Battery price increase caused more PHEVs and low-power BEVs

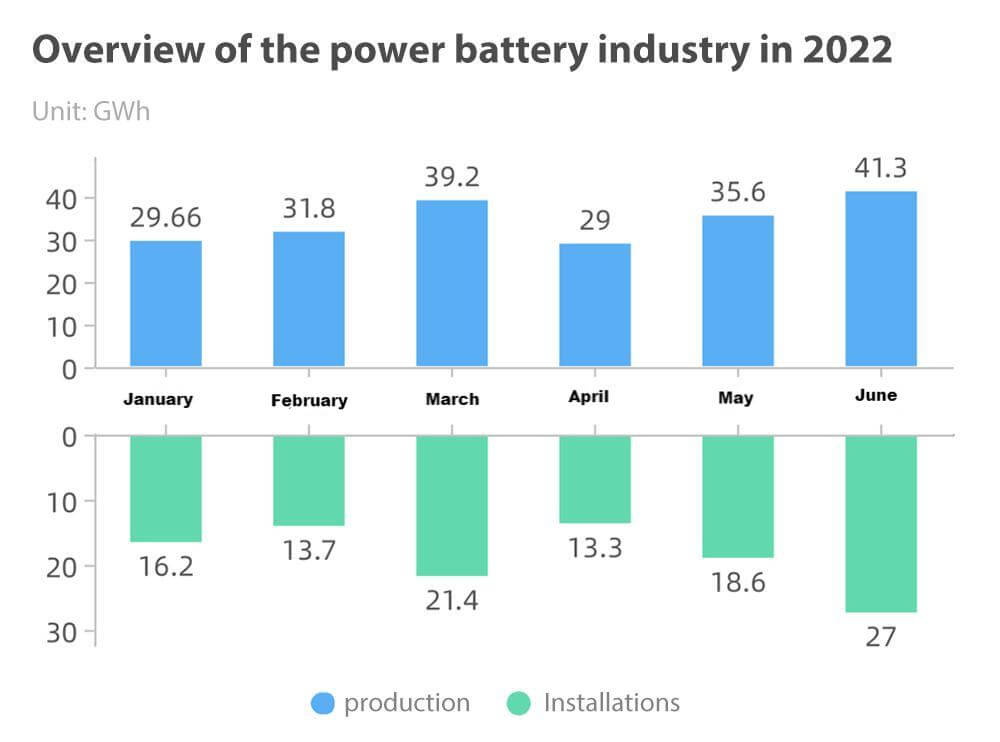

The installed capacity of power batteries was 27.0GWh, a year-on-year increase of 143.3% and a month-on-month increase of 45.5%. In the first half of the year, the cumulative output of power batteries was 206.4GWh, and the corresponding cumulative installed capacity of power batteries was 110.1GWh, with a gap of about 96.3GWh.

From power battery industry perspective

1) At present, power batteries are in a state of high demand and high prices. BYD’s sales soared in the first half of the year, which will lead independent and joint ventures to increase the volume in the second half of the year. The second half of the year is a time period for auto brands to take full action. Due to the high oil price, the B-end market can absorb many new energy vehicles.

2) Due to the limited delivery of overall joint ventures and foreign investment in the first half of the year, these car companies will play a more significant role in driving ternary batteries in the second half of the year, so the output and installed capacity of ternary lithium battery will rebound.

3) Looking forward to the overall demand in Q3 and Q4, it is expected that since car companies will install cars before the end of the subsidy in Q4 and increase the installed capacity of power batteries, we can judge that the capacity of Q3 will continue according to the current curve. Such a large amount will support the continued strength of the upstream prices of lithium carbonate and lithium hydroxide.

4) At present, the average charge of pure electric passenger vehicles is 52.9kWh, and the battery cost is very high. On the one hand, PHEV & EREV took the opportunity to grow, on the other hand, the A00 model also evolved to a small battery.

