Lithium ion battery anode material industry situation

A variety of anode materials and various performance indicators

Anode materials are an important part of lithium-ion batteries. Lithium batteries are mainly composed of cathodes, anodes, electrolytes and separators. The anode material mainly affects the capacity, initial efficiency, cycle performance, and energy density of lithium ion battery.

As a fast-charging battery, lithium-ion batteries mainly rely on the rapid movement of lithium ions between the cathode and the anode. During the charging and discharging process, lithium ions are intercalated and deintercalated back and forth between the two electrodes.

The anode material is made by mixing anode active material, binder and additives, and it is evenly spread on both sides of the copper foil in paste form, and is formed by drying and rolling.

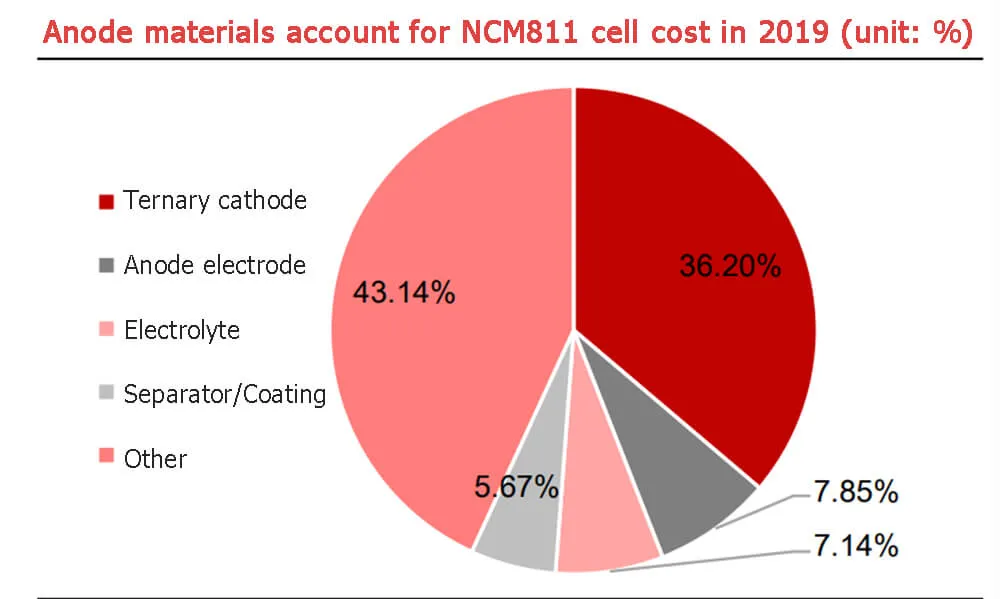

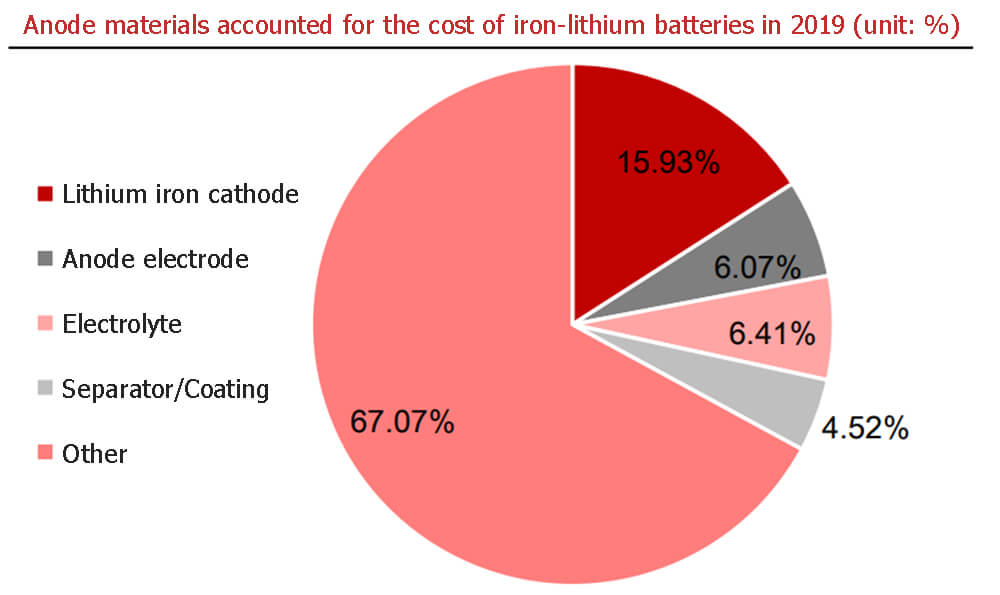

Lithium ion battery anode materials account for about 5% to 15% of the cost of power batteries. In the NCM811 cell, the anode material accounts for about 7.85% of the cell cost; in the iron-lithium battery, the anode material accounts for about 6.07% of the cell cost.

Lithium ion battery anode materials are mainly divided into two categories: carbon materials and non-carbon materials. With the advancement of technology, at present, the Lithium ion battery anode has developed from a single artificial graphite to the coexistence of multiple Lithium ion battery anode materials.

Lithium ion battery anode materials can be mainly divided into two categories: carbon materials and non-carbon materials, and carbon materials mainly include graphite, graphene and amorphous; Non-carbon materials mainly include tin-based materials, titanium-based materials, nitrogen active materials and silicon-based materials.

