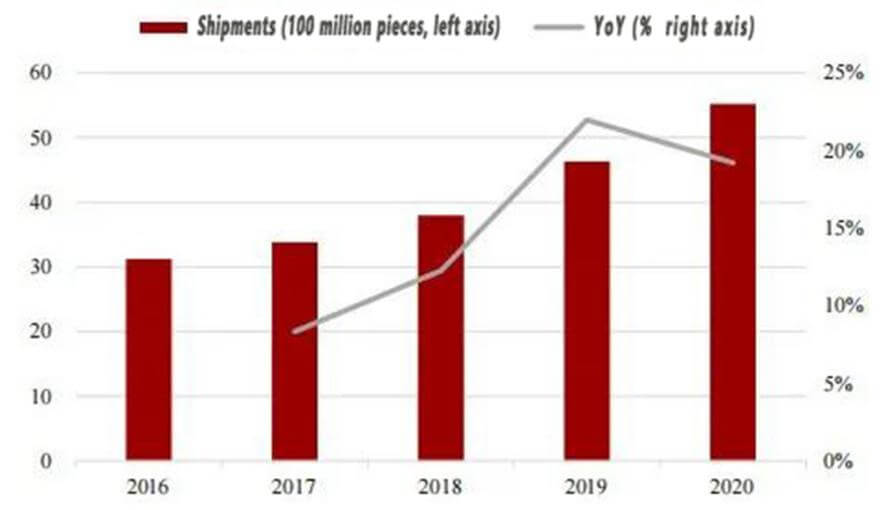

In 2020, among the lithium batteries for mobile phones/laptops/tablets, the penetration rate of pouch batteries has reached 87.5%/88.2%/99.6%. According to EV Tank data, the global shipment of small pouch lithium-ion batteries in 2020 is 5.52 billion, a year-on-year increase of 19%.

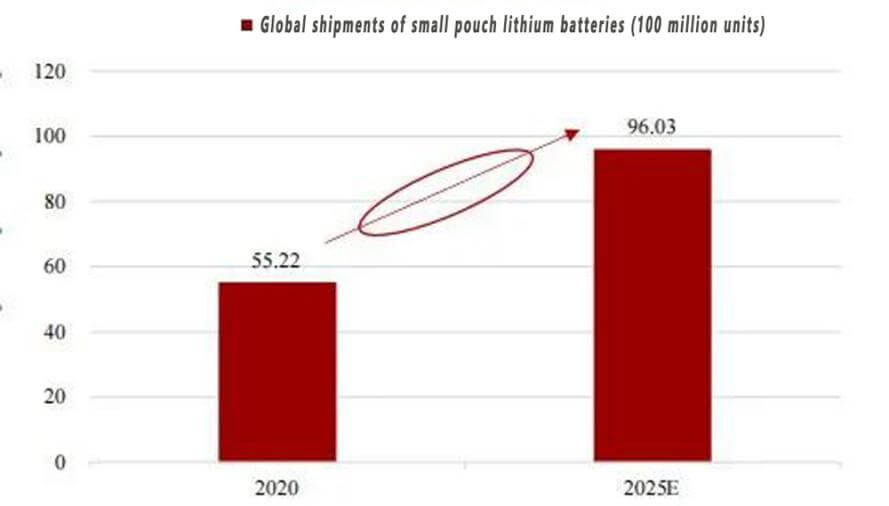

We expect that in the future, the demand for portability, thinness, and high capacity will increase the penetration rate of pouch batteries, which in turn will drive the growth of aluminum-plastic film demand. According to the “White Paper on the Development of China’s Small pouch Li-ion Battery Industry (2021)” published by EVTank et al.

It is estimated that by 2025, the global shipment of small pouch lithium-ion batteries will reach 9.60 billion, with a compound annual growth rate of 11.70%. The demand for aluminum-plastic film may reach 240 million square meters in 2025, with an average annual compound growth rate of 6%.

