Top 10 new energy heavy truck power battery manufacturers

Leading power battery companies are starting the battle for the electric heavy truck market through customer binding, circle cooperation, and product iteration.

Since 2021, the sales growth of new energy heavy trucks has been rapid, and it has become another battleground for power battery companies. Especially the two routes of power exchange and hydrogen fuel cell heavy trucks are making rapid progress.

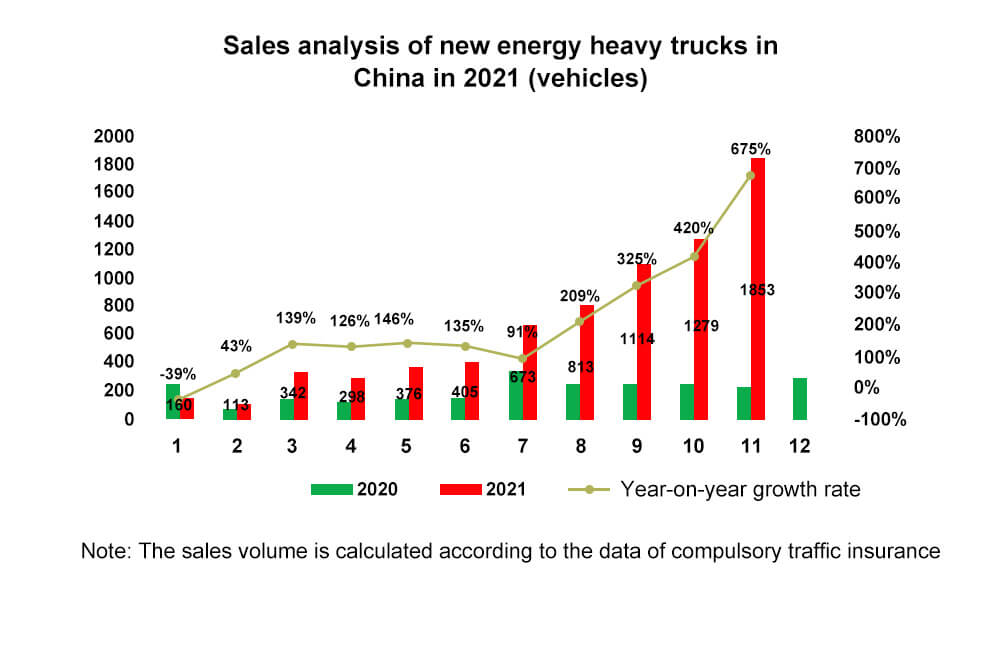

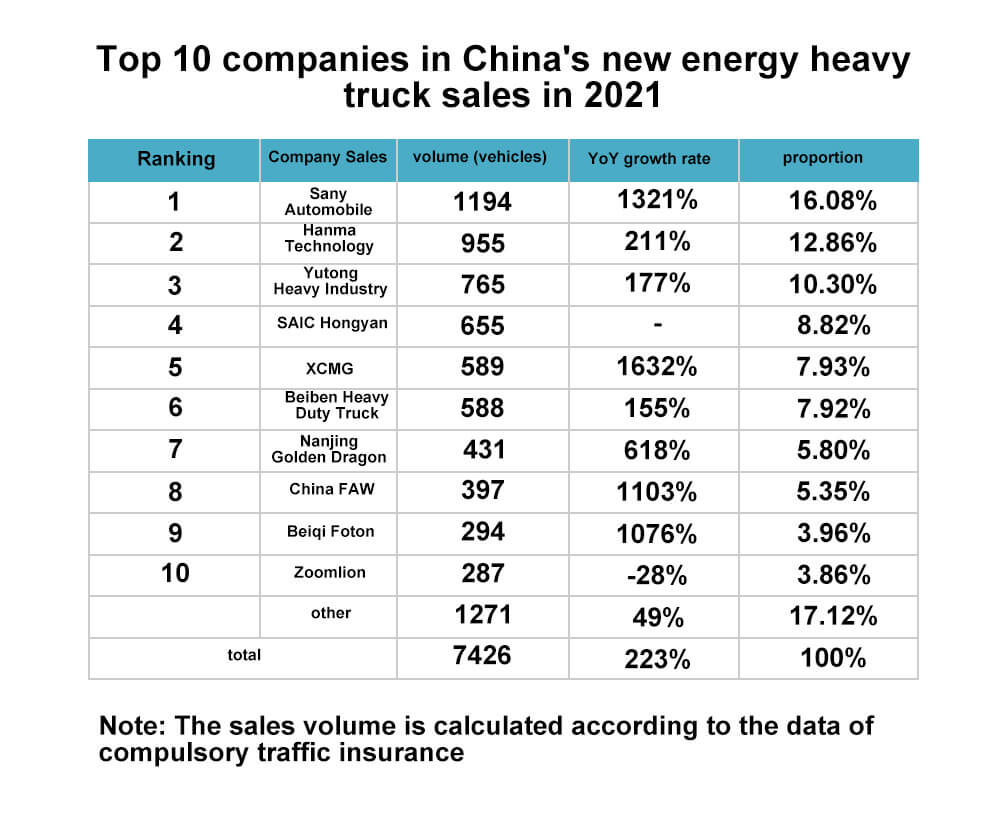

According to statistics from the “Monthly Database of New Energy Vehicle Industry Chain” released by the Advanced Industrial Research Institute (GGII), the sales volume of new energy heavy trucks in China from January to November 2021 was 7,426, a year-on-year increase of 223%.

According to the current situation, steel, coal and other heavy industry companies have clarified the product type of future transportation vehicles, that is, zero-emission or lower-carbon emission models. Under the dual carbon goal, new energy heavy trucks will usher in new development opportunities.

Judging from the recent series of actions of leading power battery companies, they are upgrading the battle for the electric heavy truck market through customer binding, circle cooperation, and product iteration.

Big car emissions

Heavy trucks with less than 5% of their ownership have always been “big emitters”.

Statistics show that the number of China automobiles has reached 287 million, and the number of trucks has reached 31.91 million, accounting for nearly 11% of the total number of vehicles.