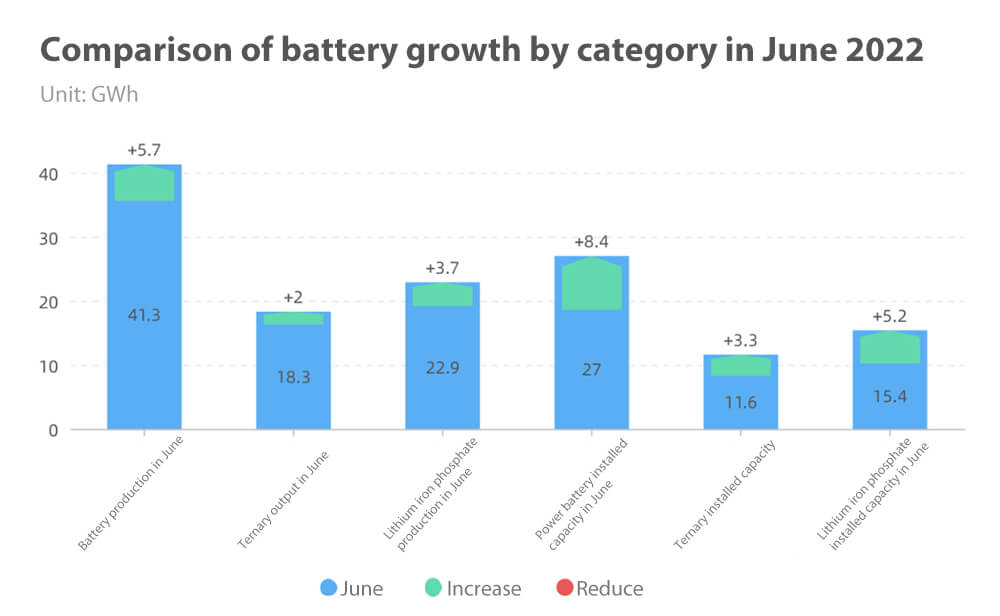

Lithium iron phosphate continues to grow

In June, the monthly growth rate of power battery types was:

● Total production increased by 5.7GWh, installations increased even more: 8.4GWh

● The output of ternary increased by 2GWh, and the installation volume increased by 3.3GWh

● Lithium iron phosphate production increased by 3.7GWh and installation increased by 5.2GWh

From the data point of view, the year-on-year growth rate of lithium iron phosphate is still higher, and the proportion of iron and lithium will remain stable at around 60% in the second half of 2022.

● The output of ternary battery is 18.3GWh, accounting for 44.3% of the total output, a year-on-year increase of 148.9%

● The output of lithium iron phosphate battery is 22.9GWh, accounting for 55.5% of the total output, a year-on-year increase of 194.8%

● The installed capacity of ternary batteries is 11.6GWh, accounting for 42.9% of the total installed capacity, a year-on-year increase of 94.9%

● The installed capacity of lithium iron phosphate battery is 15.4GWh, accounting for 57.1% of the total installed capacity, a year-on-year increase of 201.5%

