Home » battery industry » Development Status of Lithium-ion Batteries in China

Development Status of Lithium-ion Batteries in China

The lithium battery industry is an industrial industry mainly engaged in industrial production activities such as ferrous metal mineral mining and processing and ferrous metal smelting and processing, including metal iron, chromium, manganese and other mineral mining and processing, ironmaking, steelmaking, steel processing, etc.

Industry, ferroalloy smelting, steel wire and its products and other sub-sectors are one of the country’s important raw material industries. In addition, since the production of lithium batteries also involves other industrial categories such as non-metallic minerals mining and products, such as coking, refractory materials, carbon products, etc., these industrial categories are usually included in the lithium battery industry.

The lithium battery industry is an industrial industry mainly engaged in industrial production activities such as ferrous metal mineral mining and processing and ferrous metal smelting and processing, including metal iron, chromium, manganese and other mineral mining and processing, ironmaking, steelmaking, steel processing, etc.

Industry, ferroalloy smelting, steel wire and its products and other sub-sectors are one of the country’s important raw material industries. In addition, since the production of lithium batteries also involves other industrial categories such as non-metallic minerals mining and products, such as coking, refractory materials, carbon products, etc., these industrial categories are usually included in the lithium battery industry.

Development Prospects of Lithium Battery Industry under “Dual Cycle”

Energy crisis drives industry progress

China’s natural resource endowments are rich in coal, poor in oil, and little in gas, and its dependence on crude oil is high. Reducing the fuel consumption of motor vehicles and maintaining national energy security are the hard constraints for the development of the automobile industry. In addition, China’s electric power industry is developed, and “replacing oil with electricity” is a long-term trend in the development of the automobile industry. In the context of the implementation of the double-point policy in China and the restriction of travel in major cities, new energy vehicles have become the main trend of the future development of the global automobile market. As the core component of new energy vehicles, lithium batteries will inevitably grow rapidly in the market.

Enhancement of environmental protection requirements

With the rapid development of China’s economy and the continuous increase of car ownership, the problem of environmental pollution has become increasingly prominent, and people’s demand for new clean energy is becoming more and more urgent. The environmental problems caused by the exhaust gas emitted by traditional vehicles have directly intensified people’s desire to apply new energy. During the “14th Five-Year Plan” period, through technological innovation, industrial transformation, new energy development and other means, developing a new energy vehicle industry based on low pollution and low emissions is an important way to achieve sustainable economic development. As far as the market demand for lithium batteries is concerned, the field of power batteries for new energy vehicles is undoubtedly a growth point with huge potential.Strong support from national policies

In February 2020, the “Guiding Opinions on Promoting the Orderly Resumption of Work and Production of Industrial Communication Enterprises” was released, mentioning that it is necessary to continue to support industries such as smart photovoltaics and lithium-ion batteries, as well as single champion enterprises in the manufacturing industry, so as to consolidate the competitive advantages of the industrial chain. Focus on supporting strategic emerging industries such as 5G, industrial Internet, integrated circuits, industrial robots, additive manufacturing, intelligent manufacturing, new displays, new energy vehicles, energy conservation and environmental protection. On the basis of national policy support, various localities also provide different preferential policies and subsidy measures for the lithium battery industry, which will help the further development of the lithium battery industry.The rapid improvement of China’s status in the global lithium battery industry

China’s new energy market has broad prospects, and the upstream and downstream industries have been continuously improved. At the same time, with the support of the national subsidy policy, the competitiveness of Chinese power lithium battery companies in the global market has been continuously enhanced, and the market share has grown rapidly, supporting upstream advanced precision structural parts. The development of enterprises creates conditions. In addition, LG, Panasonic, Samsung and other international lithium battery giants have set up subsidiaries in China, including R&D centers, production and manufacturing departments, etc., and the proportion of localization of lithium battery materials has gradually increased, thus providing the development of Chinese lithium battery precision structural parts enterprises. good market opportunities.

