Home » battery industry » In-depth analysis of EV battery swapping industry chain

In-depth analysis of EV battery swapping industry chain

With the rapid development of new energy vehicles and the support of national policies, the EV battery swapping industry is expected to achieve leapfrog growth during the “14th five-year plan” period.

It is predicted that in 2025, the sales of battery-swapped vehicles will exceed 2.8 million passenger cars, and the sales of battery-swapped commercial vehicles will reach 500,000. Corresponding to a market size of 76.5 billion, the demand for supporting batteries is about 55gwh, corresponding to a market size of 38.8 billion, and corresponding to a power income of 216.8 billion, and the total industrial chain scale is about 300 billion.

EV battery swapping mode overview

The EV battery swapping mode refers to the centralized storage, centralized charging and unified distribution of a large number of batteries through centralized charging stations. And in the battery distribution station, the battery replacement service for electric vehicles is carried out, or the battery charging, logistics deployment, and battery replacement services are integrated.

The essence of the EV battery swapping mode is to tap the full life cycle value of the power battery and realize the redistribution of the interests of enterprises and consumers.

From the perspective of the development of new energy vehicle technology, the current “charging + EV battery swapping + vehicle and electricity separation sales” model of new energy vehicles is mature, and new EV battery can be bought, rented or exchanged.

At present, the EV battery swapping application of new energy vehicles has good applications in the private side, the operating vehicle side, and the commercial vehicle side. It can fully solve the problem of high average daily mileage of operating vehicles and commercial vehicles and high demand for energy supplementation efficiency, and make up for the shortage of charging piles.

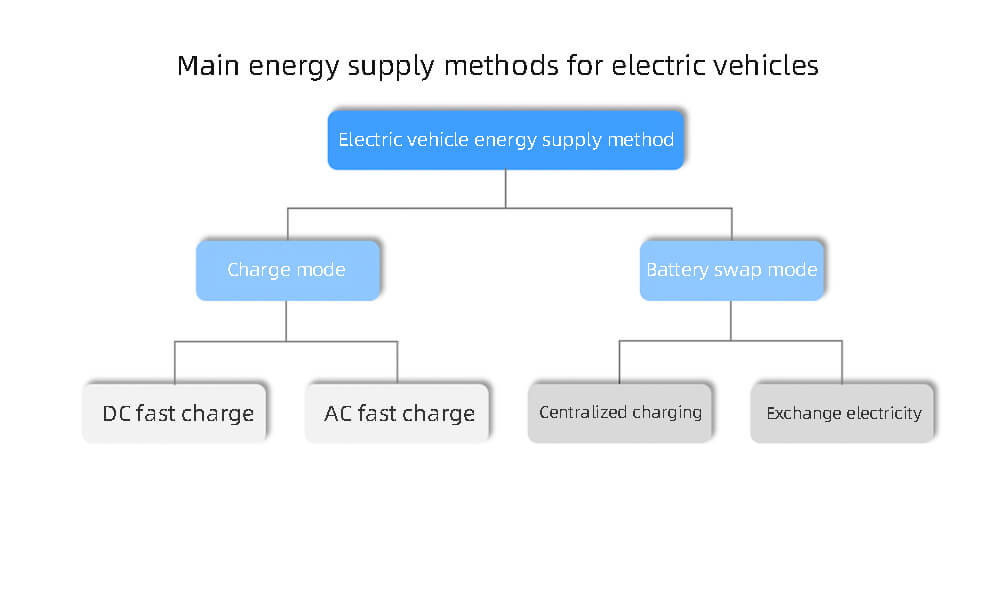

Comparison of charging and swapping modes

Compared with the charging mode, the key advantage of the EV battery replacement mode is that it has high energy replenishment efficiency and greatly shortens the energy replenishment time. 5 minutes.

The EV battery swapping mode also has great advantages in reducing the cost of car companies, extending the service life of the battery and shaving peaks and filling valleys in the power grid.

Operating vehicles can save about 80RMB/day or 24,000 RMB/year, and heavy trucks can save about 150RMB/day or 45,000RMB/year, which is more friendly to taxis and commercial vehicles that have operating cost pressures.