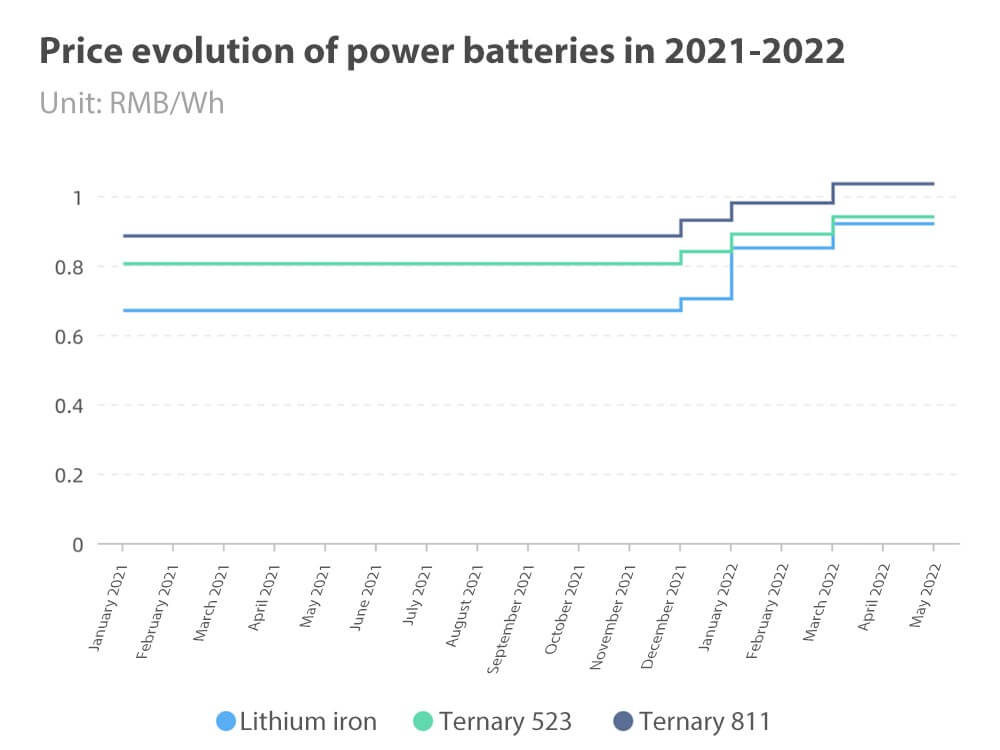

The price of lithium iron phosphate increased by 37.3% in half a year

Note: The price system here is used as a reference, and the actual price increase of battery cells is larger

Compared with 2021, the price of lithium salt raw materials for power batteries has basically doubled, resulting in a sharp rise in the price of power batteries. Since the price is calculated on a one-year basis before 2021, the price of battery packs in May 2022 is higher than that of battery packs. December 2021:

● Ternary 523, the price increased by 11.3%

● Ternary 811, the price increased by 11.9%

● Lithium iron phosphate, up 37.3%

In the first half of the year, the cumulative output of ternary batteries was 82.9GWh, accounting for 40.2% of the total output, and the cumulative output of lithium iron phosphate batteries was 123.2GWh, accounting for 59.7% of the total output. Lithium iron phosphate demand for upstream materials is clearly growing faster.

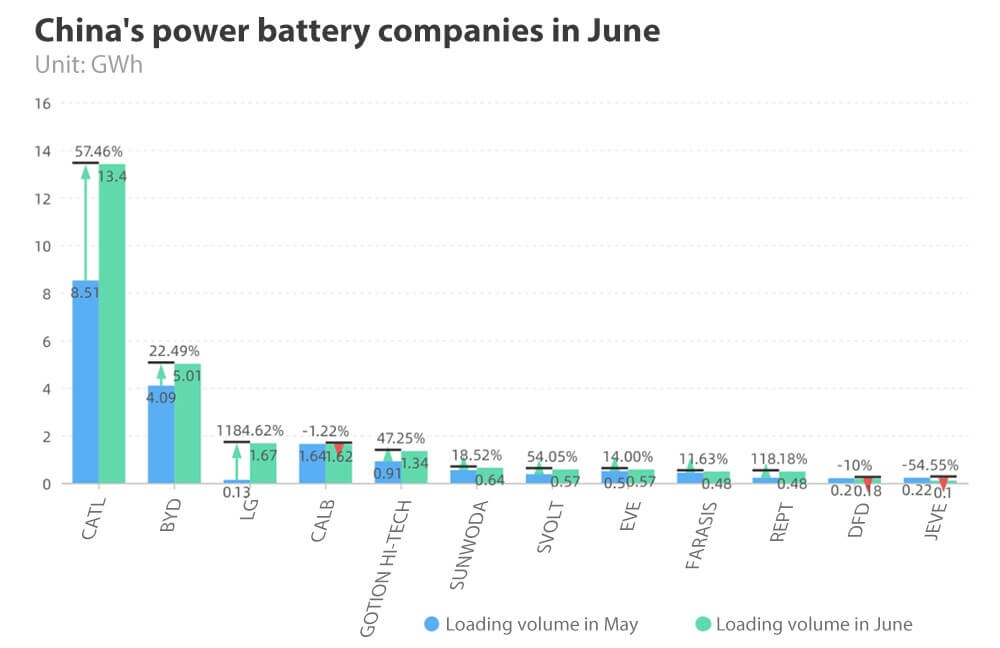

CATL increased by more than 50% month-on-month

In June, the power battery companies ranked the top 3, top 5, and top 10. The battery installed capacity was 20.1 GWh, 23.0 GWh and 25.8 GWh, accounting for 74.3%, 85.3% and 95.4% of the total installed capacity, respectively.

