Chinese companies are deploying lithium resources in Africa

Table of Contents

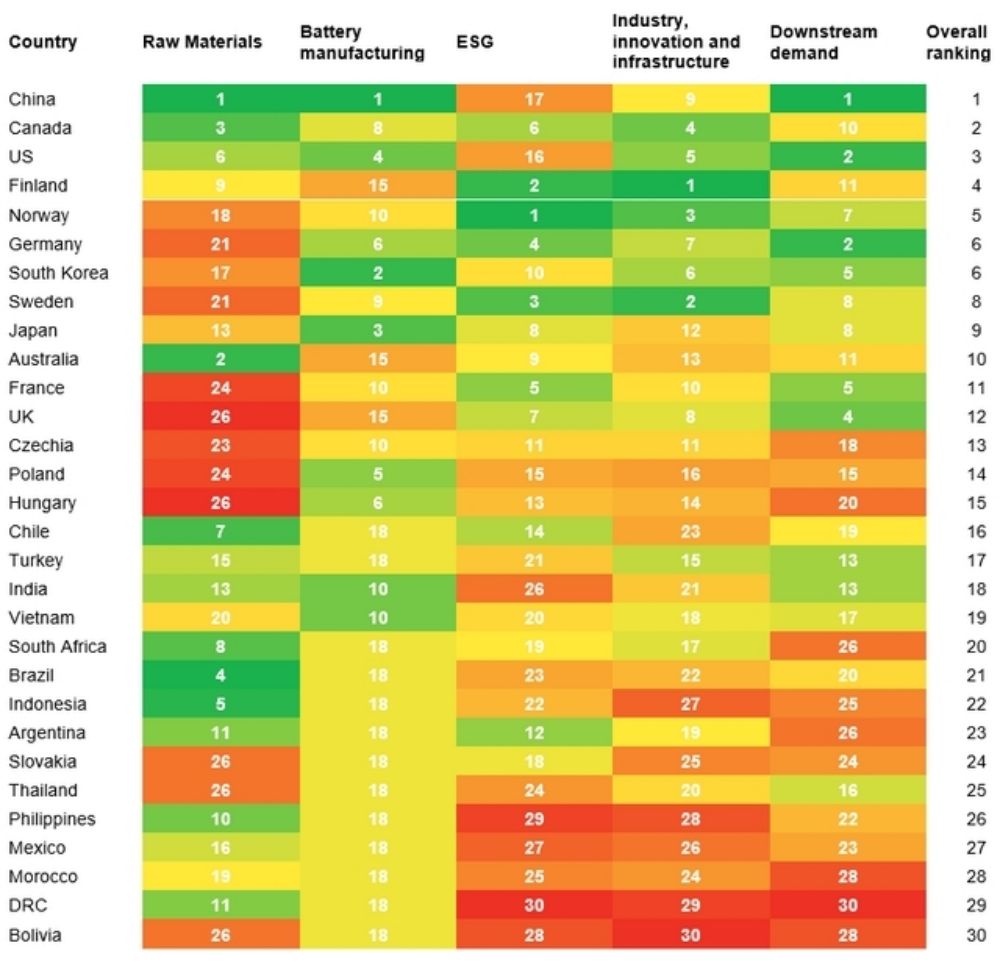

The gap between Chinese processing capacity and lithium resources

On November 24, Yahua Group announced that its subsidiary, Yahua International, plans to acquire 70% of the equity of two wholly-owned subsidiaries of China-Africa Industrial (Hong Kong) Co., Ltd. for no more than US$145 million. And indirectly owns 70% of the control rights of the four lithium mines in the Damaraland mining area in Namibia, adding another fortune to Lithium Africa.The battery industry chain is affected by the rise in lithium prices

As an important raw material for power batteries, starting from 2021, driven by the sales of new energy vehicles, the price of lithium has entered an epic level of rise, rising more than 10 times within a year. On November 16, the Australian lithium miner Pilbara completed another lithium concentrate auction with a transaction price of US$7,805/ton, an increase of US$705/ton from the October transaction price, setting a new high. China’s battery-grade lithium carbonate spot also exceeded RMB 600,000/ton at the beginning of this month, and the current average price fluctuates at a high level of RMB 580,000-600,000/ton.