There are various performance indicators for anode materials. Compared with other materials for lithium batteries, the performance evaluation dimensions of anode materials are more diverse. The indicators reflecting the performance of anode materials mainly include specific capacity, initial efficiency, cycle life, rate performance, compaction density, tap density, true density, specific surface area, etc.

The specific capacity refers to the amount of electricity that can be released by a unit mass of active material; the first efficiency refers to the first discharge efficiency, which is calculated by dividing the discharge capacity of the first charge-discharge cycle by the charge capacity; the rate performance is a measure of the battery’s charge-discharge capacity. an indicator;

Specific surface refers to the surface area of an object per unit mass, which is an important factor affecting rate performance; compaction density refers to the density of anode active materials and binders made into pole pieces after rolling, which affects specific capacity. Key factor;

The tap density is the density that depends on the vibration to make the powder show a relatively tight packing form; the cycle life cycle has a cathode correlation with the expansion, and the expansion of the anode will lead to poor cycle performance.

Various types of lithium ion battery anode materials have their own advantages, and it is difficult to take into account different performance indicators.From the perspective of specific performance indicators, the theoretical specific capacity of silicon-carbon composite materials is currently the largest, which can exceed 1000mAh/g, and the specific capacity of hard carbon in carbon materials is also relatively high;

In terms of first efficiency, the non-carbon material lithium titanate can reach 99%, which is close to the theoretical limit, and both natural graphite and artificial graphite can reach more than 90%, while the first efficiency of silicon carbon composite material is relatively low;

In terms of cycle life, carbon materials are basically more than 1,000 times. Among non-carbon materials, lithium titanate has the strongest cycle performance of 30,000 times, while silicon-carbon composite materials are only between 300-500 times.

In terms of safety, carbon materials are basically at the middle level, lithium titanate has the best safety among non-carbon materials, and silicon-based lithium ion battery anode materials are poor;

In terms of fast charging, lithium titanate still performs well. On the whole, different materials have their own advantages, and it is difficult to take into account different performance indicators. Artificial graphite and natural graphite in carbon materials have excellent comprehensive performance.

The specific capacity of lithium titanate of non-carbon materials is poor, and other performance advantages are obvious; while the theoretical specific capacity of silicon-based composite materials has absolute advantages, and other properties still need to be improved.

Graphite-based materials have high comprehensive cost performance, and silicon-based materials have great application potential. At present, artificial graphite and natural graphite in carbon materials are the mainstream lithium ion battery anode materials in the market.

Compared with other types of lithium batteries, graphite batteries have more mature technology and supporting processes, and have a wide range of raw material sources, low prices, and advantages in comprehensive cost-effectiveness. They are the current mainstream materials.

However, with the improvement of the performance demand of lithium batteries, the disadvantages of graphite materials have also begun to appear, and the specific capacity has become its short board, and the specific capacity of natural graphite has basically reached the theoretical upper limit.

In this context, silicon-based lithium ion battery anode materials with much higher gram capacity than other materials have emerged, and silicon-based materials are also regarded as lithium ion battery anode materials with great application potential in the future because of their superior specific capacity.

However, during the charging and discharging process of lithium batteries, the volume of silicon changes greatly, resulting in material pulverization, increased internal resistance, loss of electrical contact, and rapid capacity decay, and the new anode material has certain matching problems with other lithium battery materials. There are still some obstacles to large-scale application.

Electrification drives demand expansion

The advantages of Chinese leading companies appear

Japan took the lead in realizing the commercialization of lithium batteries and was the global leader in the early stage of anodes.

Japan is the first country to realize the commercialization of lithium batteries. Before 2000, the global share of Japanese companies in the anode market reached more than 90%, making it the global leader in the early days of anodes.

However, since the 1990s in China, the lithium ion battery anode industry has begun to take off, and has experienced leapfrog development, realizing the import substitution of lithium ion battery anode materials.

Chinese lithium ion battery anode materials started with mesocarbon microspheres and gradually realized import substitution. In terms of technology research and development, in 1997, Anshan Thermal Energy Research Institute first developed mesocarbon microspheres and realized small-scale trial production;

In 1999, Shanshan Co., Ltd. and Anshan Thermal Energy Research Institute established a joint venture company to engage in the research and development, production and sales of lithium ion battery anode materials, and to realize the commercial promotion of lithium ion battery anode materials in China;

In 2001, Shanshan Co., Ltd. realized the large-scale production of mesocarbon microspheres and began to replace it with localization, replacing Japan as the main domestic supplier of mesocarbon microspheres.

In the ten years of the leap-forward development of the lithium battery industry, Chinese companies have emerged. From 2001 to 2010, it was the leap-forward development stage of China’s Lithium ion battery anode industry.

During the period, the 3C digital field began to use lithium batteries for power supply on a large scale. Mesocarbon microspheres were limited by low specific capacity and high price, and gradually withdrawn from mainstream application scenarios, replaced by graphite materials with superior specific capacity and cost.

In 2003, Bertray successfully developed spherical graphite with natural flake graphite as raw material and realized industrialization, and completed the modification of natural graphite. Through continuous innovation and process improvement, the specific capacity of Betri’s natural graphite material has reached 360mAh/g, and the performance level is internationally leading.

In 2005, Shanshan successfully developed a new type of artificial graphite material and became a leading enterprise in the field of artificial graphite in China. By 2010, Bettary’s anode material shipments ranked first in the world and became a leading company in the global natural graphite field.