● CATL increased from 8.51GWh last month to 13.4GWh, an increase of 57.46%

● BYD increased from 4.09GWh to 5.01GWh, an increase of 22.49%

● LG New Energy is 1.67GWh this month

There are also CALB and Gotion high-tech in top 10 power battery companies with more than 1GWh, followed by Sunwoda, SVOLT and EVE Lithium Energy are also trying to expand production. In the power battery market in 2022, the capacity expansion of second-tier power battery companies is in progress.

But because of the shortage of materials, it is difficult for them to obtain these materials and balance the price. Therefore, at present, leading enterprises still have a great advantage in ensuring output output.

Demand for battery replacement for heavy-duty vehicles

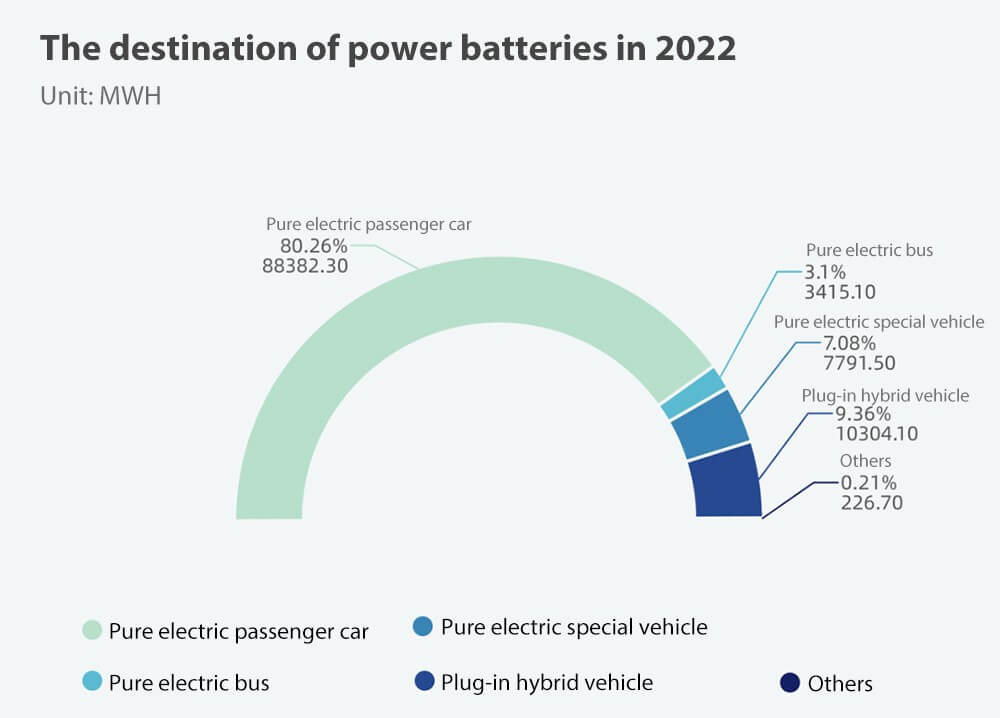

From the first half of the year, the 110.1GWh installed capacity of power batteries is:

● The usage of pure electric passenger vehicles is 88.38GWh, accounting for more than 80.26%;

● The usage of pure electric buses is 3.415GWh, accounting for only 3.1%. This market segment is greatly affected by the shrinking demand for public transportation in the whole city;

● The usage of pure electric special vehicles is 7.791GWh, accounting for 7.08%. With the gradual introduction of truck battery swapping this year, the electrification of the freight part of commercial vehicles can effectively stimulate the demand for commercial vehicles.

● Plug-in hybrid is a big increase, currently using 10.3GWh, accounting for more than 9.36%, a year-on-year increase of 221.4%.

As the battery price trend changes, the plug-in hybrid solution can satisfy more customers without driving up the demand for batteries like pure electric models.

From a global perspective, China’s power battery industry is in a period of rapid development, which has widened the gap with other countries in terms of production and installation. The difference between the output and installed capacity of China’s power batteries is partly sold to the world: some are shipped directly by sea, and some are exported to the world through complete vehicles.