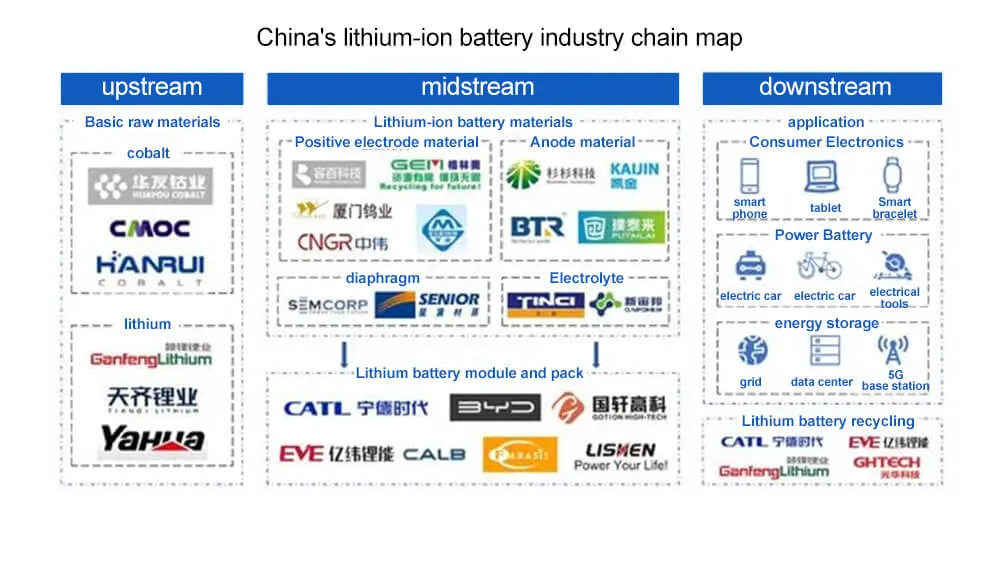

Industrial chain structure

It consists of upstream basic raw materials, midstream lithium-ion battery materials and lithium battery modules and PACKs, downstream applications and lithium battery recycling.Upstream

Cobalt, lithium, nickel, manganese, graphite, etc. are the basic raw materials for lithium-ion batteries.Midstream

Lithium-ion batteries are mainly composed of four materials: positive electrode, negative electrode, separator, and electrolyte. Among them, the positive electrode materials are mainly divided into ternary materials, lithium iron phosphate, lithium cobaltate, lithium manganate, etc.; the negative electrode materials mainly include artificial graphite, natural graphite, etc., artificial graphite has the best comprehensive performance and occupies the mainstream of the negative electrode material market. The diaphragm directly affects the charging speed and safety of the battery. There are two production processes: dry method and wet method. The electrolyte is called the “blood” of lithium-ion batteries, which has a significant impact on the cycle life and safety of lithium-ion batteries. , which consists of three parts: solvent, lithium salt and additive. Lithium battery module and PACK are the process of processing cells into batteries.Downstream

The application areas mainly include consumer electronics, power batteries and energy storage. Among them, consumer electronics mainly cover smartphones, tablet computers, smart bracelets, etc.; power batteries are mainly used in electric vehicles, electric bicycles, power tools, etc.; energy storage fields include power grids, data centers, 5G base stations and other scenarios. Lithium battery recycling is to use pyrotechnic, hydrometallurgical process and solid-phase electrolytic reduction technology to recycle the used battery.