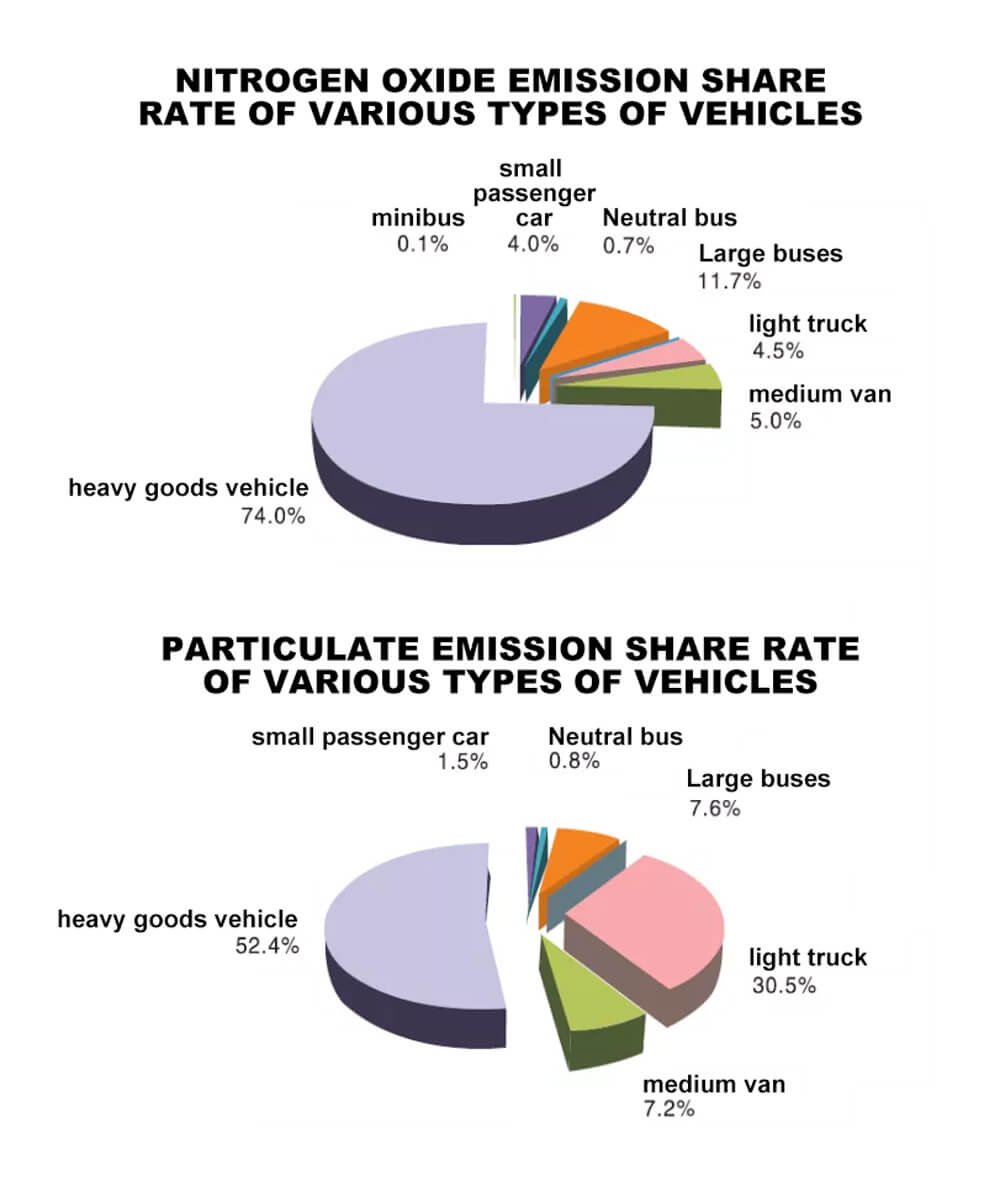

“According to estimates, the number of heavy-duty vehicles in China is more than 11 million, accounting for only 4.4% of the total number of vehicles in China, but the NOx and particulate matter emitted by them reach 85% and 65% of the total vehicle emissions, respectively.” Spokesman of the Ministry of Ecology and Environment Liu Youbin introduced the situation in May this year.