In EV battery swapping mode, the battery maintenance is lower, the land area of the swap station is small, and the recycling rate of the scrapped battery is improved.

The battery is controlled and managed by professionals, extending EV battery life by 30%-60%; making full use of trough charging and peak discharge to reduce EV battery loss and improve profitability; From the perspective of power battery recycling, the cascade utilization technology of the whole package of retired batteries: lays the foundation for the operation of the energy storage system.

However, the shortcomings of EV battery swapping mode cannot be ignored. The initial investment cost of the battery swapping station is high. In addition to the cost of land, manpower, and purchase of EV battery swapping equipment, the construction of the battery swapping station also requires huge battery storage costs, battery charging and electricity costs.

At the same time, compared with the charging mode, the later operation cost of the swap station is high. The charging station can be almost unattended, and the owner can operate the charging pile for charging, and its operating cost is relatively low.

The operation and maintenance of the EV battery swapping equipment in the battery swapping station, the unified charging, storage and deployment of the power battery all require a certain number of workers. Therefore, the later operation cost of the EV battery swapping station is higher than that of the charging station.

Centralized charging mode and charging-swap mode

The centralized charging mode refers to the centralized storage, centralized charging and a large number of batteries are distributed uniformly through centralized charging stations, and battery replacement services for electric vehicles are provided at battery distribution stations.

The charging and swapping mode refers to the EV battery swapping station as the carrier. The swapping station has both battery replacement and battery charging functions. The station includes power supply system, charging system, battery replacement system, monitoring system, battery detection and maintenance management.

At present, most of the battery replacement methods used in the market are the charging station mode.

Mainstream EV battery swapping method

At present, the mainstream methods of EV battery on the market are chassis battery swapping, side battery swapping and sub-box battery swapping. NIO’s EV battery-swapping models use chassis swaps to replace batteries

The battery replacement model of Zhejiang Shikong Electric Co., Ltd. adopts the method of side battery replacement to replace the battery. The battery replacement model of Lifan Motors adopts the method of sub-box battery replacement to replace the battery.

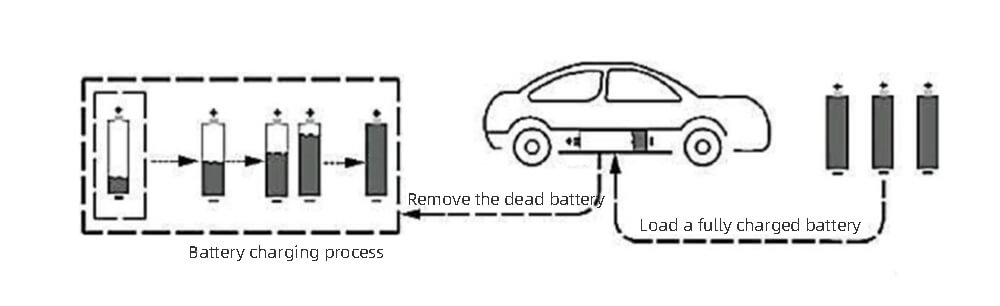

Schematic diagram of electric vehicle battery exchange:

