Pumped storage power plant report - indispensable stabilizer

The basic introduction of pumped storage

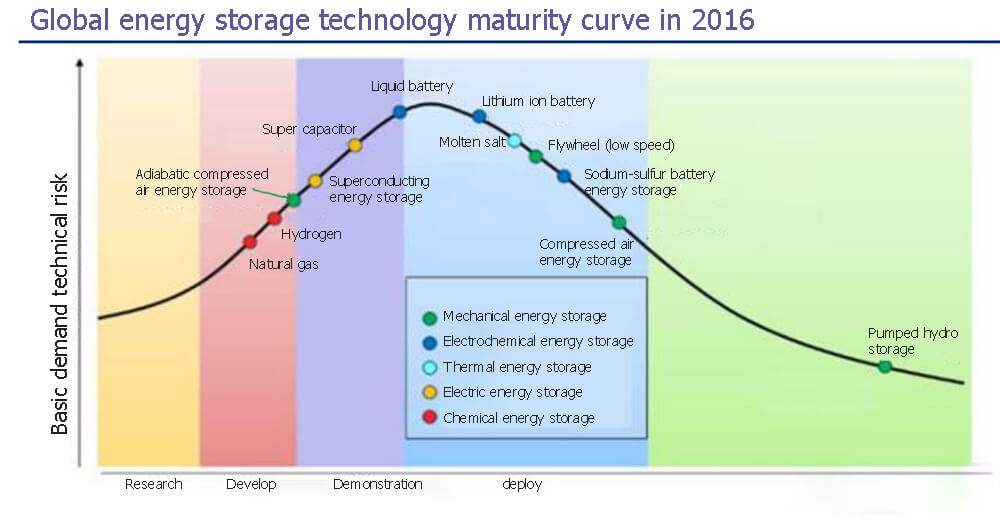

Pumped storage power plant is the most widely used energy storage solution in the world. Broadly speaking, energy storage can be divided into three categories: electric energy storage, thermal energy storage and hydrogen energy storage, among which electric energy storage is currently the most important form of energy storage. Electric energy storage can be divided into electrochemical energy storage and mechanical energy storage according to different storage principles.

1) Electrochemical energy storage should include lithium ion batteries, lead-acid batteries and sodium-sulfur batteries.

2) Mechanical energy storage mainly includes pumped water storage, compressed air energy storage and flywheel energy storage.

According to statistics, by the end of 2020, the cumulative installed capacity of energy storage projects in operation around the world was 191.1GW, of which the cumulative installed capacity of pumped storage power plants reached 172.5GW, accounting for more than 90%, followed by electrochemical energy storage, accounting for about 7.5%.

Basic principles

The basic principle of pumped storage power plant is the mutual conversion of gravitational potential energy and electric energy, which is mainly composed of two reservoirs with different altitudes, pumps, turbines and supporting water delivery systems.

When the demand for electricity is low and there is a surplus of electricity, electricity is used to pump water from reservoirs at lower altitudes to reservoirs at higher altitudes, and temporarily convert excess electricity into potential energy for storage.

When the demand for electricity is high and there is a shortage of electrical energy, the water in the high-altitude reservoir is released to return to the low-altitude reservoir and push the turbine to generate electricity to convert potential energy into electrical energy.

Pumped-storage power plants can be divided into pure pumped storage power plants and hybrid pumped storage power plants. The main difference lies in whether there is natural runoff inflow and whether natural runoff can be used to generate electricity.

Pure pumped-storage power have no or only a small amount of natural runoff, and their operation is mainly through the water recycling of upper and lower reservoirs. To offset the loss of evaporation and seepage, a small amount of water needs to be supplemented;

The upper reservoir of the hybrid pumped storage power plant has natural runoff, which can not only use the river runoff for conventional power generation, but also meet the needs of peak regulation, frequency regulation, and phase regulation.

The hybrid pumped storage power plant is equivalent to adding a reversible unit and a pumping pump on the basis of a conventional hydropower station, so that the generated electrical energy can be stored and converted into potential energy.

Conventional hydropower stations can be developed through reconstruction and pumped storage power plant. There are usually three types of reconstruction methods: combination of upper storage, pump expansion and integrated reconstruction.

Comparison of energy storage schemes

According to application scenarios, energy storage solutions can be divided into three categories: grid side, power supply side and user side. In different scenarios, energy storage plays different functions:

1) Power generation side: mainly to solve problems such as power deviation and output fluctuation. Common solutions include thermal power flexibility transformation, integration of wind power and storage, etc.;

2) Grid side: The main value is reflected in alleviating the power gap, participating in grid peak regulation and frequency regulation, and enhancing grid reliability. Pumped storage is the main solution for grid side energy storage;

3) User side: On the user side, energy storage is the main means to achieve time-of-use electricity price management, and can also be used for capacity management and power quality regulation. Possible solutions include electrochemical energy storage, energy storage participation in demand-side response regulation (virtual power plants) 1) etc.

Analysis of the advantages and disadvantages of pumped storage power plant

Mechanical energy storage is currently the most mature energy storage technology, and pumped storage power plant is an example of mature applications, accounting for more than 90% of the world’s grid-connected energy storage devices.

Electrochemical energy storage has great potential, and in recent years with rapid technological progress, it has gradually entered the stage of industrialization from the stage of development and demonstration. Direct energy storage forms such as superconducting and supercapacitor energy storage are at an earlier stage and are still being researched and piloted.

In addition to mature and reliable technology, pumped-storage power plants also have significant advantages such as large capacity, good economy, and flexible operation. The pumped storage power plant has a large single-machine capacity, and the general scale is between tens of thousands of kilowatts to hundreds of thousands of kilowatts.

At present, the installed capacity and energy storage capacity of Hebei Fengning pumped storage power plant have reached 3.6 million kilowatts, with a total installed capacity of 3.6 million kilowatts and a full utilization hour of 10.8 hours, which can provide a maximum adjustment equivalent to one-third of the Three Gorges Hydropower Station. contribute.

In addition, due to the relatively small loss of water evaporation and infiltration, the energy storage period of the pumped storage power plant system is large, ranging from a few hours to more than ten years. level.

As a mechanical energy storage, the pumped storage power station has a stable operation efficiency at a high level, and will not be troubled by problems such as energy attenuation caused by long-term use. It has a long service life and no pollution. Based on its mature technology, many cycles, long service life and low loss, the pumped storage power station has a great advantage in the cost of electricity per kilowatt hour.