The consumer lithium battery market has entered a mature stage, and new energy vehicles have brought new opportunities for power lithium batteries. After 2011, the traditional 3C digital market has gradually entered a mature stage, and the growth rate of digital lithium battery demand has slowed down, but the rapid development of new energy vehicles has brought new development opportunities for the lithium battery industry.

At this stage, Jiangxi Zichen has become a new star in the industry, relying on FSN-1 and G1 series products to achieve breakthroughs in high-end artificial graphite and achieve rapid development. Anode materials are widely used in the lithium battery market due to their technological maturity and comprehensive performance advantages.

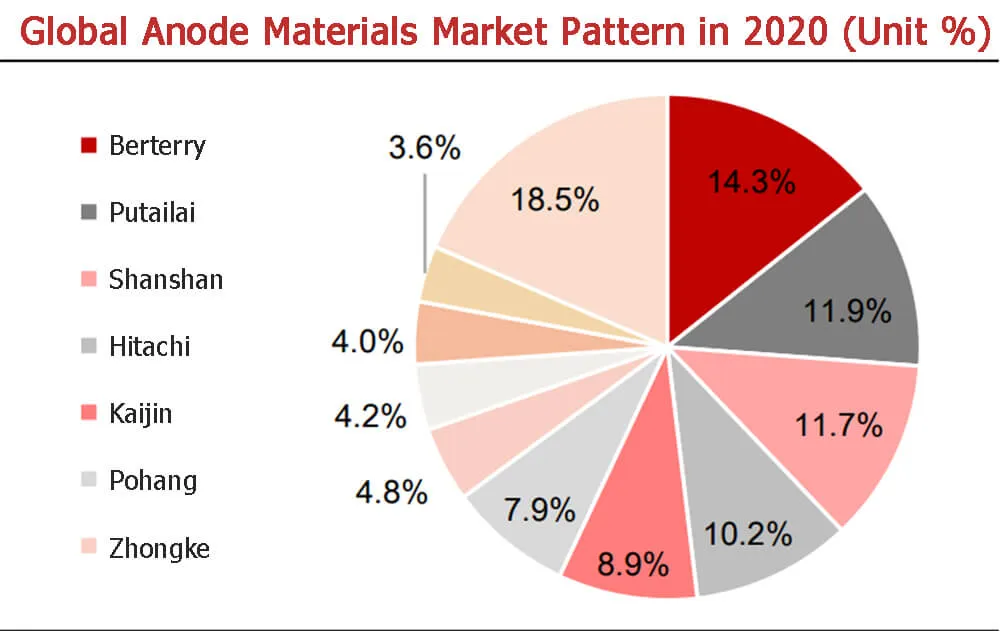

Chinese enterprises accelerate global supply and have obvious competitive advantages. Judging from the current global competition pattern, Chinese companies have a relatively high market share. The only major other countriess anode companies are South Korea’s Posco, Hitachi Chemical, and Mitsubishi Chemical, while China’s companies include Bettray, Ningbo Shanshan, Jiangxi Zichen, and Dongguan Kaijin. and many other companies.

According to statistics, the global output of lithium ion battery anode materials in 2020 will be 530,000 tons, and China’s output will be 365,000 tons, accounting for 69% of the total; than 92%.

Considering the high energy consumption and technology-intensive characteristics of lithium ion battery anode material production, the pace of production expansion in other countries is significantly slower than that in China. It is expected that the market share of Chinese enterprises will continue to rise in the future, and Chinese companies have obvious advantages.

Downstream demand continues to expand

The main application areas downstream of lithium batteries are power batteries, 3C digital batteries and energy storage batteries.

Among them, power battery is an important growth pole of future lithium battery demand. Benefiting from the drive of new energy vehicles, power battery is entering a stage of accelerated development. With the support of various countries’ policies, the demand for power lithium battery growth is relatively certain, and there is room for future growth. broad;

The traditional 3C digital market has entered a mature stage, and the market tends to be saturated. The future demand for digital batteries will mainly come from smart home devices and wearable devices. The 5G replacement wave will also form a certain support for the demand for digital batteries.

Energy storage is the blue ocean field of lithium batteries, which is expected to bring a huge market to the demand for lithium batteries.

With the rapid growth of downstream demand, the market size of lithium ion battery anode materials continues to expand. From 2015 to 2020, China’s lithium ion battery anode material shipments increased from 72,800 tons to 365,000 tons, with a 5-year compound growth rate of 38.05%.

The scale of China’s lithium ion battery anode material market has grown from 3 billion yuan to 14.8 billion yuan, with a 5-year compound annual growth rate of 37.6%. In 2021, benefiting from the rapid growth of the downstream lithium battery market, China’s lithium ion battery anode material shipments will be 720,000 tons, a year-on-year increase of 97%.

The growth rate of the traditional 3C digital market has slowed down, and 5G applications have increased the consumption of consumer batteries.

Consumer lithium batteries are an important downstream application area of lithium batteries. Thanks to the popularization of communication tools and the rapid development of smart products, the market size of consumer lithium batteries continues to grow.

However, the traditional 3C digital market has entered a mature stage, and the growth rate of products has slowed down. According to the data, since 2013, the growth rate of global smartphone sales has slowed down. In 2020, the sales volume will decline by 12.5%, and the anode growth will continue; 5.42%.

China’s smartphone market demand saturation is slower than the global market, but since 2016, smartphone shipments have declined year-on-year.

In the future, the wave of 5G phone replacement is expected to form a certain support for the smartphone market. According to the data, it is expected that the sales volume of 5G mobile phones will reach 416 million units in 2030, accounting for 28.1%.

