Home » battery news » How long before solid-state batteries are actually available in cars?

How long before solid-state batteries are actually available in cars?

In 2017, Fisker, an American electric vehicle company headquartered in Anaheim, California, issued a patent for a solid-state lithium battery that has just completed its application: charging for 1 minute and driving 800 kilometers.

This endurance performance is 2.3 times that of Tesla’s Model 3 released in 2016, which has a range of about 346 kilometers.

Founder Henrik Fisker vowed in an interview that solid-state lithium batteries will be mass-produced in 2023, and the price is only one-third of lithium batteries.

This is not the first time Fisker has ventured into the field of solid-state batteries, nor is it the first time that Henrik Fisker has drawn a “solid-state battery” pie to the public.

In 2018, Henrik Fisker said the company had overcome the problem of solid-state batteries and the final design would be revealed within months.

In 2019, the Fisker sports car equipped with solid-state batteries was slow to roll off the production line, and the company could only launch ordinary electric vehicles equipped with liquid lithium-ion batteries to block the increasingly fierce criticism.

In 2021, Henrik Fisker said that the solid-state battery plan has been completely abandoned.

So far, Fisker’s dream of the fastest mass production of solid-state batteries in the world has been completely shattered.

“It’s a technology where when you feel like you’re 90 percent done, you’re almost there, and then you realize that the remaining 10 percent is much harder than the previous 90 percent. So now, we’re completely ditching solid-state batteries. , because it really can’t land.” Henrik Fisker said, “I personally think that no matter what form of mass production, solid-state batteries are at least seven years away.”

As a substitute for liquid lithium-ion batteries, the emergence and development of solid-state batteries is a historical inevitability.

Compared with lithium-ion batteries, solid-state batteries are safe, lightweight, cost-effective, and support fast charging. They are the best way out for next-generation power batteries. They are the only prescription for eradicating the cruising range of existing electric vehicles. Electric vehicles can completely kill fuel vehicles. Sharp killer.

In 2022, NIO, a Chinese smart electric vehicle company, will be equipped with a solid-liquid hybrid battery pack with a capacity of 150 degrees on the new model ET7. Therefore, 2022 will be designated as the “first year of solid-state batteries.”

It is a futures fantasy, or a down-to-earth.

The answer is written in the electrolyte of the solid-state battery.

New battery life of electric vehicles

When it comes to electric vehicles, most people’s first reaction is: the battery life is too short.

It is bluntly pointed out that the cruising range of electric vehicles on sale generally cannot cover the driving scenarios that a vehicle should be able to support.

There are common reports on the absurd problems encountered when driving an electric vehicle, such as a significant reduction in battery life, lying down halfway, and almost freezing when driving an electric vehicle in winter.

While the shortcoming of electric vehicle battery life is magnified several times in cold weather, it also lowers the trust threshold of potential consumers in this new form of energy.

Dai Kangwei, deputy dean of BAIC New Energy Research Institute, once summarized the three major factors for the decline of electric vehicle battery life in winter:

The first trouble is the battery itself. As a chemical product, once the temperature is low, the internal electrolyte will become viscous and the lithium ion migration rate will slow down, resulting in lower battery activity and affecting battery performance and capacity.

The second trouble is the air conditioning system. In a fuel vehicle, the air conditioning system relies on engine waste heat for heating. However, electric vehicles do not have an engine and rely on batteries for heating, which consumes a lot of money.

The third distress is the increase in driveline drag caused by low temperatures. The density of air in winter is different from that in summer. In winter, the density of air increases, resulting in increased wind resistance and a sharp increase in power consumption.

The “range anxiety” that has been deeply tied to electric vehicles since the birth of electric vehicles has not changed much due to technological progress. The reason is that there is no disruptive innovation in the power battery, the heart of electric vehicles.

In 1881, the world’s first electric car, the 42-year-old French electrical engineer Gustave Trouvé showed it for the first time at the International Electricity Exhibition in Paris, driving it forward is bulky and dangerous. Lead-acid batteries.

In 1997, the hybrid car that would dominate the world in the future, the first-generation Toyota Prius, was mass-produced and delivered. It used a nickel-metal hydride battery pack made by Japan’s Panasonic and weighing 53.3 kg.

But before the Prius took the world by storm, Japan’s Sony successfully produced the world’s first commercial lithium-ion battery in 1991. The two characteristics of high energy density and fast charging friendliness make lithium-ion batteries a soaring injector in the field of consumer electronics.

In 2008, Tesla loaded lithium-ion batteries on the Roadster, a sports car that completely subverted the pattern of the century-old automobile industry. A car myth of lithium-ion batteries began.