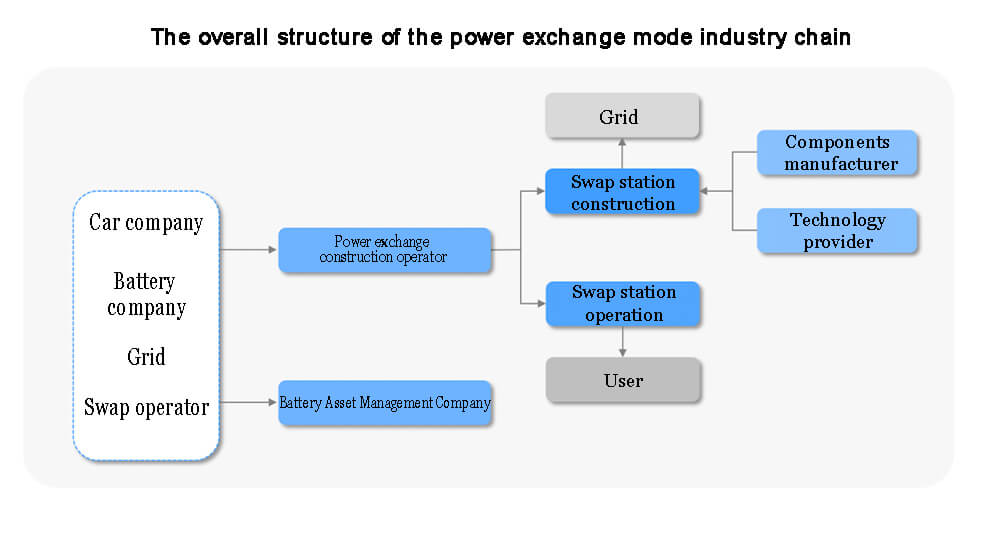

EV battery swapping industry chain

EV battery swapping industry chain is mainly composed of upstream battery swapping stations, midstream vehicle manufacturers and operators, and downstream terminal consumption.

Upstream of battery swapping industry chain-battery swapping station

The upstream swap station is mainly composed of three parts: quick swap system, charging system and power battery.

Quick change system

EV battery swapping system at the vehicle end is composed of mechanical connection parts, mechanical locking parts, and EV battery swapping battery boxes.The locking and unlocking platform can realize the locking and unlocking function of the vehicle and battery replacement, the palletizer is used to exchange and transport the battery, and the locking link assembly can automatically realize the locking and separation of the power battery and the body.

Quick-change electrical connectors, liquid-cooled connectors, and water connectors are mainly used for connection. The main forms are divided into parallel and vertical power-changing connections. The manufacturers include Sichuan Yonggui, Shanghai Dianba, Amphenol and so on.The main manufacturers of quick-change systems include Shenzhen Jingzhi, Bozhong Precision, Bronte, Keda Intelligent, EAST and Shandong Weida.

Among them, Shandong Weida is the world’s leading enterprise in the drill chuck industry, with a global high-end customer base in the field of power tools.In the future, it is expected to expand its business to other customers who have deployed EV battery swapping stations. Its holding subsidiary Kunshan Swop also participated in the research and development of NIO and the testing process of the second-generation EV battery swapping station.

Bozhong Seiko joined Dongfeng Motor’s “Power Replacement Alliance” in October 2020, and plans to provide automation equipment for all aspects of the entire industry chain, including the operation and maintenance of power replacement in the later stage.

Charging system

The charging system in the swap station mainly charges the replaced batteries by means of centralized charging and AC slow charging.

In the charging system, the battery box design technology has high requirements for environmental control, safety protection, locking and quick unlocking technology.

At present, the charging module suppliers include Titan, Tonghe, Huawei, etc., the charging power is 10KW-60KW, and the charging voltage is 200V-500V.

| Battery swap mode industry chain segmentation and related targets | ||

| Industrial chain link | Segmentation | Related subject |

| Equipment manufacturer | Battery swapping equipment | Weida, Nan Rui, Zhongheng, Xu Ji, HKUST |

| Battery companies | Power battery | CATL,BYD,Guoxuan Hi-tech,EVE etc. |

| Swap operator | Main operator | Aodong, Weilai, Bertan, Space-Time Electric |

| New entrant | FAW, Dongfeng, Geely, Changan, BAIC, etc. State Grid, China Southern Power Grid, State Power Investment, GCL Energy, Ali, Tencent, Meituan, Sinopec, China Tower | |

Power battery

The EV battery swapping mode means the separation of “car power”, one car and one battery will become one car with multiple batteries, and the battery is expected to usher in incremental demand. Increase the battery usage to facilitate the cascade utilization and recycling of the battery.

The low-cost and long-cycle lithium iron phosphate market is better for close cooperation with OEMs. Leading companies with superior technology and scale have super advantages. CATL, Sunwoda, and Huading batteries have entered the field of EV battery swapping and are planning to deploy the market ahead of schedule.

