Large-scale energy storage and six links in the energy storage industry chain

At present, the profit channels of China’s large-scale energy storage projects are mainly peak-valley arbitrage, peak-shaving and frequency-regulation and other ancillary service income, and capacity leasing. The high growth rate of China’s energy storage has high certainty.

Large-scale energy storage – the main force of global energy storage installed capacity

From the perspective of product form and sales model, energy storage can be divided into two categories: large-scale energy storage and home energy storage.

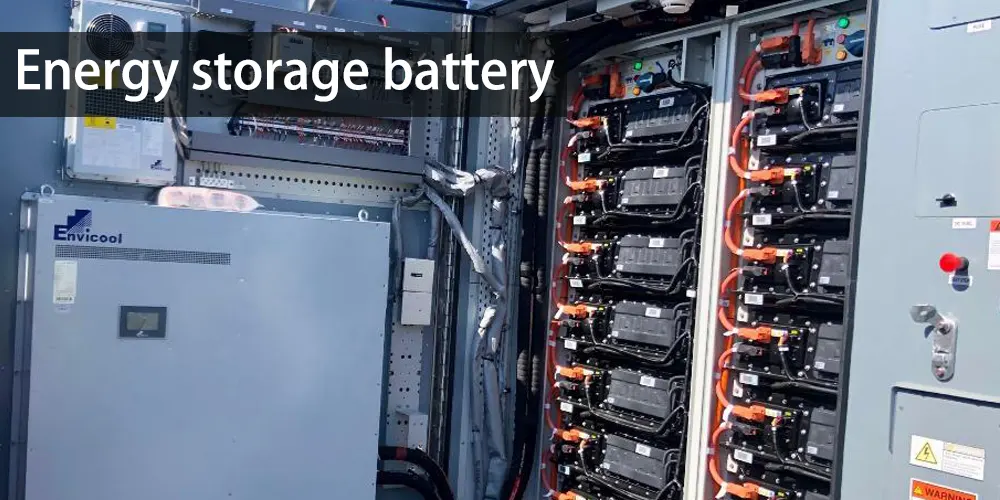

Among them, large-scale energy storage is mainly containerized systems above the MWh level, and the end customers are large power companies or industrial and commercial enterprises, which are mainly sold directly through centralized procurement, bidding, etc., with strong B-end attributes.

Home energy storage is mainly small battery systems of 5-20kWh, and the end customers are scattered households. They are mainly sold through local dealers and installer networks, and have certain C-end attributes.

From a structural point of view, in the past few years, the installed capacity of large-scale energy storage in the world accounted for about 80%, which is the main component of the installed capacity of energy storage. Large storage also occupies a dominant position in China’s installed capacity of electrochemical energy storage, and large storage accounts for more than 95% of China’s new installed capacity of energy storage.

Energy storage costs are affected by upstream prices such as lithium carbonate and silicon materials. After the three departments interviewed upstream silicon material enterprises in the photovoltaic industry chain, the upstream price is expected to be adjusted back.

The 22-year tight supply and demand situation of lithium carbonate and silicon materials is expected to ease, and the cost side of the energy storage system is expected to decrease, which will further promote the demand for installed capacity of ground power stations, and further promote the demand for large-scale energy storage.

Six links in the energy storage industry chain

The upstream of China’s electrochemical energy storage industry chain is raw materials, the midstream is core component manufacturing and system integrators, and the downstream is system operation and application. Among them, the manufacturing of the core components of the midstream energy storage system is mainly divided into two parts: batteries and systems. Under subdivision, it generally includes four parts: battery pack, battery management system (BMS), power storage converter (PCS), and energy management system (EMS).

Batteries account for the highest cost in energy storage systems. Among them, the cost of large storage batteries (battery cells + PACK + BMS) accounted for 67%, household storage costs accounted for 35% (solar-storage integrated machines), and accounted for 49% without photovoltaic modules.

The cost of large storage PCS accounts for about 10%, and household storage accounts for about 23% (32% after removing components). The structure of household storage is relatively simple. PCS is one of the core components, and its value is higher than that of large storage.

Battery

The battery system is the core of the energy storage system and determines the storage capacity of the energy storage system. A large storage battery is also composed of a single battery cell, and there is not much room for cost reduction in terms of technology in terms of scale. Therefore, the larger the scale of the energy storage project, the higher the proportion of batteries.