The main disadvantage of pumped storage power plant is that it has higher requirements on geographical conditions and a long construction period. There needs to be a sufficient height difference between the upper and lower reservoirs of the pumped storage power plant to provide large potential energy, and the current average height difference is between 200 and 600 meters;

In addition, a larger area is needed to build a large enough reservoir. The total storage capacity of the small and medium-sized pumped storage power plant is less than 100 million cubic meters, while the first phase of the Fengning pumped storage power plant, the world’s largest, has a storage capacity of more than 1.1 One hundred million cubic meters.

Since the areas with large height difference are generally dominated by mountains and forests, the construction of pumped storage power stations is difficult to a certain extent. The period from planning to completion is long (generally more than 6 years). The site location is generally remote and there is a certain distance from the load center.

Quantitatively compare the cost advantages of pumped storage power plant

The pumped storage power plant is more economical than other energy storage solutions. As an important part of the power system, in addition to safety and efficiency, the economic benefit of energy storage is an extremely important consideration in its selection and application.

Based on a series of assumptions about the investment cost, power generation efficiency, and maintenance cost of various energy storage power plants, the pumped storage power plant has the lowest cost per kilowatt-hour.

Combined with practical applications, after properly adjusting the calculation parameters, the kWh cost of pumped storage can be reduced to about 0.3 RMB/kwh, which is significantly lower than other schemes such as compressed air energy storage and electrochemical energy storage.

One of the important criteria for evaluating whether energy storage is economical is the peak-valley price difference. According to the North Star Energy Storage Network, in 2021, the peak-valley price difference of general industrial and commercial industries in most provinces or municipalities across the country will exceed 0.3 RMB/KWh, and about half of the regions will exceed 0.5 RMB. /kwh.

And the areas with high peak-to-valley price difference are mainly concentrated in economically developed areas such as Beijing, Guangdong, and the Yangtze River Delta. The economy of pumped storage power plant application can be better reflected, and the current cost of electrochemical energy storage is still more than 0.5 yuan. /kwh or more.

It should be noted that, due to the rapid iteration of new energy storage solutions such as compressed air and electrochemical energy storage, and the gradual maturity of the industry, the cost decline curve is significantly steeper than that of pumped hydro storage.

The good economic benefits of pumped storage power plant mainly come from its long service life, moderate operation and maintenance cost, relatively low investment cost and high conversion efficiency.

In its kWh cost structure, the two highest proportions are the initial investment cost and the charging cost. The initial investment cost is difficult to reduce. Therefore, improving the use efficiency of pumped storage and reducing the charging cost are the main cost reduction methods for pumped storage power stations.

With the continuous advancement of technology, electrochemical energy storage has great room for improvement in terms of initial investment cost and cycle times.

However, considering the huge scale and urgency of energy storage demand, we believe that pumped storage power stations will play an important role in the energy storage system in both the short-term and the medium-to-long term.

The double-carbon era begins

Insufficient demand and cost alleviation are the factors affecting the development of pumping and storage in the past

Pumped hydro storage is one of the earliest energy storage methods in the world, and the development of various countries is driven by demand.

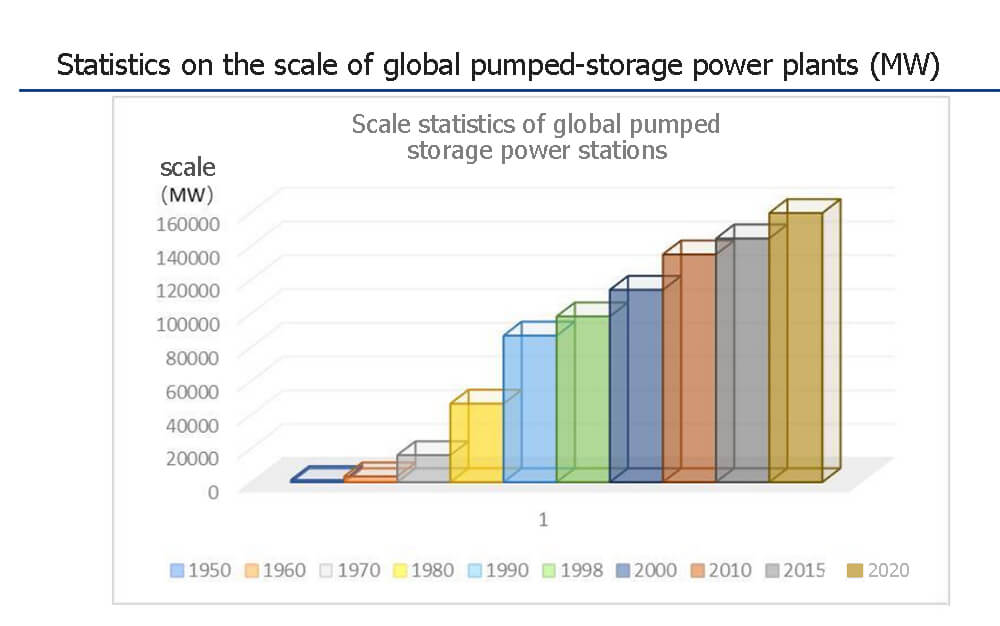

As early as the 1950s, the development of pumped storage power plants had already started, but due to immature technology and insufficient demand, the average annual newly installed capacity was only about 200MW.

In the 1960s, the economies of developed countries such as the United States, Europe and Japan experienced rapid economic growth. After the construction of conventional hydropower stations was relatively abundant, the demand for system peak shaving and backup power gradually increased, and the role of pumped storage power plants began to emerge, which began to flourish.

In ten years, the world’s total installed capacity has increased from 3,500MW to 16,010MW. After that, the two oil crises in the 1970s led to the reduction of the proportion of oil-fired power plants, the acceleration of the construction of nuclear power plants, and the decline of the proportion of conventional hydropower, which in turn led to insufficient peak-shaving capacity of the power grid, and the demand for pumped storage power plants increased rapidly.

After the 21st century, the demand for pumped storage power stations in Western countries gradually slowed down, while the pumped storage power plants in China, South Korea, India and other Asian countries began to develop rapidly. In 2017, China surpassed Japan for the first time to become the country with the largest pumped storage power station in the world.

