Analysis of lithium supply, demand and future price forecast

Distribution and supply of global lithium resources

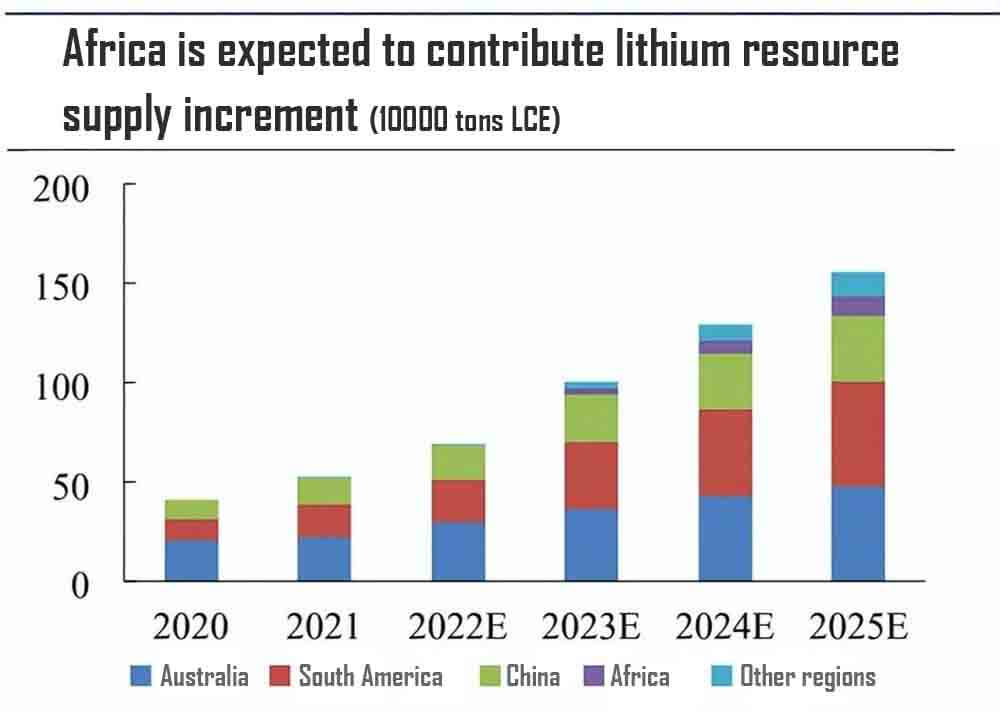

The global lithium supply sources mainly include Australia, South America, China and Africa. Among them, the lithium supply and development systems in Australia, South America and China are mature, with stable output contribution every year.

Africa is rich in lithium resources, but most of the projects are still in the early stage of development, and the lithium supply contributes less to the output.

According to statistics, in the distribution of global lithium resource output in 2021, lithium supply in Australia accounts for the highest proportion, 43%; It is followed by South America and China, with the supply and output of lithium accounting for 32% and 24% respectively; Other regions accounted for the remaining 1%.

In addition to the mine end and salt lake end, the future global lithium supply sources also include lithium battery recycling. With the rapid increase in the number of new energy vehicles, the scale of recycling of waste batteries will be considerable in the future.

Lithium supply in Australia

The increase of lithium supply in Australia is dominated by the increase of production of mines in production and the resumption of production of mines out of production.

Among the seven mines built in Western Australia, Greenbushes, Mt Marion, Pilgangoora-Pilbara and Mt Cattlin mines have been in production.

In addition to Mt Cattlin, the other three mines in production have clear plans for expansion for lithium supply. Among the closed mines, the two production lines of Wodgina will resume production in May and July 2022 respectively.

Mt Finniss is expected to resume production in the fourth quarter of 2022 for lithium supply. Bald Hill has no clear plan for resumption of production at present.

The release of new capacity of these mines has limited effect on easing the tension of lithium supply. At the same time, lithium production in Western Australia is often interfered by factors such as labor shortage and repeated epidemics, and lithium supply is uncertain.

Lithium supply in South America

There are many expansion projects in South America’s salt lakes, and the progress of lithium supply is questionable. At present, there are 4 salt lake projects in South America, including:

● Salar de Atacama(SQM)

● Salar de Atacama(ALB)

● Salar de Olaroz

● Salar del Hombre Muerto

Salar de Atacama completed the construction of LeNegra Phase III and Phase IV projects at the end of 2021 for lithium supply, which is now in the creeping production period.