Wearables and smart home devices bring incremental demand. From 2018 to 2020, the global wearable device shipments were 186 million units, 337 million units and 445 million units, respectively, with a 2-year CAGR of 54.62%.

In 2020, the global end-user spending on wearable devices is US$69 billion, of which smart earphones, smart watches and smart bracelets occupy the main market share, accounting for 59.14%, 23.08% and 17.08% respectively.

According to forecasts, the global wearable device spending will reach US$81.5 billion in 2021, a year-on-year increase of 18.1%, and the market has broad room for development.

China’s smartphone shipments from 2013 to 2021 (unit: 100 million units)

The digital battery market still has room for growth. In 2018, the global digital battery market demand was 68.3GWh, of which China’s digital battery market demand was 31.8GWh.

According to forecasts, in 2023, the global digital battery market will reach 89GWh; the Chinese digital battery market will reach 43GWh, and high-end smartphones, wearable devices and drones will become the main growth points.

Mechanical energy storage is widely used, and electrochemical energy storage has obvious advantages. In 2020, China’s cumulative installed capacity of energy storage will be 35.6GW, accounting for 18.60% of the global total, and the newly installed capacity will be 3.2GW; in 2021, China’s cumulative installed capacity of energy storage will reach 45.74GW, a year-on-year increase of 28.48%.

Mechanical energy storage is currently the most widely used method in China. However, due to factors such as severe terrain constraints and long construction periods, pumped energy storage cannot meet application scenarios such as power grid peak regulation and frequency regulation, and household energy storage.

The electrochemical energy storage technology has the advantages of short response time, high energy density, flexibility and convenience, and low maintenance cost. It is almost unaffected by natural conditions and can be efficiently and flexibly applied to various energy storage scenarios.

As of 2020, the market share of pumped hydro energy storage is 89.3%, down from 93.7% in 2019; electrochemical energy storage accounts for 9.2%, an increase of 4.3 percentage points from the same period last year.

The electrochemical energy storage market has huge development potential. The three major application scenarios of electrochemical energy storage are the grid side, the user side and the power generation side.

In recent years, the installed capacity of electrochemical energy storage has increased rapidly. In 2020, the cumulative installed capacity of electrochemical energy storage in China will reach 3.27GW, a year-on-year increase of 91.23%.

The electrochemical energy storage industry has huge development potential. On the one hand, the future energy Internet will require a large number of power storage equipment; on the other hand, with the gradual promotion of 5G technology, the pace of 5G base station construction has accelerated, and the demand for energy storage batteries has increased.

Lithium ions are the main means of electrochemical energy storage. In electrochemical energy storage, lithium-ion batteries are the main method, accounting for 88.8%, followed by lead-acid batteries, accounting for 10.2%.

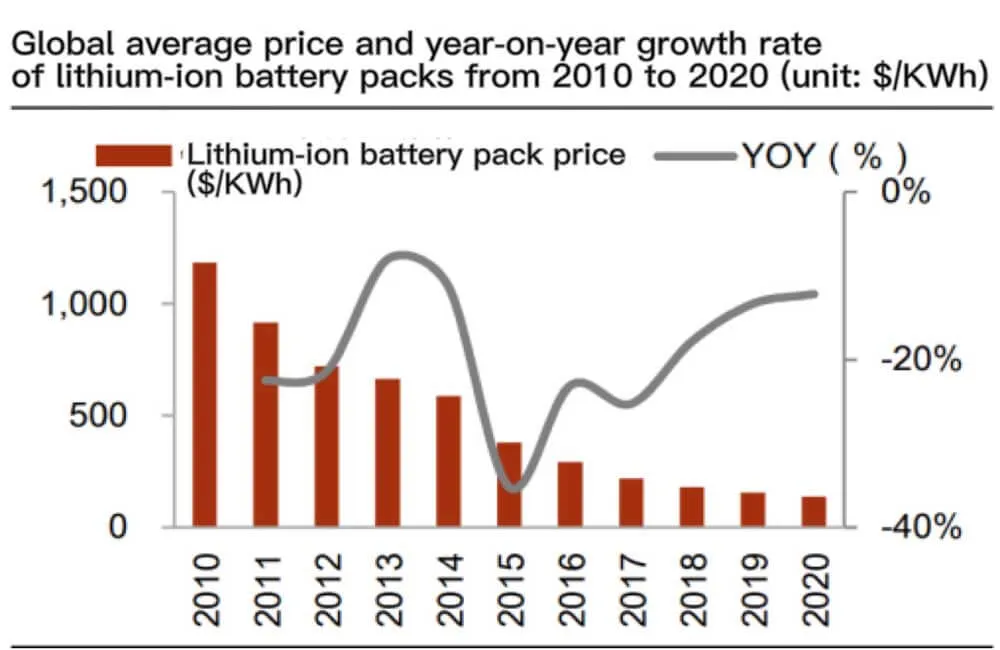

Compared with traditional lead-acid batteries, lithium-ion batteries have performance advantages such as low pollution and long cycle life. As the price of lithium-ion batteries continues to drop and the business model matures, lithium-ion is expected to further replace lead-acid batteries.

According to statistics, from 2010 to 2020, the global average price of lithium battery packs dropped from $1,100/KWh to $137/KWh. In 2020, China’s energy storage lithium-ion battery shipments will reach 16.2GWh, a year-on-year increase of 76%.