Looking forward to 2025, EVTank predicts that the global shipment of small pouch lithium-ion batteries will reach more than 9.60 billion. In terms of market size, in 2020, the global market size of small pouch lithium-ion batteries will exceed 100 billion yuan for the first time, reaching 106.03 billion yuan

Pouch power battery is the core driving force for aluminum-plastic film industry

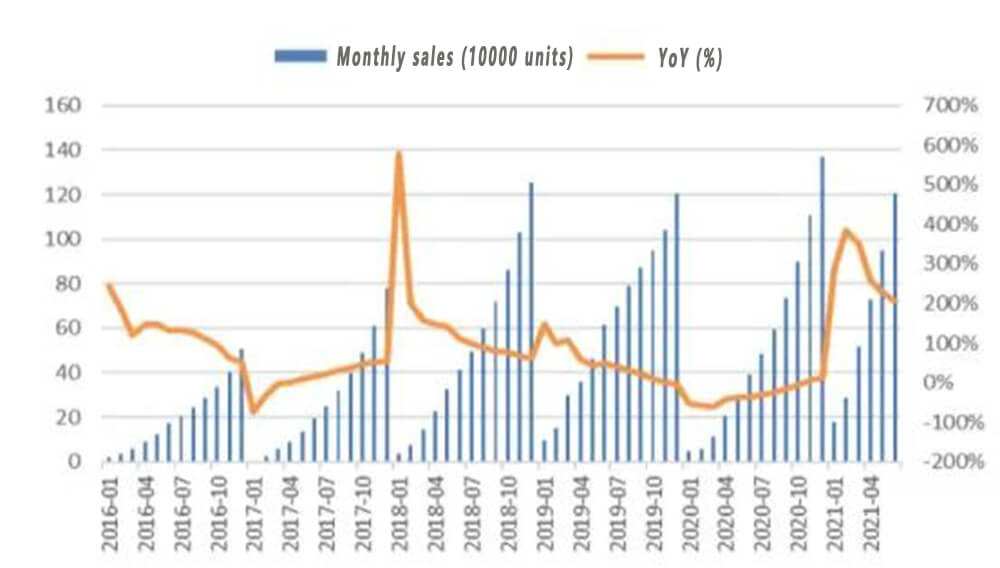

The development of new energy vehicles will become an important driving force for the improvement of the prosperity of the aluminum-plastic film industry. According to the statistics of the China Association of Automobile Manufacturers, in the first half of 2021, the production and sales of new energy vehicles will be 1.215 million and 1.206 million respectively, an increase of 2 times year-on-year.

Among them, the production and sales of pure electric vehicles were 1.022 million and 1.005 million, an increase of 2.3 times and 2.2 times year-on-year, respectively, and the production and sales of plug-in hybrid vehicles were 192,000 and 200,000, an increase of 1 and 1.3 times respectively.

In addition, the global sales of new energy vehicles also showed rapid growth. According to industry data released by EVTank, the global sales of new energy vehicles will be about 3.31 million in 2020, and Europe has become an important growth point for global new energy vehicle sales. Looking forward to 2025, EVTank predicts that global sales of new energy vehicles are expected to reach 16.4 million units, a year-on-year increase of 395.5% compared to 2020.

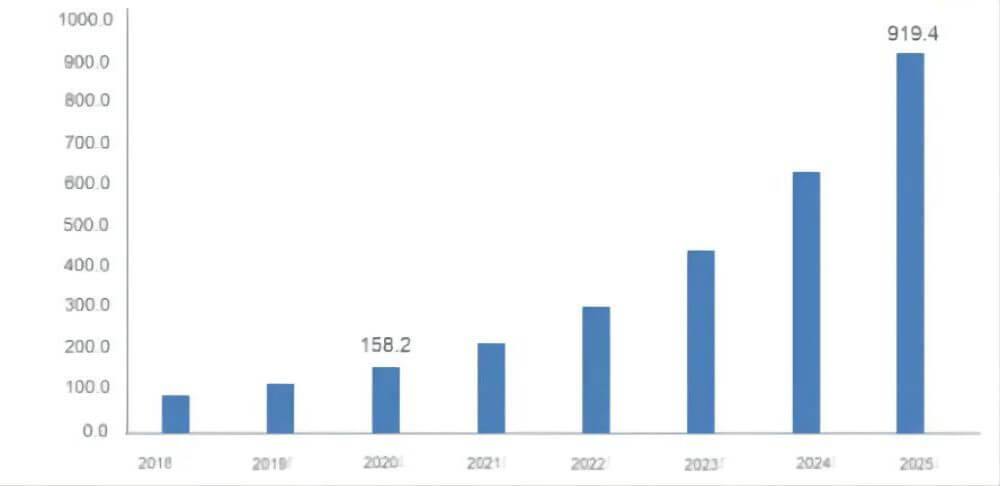

At present, the installed capacity of new energy vehicle batteries per vehicle ranges from 50GWh to 75GWh. Combined with the installed capacity per vehicle and global sales of new energy vehicles, the global shipments of new energy vehicle power batteries in 2020 will be about 158.2 GWh.