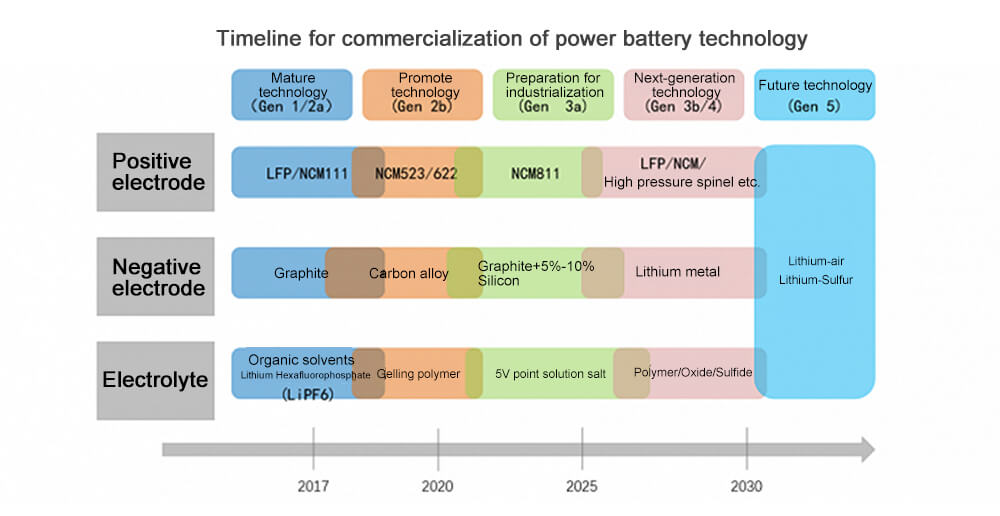

So far, lithium-ion batteries have completed three technological intergenerational transitions: lithium cobalt oxide cathode is the first generation, lithium manganate and lithium iron phosphate are the second generation, and ternary lithium is the third generation. Three generations of lithium-ion batteries are composed of four major parts: positive electrode, negative electrode, electrolyte and separator.

Lithium iron phosphate and ternary lithium are the most preferred mainstream formulas by major automobile companies. The former is low in price, stable and safe, but has low energy density and poor low temperature performance. The latter has high energy density and supports fast charging, but is expensive and has poor thermal stability.

But both lithium iron phosphate and ternary lithium will soon face two major ceilings: energy density and safety issues.

First, the current energy density limit of liquid lithium-ion batteries is about 280Wh/kg. Even if silicon-based alloys are introduced into the negative electrode, it is difficult to break through the upper density limit of 400Wh/kg.

The Ministry of Industry and Information Technology pointed out: “By 2025 and 2030, the energy density of my country’s power battery cells needs to reach 400Wh/kg and 500Wh/kg, respectively.”

Failing to cross the energy density threshold means that new energy subsidies that are highly linked to energy density cannot be obtained, which is enough to make ordinary consumers instantly disappointed with electric vehicles.

Secondly, the highly flammable liquid organic electrolyte in liquid lithium-ion batteries is generally considered to be the first reason behind the frequent occurrence of spontaneous combustion accidents in electric vehicles.

In 2019, the State Administration for Market Regulation recalled 33,000 new energy vehicles. The number of recalls due to power battery problems was 6,217 units, accounting for 18.7% of the total recalls of new energy vehicles.

In 2020, 357,000 new energy vehicles were recalled, of which 112,000 were recalled due to defects in the three-electric system, accounting for 31.3% of the total number of new energy vehicles recalled.

In the “Electric Vehicle Safety Report” issued by the China Electric Vehicle Association of 100, spontaneous combustion accounted for 31% of the domestic new energy vehicle fire accidents. The safety concept will not be achieved, and the long-term vision of electric vehicles to completely replace gasoline vehicles will not be realized.

Since Tesla introduced liquid lithium batteries into the electric vehicle field in 2008, traditional liquid lithium ion batteries have dominated the power battery market for more than ten years. Energy density, safety requirements, cruising range, cost demands and liquid lithium ion batteries The conflict between them is irreconcilable.

Ouyang Minggao, an academician of the Chinese Academy of Sciences, has publicly stated that to achieve the energy density target of 500Wh/kg in 2030, a breakthrough at the solid electrolyte level is the only way to go.

Solid-state batteries are the closest milestone to us on this road.

