The prospect of lithium carbonate industry and its impact

According to preliminary estimates, by 2025, the demand for lithium carbonate in China is expected to reach 930,000 tons, the output is expected to reach 710,000 tons, and the demand for soda ash for lithium carbonate production in China is expected to reach 1.42 million tons, an increase of nearly 1 million tons compared with 2021.

Definition of lithium carbonate

Lithium carbonate, an inorganic compound, a common raw material for sodium ion battery. Lithium carbonate is a colorless monoclinic crystal or white powder, which is soluble in dilute acid, slightly soluble in water, more soluble in cold water than in hot water, and insoluble in alcohol and acetone. It can be used to make ceramics, medicines, catalysts, etc.

Lithium carbonate production process

According to different sources of raw materials, the production process of lithium carbonate can be divided into salt lake brine extraction and ore extraction.

At present, other countries mainly use the salt lake brine extraction process to produce lithium carbonate, while China mainly uses the solid ore extraction process.

In terms of process characteristics, the ore extraction process is relatively mature, but the ore extraction process has high energy consumption, heavy pollution and high cost;

The advantages of lithium extraction from salt lake brine are high lithium carbonate content and low cost, but the disadvantage is that it is technically difficult, especially the purification of battery-grade lithium carbonate.

In extraction technology, ore extraction method and salt lake extraction method are very different. The ore extraction method uses spodumene as raw material, the main processes for preparing lithium carbonate include sulfuric acid method, spodumene and sulfate mixed sintering method, sodium carbonate pressure leaching method, chlorination roasting method, limestone roasting method, etc.

The lithium extraction process from salt lake brine refers to the extraction of lithium carbonate and other lithium salt products from lithium-containing salt lake brine.

The current global salt lake brine extraction technology, there are mainly precipitation methods (carbonate precipitation method, aluminate precipitation method, boron-magnesium and boron-lithium co-precipitation method), calcination leaching method, carbonization method, solvent extraction method, ion exchange method, etc.

Among them, solvent extraction method and ion exchange method have not achieved large-scale industrial application.

Generally speaking, the extraction of lithium carbonate by ore method has a long development cycle. First of all, it is necessary to explore resources, then prepare the JORC report on ore reserves, then the EIA report, the delivery of the license, and then start the design and mining.

Generally, it will go through a construction period of about 2 years, and the product will be delivered in the third year.

The entire project takes 8-9 years from initial exploration to final output. The expansion of salt lakes has a longer period due to the complexity of the environment and other reasons. The long production cycle of lithium carbonate is also a major factor affecting the supply of lithium carbonate.

| Summary of Lithium Carbonate Production Process | |

| Ore extraction method | Chlorinated Roasting Limestone roasting Pressure leaching Sulfuric acid Sulfur and salt mixed roasting |

| Lake law extraction method | Precipitation Adsorption calcining leaching Electrodialysis Ion exchange Extraction |

Lithium carbonate industry chain

According to purity and chemical indicators, lithium carbonate can be divided into industrial grade, battery grade and high-purity grade lithium carbonate. Industrial grade lithium carbonate is mainly used to prepare various deep-processed lithium products, and also used in glass ceramics industry, etc.;

Battery-grade lithium carbonate (purity ≥99.5%) is mainly used for the production of cathode materials and electrolytes for lithium-ion batteries; high-purity lithium carbonate is the main raw material for the production of piezoelectric material lithium tantalate.

Distribution characteristics of global lithium carbonate resources

The development of global lithium mines is dominated by salt lakes, supplemented by ore. The global lithium resources mainly include salt lake lithium and lithium ore.

From the perspective of production, about 70% of the global lithium resources are salt lake lithium, and about 30% are lithium ore. Rock minerals include spodumene, lepidolite, and feldspar.

According to the report, as of 2020, the global reserves of lithium ore (lithium carbonate) are 128 million tons and the resources are 349 million tons, mainly distributed in Chile, Australia, Argentina, Bolivia and other countries.