Looking forward to 2025, global power battery shipments are expected to reach 919.4Gwh. China’s power battery shipments are about 80Gwh in 2020, and China’s shipments account for 50.57% of the world’s shipments.

According to China’s planning requirements for each stage of power batteries in the “Energy-saving and New Energy Vehicle Industry Development Plan (2012-2020)”, “Energy-saving and New Energy Vehicle Technology Roadmap” and other policies. Mainly divided into three stages:

1) In 2020, it should meet the needs of pure electric vehicles with a distance of more than 300km: the energy density of a single unit reaches 350Wh/kg and 650Wh/L, the specific power of a single unit reaches 1000W/kg, the unit cost is reduced to 0.6 yuan/Wh, and the cycle life is 2000 times.

2) In 2025, it should meet the needs of pure electric vehicles with a distance of more than 400km: the energy density of a single unit will reach 400Wh/kg and 800Wh/L, the specific power of a single unit will reach 1000W/kg, the unit cost will be reduced to 0.5 yuan/Wh, and the cycle life will be 2000 times.

3) In 2030, the demand for pure electric vehicles over 500km should be met: the energy density of a single unit reaches 500Wh/kg and 1000Wh/L, the unit cost is reduced to 0.4 yuan/Wh, and the cycle life is 3000 times.

From the perspective of the technical idea of battery capacity density improvement, the research and development and selection of new materials are important methods. As the material choice to reduce the overall quality of the battery cell, the aluminum-plastic film is expected to continue to increase in the future penetration rate of the pouch battery technology route. The aluminum-plastic film is an indispensable link for battery manufacturers to manufacture pouch batteries.

The pouch process is the best matching solution

At present, the two mainstream routes in the industry are lithium iron phosphate and ternary batteries, but neither can escape the two issues of safety and cruising range. In the face of these two problems, solid-state batteries are the most recent way.

Specifically, on the one hand, the safety performance of liquid batteries has always been a major focus of the industry. In the field of traditional liquid batteries, pouchs have not been applied on a large scale due to factors such as leakage defects and insignificant advantages in system-level energy density. However, in solid-state battery systems, the defects of pouchs will gradually disappear. The reasons are as follows:

①The vast majority of cylindrical or square batteries use the winding process. Due to the poor flexibility and mechanical properties of the solid electrolyte, the winding cannot be used, but the form of lamination can only be used. The pouch has advantages in the form of stacking of pole pieces.

② Lithium batteries are always accompanied by volume changes during the charging and discharging process, and the flexibility of the aluminum-plastic film is better, which coincides with the pouch route.

③Compared with square shells and cylinders, the aluminum-plastic film is lighter in weight, and the energy density advantage of solid-state batteries will be further magnified.

④The electrolyte content in semi-solid and all-solid-state batteries is very small, and there is no need to worry about leakage when using pouchs.

On the other hand, the Ministry of Industry and Information Technology’s “Made in China 2025” proposes that by 2025/2030, the energy density of my country’s power battery cells needs to reach 400Wh/kg and 500Wh/kg respectively.

However, even a liquid battery that uses a silicon-based negative electrode to greatly increase the energy density is difficult to cross the “hurdle” of 500Wh/kg. The solid-state battery can provide an energy density of about 300-400Wh/kg, far exceeding that of conventional batteries.

From this point of view, pouchs are an inevitable choice for solid-state batteries.

At present, in the automotive industry, a large number of electric car companies continue to bet on solid-state battery technology.

Mercedes-Benz announced that it is making a strategic investment in the US solid-state battery start-up FactorialEnergy, amounting to “up to more than 1 billion US dollars”, this investment is aimed at accelerating its development in the field of solid-state batteries.

“We plan to test prototype batteries as early as next year and integrate solid-state battery technology into a certain number of vehicles within the next five years.”

After reaching a strategic cooperation with Factorial Energy, Mercedes-Benz officially stated that through this cooperation, the company is taking research and development in the field of promising solid-state batteries to a new level. “

In addition to Mercedes-Benz, BAIC Blue Valley, Dongfeng, Weilai and other car companies have also released related semi-solid battery on-board plans.

On December 13, 2021, BAIC Blue Valley stated on the interactive platform that the company has now completed the development of the second-generation solid-state battery cell, the battery system bench test verification, and the vehicle (ARCFOX αT) installation verification.

The planned third-generation solid-state battery technology plans to match the new models of the Jihu brand, and develop a solid-state battery with high safety (no fire) and high energy density (cell energy density of 360Wh/kg, which is currently in the process of model project approval.