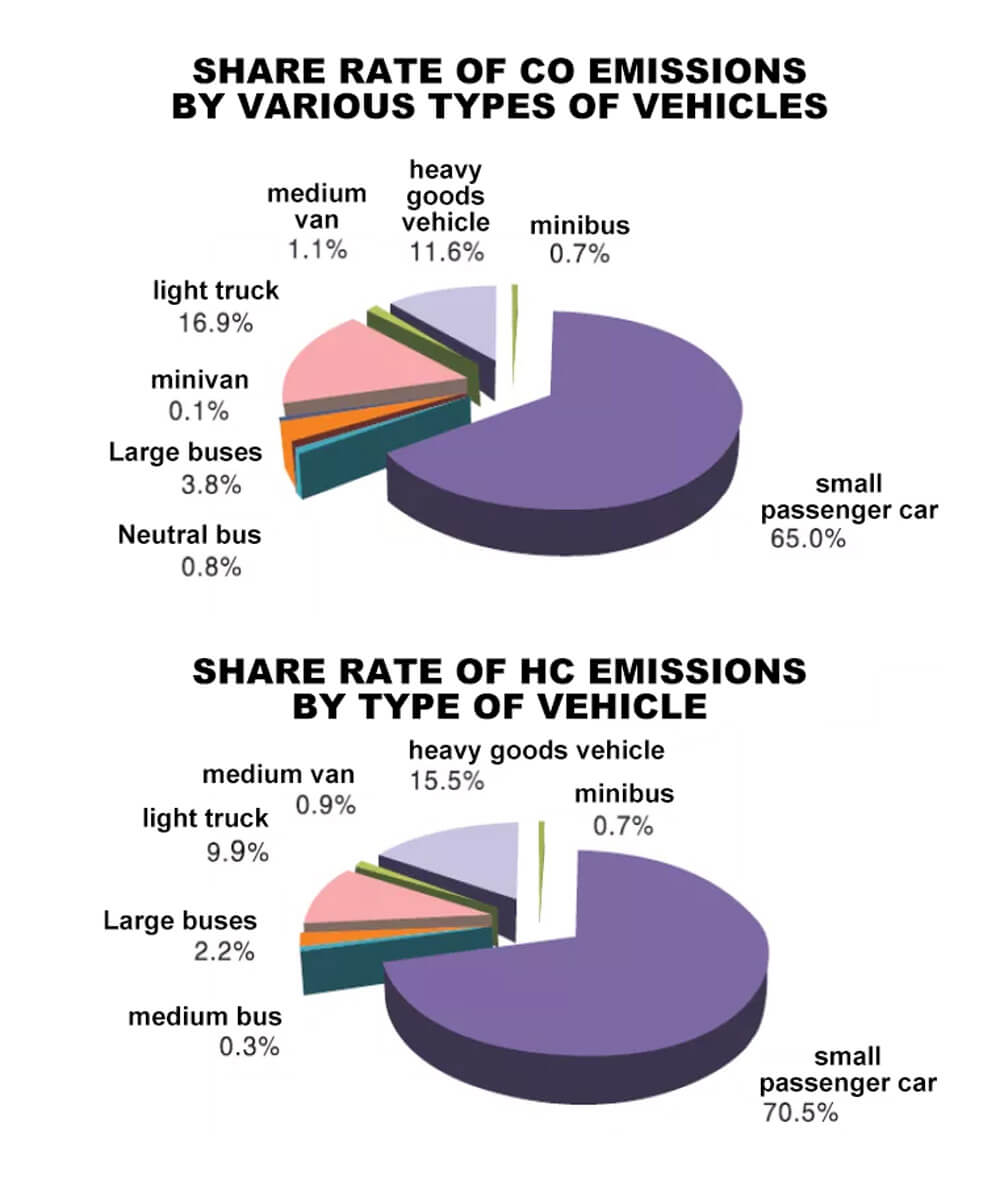

The Ministry of Ecology and Environment’s “China Mobile Source Environmental Management Annual Report (2020)” also shows that among the total pollutants emitted by motor vehicles in China in 2019, the national trucks carbon monoxide (CO), hydrocarbons (HC), nitrogen oxides (NOx), particulate matter (PM) emissions were 2.057 million tons, 450,000 tons, 5.196 million tons, and 62,000 tons, respectively.

They account for 29.7%, 26.3%, 83.5% and 90.1% of the total vehicle emissions respectively. Among the light, medium, heavy and mini trucks, the four pollutant emissions of heavy trucks are 806,000 tons, 265,000 tons and 460.7 tons respectively. 10,000 tons, 36,000 tons. That is, in NOx emissions, heavy goods vehicles account for 74%; in PM emissions, it accounts for 52.4%.

Another data shows that the pollution emissions of a fuel heavy truck is equivalent to 250-300 passenger cars.

The promotion of new energy commercial vehicles, especially the realization of new energy for heavy trucks, has become one of the key tasks for the auto industry to implement the dual carbon goals. The major auto emission companies will also be transformed into major auto carbon trading companies.

“It is the general trend for heavy trucks to intervene in the carbon trading market.” Liu Xubao, deputy general manager of China Power Investment Green Power Transportation Industry Innovation Center and Shanghai Qiyuanxin Power Technology Co., Ltd., once said that in the transportation sector, heavy trucks should be the future carbon emissions trading. One of the main force.