Why must it be a solid-state battery? There are three reasons:

First, the non-flammable, non-corrosive, non-volatile, non-leaking, high-temperature-resistant solid electrolyte replaces the electrolyte, electrolyte salt and diaphragm, and completely solves the risk of spontaneous combustion caused by the flammable liquid organic electrolyte;

Second, solid-state batteries have high energy density, and there is great hope to break through the 500Wh/kg mark, which can increase the cruising range of electric vehicles to 800 kilometers to 1,000 kilometers. In addition, the solid-state battery has a wide operating temperature range and supports super fast charging.

Third, solid-state batteries can greatly reduce the weight of the system. Solid-state battery cells do not contain liquid and can be connected in series before packaging. At the same time, due to its completely non-flammable characteristics, the BMS temperature control components will no longer exist, and multiple measures will be taken to increase the cruising range.

From the perspective of technical latitude, solid-state batteries are the best way out for the next generation of power batteries, the only prescription for eradicating the stubborn cruising range of existing electric vehicles, and a sharp killer for electric vehicles to kill fuel vehicles.

However, in the timetable for the landing of major auto companies, both traditional giants and emerging forces, the earliest appearance of solid-state batteries is in the fourth quarter of 2022. At this time, the solid-state battery version of the NIO ET7, equipped with a 150-degree battery pack and a battery life of more than 1,000 kilometers, will officially start.

But this seems to be a 150-degree battery pack that can carry the banner of “solid-state battery” commercial mass production. It is essentially a transitional product under the final technical route. It has a “semi-finished” name-semi-solid-state battery.

Tech myth or hoax

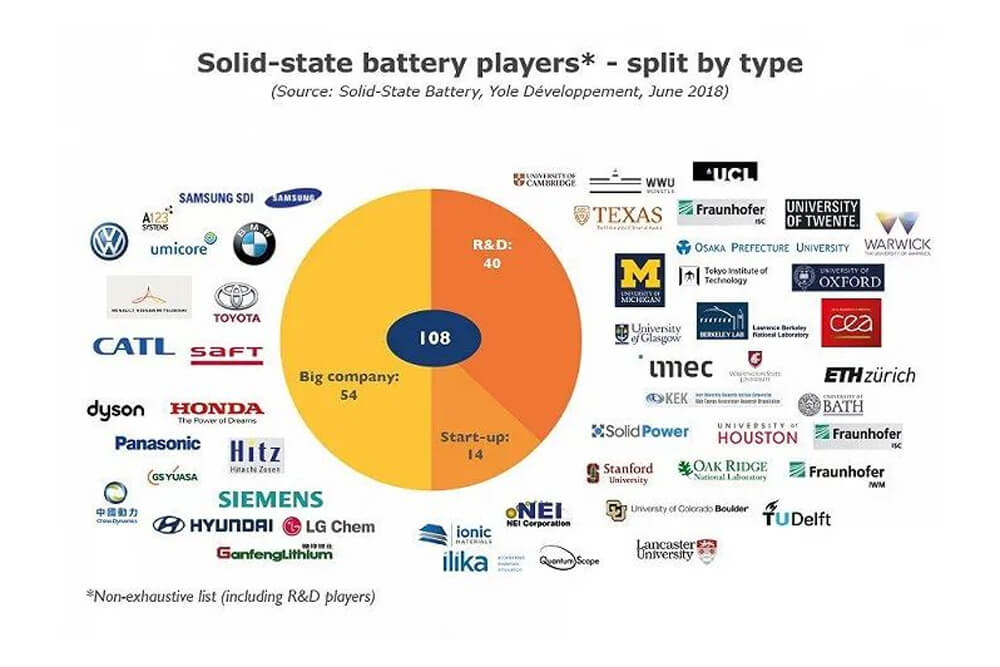

As something as new as electric vehicles, solid-state batteries are highly favored by capital, but they are also being questioned with the same intensity.

Among them, the most frequently capitalized and bolded angle of suspicion is: mass production progress.

The answer to this question can be seen from the solid-state battery pick-up schedules of the world’s major car companies.

Weilai is the “class representative” with the fastest progress among the global auto companies and the obvious first-mover advantage. The 150-degree semi-solid battery pack is expected to be mass-produced in the fourth quarter of next year.

The fastest among Japanese car companies is Toyota. Although a test prototype has been built in 2020, the actual mass production will not be completed until 2025.

German car companies are currently going head-to-head, with Volkswagen Group investing $100 million in solid-state battery Silicon Valley startup QuantumScape in 2018, becoming the largest shareholder. An additional $200 million in 2020. This year, the Volkswagen Group announced that it would use solid-state batteries by 2025.

BMW Group invested $130 million this year in Solid Power, a Colorado-based solid-state battery start-up company, and will begin testing and integrating solid-state battery prototypes next year. Prototype vehicles will be launched by 2025 and mass-produced by 2030.