The Dongfeng E70 equipped with Ganfeng Lithium’s semi-solid battery is expected to be delivered before the Spring Festival, and the new NIO model ET7 equipped with a semi-solid battery pack will also be unveiled next year.

In addition, BYD, SAIC, FAW, Great Wall Motor, etc. are all developing solid-state battery technology. Multinational companies such as Toyota, Honda, Hyundai, BMW, and Volkswagen have also participated in the research and development of solid-state battery technology in various ways.

From the perspective of battery companies, some companies have entered the pilot stage of solid-state lithium-ion batteries (semi-solid-state batteries) and are developing all-solid-state batteries.

For example, CATL said that the company has always paid close attention to and carried out technical layouts for next-generation batteries such as cobalt-free batteries, all-solid-state batteries, and rare metal-free batteries and emerging technologies in the industry.

Guoxuan Hi-Tech is currently conducting technical research on solid-state batteries, and plans to introduce relevant technologies within two years, and gradually realize iterative upgrades to produce high-safety solid-state batteries. SVOLT plans to make a fourth-generation, all-solid-state electrolyte battery by the end of 2030.

At present, major battery manufacturers have deployed solid-state batteries. There are more and more solid state battery companies. At present, from the products or samples announced by the known solid-state battery research and development companies, almost all of them use the pouch form.

Calculation of space required for aluminum plastic film

Aluminum-plastic film is a necessary material for the production of pouch batteries, so the demand for aluminum-plastic film is closely related to the output of pouch batteries.

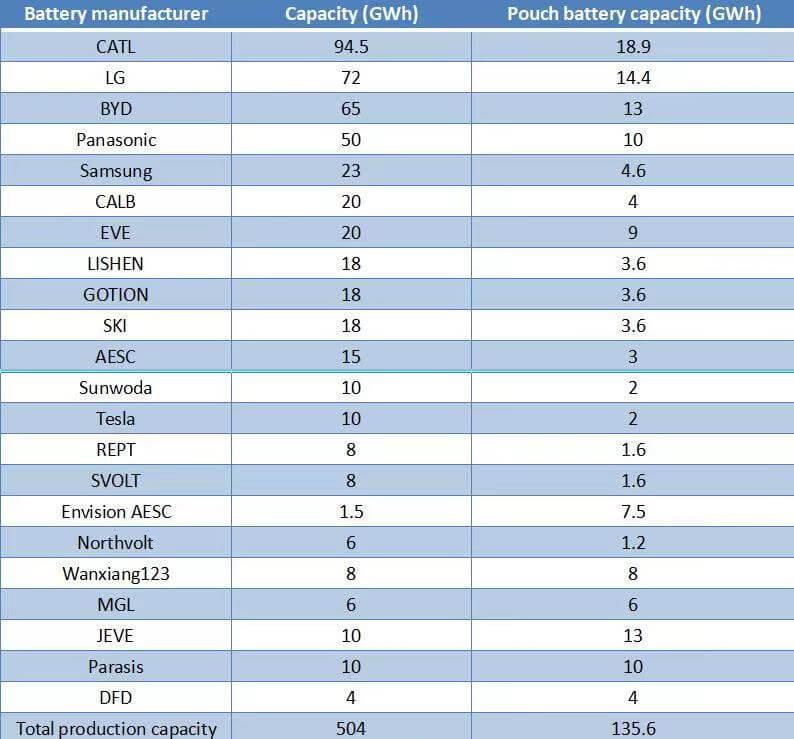

According to public information, at present, major battery manufacturers produce a small amount of pouch batteries, and there are also leading pouch battery companies such as Farasis, DFD, Gateway Power, MGL, Wanxiang 123, etc. specializing in pouch batteries. production development.

We calculate the production capacity of pouch batteries disclosed in the public information of major companies and according to the fact that the production capacity of pouch batteries accounts for 20% of the total production capacity of major battery manufacturers.

According to the production capacity of each manufacturer in 2021, the total production capacity of pouch batteries can reach 135.6GWh.

Since the demand for aluminum-plastic film for a single GWh of pouch power battery is about 1.2 million square meters, the demand for aluminum-plastic film according to the current production capacity is about 162.72 million square meters.

According to the production capacity of domestic aluminum-plastic film companies in 2021, the total production capacity of aluminum-plastic film provided to pouch power batteries is 150 million square meters. It is far from meeting the demand for aluminum-plastic film for pouch power batteries.

With the continuous expansion of battery manufacturers in the future, the technical route of pouch batteries is gradually recognized by new energy vehicle companies and solid-state batteries will be mass-produced from 2025 to 2030. Therefore, the demand for aluminum-plastic film will explode in the next five years.