Main industrial chain of lithium carbonate

Global supply and demand pattern of lithium carbonate

According to one of the top 10 Lithium salt enterprises in China Tianqi Lithium, as of 2021, including the output from brine and mineral conversion resources (excluding lithium carbonate produced from recycled materials and reprocessing of lithium compounds), global lithium carbonate production will total 399,000 tons of LCE.

By 2025 and 2032, the total global lithium carbonate production will be 779 kilotons LCE and 987 kilotons LCE, respectively.

In terms of lithium supply, the global distribution of lithium ore resources is extremely uneven. According to the report, as of 2020, the global reserves of lithium ore (lithium carbonate) are 128 million tons and the resources are 349 million tons, mainly distributed in Chile, Australia, Argentina, Bolivia and other countries.

According to data, as of the end of the survey, the world’s proven lithium resource reserves are equivalent to 116.6 million tons of lithium carbonate equivalent. Among them, Chile’s lithium reserves account for 42% and Argentina’s 10%, mainly concentrated in the junction of Chile, Argentina and Bolivia, in the form of salt lakes;

Australia’s lithium reserves account for 26%, mainly in the form of spodumene; China’s lithium reserves account for 6.8%, mainly in the form of salt lakes.

In terms of suppliers, the global supply pattern is an oligopoly, and the global supply of lithium resources is mainly controlled by international giants such as Australia’s Talison, Reed Industrial Minerals, Pilbara Minerals and China’s Yichun tantalum and niobium mine.

In terms of the supply of lithium resources from minerals and clay deposits, according to statistics, as of December 31, 2021, the Greenbush Mine owned by Talison, a subsidiary of Tianqi Lithium Holdings, has the world’s largest lithium reserves.

The reported mineral reserves are 168 million tonnes at a grade of 2.04% lithium oxide containing 8.3 million tonnes of LCE. In terms of lithium brine deposits,

According to statistics, SQM’s Atacama Salt Lake operation in Chile’s Atacama region has the largest brine reserve, 45.51 million tons of LCE, with high-grade lithium ore, large reserves and low-cost comprehensive processing capabilities.

From the perspective of consumption, the downstream consumption of lithium carbonate mainly includes four fields: power batteries, consumer batteries, energy storage batteries and industrial applications. The global demand for lithium carbonate in 2021 is about 410,000 tons.

According to the analysis, the current demand for lithium for rechargeable batteries is growing rapidly. The production and sales of new energy vehicles have increased significantly, and the demand for lithium carbonate has also increased significantly, and its impact is expected to continue in the next 10 years.

In 2015, the demand for lithium carbonate on the battery side accounted for less than half, and the proportion of demand for lithium carbonate has been increasing in the past six years. The development of the automobile industry will drive the generation of millions of lithium carbonate demand.

From the perspective of other consumers, with the in-depth development of the digital age, consumer electronics will contribute to a low growth rate but stable incremental demand.

Benefiting from the deepening of the green energy revolution, the demand for energy storage batteries and industrial applications of lithium carbonate is also expected to continue to increase.

In general, the global consumption of lithium carbonate will show a continuous growth trend, and power batteries will contribute the most important incremental demand.

In terms of power batteries, the global consumption of new energy vehicles will be about 6.5 million in 2021, and the demand for lithium carbonate will be about 220,000 tons. With the growth of global production of new energy vehicles, power batteries will become the main growth point of lithium carbonate demand.

Several institutions predict that the global production of new energy vehicles will be close to 12 million in 2025. Based on this, we predict that the demand for lithium carbonate for power batteries will reach 970,000 tons in 2025.

In terms of consumer batteries, the demand for lithium carbonate in 2021 is about 50,000 tons. According to the data, we believe that the stock of mobile phones, tablets and notebook computers in consumer electronics is close to saturation, and the future consumption will mainly be on stock updates, there is still room for growth in mobile power supplies and smart wearable devices, so we predict that the demand for lithium carbonate in consumer electronics will reach 60,000 tons in 2025.