However, for a long time, Chinese electric vehicle companies have independently deployed EV battery swapping stations and are still in the stage of self-exploration. Due to different understandings of technical routes, there are also differences in the versatility of replacing battery packs, and the battery technologies they master are different, the power battery standard has not yet been unified, and the standardization of the battery in the EV battery swapping mode is a direction worthy of exploration and improvement.

Midstream of the EV battery swapping industry chain-construction and operation of EV battery swapping stations

There is a large demand for capital for the construction and operation of power swap stations, and there are strong requirements for battery investment, parking location selection, wiring transformation and operation management.

According to the China Charging Alliance, there are currently three companies operating power swap stations in China: Aodong New Energy, Weilai, and Hangzhou Bertan Technology.

As of October 2021, the ownership of Aodong power station is 56.08%, Weilai 34.07%, Hangzhou Bertan 9.85%.

At present, Aodong, which accounts for the largest proportion of the EV battery swapping field, plans to complete the construction of 10,000 EV battery swapping stations within five years. State Grid, NIO, State Power Investment Corporation, Sinopec, GCL Nengke, etc. all have plans for more than 4,000 charging and swapping stations during the “14th Five-Year Plan” period.

According to the NIO Power 2025 battery swap station layout plan of NIO, the total number of completed target stations in 2021 will increase from 500 to more than 700 battery swap stations. A high-speed power exchange network with “five verticals, three horizontals and four metropolitan circles” will be built before the Spring Festival in 2022.

From 2022 to 2025, NIO will add 600 new EV battery swapping stations in the Chinese market every year, turning 90% of NIO users’ residences into power district houses. By the end of 2025, the total number of NIO batteries in the world will exceed 4,000 switching stations, with about 1,000 in markets outside of China.

New energy vehicle manufacturers including Dongfeng, Weilai, Aodong, BAIC, Changan, SAIC, Geely, etc. will increase the promotion of EV battery swapping tracks from 2021.

BAIC has launched a series of mature battery-swap models, and OEMs such as SAIC, GAC, FAW, and Geely are actively developing battery-swap models, some of which have already been mass-produced.

In 2021, both SAIC Roewe Ei5 and Geely Jiaji electric car will start mass production; FAW Bestune NAT electric car and FAW Hongqi E111 electric car will start mass production.

Dongfeng plans to build 6 standard EV battery swapping stations, 50 express stations, and put 2,000 EV battery swapping stations; Weilai realizes the construction of 1 EV battery swapping stations per day; Geely’s registered subsidiary, Yiyi Swap, has signed contracts for 1,000 EV battery swapping stations.

The downstream of the EV battery swapping stations industry chain is mainly the users of new energy vehicles. At present, China’s EV battery swapping model is still in the early stage of industry development. Most midstream operators of power swapping stations in China mainly develop 2B services, such as buses, taxis, online car-hailing, and heavy trucks. Some battery-swapping operators are also gradually expanding their business to C-end users.

On November 1, 2021, the national standard “Safety Requirements for Electric Vehicle Swapping” was officially implemented. This standard was approved and released by the State Administration for Market Regulation in April. General national industry standard.

This standard helps to improve the safety level of electric vehicles using EV battery swapping technology in terms of mechanical strength, electrical safety, environmental adaptability, etc.

It solves the urgent problem that there is no standard for EV battery swapping mode, which helps to guide the product research and development of automobile companies, improve the safety of EV battery swapping electric vehicles, and support the high-quality development of the new energy automobile industry.

Judging from the current time node, there are two links in the battery swapping industry that deserve special attention:

One is that the battery swapping equipment will first start with the implementation of the EV battery swapping stations plan.Second, with the market’s recognition of the EV battery swapping model and the increase in EV battery swapping models, the market space for the operation of EV battery swapping stations will rapidly increase.

The operation of the EV battery swapping stations is expected to focus on 2B (commercial vehicles, operating vehicles), and at the same time provide services to the high-end 2C market to achieve profitability. After the integration of the industrial chain, the economic benefits will be fully utilized, and the upstream and downstream links will explore to form a complete ecological network.