Cao Xi, director of the Technology R&D Department of State Grid Commercial Electric Vehicle Investment Co., Ltd., also introduced the results of his calculations. If all the tens of millions of heavy trucks and construction machinery currently held in China are electrified, the annual electricity demand will exceed 1 trillion kilowatts. If all clean energy is used, 900 million tons of carbon dioxide emissions can be directly reduced every year, accounting for nearly 9% of the national carbon dioxide emission.

Top 10 new energy heavy truck power battery manufacturers

CATL

Among the supporting battery companies, CATL supplied 4,148 vehicles (including optional models), accounting for 83.85%, all of which were lithium iron phosphate batteries, becoming the power battery company with the largest number of supporting models in the field of new energy logistics heavy trucks. As a leader in power batteries, Ningde era has taken the lead in the new energy heavy truck power battery market based on its technological advantages and market layout in advance.

Linkage Tianyi

Linkage Tianyi New Energy Co., Ltd. provided 395 new energy logistics heavy trucks with lithium iron phosphate batteries (including optional models).

EVE power

Hubei EVE power Co., Ltd. provided lithium iron phosphate batteries for 327 new energy logistics heavy trucks. EVE power signed a strategic cooperation agreement with Sany Heavy Truck and Special Call. The three parties will carry out comprehensive cooperation in new energy heavy trucks, power battery manufacturing research and development, charging services, battery cascade utilization, and energy storage microgrids.