The accelerated pace of 5G base station construction drives the demand for energy storage lithium-ion batteries. The energy storage of the communication base station can not only be used as a backup power source, but also can be used for peak regulation and frequency regulation between high and low grid loads to reduce power grid fluctuations and ensure the smooth operation of the communication base station.

With the advent of the 5G era, the 5G-related investment of the three major operators continues to increase. In 2021, China Mobile will invest 110 billion yuan, China Telecom will invest 39.7 billion yuan, and China Unicom will invest 35 billion yuan.

The three major operators have built a total of 1.15 million 5G base stations, covering all prefecture-level cities (inclusive) and above in the country.

The electrification of automobiles has become a global consensus, and the industry has achieved vigorous development. As the global energy crisis and environmental pollution problems have become increasingly prominent, the development of the new energy vehicle industry has been highly valued, and the development of new energy vehicles has reached a consensus on a global scale.

From 2015 to 2021, the global sales of new energy vehicles will increase from 440,000 to 6.35 million, with a six-year CAGR of 56%. As for the China’s market, in China, as the world’s largest new energy vehicle market, has achieved rapid development in recent years with the support of national policies.

From 2016 to 2017, the regulatory policies and subsidy policies for new energy vehicles were successively introduced, and the market entered a stage of sustained and rapid development. In 2018, the new energy vehicle market continued the strong growth trend in 2017, with sales increasing by 62% year-on-year to 1.26 million;

The sales volume in 2019 was 1.206 million units, a year-on-year decrease; the sales volume in 2020 was 1.37 million units, a year-on-year increase of 13%, and the prosperity rebounded; the sales volume in 2021 was 3.52 million units, a year-on-year increase of 158%, and the market resumed rapid growth.

The development of new energy vehicles has led to a rapid increase in the demand for lithium batteries and power anode materials. In the context of China, Europe, Japan, South Korea, the United States and other major countries vigorously developing global new energy vehicles, the global power lithium battery market has maintained a rapid growth trend in recent years.

In the next few years, with the implementation of China’s new energy vehicle dual-point system and the acceleration of vehicle electrification in EU countries and the United Kingdom, power lithium batteries will maintain a high growth trend driven by new energy vehicle terminals.

It is expected that the global power lithium battery market will continue to maintain a rapid growth trend. By 2024, the global installed capacity of power lithium batteries will reach 1192GWh, and the global demand for power lithium ion battery anode materials will reach 1.36 million tons, with a CAGR of 54% compared with 2021. .

Taking into account the applications in power, energy storage, and digital fields, it is expected that the global demand for lithium ion battery anode materials will reach 1.59 million tons in 2024, with a CAGR of 46% compared with 2021.

The industry has multiple barriers

Capital and technology constitute entry barriers

Capital and technology constitute entry barriers, and industry barriers are high.

Capital, technology and customers have built multiple industry barriers, and the status of anode leading companies has been continuously strengthened. The research and development of anode products requires a large amount of capital investment, and there are uncertainties in the research and development process. There are certain requirements for the financial strength of enterprises, and there are barriers to entry.

After the company enters, the continuous improvement of the production process requires the company to have a profound technical background and in-depth research on the selection of raw materials and process details, and the industry barriers are relatively high.

In the process of improving many performance indicators, the head enterprises have high output, many tests, and accumulated production experience and achievements, and have advantages in improving the comprehensive performance of products.

Due to factors such as output and quality, downstream high-quality customers usually establish cooperation with leading companies, and because customers are very cautious in product selection,

After the supply relationship is determined, the replacement probability is low, and the customer stickiness is high, resulting in the share growth dividends of the downstream leading companies are often shared by the leading lithium ion battery anode material companies, and the leading position of the leading lithium ion battery anode companies is continuously strengthened.

The anode market is highly concentrated, and the competitive landscape is relatively good

Compared with other materials for lithium batteries, the market concentration of lithium ion battery anode materials is relatively high, and the industry competition pattern is relatively good. In 2020, the lithium anode materials CR3 and CR6 are 53% and 76%, respectively. In 2021, the lithium anode materials CR3 and CR6 are 50% and 80%, respectively, and the head concentration has decreased.

In 2020, the top four companies by sales volume in the anode industry are Betri, Jiangxi Zichen, Shanshan Technology and Dongguan Kaijin, with shipments of 75,000 tons, 63,000 tons, 60,000 tons and 48,000 tons respectively.

Among them, Beitray, Jiangxi Zichen and Shanshan Technology have been in the top position, while Dongguan Kaijin has performed well in recent years. With the development of Dongguan Kaijin, the pattern of lithium anode materials has evolved from “three big and many small” to “four big and many small”.