Scale of Market

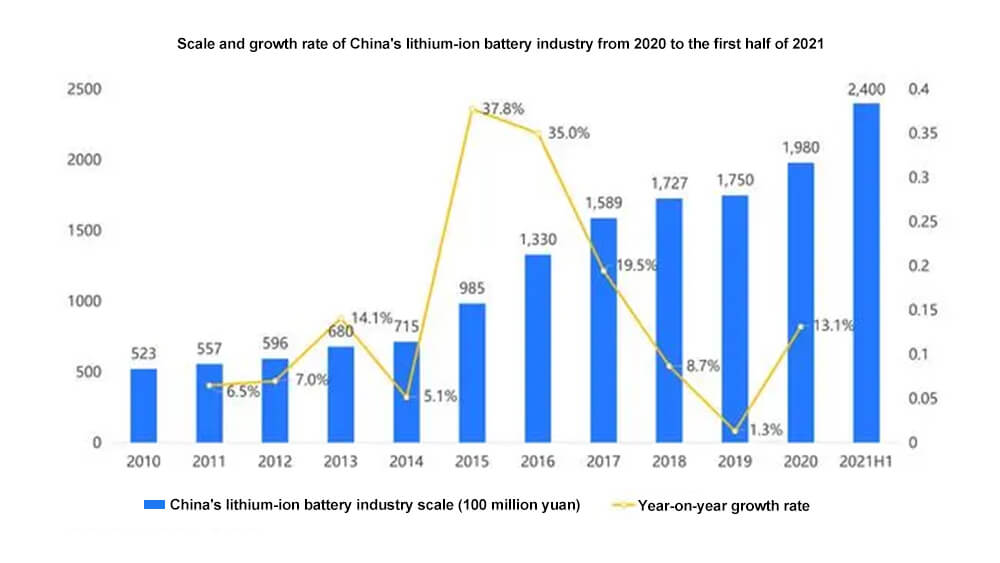

Strong demand in the application field combined with a narrowing price drop, and the scale of the lithium-ion battery industry continues to expand Since 2020, China’s new energy vehicles, electric bicycles, consumer electronics and other application markets have achieved rapid growth. Among them, new energy vehicles have regained a strong growth momentum. From January to November 2021, the sales volume has increased by 1.7 times year-on-year, driving the production of lithium-ion batteries to increase. According to data from the Ministry of Industry and Information Technology, China’s lithium-ion battery production exceeded 110GWh in the first half of 2021, a year-on-year increase of more than 60%. At the same time, with the narrowing of the price drop, the scale of the lithium-ion battery industry has further expanded. The total output value of the industry in the first half of 2021 exceeded 240 billion yuan, with a rapid growth rate.

Regional competition

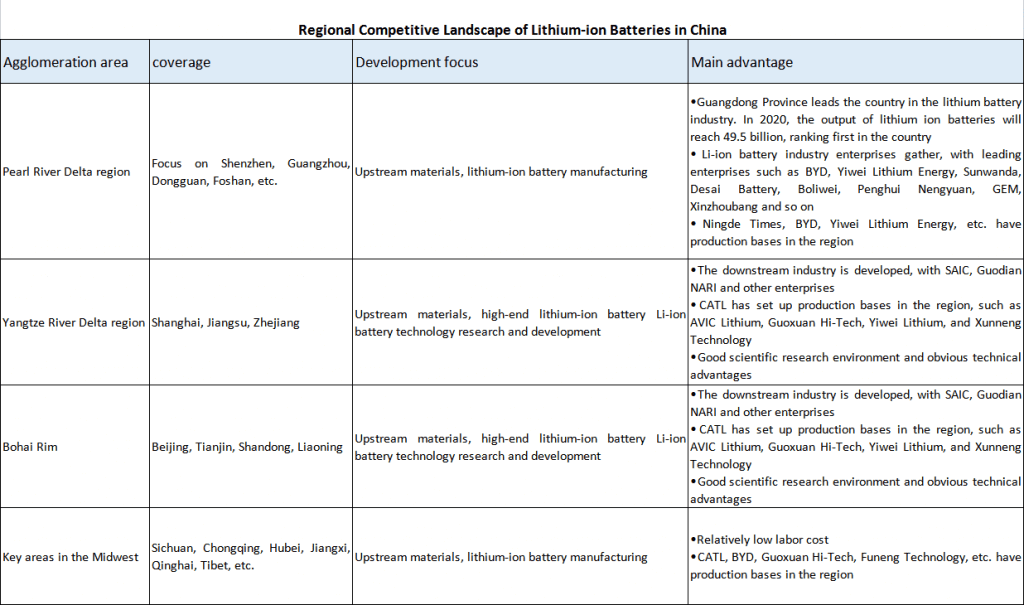

The Pearl River Delta region has formed a relatively complete industrial chain, and the production of lithium-ion batteries leads the country Under the policy guidance of the standardized development of the relevant lithium-ion battery industry in China, many cities have begun to strengthen the layout of the lithium-ion battery field. From the perspective of regional competition, China’s lithium-ion battery industry has initially formed a comprehensive development trend in the Pearl River Delta, Yangtze River Delta, Bohai Rim and key regions in the central and western regions. A large number of leading enterprises are gathered in the Pearl River Delta region, the output of lithium-ion batteries is leading in China, and the industrial chain is relatively complete. The Yangtze River Delta region and the Bohai Rim region have a good scientific research environment and obvious technological advantages; Sichuan, Jiangxi, Qinghai, Tibet and other central and western key regions are rich in lithium ore resources, and the labor cost is relatively low, and the output of lithium-ion batteries is growing rapidly.