In terms of energy storage batteries, the demand for lithium carbonate in 2021 is about 20,000 tons. Energy storage battery energy storage technology is used in power systems, communication base stations, data base stations, industrial applications, military applications, aerospace, etc., and the potential demand is huge.

According to the data, we found that with the construction of new energy projects such as wind power and hydropower, the demand for energy storage batteries will be supported, and the proportion of lithium battery energy storage installed capacity will continue to rise in the future.

According to the data, the cumulative installed capacity and installed capacity of the global energy storage market will increase from 11GW/22GWh in 2019 to 1676GW/5827GWh in 2050.

Based on the expected growth of the energy storage battery market and the rising proportion of lithium battery energy storage capacity, we forecast that the demand for energy storage batteries in 2025 will be 90,000 tons.

In terms of industrial demand, the demand for lithium carbonate in 2021 will be about 120,000 tons. According to the data, lithium carbonate is used in traditional industrial fields such as glass, grease and air conditioner manufacturing.

At present, the demand for lithium carbonate in industrial demand is relatively stable. We predict that the industrial demand will be 140,000 tons in 2025.

Global lithium carbonate demand forecast (10,000 tons) | |||||

| Years | 2021 | 2022E | 2023E | 2024E | 2025E |

| Power battery | 22 | 34 | 51 | 72 | 97 |

| Y-o-Y growth rate | 55% | 50% | 心 | 35% | |

| Consumer battery | 5 | 5 | 6 | 6 | 6 |

| Y-o-Y growth rate | 5% | 5% | 5% | 5% | |

| Energy storage battery | 2 | 3 | 5 | 7 | 9 |

| Y-o-Y growth rate | 50% | 50% | 45% | 35% | |

| Industrial needs | 12 | 12 | 13 | 13 | 14 |

| Y-o-Y growth rate | 3% | 3% | 3% | 3% | |

| The total demand | 41 | 55 | 74 | 97 | 125 |

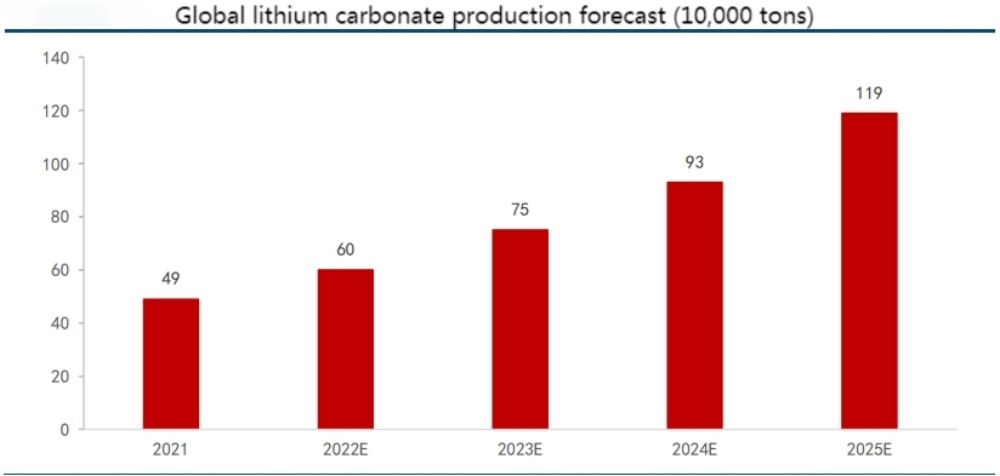

On the supply side, the global supply of lithium carbonate in 2021 is about 490,000 tons. At present, the world’s lithium carbonate reserves are abundant.

With the expansion of demand, global lithium carbonate producers are accelerating the expansion of production. Many institutions predict that by 2025, the global lithium carbonate production capacity will reach about 1.4 million tons.