From a global perspective, CATL will rank first with a market share of nearly 25% in 2021, followed by BYD, South Korea’s Samsung SDI, and South Korea’s LGES. The combined share of lithium-ion battery shipments of the above four companies is close to 70%. From the perspective of China, CATL’s leading enterprises have obvious advantages, and some of top 10 energy storage battery companies in China include BYD, EVE, Great Power, GOTION HIGH-TECH, Pylon Tech, etc.

EMS

EMS (energy management system) plays a decision-making role in the energy storage system and is the decision-making center of the energy storage system. The energy storage system participates in power grid dispatching, virtual power plant dispatching, and “source-network-load-storage” interaction through EMS. The core competitiveness of EMS in the future depends on software development capabilities and energy optimization strategy design capabilities.

PCS

The power conversion system (PCS) is a key part of the energy storage power station, which controls the charging and discharging of the battery, and performs AC-DC conversion, and directly supplies power to AC loads without a grid. The PCS link focuses on three core competitiveness: iterative cost reduction capabilities, brand power & bankability, and channel capabilities.

At present, China’s power conversion system market is still in the initial stage of quality improvement, cost reduction, and large-scale development. The market structure is still undecided, and competition from latecomers is fierce. Energy storage converters and photovoltaic converters have the same technology, and leading manufacturers are highly overlapped.

BMS

As a key monitoring system, the battery management system (BMS) is an important part of the energy storage battery system. In 2025, the market size of the energy storage BMS is close to 20 billion. Energy storage BMS is more complex and demanding than the BMS of automotive power batteries.

At present, BMS manufacturers mainly include car factories, battery factories and professional BMS manufacturers. Unlike power battery BMS, which is mainly dominated by terminal car manufacturers, end users of energy storage batteries have no demand for BMS R&D and manufacturing; at present, there is no leader in energy storage BMS.

At present, the technology maturity of the industry is low, the industry standard is lacking, and the competition pattern is scattered. In the future, the energy storage battery BMS will most likely continue the power battery BMS market pattern.

Energy storage temperature control and fire protection

Large-scale energy storage is the main track of energy storage temperature control. Large-scale energy storage has the characteristics of large capacity and complex operating environment, and has higher requirements on the temperature control system, which is expected to increase the proportion of liquid cooling.

At present, some of top 10 energy storage liquid cooling companies such as BYD, CATL, and Sungrow have launched liquid cooling solutions. In the short term, energy storage temperature control is still in its infancy, and there is a strong demand for product customization. In the long run, leading companies with first-mover advantages in the industry are expected to benefit first.

Energy storage fire protection accounts for about 3% of the cost of energy storage systems. It is expected that with the rise of energy storage market demand, its value growth is expected to exceed market growth.

EPC integration

There are many system integrators in China, and companies with integration capabilities, operation and maintenance services, local channels and brand power have first-mover advantages. The integrator link has a trend of industrial chain integration.

At the same time, Chinese energy storage integrators have a competitive and cooperative relationship with overseas integrators, and they also provide OEM services for some overseas integrators. Integrators are also an important entry point for Chinese companies to participate in the US energy storage market.

The EPC market is highly dependent on upwards, and the EPC model is currently the main model for engineering construction. It can be seen from the participating companies of the integrator that companies in the PCS and battery sectors are also gradually participating in the integration process, among which PCS companies are more involved in the integrator.

Power equipment enterprise layout integrators also have natural advantages. As a new link in the power system, large-scale storage requires the accumulation of power-related technologies, and power equipment companies have power-related “genes”, so the transformation is relatively smooth, and they are expected to enter quickly in the future and have greater competitiveness. Downstream of power equipment enterprises are State Grid South Power Grid and Power Generation Group, which have a customer base.

Conclusion

The economy of large storage projects is generally poor at present, and policy subsidies are an important source of income. In recent years, a series of policies have been issued intensively, and China’s national or local governments have introduced more than 400 related policies to support the development of energy storage.

In 2022, China’s large-scale storage bidding will see a blowout growth. With the start of ground photovoltaic demand, energy storage bidding and installation will gradually accelerate, and the project economy will be greatly improved.

With the general trend of new energy power generation, driven by new models such as mandatory storage + shared energy storage, China’s large storage is expected to usher in rapid development. From the perspective of the global market, the rigid demand for distribution and storage brought about by the high cost of power facility renovation in the United States will effectively drive the accelerated penetration of global large storage.