China’s pumped storage power plant started late, and the demand and electricity price mechanism are the main factors restricting the development of pumped storage.

Before the 1970s, China’s pumped storage has been in exploration and experimentation.

After the 1980s, the rapid economic development has brought about an increase in power demand, and the large-scale construction of nuclear power plants has led to the problem of insufficient power supply-side adjustment capabilities. The technology is not mature, and the design and manufacture of the unit is heavily dependent on imports.

After 2000, the power load increased rapidly, the demand for peak shaving increased, and the construction of pumped storage energy also accelerated. From 2000 to 2010, 8990MW of new pumped storage power stations were put into operation nationwide. It has also gradually matured. At present, the design, construction and supporting equipment manufacturing of China’s pumped storage power plants have reached the world’s advanced level.

However, from a total point of view, by 2020, the installed capacity of pumped storage power plants in China will only account for only 1.4% of the total installed capacity of power sources, which is still far from the level of 4% to 8% in developed countries such as Europe and Japan.

There are two main reasons:

1) Insufficient demand. In the past, most of the electricity contribution came from thermal power. Although the power consumption continued to increase, the thermal power supply was stable, and the hydropower itself had the function of peak regulation and frequency regulation. The power grid’s demand for energy storage was not very urgent;

2)Due to the problem of the electricity price mechanism, the cost of pumped storage power plants has been unable to be transmitted smoothly, and the willingness to invest in the power grid is not strong. In addition, the profit of pumped storage power plants and the operating profit of the power grid are calculated in a bundled manner, resulting in low participation of social capital.

The demand for pumping and saving further expands

1. Energy structure transformation promotes the growth of energy storage demand

The proportion of thermal power installed capacity in the country continues to decrease, but the dependence on power generation is still high.

Since the 13th Five-Year Plan, the proportion of thermal power installed capacity in the country has decreased year by year, and the proportion of cumulative installed capacity in 2021 has dropped to less than 55%, but power generation is still highly dependent on thermal power.

In 2021, its power generation will account for 67.4%, while hydropower, wind and solar power, and nuclear power will only account for 16%, 12%, and 5%. Besides hydropower, almost all other new energy power sources have the problem of unstable power generation. With the further increase in the proportion of new energy power in the future, the power grid will face greater challenges.

Referring to related articles, taking the cold wave weather on January 7 as an example, according to the output of different power sources, it is estimated that the national power supply and power demand under extreme weather are only barely balanced. If the actual power transmission and the power distribution in each province are considered , the electricity situation may be more stressful.

2. The mid- and long-term plan for pumped hydro storage was introduced

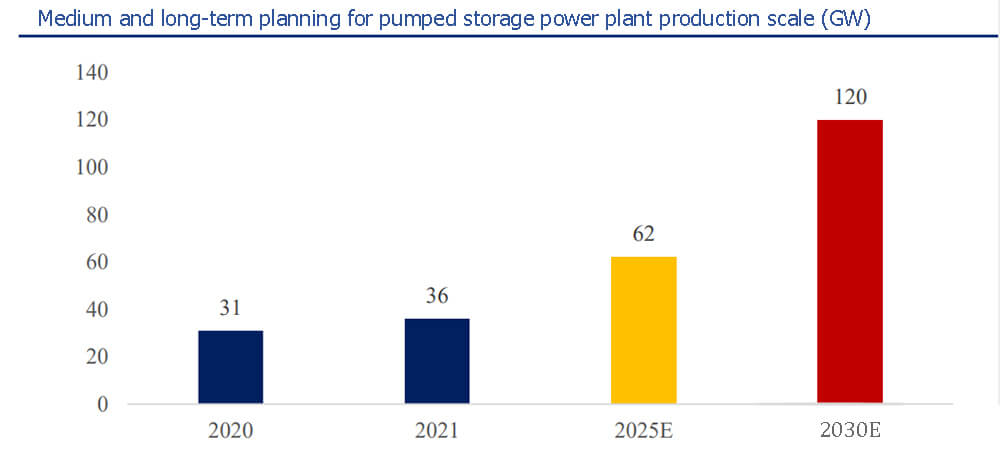

On September 17, 2021, the National Energy Administration plans to propose that the national pumped storage and production scale will reach 62GW and 120GW in 2025 and 2030, respectively, that is, double the 14th and 15th five-year periods.

At the same time, the plan also emphasizes the need to strengthen the project layout and reserve. The scale of key implementation projects and reserve projects in the medium and long-term plan are 421GW and 305GW respectively. The total scale is much larger than that of the 2030 plan, and the project reserve is sufficient.

It is estimated that the total investment in the next three years will be nearly 170 billion yuan. According to the National Energy Administration, as of 2021, the scale of pumped storage power plants in operation nationwide will reach 36GW.

According to the accumulative targets of 62GW and 120GW in 2025 and 2030, the annual average new operation scales in the 14th and 15th five-year plans are expected to be 6.5GW and 11.6GW respectively. Assuming that the investment per watt is 6 yuan, the annual The average investment amounts are 39 billion and 69.6 billion respectively.

However, this calculation method ignores the long-term dynamic changes of pumped storage power plants. For example, most of the projects put into operation during the 15th Five-Year Plan have already started construction during the 14th Five-Year Plan period, resulting in investment. In addition, there may be new projects started every year. (at least 6 years before operation) and none of these factors are taken into account.

Here we use another calculation method: assuming that the average construction period of the pumped storage power plant is 7 years, and at the same time assuming that the annual completion progress is average, and the investment per watt is still calculated at 6 yuan, the investment completion amount in the current year is approximately equal to (the investment in the current year is approximately equal to According to this method, it is estimated that the completed investment in 2022-2024 will be RMB 52.1 billion, RMB 56.5 billion and RMB 60.9 billion respectively, totaling RMB 169.5 billion.

We believe that the plan is only to guarantee the minimum demand, and the actual progress may be better than expected.