By 2025, global lithium carbonate production is expected to reach 1.19 million tons. Based on the supply and demand data, we expect that the supply and demand of lithium carbonate will maintain a tight balance in the next three years, and the probability of serious shortage or surplus is small.

Distribution and sources of lithium ore resources in China

Lithium resources in China are mainly distributed in Tibet, Xinjiang, Qinghai, Sichuan, Jiangxi and other provinces. China’s proven lithium resource reserves are about 6 million tons, of which salt lake resources account for about 60%, and the rest are hard rock and sedimentary lithium.

Lithium ore resources can be divided into brine lithium and ore lithium. The brine type is mainly carbon Acid, sulfate and chloride forms. Qinghai Lithium Salt Lake is a salt lake brine deposit, which is the largest lithium-based salt lake brine deposit in China.

The Qinghai brine deposit has a lower lithium grade but more reserves; Hard rock types include granite pegmatite type and granite type lithium ore. Lithium ore is mainly spodumene, lithopene, lithium feldspar, and lepidolite in Yichun, Jiangxi, which are the mainstream lithium mines overseas.

The reserves of lithium salt lakes in Tibet are second only to Qinghai. Due to the natural conditions in Tibet, development is difficult and production capacity growth is relatively slow. However, the lithium-containing grade is high, the impurities are relatively small, and there is a large space for utilization.

According to the classification of production raw materials, about 50% of China’s lithium carbonate production is produced with spodumene as raw material, about 20% is produced with lepidolite as raw material, and about 30% is produced with salt lake brine as raw material.

In terms of the source of lithium salt raw materials, according to the introduction of Shengxin Lithium Energy, although China’s lithium resources are at the forefront of the world and the variety of resources is relatively rich, there is still a certain gap in demand and output compared with China’s lithium salt production capacity, and the dependence of lithium raw materials on external Higher, 65% of lithium raw materials need to be imported.

As China’s lithium carbonate demand further increases, imports are also expected to continue to increase to meet Chinese demand.

Lithium carbonate supply and demand in China

As of 2021, China’s lithium carbonate demand side mainly includes four fields: power batteries, consumer batteries, energy storage batteries and industrial applications. If it is further subdivided, it can be divided into automotive power batteries, lithium iron phosphate, ternary materials, 3C digital batteries and energy storage batteries.

New energy vehicle batteries are the most important engine for the growth of downstream consumption of lithium carbonate, while lithium iron carbonate and ternary materials are indispensable materials for cathode materials of new energy vehicle power batteries.

Therefore, the production and sales of new energy vehicles have a very significant impact on the demand for lithium carbonate in China.

China’s apparent consumption of lithium carbonate has grown rapidly in the past two years, with year-on-year growth rates of 21.64% and 46.12% in 2020 and 2021.

Driven by the consumer side, China’s lithium carbonate production capacity has also ushered in a wave of release and expansion, with year-on-year growth rates of 7.09% and 36.65% in 2020 and 2021.

Due to the substantial increase in demand and the current tight domestic supply of lithium carbonate, domestic lithium carbonate prices have risen rapidly.

Although Chinese lithium carbonate suppliers have increased their horsepower to increase production, due to capacity constraints and the long production cycle of lithium carbonate, the production capacity cannot meet domestic demand, which has led to a rapid increase in China’s lithium carbonate imports.

At the same time, China’s lithium carbonate production is mainly used to meet domestic demand, and the export volume is relatively small.

Major Enterprises and Competitive Landscape of China’s Lithium Carbonate Industry

Lithium carbonate manufacturers in China mainly include Ganfeng Lithium the leading company in top 10 lithium mining companies in China, Jiangte Electric, Zangge Holdings, Tibet Mining, Tibet Everest, Tianqi Lithium, Yahua Group, Yongxing Materials, Shengneng Lithium, Guoxuan Hi-Tech, etc. , there is a certain gap in the production capacity of various manufacturers.