AVIC

Not long ago, in December 2021, Zhongxin Aviation (AVIC Lithium Battery) was appointed by China National Heavy Duty Truck Group Chengdu Ace Commercial Vehicle Co., Ltd. for three heavy-duty truck models in different application fields and completed the loading. After obtaining three heavy-duty trucks, CNOOC will take this as a demonstration to carry out the market layout and power-swap layout of pure electric heavy-duty truck projects in Chengdu, Sichuan and even Southwest China.

Envision

Envision Power signed a strategic cooperation agreement with FAW Jiefang and GCL Nengke in Changchun. The three parties reached an agreement on the development of battery replacement products, technical iterative upgrading, standardization and other aspects to open up the heavy truck battery replacement industry chain.

SVOLT

Also in December, SVOLT Energy and Hongxin Electronics signed a strategic cooperation framework agreement. The two parties will cooperate in new energy power batteries, energy storage, related applications in new energy heavy trucks + Internet of Vehicles, energy big data and other fields.

REPT

In July 2021, REPT launched a new “Scorpion” standard power battery system for new energy heavy-duty mining trucks. It adopts the profile box structure design and CTP process to solve the pain point of continuous operation in the terminal market under harsh conditions.

BYD

In December, BYD Mexico Branch delivered 20 21-ton pure electric heavy-duty trucks to Grupo Modelo, a large local beer production and distribution company. The 20 pure electric heavy trucks delivered to Modelo Group this time are the largest pure electric logistics truck fleet in Latin America.

Lishen

Lishen Battery’s new energy business covers two major sectors: consumer (3C digital, power tools, electric two-wheeled vehicles, etc.) and power (power + energy storage). . Lishen has also developed standard battery products in the field of heavy-duty truck power exchange, and is now ready for commercialization, and will make efforts in the heavy-duty truck power exchange market.

Thornton New Energy

Thornton New Energy, from the perspective of electric heavy truck battery support, the installed capacity of China’s electric heavy truck market in Q1 2021 is about 0.18GWh, an increase of 18% year-on-year. The supporting enterprises include Thornton New Energy.

Competitive landscape of new energy heavy truck market

At present, the year-on-year growth rate of sales of new energy heavy trucks is showing a rising trend. According to GGII’s “Monthly Database of New Energy Vehicle Industry Chain”, the sales volume of new energy heavy trucks in China from January to November 2021 was 7,426, a year-on-year increase of 223%.

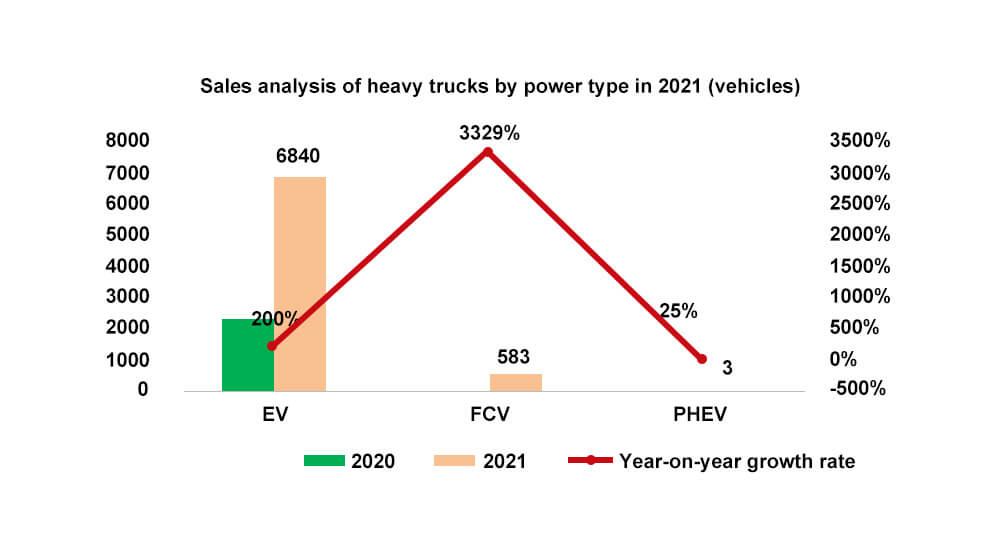

From the perspective of power types of new energy heavy trucks, fuel cell heavy trucks have the highest year-on-year sales growth from January to November 2021, with a year-on-year increase of more than 33 times. It is expected that the sales of fuel cell heavy trucks will maintain rapid growth next year.