Product structure

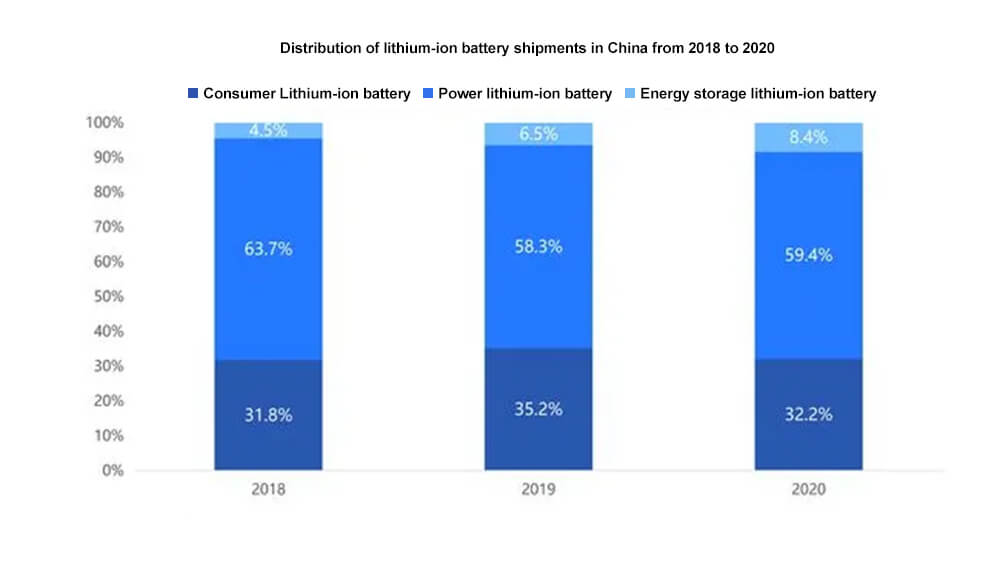

power-type lithium-ion batteries dominate, and energy-storage lithium-ion batteries grow rapidly. According to different application fields, lithium-ion batteries are mainly divided into three categories: consumption type, power type and energy storage type. Among them, the power lithium-ion battery dominates, and the energy storage lithium-ion battery grows faster. Specifically, according to CCID think tank data, in 2020, the shipments of power-type lithium-ion batteries mainly used in the three major markets of new energy vehicles, electric bicycles, and power tools will reach 94.1GWh, accounting for 94.1GWh of total lithium-ion battery shipments. 59.4%; the shipment of energy storage lithium-ion batteries widely used in energy storage power stations, 5G base stations and other fields was 13.4GWh, a year-on-year increase of 55.8%. Batteries are used in new energy vehicles, electric vehicles, photovoltaics, energy storage, wind power, 5G\data centers, 3C electronics, smart terminals and other fields. The demand from the market provides a broad development space for the battery industry. And the emerging track under “carbon neutrality” and “carbon peak”, the trillion-dollar market is gradually opening. Under the background of good market prospects, the World Battery Industry Expo has shown greater vitality. Both the battery and the industrial chain need such an exhibition and trading platform to exchange technology and industry information.

Batteries are used in new energy vehicles, electric vehicles, photovoltaics, energy storage, wind power, 5G\data centers, 3C electronics, smart terminals and other fields. The demand from the market provides a broad development space for the battery industry. And the emerging track under “carbon neutrality” and “carbon peak”, the trillion-dollar market is gradually opening. Under the background of good market prospects, the World Battery Industry Expo has shown greater vitality. Both the battery and the industrial chain need such an exhibition and trading platform to exchange technology and industry information.

Diaphragm material

In terms of diaphragms, the output of diaphragms in the first half of the year was about 3.4 billion square meters. The three leading companies such as Enjie, Xingyuan Materials, and Sinoma Technology actually continued to run at full production, and orders were also very tight. Like some second-tier companies like Jinli, Zhongxing New Materials, Cangzhou Mingzhu, and Huiqiang, the production capacity utilization rate of these companies is also improving significantly. Driven by the substantial increase in the installed capacity of lithium iron phosphate and the strong demand for two-wheeled vehicles and energy storage, the growth rate of dry-process separators is higher than that of wet-process separators, and the market demand for dry-process separators will further increase in the future. Companies such as Enjie and Xingyuan Materials are also increasing the number of dry diaphragms. At present, it seems that by 2022, the diaphragm may be a bottleneck for the development of the lithium battery market. Because taking Enjie as an example, its production capacity was 3.3 billion square meters last year, and its actual shipment volume was more than 2 billion square meters. This year, the annual growth rate is 1 billion square meters, which means it can meet the production demand of 50G watt-hours. Therefore, the entire industry has added new The production capacity of these batteries may not be able to meet the needs of these battery factories.

Companies such as Enjie and Xingyuan Materials are also increasing the number of dry diaphragms. At present, it seems that by 2022, the diaphragm may be a bottleneck for the development of the lithium battery market. Because taking Enjie as an example, its production capacity was 3.3 billion square meters last year, and its actual shipment volume was more than 2 billion square meters. This year, the annual growth rate is 1 billion square meters, which means it can meet the production demand of 50G watt-hours. Therefore, the entire industry has added new The production capacity of these batteries may not be able to meet the needs of these battery factories.