The sharp increase in raw materials is accompanied by the gradual tightening of investment restrictions on foreign-funded lithium mining companies in the lithium triangle of Canada, Australia and South America, China’s industrial chain is very affected, the “battle for lithium” is in full swing, and Africa has become the main arena for the next round of lithium capacity expansion.

According to the data, Congo (Kinshasa), Mali, Zimbabwe, Ghana and Namibia have a total of about 4.38 million tons of lithium resources, and are the main lithium resource countries in Africa. This round of Africa’s search for lithium is the focus of the layout of the above-mentioned Chinese companies.

Chinese companies deploy lithium resources in Africa

According to public information, since 2021, Sinomine Resource, Zijin mining, Huayou cobalt, one of the top 10 lithium carbonate manufacturers in China Ganfeng lithium and many other Chinese companies have begun to deploy lithium resources in Africa.

The Bikita lithium mine is located in Zimbabwe. In February this year, Sinomine Resource acquired a 74% stake in it for US$180 million in cash (approximately RMB 1.146 billion). According to the report, the accumulated reserves of lithium mineral resources discovered in the Bikita lithium mining area are 29.414 million tons of ore, of which the lithium oxide metal content is 344,000 tons, equivalent to 849,600 tons of lithium carbonate equivalent.

The mine is the only mine in production in Africa (as of the end of 2021). On July 31, the first batch of concentrate shipped to China was shipped from the Port of Durban, South Africa. It took 29 days to arrive at Nanchang Xiangtang Wharf. Then it is transported by land to Jiangxi Dongpeng New Material Co., Ltd., a subsidiary of Sinomine Resource, for processing. At present, the mine is promoting a 2 million t/a construction project. After the project is put into production, the average annual output of spodumene concentrate is about 300,000 tons.

Arcadia lithium mine, located in Zimbabwe, on December 22, 2021, one of the nickel cobalt manufacturers Huayou cobalt acquired an 87% stake in the project for US$377.8 million, the JORC (2012) standard resources of the Arcadia project are 72.7 million tons, the grade of lithium oxide is 1.06%, and the grade of tantalum pentoxide is 121ppm.

The amount of lithium oxide metal is 770,000 tons (1.9 million tons of lithium carbonate equivalent), and the amount of tantalum pentoxide metal is 8,800 tons. The project started construction in May this year. It is planned to complete the installation of the main equipment and start trial operation in the first half of 2023.

After the completion of the project, the annual processing capacity is expected to be 4.5 million tons, it will form an annual output of 297,000 tons of spodumene concentrate, 173,000 tons of technical grade lithium petalite concentrate, and 62,000 tons of chemical grade lithium petalite concentrate.

Goulamina spodumene in Mali, Ganfeng lithium in June 2021. Ganfeng International, a wholly-owned subsidiary, acquired a 50% stake in the Dutch SPV company at a price of US$130 million with its own funds, thereby obtaining a 50% stake in the mine. The mine has currently explored a total of 108.5 million tons of ore resources, corresponding to a total lithium resource of approximately 3.89 million tons of LCE, with an average lithium oxide grade of 1.45%.

The project is under construction and is expected to be completed in 2024. After reaching full capacity, it will produce an average of 726,000 tons of spodumene concentrate per year, with an estimated peak annual output of 880,000 tons. Manono Lithium Mine, located in Congo (Kinshasa), top hard rock lithium mine, one of the largest undeveloped hard rock lithium deposits in the world, it has 401 million tons of resources, lithium oxide content is 1.65%, and the exploration target is as high as 1.2 billion tons.

The Australian company AVZ holds a 51% stake in the project, and companies such as China Tianhua Super Clean, one of the top 10 lithium ion battery manufacturers CATL, Zijin mining, and Huayou cobalt are all involved through direct or indirect shareholding. At present, the Manono lithium mine is expected to have an annual production capacity of 700,000 tons and is expected to start production in 2023.

According to various media reports, since this year, more and more people have gone to Zimbabwe, Nigeria, and Congo (Kinshasa) to investigate lithium mines in Africa, and he found that Chinese companies are making business decisions faster and faster.