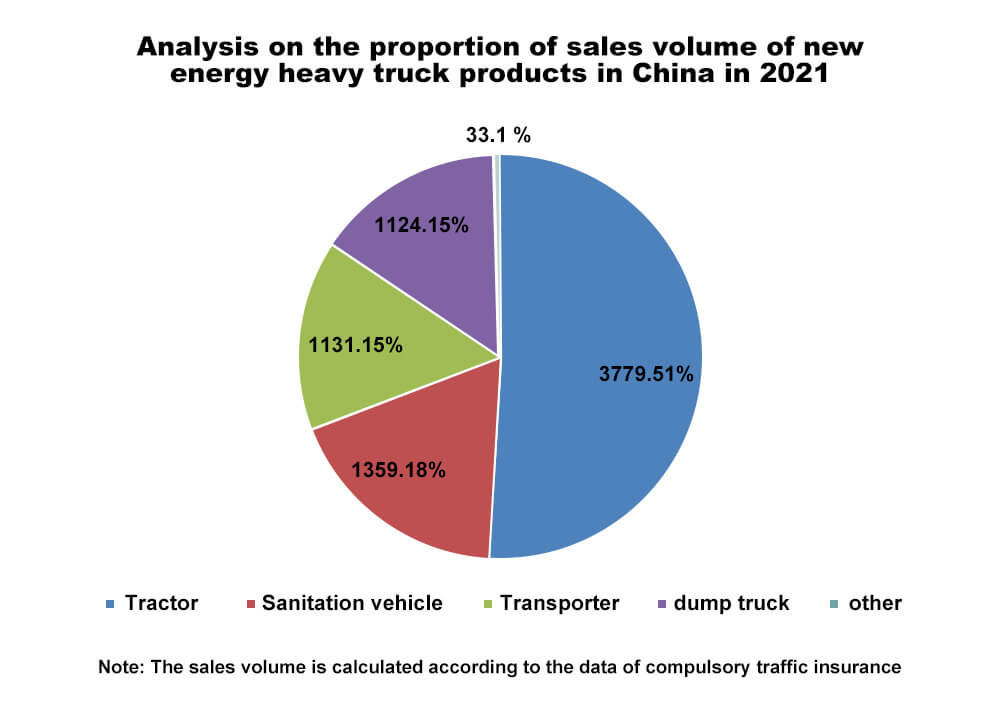

From the perspective of the sales of new energy heavy truck products, from January to November 2021, the sales of new energy heavy trucks are mainly tractor vehicles, with a total sales volume of 3,779 units, accounting for 51% of the total. In tractors, battery-swappable products account for about 47%, and rechargeable (fixed battery) products account for 53%.

Judging from the sales of new energy heavy trucks by specific companies, the top ten companies in sales from January to November 2021 have a total sales volume of 6,155 vehicles, accounting for 82.88% of the total. It is worth noting that the sales volume of Sany Automobile exceeded 1,000 units, an increase of 13 times compared with the same period last year, and it has entered the first place in the sales volume of the new energy heavy truck market.