1) Huge demand for energy storage: According to Chen Guoping, chief engineer of the State Grid Corporation of China, “In order to achieve 1.2 billion kilowatts of new energy installed capacity in China in 2030, at least 200 million kilowatts of energy storage must be matched”;

2) The planning of the two power grids is higher than that of the whole country: According to the respective mid- and long-term plans of the State Grid and China Southern Power Grid, it is estimated that the scale of the newly put into operation during the 14th and 15th Five-Year Plan period will reach 33GW and 65GW respectively, which are also high. In the national planning, and the planning of each power generation group and local state-owned assets has not been taken into account;

3) The construction cost may gradually increase: the construction cost of pumped storage power plant will vary greatly according to different geographical conditions. Generally, the area suitable for construction will start earlier, such as the pumped storage power station put into operation in the 11th and 12th five-year plan.

The average cost is mostly 3~5 RMB/W, and the average cost of the pumped storage power plant currently under construction has exceeded 6 RMB. In addition, the labor cost is also rising. It is expected that the construction cost will gradually increase in the future.

Pumped storage power plant is moving towards a new stage of high-quality development

China’s pumped-storage electricity pricing mechanism has undergone many changes, and cost alleviation is the main factor affecting the enthusiasm of investors in recent years.

The first stage

Before 2008, the lease system is the main

Lease-based payment means that the power grid determines an annual fixed rental fee based on the principle of compensating for fixed costs and reasonable income, and does not determine the electricity price separately.

The lease payment system is easy to settle, and the rights and responsibilities are clearly defined. The power grid operator obtains all the right to use the power station and can flexibly dispatch according to their own needs, while the power station owner obtains a stable income, which is suitable for the initial stage of pumped storage power plant construction and is easy to operate.

However, the disadvantages of this model are also very obvious. Since the annual rental fee is determined in advance according to the method of “cost + expected income”, the utilization of pumped storage resources is not directly linked to income, and the cost cannot reflect the cost of pumped storage power station. true value. The enthusiasm of pumped storage power plant is low, and it cannot give full play to its function of peak regulation and frequency regulation.

At the same time, although there is a rental cost sharing plan, that is, the power grid bears 50%, and the power generation enterprise and the user bear 25% each, but the actual operation has not been fully implemented. The pumped-storage plants were eventually sold at a loss.

The second stage

2008-2014, the “lease fee” turns to a single-capacity electricity fee

The leasing model is a market behavior, and theoretically, the management method of government price verification should not be adopted. In 2008, the National Development and Reform Commission issued relevant documents on pumped storage power plant, which clearly stated:

The “rental fee” of Tongbai and other pumped-storage power stations has been uniformly changed to “capacity electricity fee”, and the original approved standard remains unchanged. After that, the price of electricity for pumped storage is basically based on the electricity price of single capacity.

The third stage

After 2014, the two-part electricity price is proposed

In order to solve the problem of the extremely low contribution of power stations to the power grid caused by the fact that the revenue is not linked to the use of power stations in the above two electricity price mechanisms, in 2014, the National Development and Reform Commission issued a document stating that “before the formation of the electricity market, a two-part electricity price system was implemented.

The electricity fee and loss of pumped storage capacity are included in the unified accounting of the operation cost of the local provincial power grid, and are channeled to the end user through the sales electricity price”, that is, the pumped storage cost can be borne by the end user.

Two-part electricity price, including capacity electricity price and electricity electricity price, capacity electricity price mainly reflects the value of pumped storage power plant providing auxiliary services such as frequency regulation, voltage regulation, system backup and black start, and pumped storage power plant recovers the operation cost through capacity electricity price. other costs and obtain reasonable benefits, irrespective of the actual electricity consumption;

The electricity price mainly reflects the value of the peak shaving service provided by the pumped storage power station, and makes up for the pumped storage power plant to recover the operating costs of pumping and generating electricity through the electricity price.

The price of pumped electricity is 75% of the benchmark on-grid electricity price for coal-fired units. However, since the efficiency of pumping and storage is about 75%, which is often referred to as “pumping four and generating three”, the benefits that can be obtained from the electricity price are very limited.

However, due to the limited effect of pumped storage power plant on the power grid at that time, the participation of pumped storage power plant in electric auxiliary services is still in the exploration period, and the economic benefits of pumped storage power plant cannot be fully reflected.

At the same time, limited by the distribution of property rights and other issues, there is still no unified pricing mechanism nationwide, and the implementation of the two-part electricity price has become a difficult problem.

Taking State Grid Xinyuan as an example, as of 2020, the company has put into operation 13 of the 20 pumped storage power plants with capacity tariffs and 7 with two-part tariffs.

The fourth stage

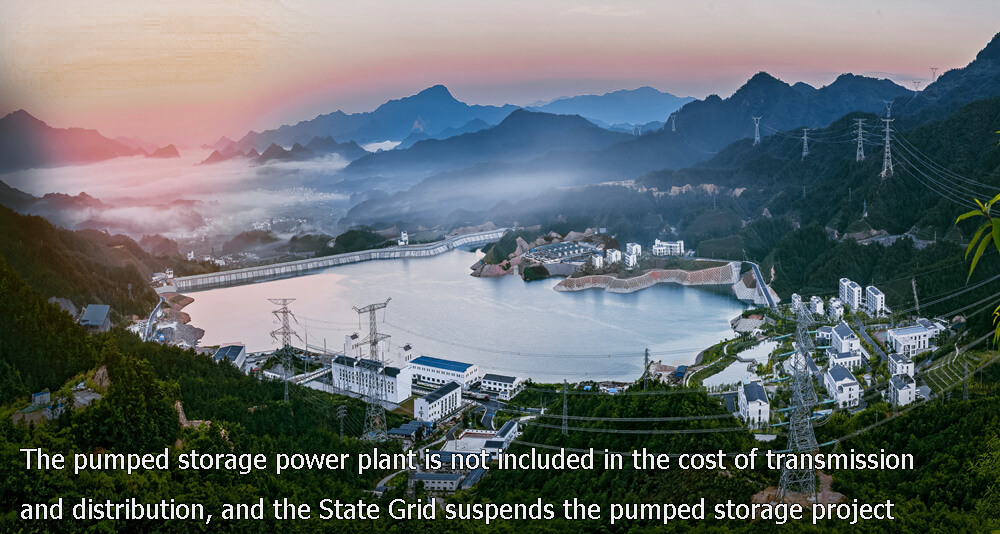

Since 2016, the pumped storage power plant is not included in the cost of transmission and distribution, and the State Grid suspends the pumped storage project

In the new round of electricity reform in 2015, market-oriented users will not implement the catalog electricity price, but instead will be “market-oriented transaction on-grid electricity price + transmission and distribution price + government fund electricity price”, excluding the electricity price of pumped storage capacity.