Mercedes-Benz also reached a strategic agreement with solid-state battery startup Factorial Energy this year to begin testing battery prototypes in 2022, with mass production on the road in the next five years. This is the second time Mercedes-Benz has invested in a solid-state battery company after its partnership with Hydro Quebec.

American auto companies show a distinct sense of division. Ford Group, one of Detroit’s three giants, invested in Solid Power in 2017, began testing products next year, and entered road testing between 2025 and 2030.

General Motors announced in October this year that it would invest in the establishment of a new electric vehicle battery research and development center in Michigan, the United States, to focus on overcoming the technical difficulties of solid-state battery research and development. In 2018, General Motors injected Series B financing into Solid Energy Systems, a solid-state battery company. In April of this year, it also led a Series D financing of $139 million in Solid Energy Systems.

The Stellantis Group, which has merged into the world’s fourth largest automotive company, announced in December that it signed a joint development agreement with Factorial Energy, a manufacturer of solid-state electrolyte materials based in Woburn, Massachusetts, to introduce the first competitive solid-state battery in 2026. Technology.

Although solid-state batteries have been identified as the “terminator” of liquid lithium-ion batteries, there is always one person who does not buy it.

He is Elon Musk.

Contrary to the eagerness of major car companies to move forward with solid-state batteries, Elon Musk and his Tesla have always kept quiet and distance from this new technology.

At Tesla’s annual shareholder meeting and “Battery Day” event in 2020, Elon Musk claimed that the company’s newly developed “4680” battery has increased energy density by 5 times, increased cruising range by 16%, and increased charging and discharging power by 6 times. , the cost per kWh fell by 14%, and the speed of the battery production line was increased by 7 times.

The new battery pack adopts a module-free design and is composed of about 960 (40×24) “4680” batteries. Compared with the battery pack composed of more than 4400 “2170” batteries, the volume and weight are greatly reduced, and the energy density is increased to 300Wh/kg , easily breaking the energy density limit of liquid lithium-ion batteries.

It is an indisputable fact that solid-state batteries surpass liquid lithium-ion batteries in all latitudes, but it is not difficult to find the commonality of solid-state batteries from the timetables of major automobile companies: commercialization is too long, and 2030 is the most optimistic estimate.

Here, let us turn our attention to the Bollore Group, the only French group that has achieved mass production in the field of power batteries so far.

Bollore Group is a Fortune 500 company fully controlled by the famous French Bollore family. It is one of the institutions with the longest history and strongest R&D strength in the field of solid-state batteries.

In October 2011, Bollore Group began to carry solid-state batteries with a capacity of 30 degrees and manufactured by BatScap on its self-developed electric car “Bluecar” and electric bus “Bluebus”. These vehicles are shared in Paris and its suburbs, France. way of service. As of the closure in 2019, the 2,900 solid-state battery electric vehicles have served nearly 200,000 users, with a daily usage of about 18,000.

Bollore Group is the first company to successfully commercialize solid-state batteries on a large scale, but the capacity of this solid-state battery pack is only 30 degrees, and the energy density is only 100Wh/kg, which is only half of that of liquid lithium-ion batteries.

The problem facing Bollore solid-state batteries is exactly what all solid-state battery manufacturers need to tackle: the difference between the inside and outside of the laboratory.

In November, QuantumScape, an American solid-state battery startup with a market value that surpasses Ford Motor, announced that a prototype battery cell maintained more than 80% of its initial capacity after 800 cycles (100% depth of discharge).

But investment research site Seeking Alpha said in a public report that QuantumScape’s batteries were “too small to be tested outside the lab.”

Seeking Alpha believes that it is very, very difficult for solid-state batteries to achieve the required rate and temperature functions in real scenarios outside the laboratory, so difficult that no one has done it. “They may never achieve the performance advertised,” Seeking Alpha said.

QuantumScape founder and CEO Jagdeep Singh hit back, saying, “Seeking Alpha’s report reads like it was written by someone who doesn’t know anything about batteries.”

So, what are the core factors that keep solid-state batteries in the scientific research stage for a long time and stand outside the door of commercial mass production?

Returning to the essence of solid-state batteries – solid-state electrolytes, can clear the fog.

There are currently three mainstream systems for solid-state electrolyte materials: polymers, oxides, and sulfides.

These are three material routes with completely different beliefs. European and American companies choose oxide and polymer systems, and Japanese and Korean companies prefer sulfide systems.

The advantages of polymer systems are high ionic conductivity at high temperatures and ease of processing. However, its ionic conductivity is extremely low at room temperature, which greatly restricts its development.