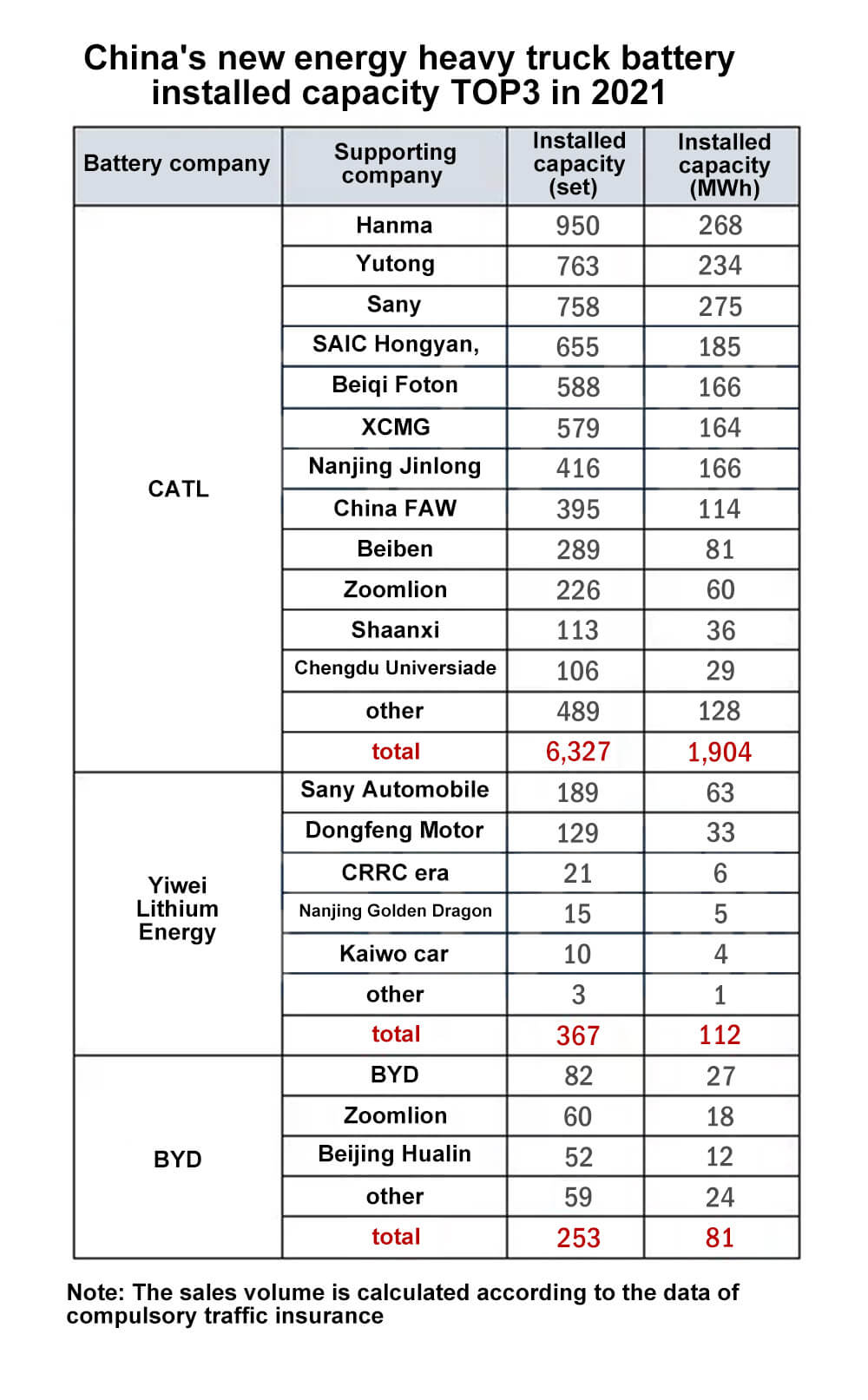

From the perspective of new energy heavy truck battery support, China’s new energy heavy truck power battery installed capacity is about 2.23GWh from January to November 2021, a year-on-year increase of 229%. There are 16 power battery companies with supporting installed capacity, and the top three companies in terms of installed capacity, Ningde Times, Yiwei Lithium Energy, and BYD, together account for 94%. Among them, the Ningde era accounted for 85% of the share.

It is worth noting that, under the resonance of policy support and market demand, the new energy heavy truck market has already been “rising”. In particular, the battery swap model has also become an important business model for new energy heavy trucks.

However, in the large-scale promotion of battery-swapped heavy-duty trucks, several major problems need to be solved urgently:

First, the cost of replacing heavy-duty trucks is high, and it is still difficult to implement the business model.

The second is that there are many battery companies involved, the battery size is not uniform, and there are challenges in the way of battery replacement and battery replacement technology.

Third, there are three types of power exchange modes: top exchange mode, lateral power exchange mode, and chassis power exchange mode, and the maturity of each mode still needs to be improved.

Fourth, the optimization of battery swapping technology and improving the operational efficiency of battery swapping are still difficult for large-scale promotion.

The unanimous view in the industry is that the business model of battery replacement heavy trucks must withstand the torture of cost and profitability, and the cost is enough to support the operation needs of users to adopt the battery replacement mode, and the battery replacement heavy truck market will really flourish.