In 2016 and 2019, the National Development and Reform Commission issued documents one after another, announcing that “pumped storage power plant shall not be included in the scope of fixed assets for which income can be accrued”, “pumped storage power plant is not allowed to be included in transmission and distribution costs”, and the cost of pumped storage cannot be smoothly transmitted. influenced by,

In 2019, the State Grid Corporation of China issued the “Notice on Further Strictly Controlling Grid Investment”, proposing that “no new pumped storage projects will be arranged”.

Circular 633 was introduced to clarify the cost transmission mechanism to further ensure the profitability of pumped storage power plants.

On April 3, 2021, the National Development and Reform Commission issued relevant documents emphasizing that “the two-part electricity price policy should be taken as the main body to further improve the pricing mechanism for pumped storage.

Form the electricity price in a competitive way, incorporate the capacity electricity price into the transmission and distribution price recovery, and at the same time strengthen the connection with the construction and development of the electricity market, and gradually promote the pumped storage power plant to enter the market”.

Among them, the main changes are the dredging of the transmission mode of capacity electricity price, ensuring the internal rate of return of 6.5% of the power station, the electricity price still not contributing to the main profit, and encouraging market-based pricing.

The issuance of Circular 633 once again clarified the price mechanism of the two-part electricity price for pumped storage power plants, and clarified the details of the two-part electricity price, which improved the operability of the two-part electricity price. The operation of the plant provided more incentives and became a landmark document in the formation of China’s pumped-storage electricity pricing mechanism.

Improve the capacity electricity price approval mechanism

①According to the pricing method for the operating period, the electricity price of pumped storage capacity is determined, the operating period of the power station is determined by 40 years, and the internal rate of return of capital during the operating period is determined by 6.5%.

②Establish a mechanism for incorporating the capacity electricity fee into the transmission and distribution price recovery mechanism. The capacity electricity fee corresponding to the pumped storage capacity electricity price approved by the government shall be paid by the power grid company and included in the transmission and distribution price recovery of the provincial power grid. and the distribution method between the power system.

Form electricity price in a competitive way

① In places where the electricity spot market operates, the pumped storage power plant’s pumped electricity price and on-grid electricity price are settled according to the spot market price and rules;

② In places where the electricity spot market has not yet operated, the pumped storage power plant can provide the electricity from the power grid company, and the price of the pumped electricity is 75% of the benchmark price of coal-fired power generation. Entrusted power grid companies are encouraged to purchase through competitive bidding, and the price of pumped electricity is the price of the winning bid. implement;

③ For a pumped storage power plant that needs to allocate capacity electricity charges in multiple provinces, the pumped electricity and on-grid electricity are allocated to the relevant provincial power grids according to the capacity electricity charges.

However, the role of electricity price remains the same as before, and does not contribute to the main profit. According to the document, pumped storage power plants are encouraged to participate in the ancillary service market or ancillary service compensation mechanism, and the corresponding income formed in the previous supervision cycle.

20% of the revenue generated by the implementation of the pumped electricity price and the on-grid electricity price will be shared by the pumped storage power plant, and 80% will be deducted accordingly when the electricity price for the capacity of the power station is approved in the next supervision cycle, and the resulting loss will be borne by the pumped storage power plant.

Introduction of industry chain and statistics of existing pumping and saving projects

Industrial chain

Power China is the leader in construction and State Grid is the leader in operation

The upstream of the pumped storage industry chain is the equipment supplier of the pumped storage power plant, which mainly includes pumps, turbines, generators, water inlet valves, etc. The equipment investment usually accounts for 25%~30% of the investment cost of the pumped storage power plant, and the civil construction cost accounts for 25%~30%. than about 50%;

The midstream of the industry is the design, construction, and operation of power plants. Representative companies include POWERCHINA and POWERCHINA. Among them, POWERCHINA’s share in China’s pumped storage planning and design accounts for about 90%, and the share of construction projects undertaken accounts for about 90%. 80%;

The downstream of the industry is mainly the application of pumped storage power plant in the power grid system, including peak regulation, frequency regulation, valley filling, etc. Currently, the operators are State Grid Xinyuan Holdings Co., Ltd. controlled by State Grid and China Southern Power Grid’s peak and frequency regulation. Power Generation Co., Ltd. is the main one, and the two together account for about 90%.

Statistics of existing projects

The scale of individual investment is relatively large, mainly concentrated in Guangdong, Zhejiang, Hebei and other places

We counted the details of 46 pumped-storage power plants currently under construction and planned (commissioned after 2022):

1) The scale of a single project is mostly between 1.2-2 million kilowatts, and the investment scale is mostly between 6-10 billion, and the construction of pumped-storage power stations has a large demand for capital;

2) The average investment scale per watt is 6.2 yuan, and there is a large gap between projects, the minimum is 4.2 yuan/W, and the highest is 8 yuan/W. Geographical conditions will affect the construction cost of pumped storage power stations.

The pumped storage power plant projects in operation and under construction of the two networks are mainly concentrated in Guangdong, Zhejiang, Hebei, Shandong and Anhui.

As of 2021, there will be 31 pumped-storage power stations in operation in the two networks, with a total scale of about 36GW3, which is basically equivalent to the entire scale of the power stations that have been put into operation in the country.

The largest province is Guangdong, which has put into operation more than 7 million kilowatts of pumped-storage power stations. The second echelon is Hebei, Zhejiang, and Anhui, all of which are above 3 million kilowatts.

In terms of projects under construction, the two networks have a total of 30 pumped storage power plants under construction, with a total scale of about 31GW, which is estimated to account for about 60% of the national construction scale, which means that the participation of other investors is increasing.

In terms of regions, Shandong ranks first with a scale of about 6 million kilowatts. Others are still mainly concentrated in Zhejiang, Hebei, Guangdong and other places, and Shanxi, Henan, Xinjiang and other places are investing more.

Operation of pumped storage power stations in the past

State Grid Xinyuan Holdings Co., Ltd. is a pumped storage power plant specialized company controlled by State Grid (State Grid holds 51.54% shares), responsible for the development, construction, operation and management of pumped storage power plants in the operating area of State Grid Corporation. As of the end of 2020, the controllable installed capacity of State Grid Xinyuan reached 20.57 million kilowatts.