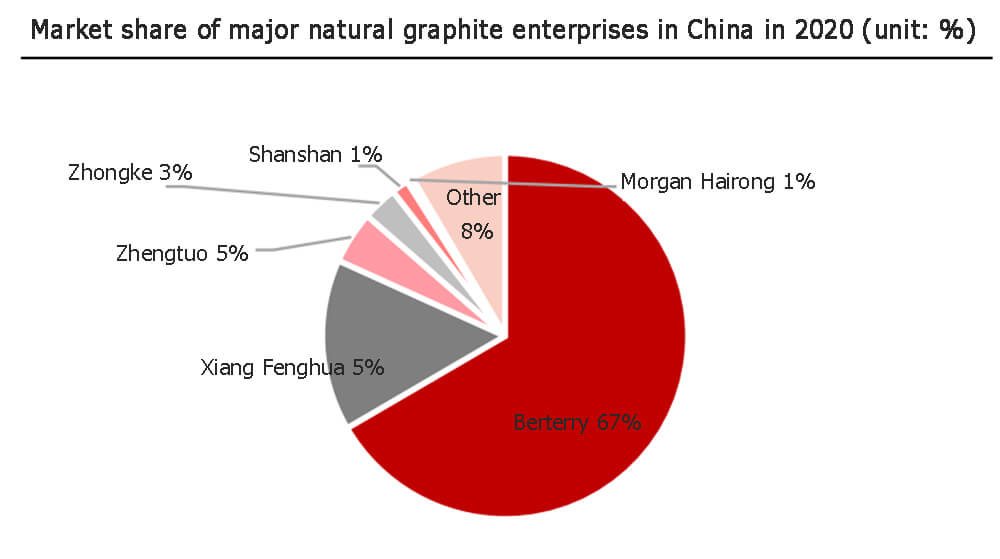

The market concentration in the field of natural graphite is higher, showing a market pattern of “one company dominates”.

In the field of natural graphite, the market concentration is higher, and the leading enterprise Bettray is the only one, with a China’s market share of 67% and 64% respectively in 2020-2021;

Next is Xiangfenghua, with a market share of 15% and 17% respectively in the same period; Jiangxi Zhengtuo and Zhongke Electric are the major players in the market.

The market pattern in the field of artificial graphite is more fragmented, showing a market pattern of “three pillars”. The three leading companies in the artificial graphite field are Jiangxi Zichen, Shanshan and Kaijin Energy.

Relying on Shanghai Putailai, Jiangxi Zichen has advantages in partners and technologies. It has in-depth cooperation with CATL in the field of power batteries, and established cooperation with world-class companies such as ATL, SDI, and Ha Guangyu in the digital field. The China’s market share in 2020-2021 21% and 20% respectively;

As a traditional leading company in the lithium battery industry, Shanshan has a relatively complete industrial chain layout, with a market share of 18% and 17% in China from 2020 to 2021; Kaijin Energy’s market share in the same period is 14% and 11%, respectively. Compared with the field of natural graphite, the market concentration of artificial graphite is lower, and the market competition is more sufficient.

Guaranteeing supply and reducing costs is a short-term demand

Silicon-based materials have great potential

At this stage, artificial graphite is the mainstream route for anodes. From the perspective of lithium anode material product types, since 2014, the shipment of graphite anode materials has always accounted for more than 92%.

Among them, the shipment volume of artificial graphite anode material increased from 29,000 tons in 2014 to 310,000 tons in 2020. The market share has increased year by year, and the proportion of shipments has increased from 56% to 84%. In 2021, the proportion of shipments will remain at 84%;

Shipments of natural graphite anode materials have been slowly increasing year by year, but the proportion of shipments has dropped significantly, from 38% in 2014 to 16% in 2020, and further to 14% in 2021. Therefore, the new market capacity is dominated by artificial graphite anode materials.

Silicon-based materials have great application potential, and the future market space is broad. Compared with graphite materials, silicon materials have higher theoretical capacity and are new anode materials with great application potential.

The silicon-carbon anode material was born in the 1990s, when Moli and Sony in Japan introduced lithium-ion batteries with carbon as the anode. After that, researches focused on the combination of micron or nanostructured silicon particles with carbon and applied them to anode material.

In 2016, a South Korean research institute effectively solved the problem of silicon volume expansion through chemical vapor deposition, and provided technical support for promoting the large-scale production of silicon-carbon composite anode materials. However, due to the maturity of technology and the matching problem with other anode materials, silicon-based materials have not yet been applied on a large scale.

In the future, under the trend of increasing energy density demand of new energy vehicles, the research and development and introduction of silicon carbon anodes are expected to accelerate.

Judging from the production capacity and output of the existing leading enterprises in China, Betri is in a leading position in China in terms of silicon carbon anode materials. In 2013, it passed the certification of Samsung and started mass production and supply.

In 2020, China’s silicon-based anode shipments were 9,000 tons, a year-on-year increase of 143%. It is estimated that by 2025, the global demand for silicon-based anode materials is expected to reach 31.3 tons.

Graphitization technology is expected to accelerate iteration

Continuous process improvement and effective cost control will become the core competitiveness of the company. Before the large-scale application of new anode materials, graphite-based anode materials will still dominate, and artificial graphite will still be the mainstream material.

Under the measurement dimension of diversified performance indicators, in the face of the market demand for cost reduction of new energy vehicles and parity of energy storage, continuous process improvement and effective cost control will become the core competitiveness of enterprises in the future.

From the perspective of the preparation process of artificial graphite, the main processes are: raw material – crushing (pretreatment) – granulation (artificial graphite) – graphitization – screening, the production process is relatively complex. Among them, raw material selection, granulation and graphitization are three very important links.

The raw material link involves both cost and quality. In the raw material selection link, the upstream raw materials of artificial graphite are divided into coal-based needle coke, petroleum-based needle coke and petroleum coke. Different coke prices vary greatly, which is an important part of cost control.

The overall difference in the granulation industry is not large, but the barriers to secondary granulation are extremely high, and the important determinant of product performance is the key link of the entire process.

The graphitization process requires high-temperature heat treatment, which requires a large amount of equipment investment and energy consumption. Many companies choose to outsource the treatment, and some companies choose the graphitization layout. They choose the location in the area with low energy consumption cost, improve their own industrial chain layout, and control product production. cost.

Raw materials and graphitization are the key links to reduce the cost of anodes. In the cost of anodes, the cost of raw materials and graphitization processing accounts for more than 85%, which are the two key links in cost control of anode products.