The French Bolloré brand solid-state battery is the product of the polymer system. An absurd event is to make your own electric car work normally at room temperature.

The Bolloré Group has specially equipped each vehicle with a heater that warms the battery system to 60 to 80°C before starting. If the heater is stopped for a long time, the heater cannot be offline, and the technology at that time cannot realize remote early start.

The advantage of the oxide system is that it has good comprehensive performance. Among them, thin-film products have strict requirements on process technology, and are very difficult to produce in terms of cost and large-scale production. They are not suitable for electric vehicles with huge production capacity. Non-film products are currently the hottest electric vehicle battery solutions, and QuantumScape is a true believer in this line.

The advantage of the sulfide system is that it has an ionic conductivity comparable to that of a liquid electrolyte, and has a high degree of fast charging support. It is the winner of whether electric vehicles can quickly replace fuel vehicles.

It is the technical route chosen by Japanese and Korean companies Toyota, Honda, Samsung and Chinese battery giant CATL. However, the development progress of the sulfide system is the most preliminary, and the risk of not being able to commercialize mass production is also the highest.

Liquid lithium-ion batteries, as the main thruster of the development of the contemporary world, the scientific principle has not substantially changed from when it appeared. The debut of solid-state batteries has shaken its once unshakable foundation. The only thing that troubles it is the mass production of Xingchenhai.

Change lanes or lose

Statistics from the Qiqi Lithium Battery Research Institute, a professional research institution in the new energy industry, show that the global installed capacity of power batteries in the first ten months of this year was 225GWh, a year-on-year increase of 116.1%.

The top ten companies are CATL, LG New Energy, Panasonic, BYD, SKI, Samsung SDI, AVIC (China Aviation Lithium), Guoxuan Hi-Tech, AESC and Honeycomb Energy, with a combined market share of 92.2%.

Five of them are CATL, BYD, AVIC (AVIC Lithium), Guoxuan Hi-Tech and Honeycomb Energy. The loss of the liquid lithium-ion battery battlefield has allowed American and Japanese companies to skip the existing stage and throw a lot of money on another track – solid-state batteries.

Ouyang Minggao, an academician of the Chinese Academy of Sciences, once said at the 2019 China Electric Vehicle 100 Forum: “In order to cope with the rise of the battery industry in China and South Korea, Japan has been developing the next generation of solid-state batteries since 2017, and has invested a lot of R&D expenses.

The United States and Europe are also going all out to develop a new generation of solid-state batteries to go beyond. Although China’s battery industry has achieved temporary advantages, the pressure of international competition is huge, and it needs to fully catch up with the cutting-edge technology of solid-state batteries. “

This year, Ouyang Minggao expressed similar views again in his keynote speech on “2021 New Energy Vehicle Technology and Market Highlights and Mid- to Long-Term Trends”.

“Japan and other countries are vigorously developing the next generation of all-solid-state batteries, and there is still a gap between Chinese brands in this regard.” Ouyang Minggao said, “All-solid-state battery technology must be industrialized and have an important impact on the market structure, which is estimated to take about 10 years. “

On the time blueprint, Ouyang Minggao gave his own prediction: by 2025, the first-generation all-solid-state battery with a specific energy roughly equivalent to the existing liquid electrolyte lithium-ion battery will appear.

After 2030, there will be the second generation of all-solid-state batteries using new positive and negative materials, the specific energy will be increased to 500 watt-hours per kilogram, and there will be high specific energy lithium-sulfur batteries and metal-air batteries.

“Existing lithium-ion batteries, including solid-liquid hybrid lithium-ion batteries, will still dominate until 2030,” Ouyang Minggao concluded.

“Global Solid State Battery Market 2017-2021” supports Ouyang Minggao’s speculation that the global solid-state battery market will grow at a compound annual growth rate of 72.33% during 2017-2021.

At present, China’s new energy vehicle market has passed the cognitive period smoothly and entered a period of rapid expansion. It is estimated that domestic sales of new energy vehicles will be about 5 million in 2022, with a market share of more than 20%; 7 to 10 million in 2025; 17 to 20 million in 2030.

The surge in the number of electric vehicles in China has directly stimulated the exponential growth of vehicle battery production. It is expected to exceed 2 billion kWh in 2025, 7 billion kWh in 2030, and 15 billion kWh in 2035.

For any auto company and solid-state battery manufacturer, this is a window of opportunity that cannot be missed. The market has pre-embedded the potential, and now it is a critical moment to test wisdom.

1 thought on “How long before solid-state batteries are actually available in cars?”

i enjoy this article