We believe that with the gradual implementation of Document No. 633, the profitability of newly put into operation pumped storage power plants will be greatly improved in the future, and their investment attractiveness will also increase.

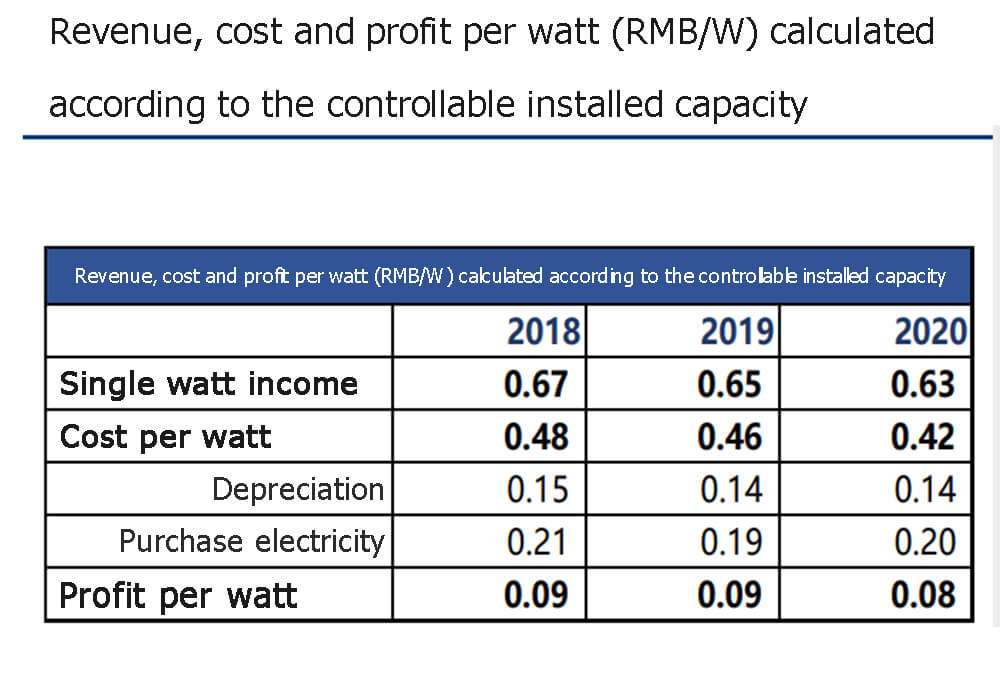

In recent years, the controllable installed capacity of State Grid Xinyuan is around 20GW, the annual revenue is about 12 billion to 13 billion, the gross profit rate is over 28%, the net profit rate is 12% to 14%, and the annual net profit is 1.6 billion. ~1.8 billion. In 2020, the company has put into production 20 pumped storage power plants, and the number of pumping times in a year is about 2.5w.

In recent years, the on-grid electricity of the company has exceeded 20 billion kWh, the average annual power generation utilization hour is about 1,100 hours, and the comprehensive utilization efficiency is nearly 80%.

The company’s operating costs are mainly composed of depreciation, labor, and electricity purchase fees, and the electricity price contributes less profit. As of 2020, of the 20 pumped storage power plants that the company has put into production, only 7 implement the two-part electricity price, and the other 13 implement the single-capacity electricity price.

The operating cost of a pumped storage power plant that implements a single-capacity electricity price does not include the electricity purchase fee, but charges a fixed fee according to the approved price. The cost is mainly labor and depreciation. It consists of electricity, labor and depreciation.

In 2020, the company’s depreciation expenses and electricity purchase expenses are 2.844 billion and 4.043 billion, respectively, accounting for 33% and 46% of the cost.

According to the company’s controllable installed capacity, we roughly estimate that the revenue per watt is about 0.6~0.7 RMB, the profit per watt is less than 0.1 RMB, and the overall profit level is low. According to different electricity price mechanisms, electricity price contributes about 30% of the revenue, but only 15% of the profit.

This means that the price difference between its pumped power generation is relatively low. We estimate that its power purchase cost is about 0.26 RMB/kwh. However, the on-grid electricity price is only 0.37 RMB/kwh, and the price difference between the two is much lower than the peak-to-valley price difference for industrial and commercial electricity.

Main companies

POWERCHINA

PowerChina was established in 2008 and is directly controlled by PowerChina, which is supervised by the State-owned Assets Supervision and Administration Commission of the State Council. As of the end of the third quarter of 2021, PowerChina held a 58.3% stake in the company.

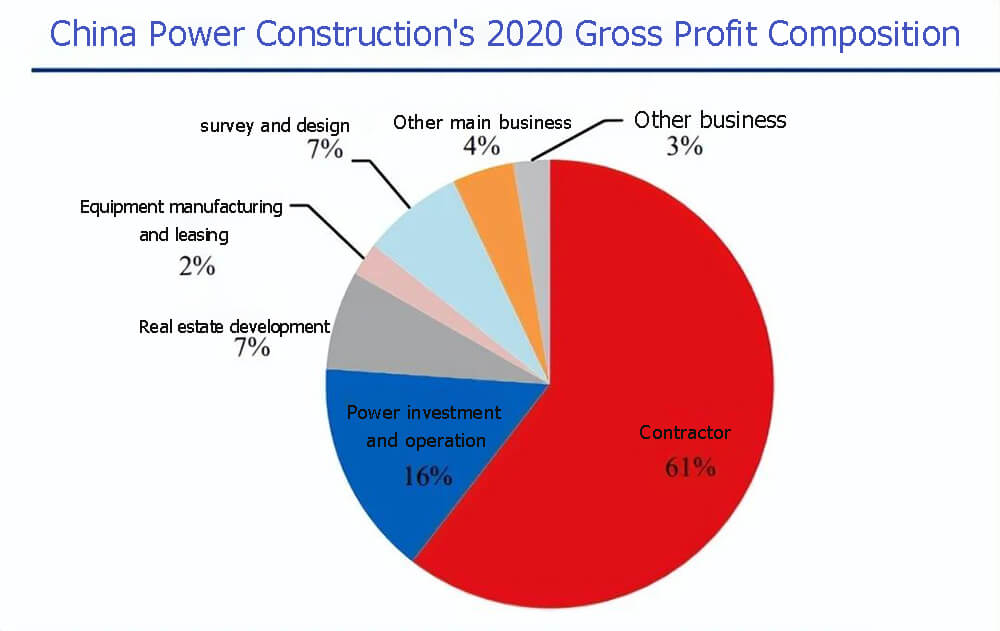

The company’s business mainly covers engineering contracting and survey and design, power investment and operation, real estate development, equipment manufacturing and leasing, etc. In 2020, the company achieved revenue of 401.955 billion RMB, a year-on-year increase of 15.24%, and net profit attributable to the parent of 7.987 billion RMB, a year-on-year increase of 10.33%.