Ganfeng Lithium Industry, Tianqi Lithium Industry and Salt Lake Co., Ltd. are the three leading enterprises in China’s lithium carbonate production industry, and have a certain dominant position in terms of production capacity.

Enterprises with a production capacity of more than 10,000 tons include Ganfeng Lithium Industry, Tianqi Lithium Industry, Yanhu Co., Ltd., Shengxin Lithium Energy, Yongxing Materials, Jiangte Motor, and Zangge Holdings.

Due to the recent rise in the price of lithium carbonate, many domestic manufacturers have announced plans to expand lithium production capacity, mainly through new industrial lines, acquisitions, and transformation and upgrading of production lines to achieve the purpose of expansion.

At the same time, many companies downstream of lithium carbonate and companies that did not have lithium carbonate production capacity have begun to enter the production of lithium carbonate. It is expected that my country’s lithium carbonate production capacity will increase significantly in the future.

The pattern of lithium carbonate in China

From the perspective of the preparation process of global lithium carbonate, light alkali is required in the specific production process.

The extraction process of lithium carbonate is mainly divided into two categories: ore extraction with spodumene as raw material and extraction from salt lake brine. Both processes require about 2 units of light alkali to produce 1 unit of lithium carbonate.

China is the country with the largest supply of lithium carbonate in the world. With the rapid growth of lithium carbonate demand, the demand for soda ash will also increase significantly.

According to the forecast of global lithium carbonate demand and production, this paper forecasts the global demand for soda ash as follows:

| Calculation of the impact of lithium carbonate on the demand for soda ash | |||||

| 2021 | 2022E | 2023E | 2024E | 2025E | |

| Global lithium carbonate demand (10,000 tons) | 41 | 55 | 74 | 97 | 125 |

| China’s lithium carbonate demand (10,000 tons) | 31 | 41 | 55 | 73 | 93 |

| Lithium carbonate production in China (10,000 tons) | 23 | 36 | 45 | 56 | 71 |

| Global lithium carbonate consumption to soda ash demand (10,000 tons) | 82 | 109 | 148 | 194 | 250 |

| China’s lithium carbonate consumption to soda ash demand (10,000 tons) | 62 | 82 | 110 | 146 | 186 |

| China’s lithium carbonate production and demand for soda ash (10,000 tons) | 46 | 72 | 90 | 112 | 142 |

| China’s lithium carbonate production demand accounted for the proportion of soda ash demand (%) | 1.62% | 2. 44% | 3. 00% | 3. 70% | 4. 69% |

At present, the amount of soda ash used in the production of lithium carbonate accounts for about 2% of the domestic demand for soda ash.

With the increase in supply and demand of lithium carbonate, especially the expansion of lithium carbonate production capacity in China, the proportion of lithium carbonate demand for soda ash will continue to increase in the future.

It is estimated that by 2025, the soda ash required for the production of lithium carbonate in China will reach 1.42 million tons, accounting for nearly 5% of the total demand for soda ash in China, and it will become one of the more important downstreams of soda ash.

From 2021 to 2025, the incremental demand for soda ash due to the increased production of lithium carbonate in China is expected to approach 1 million tons.

Conclusion

Benefiting from the dual carbon goals and related policies, the rapid development of the new energy vehicle industry has also significantly driven the demand for lithium carbonate.

In the future, the global new energy vehicles are expected to continue the high growth trend, which will significantly drive the demand for lithium carbonate, and will also drive the significant growth in the supply of lithium carbonate.

As one of the downstream of soda ash, lithium carbonate’s rapid development will also drive a significant increase in the demand for soda ash.

After calculation, we predict that by 2025, the demand for lithium carbonate in China is expected to reach 930,000 tons, and the output is expected to reach 710,000 tons.

The demand for soda ash for lithium carbonate production in China is expected to reach 1.42 million tons, accounting for nearly 5% of the demand for soda ash.