Taking Jiangxi Zichen as an example, in the cost structure of its artificial graphite products, raw materials account for about 40%, labor costs account for about 2%, processing fees (mainly graphitization) account for about 51%, and manufacturing costs account for about 7%.

The cost of graphitization is mainly composed of electricity costs, crucibles, manufacturing costs, etc. Among them, the graphitization of each ton of anode materials requires about 14,000-16,000 kWh of electricity. According to the industrial electricity price of 0.6 RMB/kWh, it is about 0.84-0.96 million RMB/ton, accounting for More than 60% of the cost of graphitization.

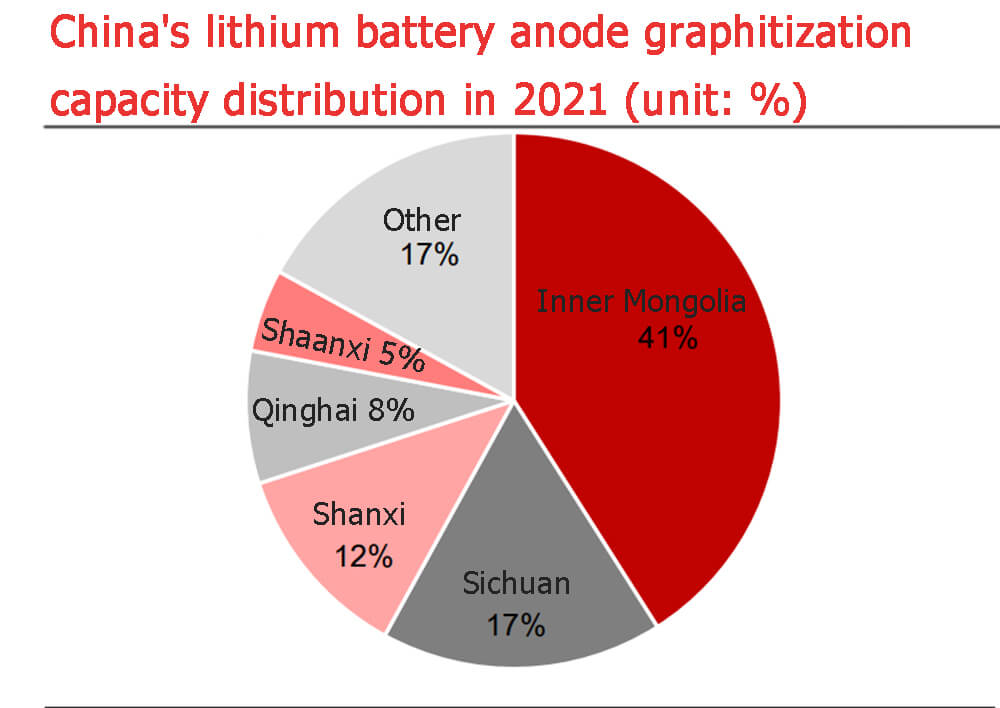

The graphitization production capacity in Inner Mongolia is concentrated, and the tight supply of graphitization restricts the supply of anode materials. According to the incomplete statistics of Baichuan Yingfu, the graphitization production capacity in Inner Mongolia in 2021 will be 271,000 tons, accounting for 41% of the national total of 658,000 tons. Inner Mongolia has become the key to the supply of anode graphitization.

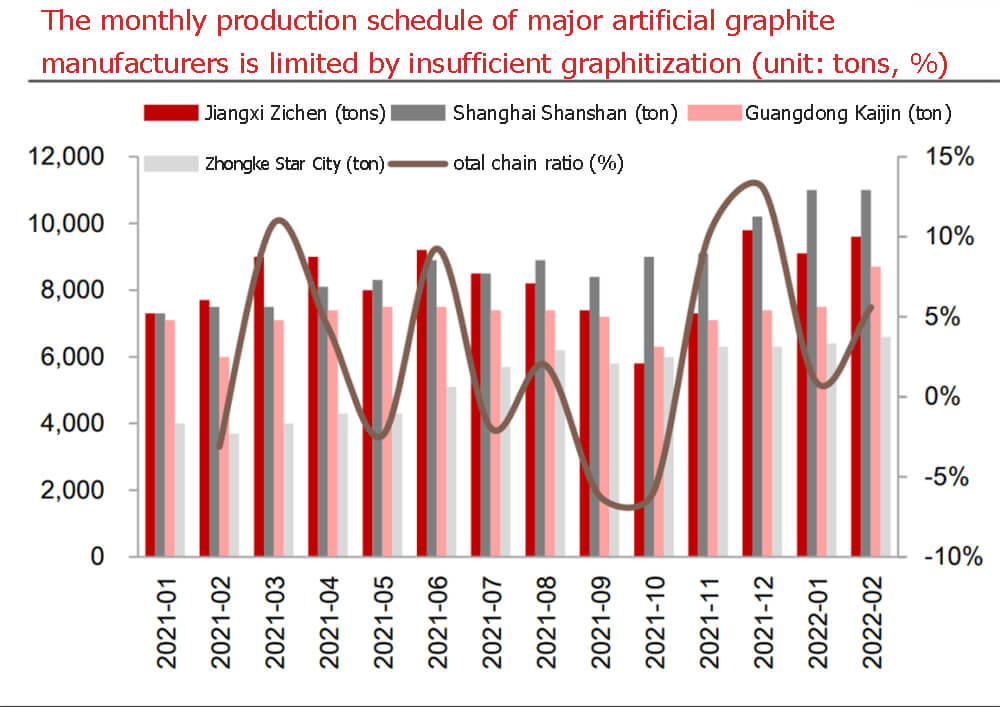

Since the beginning of 2021, different control measures have been adopted for different industries. The anode material belongs to the new material industry. The proportion of electricity curtailment encouraged by the state is as low as 20-30%, corresponding to about 20,000 tons of local production capacity, accounting for 2.86% of the country. not big;

The power curtailment ratio of independent and supporting anode graphitization enterprises ranges from 20-50%, affecting about 54,000-136,000 tons of production capacity, accounting for about 8.2%-20.67% of the national production capacity, and the impact is relatively large.