In terms of business types, the project contracting revenue accounted for the highest proportion, reaching 79%. In addition, real estate development, power investment and operation, survey and design, and equipment business accounted for 5%, 5%, 3%, and 1% respectively. The company’s comprehensive gross profit margin in the past three years has been above 14%.

In 2020, the company achieved a gross profit of 57.872 billion yuan, of which the gross profit of engineering contracting and survey and design, power investment and operation accounted for 61% and 16% respectively. 48%), equipment manufacturing and leasing (36%), survey and design (31%), real estate development (19%), engineering contracting (11%).

POWERCHINA is a leader in China and the global water conservancy and hydropower industry, undertaking more than 80% of the planning and design tasks of China’s large and medium-sized hydropower stations, and more than 65% of the construction tasks, with a market share of more than 50% in the global water conservancy and hydropower construction market.

At the same time, the company has also participated in the planning or construction of most of the pumped storage power stations in China, accounting for about 90% of the planning and design of pumped storage in China, and about 80% of the construction projects.

According to the company’s annual report, as of the end of 2020, the company’s controlled grid-connected installed power capacity reached 16.14 million kilowatts, and clean energy such as hydropower accounted for 80.42%.

Among them, the installed capacity of hydropower is 6.4 million kilowatts, the installed capacity of wind power is 5.28 million kilowatts, the installed capacity of photovoltaic power generation is 1.29 million kilowatts, and the installed capacity of thermal power is 3.16 million kilowatts. The cumulative installed capacity in operation and under construction reaches 20.09 million kilowatts.

In 2020, the company’s power investment and operation segment achieved a revenue of 18.903 billion before segment offset and a net profit of 2.498 billion, which is the company’s second largest profit-contributing segment.

Energy China

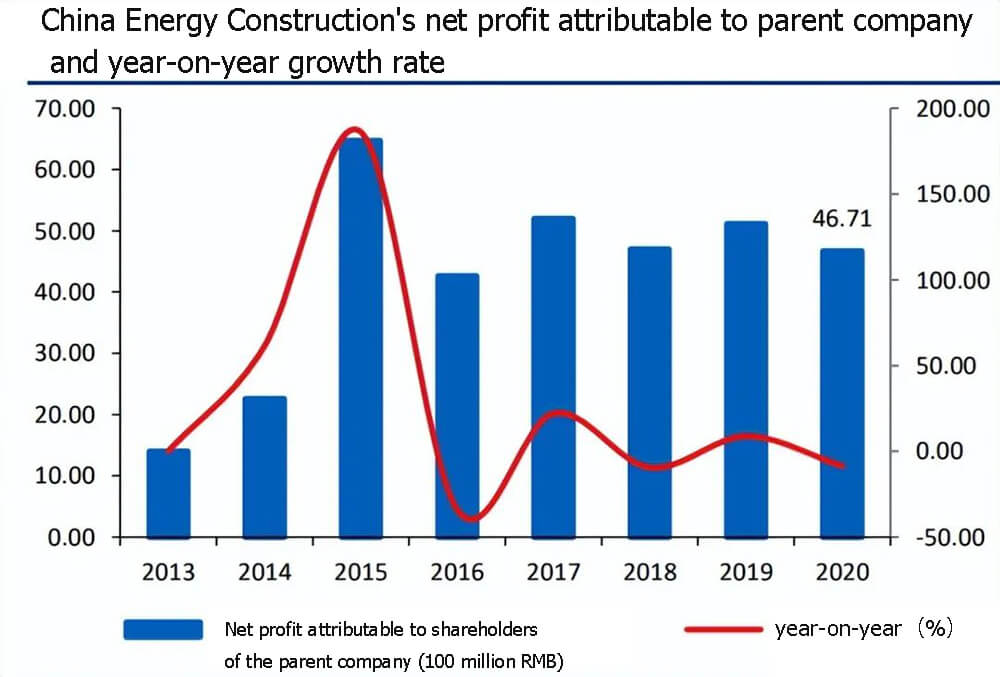

Energy China is a joint stock limited company established in 2014 by Energy China Group and its wholly-owned subsidiary, the Electronic Regulation Institute. As of the end of 2021Q3, Energy China Group holds 44.82% of the shares.

Energy China is mainly engaged in engineering construction, survey, design and consulting, industrial manufacturing, clean energy and environmental protection water, investment and other five sectors. In 2020, the company achieved a revenue of 270.328 billion yuan, a year-on-year increase of 9.32%, and a net profit attributable to the parent of 4.671 billion yuan, a year-on-year decrease of 8.64%.

In terms of sub-sectors, the engineering construction business achieved revenue of 211.539 billion yuan before segment offset, accounting for 75% of the company’s total revenue, but the gross profit margin was low, only 8.6%, contributing 50.6% of the gross profit. According to the 2020 orders In terms of structure, non-electricity accounts for nearly 50% of the company’s engineering business, and new energy, thermal power, and hydropower account for 22.7%, 18.4%, and 7.6%, respectively.

Engineering business manufacturing, survey and design, investment and other income accounted for 8.5%, 5%, and 7.7% respectively, and the gross profit margins were all over 20%, of which survey and design gross profit margins exceeded 30%;

The revenue from clean energy and environmental protection accounted for 4.2%, and the gross profit margin was 8.4%, mainly due to the loss of environmental protection water affairs. 44.3%.

As of the end of 2020, the company’s holding installed capacity was 2.866 million kilowatts, of which the hydropower holding installed capacity was 780,000 kilowatts, the new energy holding installed capacity was 1.4 million kilowatts, and the installed capacity under construction was 2.034 million kilowatts. The power generation in 2020 was 4.513 billion kilowatts.

The company aims to have a new energy installed capacity of 20 million kilowatts in 2025, with indicators such as revenue and profit doubling from 2020.

Energy China occupies an important market position in the fields of hydropower construction and new energy construction. During the 14th Five-Year Plan period, the company will “full entry into new energy and energy storage and other related industries, give full play to the advantages of the entire industry chain, and promote low-carbon transformation”. “By 2025, the holding new energy installed capacity will strive to reach more than 20 million kilowatts.” This target will increase by 13 times compared with 1.4 million kilowatts in 2020.

In addition, from the perspective of the company’s 14th Five-Year Plan, the company aims to “double its operating income, total profit, newly signed contracts, total assets and other indicators compared with 2020” in 2025.

Guangdong Hydropower

Guangdong Hydropower was listed on the Shenzhen Stock Exchange in 2006. Its largest shareholder is Guangdong Construction Engineering Group, holding 36.48% of the shares. The actual controller is the Guangdong Provincial State-owned Assets Supervision and Administration Commission.

The company is mainly engaged in the construction of water conservancy, hydropower and rail transit projects, hydropower, wind power, solar photovoltaic clean energy power generation business and wind power tower equipment manufacturing business. Nearly 80% of its revenue comes from Guangdong.

In 2020, the company achieved revenue of 12.583 billion yuan, a year-on-year increase of 12.92%, and net profit attributable to the parent of 264 million yuan, a year-on-year increase of 12.64%. By segment,

①The engineering construction business achieved a revenue of 9.602 billion yuan, accounting for 76.31% of the total revenue, including 6.556 billion yuan for water conservancy and hydropower projects, 2.377 billion for municipal engineering, and 670 million for other projects. Therefore, the proportion of gross profit contributed is only about 30%;

②The revenue of clean energy power generation was RMB 1.480 billion, of which wind power accounted for about 50% and the revenue was RMB 735 million. The revenue of solar power generation and hydro power generation was RMB 464 million and RMB 281 million respectively. % of gross profit;

③The wind power tower manufacturing business achieved revenue of 1.401 billion yuan. In 2020, the company completed the manufacture of about 1,000 sets of towers, with a total output of 175,600 tons. The gross profit margin of this segment is only slightly higher than that of the engineering business, which is 5.28% in 2020;

④In 2020, the survey and design and others achieved an income of 100 million yuan and a gross profit of 26 million yuan, which accounted for a small proportion.

As of 2021, the installed capacity of pumped storage power plants in Guangdong Province has reached 7.98 million kilowatts, accounting for about 22% of the country’s total installed capacity. It is currently the province with the highest installed capacity of pumped storage.

The company has participated in the construction of 6 pumped storage power plants in Huizhou, Shenzhen, Qingyuan, Yangjiang, Zhaoqing, and Hainan Qiongzhong (the total scale is 7.88 million kilowatts, of which the Zhaoqing pumped storage power plant is still under construction) , has rich experience in pumped storage construction, and is the enterprise with the largest installed capacity of clean energy power generation and the most developable resources in Guangdong Province.

In 2020, the company’s clean energy power generation business revenue was 1.48 billion yuan. Although the revenue accounted for a small proportion, it contributed more than 60% of the gross profit.

As of 2020, the company has accumulated a total installed capacity of 1,442MW of clean energy projects, including 213MW of hydropower, 673MW of wind power, and 556MW of photovoltaic power. In 2021, it plans to complete 200,000 kilowatts of clean energy production and 700,000 kilowatts of new approvals.

Anhui Construction Engineering

Anhui Construction Engineering, formerly known as Anhui Water Construction Co., Ltd., was renamed Anhui Water Conservancy Development Co., Ltd. in 2000, absorbed and merged with Anhui Construction Engineering Group in 2016, and changed to Anhui Construction Engineering Group Co., Ltd. in 2019.

The largest shareholder of the company is Anhui Construction Engineering Group Holding Co., Ltd., holding 32.32% of the shares, and the actual controller is Anhui State-owned Assets Supervision and Administration Commission. The company’s main business includes infrastructure construction and investment, housing construction, real estate development, prefabricated buildings, testing business, hydropower generation and building materials, etc. In 2021, the company’s operating income will be 71.340 billion RMB, a year-on-year increase of +25.22%, attributable to the parent’s net Profit was 1.096 billion, a year-on-year increase of 34.32%.

In terms of business segments, the first major business segment, infrastructure, achieved revenue of RMB 34.2 billion, with a gross profit margin of 9.06%, accounting for 48% and 39% of revenue and gross profit, respectively. and gross profit accounted for 26% and 16% respectively, commercial housing sales revenue was 7.1 billion RMB, accounting for 10% of revenue, and its gross profit margin was relatively high, accounting for 19% of gross profit. From a regional perspective, the company’s business revenue in the province accounts for about 75%.

The water conservancy business is the traditional main business of the company, and the water conservancy investment in Anhui Province is expected to continue to grow during the 14th Five-Year Plan. Water conservancy business accounts for about 15% of the company’s infrastructure engineering orders, and has maintained a rapid growth of more than 50% in the past two years.

In addition, the company’s largest holding subsidiary, Anhui Water Conservancy Development Co., Ltd., is one of the leading enterprises in the water conservancy market in the province, with a revenue of 16.3 billion and a net profit of 600 million in 2021.

The three main businesses of Anhui Water Conservancy Development are engineering construction, real estate development, and hydropower investment, construction and operation. The company owns seven power stations in Anhui and Yunnan, including Bailianya Power Station, Liubo Power Station, and Danzhuhe Cascade Power Station. 250,000 kWh, the equity installed capacity is 188,100 KW, and the annual designed power generation is about 1 billion KWH, all of which have been completed for power generation.

According to the Anhui Department of Water Resources, during the “13th Five-Year Plan” period, Anhui Province has completed a total of 210.1 billion RMB in water conservancy investment, it is nearly twice that of the “Twelfth Five-Year Plan”. In 2020, the completed investment amounted to 54 billion RMB, a record high. During the 14th Five-Year Plan period, the scale of water conservancy investment in Anhui Province is expected to reach 284.5 billion RMB, which will continue to grow.

Whether it is mechanical energy storage pumped storage power plant or electrochemical energy storage like lithium ion solar battery. It is of great significance to achieve carbon peaking, carbon neutrality and carbon emission reduction goals.