In addition, the superimposition of the influence of winter heating and the Winter Olympics has led to an aggravated shortage of anode graphitization supply. Anode material companies are limited in production and sales due to the scarcity of graphitization resources.

To ensure supply and reduce costs, anode companies have “joined hands” to speed up the integrated construction of layout. On the one hand, the production capacity of the graphitization process is in short supply, and the anode manufacturers increase the self-supply ratio of graphitization to ensure production capacity;

On the other hand, to reduce costs and improve profitability, the cost of outsourcing and self-owned graphitization is quite different, and the increase in self-supply rate will significantly improve profitability. According to the calculation results of Shangtai Technology’s prospectus, the proportion of self-supplied graphitization will increase by 20% , the gross profit margin of anode materials increased by 6 percentage points.

In the future, the lithium battery industry will enter the era of global competition, and cost will become an important competitive factor. It is expected that major anode material companies will gradually change from the “production model based on outsourced processing” to the “integrated model based on self-built graphitization capacity”. “Transformation, the new production capacity is located in areas with lower electricity prices to gain greater cost advantages.

The supply and demand of graphitization is tight, and the continuous increase of graphitization processing fee drives the anode to start a price increase cycle. The graphitization processing fee has risen from 14,500 yuan/ton in early December 2020 to now, and the price adjustment in April, July, September, and November ranges from 500-1,000 yuan/ton. As of April 12, 2022, it will reach 28,000 yuan/ton, an increase of 93% %.

The price of anode materials is rising and the boat is going down. According to Xinyu information data, the price increase node of anode will be delayed by 3 months, and it will start in February 2021. Taking mid-end artificial graphite as an example, it will reach 50,000 RMB/ton by April 12, 2022. , up 20% from 41,500 RMB/ton in early February 2021.

The graphitization supply gap will remain, and the top anode manufacturers are expected to accelerate their self-supply to enhance profitability. Existing outsourced graphitization production capacity is limited by the policy of dual control of energy consumption, and most of the new production capacity is an integrated project built by anode manufacturers.

Considering that the stricter energy evaluation and approval will affect the progress of project construction, and the graphitization project will still need about half a year to complete the ramp-up of production capacity after it is put into operation, it is expected that the graphitization supply will remain in short supply in the next year. The leading anode manufacturers are leading the layout of graphitization and self-supply, which is expected to further strengthen cost reduction and profit increase.

The traditional graphitization production technology is still at a low level, far from meeting the requirements of industrial production. Graphitization refers to the physical change in which non-graphitic carbon undergoes heat treatment above 2000 °C to perfect the development of the hexagonal carbon atomic plane network layer stacking structure and transform it into graphitic carbon with a three-dimensional regular and ordered structure of graphite.

The purpose is to improve the thermal, electrical conductivity and chemical stability of carbon materials. According to the operation method of the graphitization equipment, the graphitization process can generally be divided into batch graphitization method and continuous graphitization method.

The traditional batch equipment is mainly Acheson furnace and internal heat series graphitization furnace. Among them, Acheson furnace is the longest-used and most widely used graphitization furnace. As a semi-finished product, high temperature heat treatment is performed at a temperature of 2300°C or higher to make it into a graphite product.

The advantages of this process are simple equipment structure, easy maintenance, and convenient operation. The disadvantages are long power-on time, low energy utilization rate, large temperature difference in the furnace, and it is not suitable for granular graphitization production.

Internal heat series graphitization furnace is an energy-saving graphitization technology that uses no resistance material and uses the roasting electrode itself as a heating element;

Its advantages are mainly high heating efficiency, short power transmission cycle, low power consumption (at least 1000kWh per ton of electricity consumption per ton of DC Acheson furnace), etc., but it still cannot solve the problem of large heat dissipation loss, long cooling time, and unsuitable use. In the production of granular graphitization and other problems.

In recent years, manufacturers have pursued the technological upgrade of graphitization through furnace transformation and process innovation, and box and continuous graphitization are expected to lead the technological development.

1) The box graphitization process is based on the Acheson graphitization furnace. A carbon plate box is installed in the furnace to reduce ton consumption and increase production capacity by expanding the furnace capacity. At present, the process has been automated. Representative manufacturers include Putailai, Shanshan Co., Ltd., Zhongke Electric, etc.;

2) Continuous graphitization adopts circulation technology, and the maximum temperature can reach above 3000℃, which can realize continuous feeding and discharging at high temperature, and has the advantages of short processing cycle, low ton consumption, and environmental friendliness.

However, it is difficult to process anode materials with high degree of graphitization, and industrial application has not yet been realized. Representative manufacturers include Sunward Intelligent and so on.

Finally, if you want to know the details of Chinese companies that manufacture anode materials, you can refer to Top 10 anode material manufacturers.