The other three salt lake projects are also in the process of clear expansion plans, and the new capacity will be released in 2022-2024.

Among the new salt lake projects in lithium supply, the current construction progress of Cauchari Olaroz, Sal de Vida and Marina is relatively clear, but the construction progress of these salt lakes is still unclear, and it is difficult to release effective lithium supply in the short term.

There are many South American salt lake expansion projects for lithium supply, but according to historical experience, the progress of capacity release is often less than expected.

In addition to the long construction period of the salt lake itself, the local infrastructure in South America is backward, policy changes and other factors also affect the release of lithium supply of new capacity to a certain extent.

Lithium supply in China

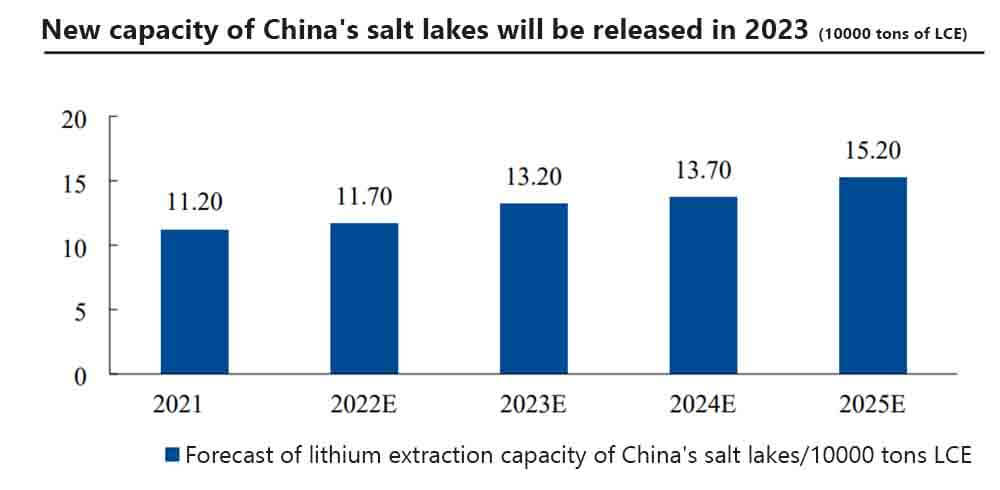

In China, lithium extraction from mica and production expansion at the salt lake end are rapid, and the new capacity of spodumene mines is limited.

Chinese manufacturers in the mica lithium extraction industry mainly include YXSS, JSMC, Nanshi Lithium, Jiuling Lithium, Gotion High Tech and CATL.

Among the spodumene mines in China, only the Yilonggou mine of Chengxin Lithium and the methylka mine of Youngy are in production.

Among them, methylka mine has an existing raw ore capacity of 450000 tons/year, and the corresponding lithium concentrate capacity is about 80000 tons/year.

China’s salt lake development projects for lithium supply are mainly located around the Qarhan Salt Lake, East Taijinar Salt Lake, West Taijinar Salt Lake and Zabuye Salt Lake in the Qinghai Tibet region.

Zangger Mining, Tibet Mineral, Salt Lake Industry and Minmetals Salt Lake have established mature production lines for lithium extraction from salt lakes.

In the recent salt lake expansion projects, the Dachaidan Salt Lake Project invested by EVE and the Eight Thousand Cuo Salt Lake Project invested by Jinyuan EP are expected to be put into production by the end of 2022 for lithium supply, contributing 10000 tons of lithium carbonate capacity each.

The 30000t/a lithium carbonate project for lithium supply jointly constructed by BYD and Salt Lake is currently in the pilot stage.

Lithium supply in Africa

Africa is expected to become a new pole of global lithium supply. Lithium mines in Africa are the focus in lithium supply for Chinese companies to reserve mineral resources in other countries.

Bikita mine acquired by Sinomine Resources and Sabicin lithium tantalum mine acquired by Huayou Cobalt are relatively mature lithium mines at present. The 1.2 million t/a reconstruction and expansion project of Bikita mine is expected to be completed by the end of 2022.

Power battery recycling enhances the capacity of global lithium supply

Power battery recycling has enhanced the capacity of global lithium supply. Here are the top 10 lithium Iron phosphate power battery manufacturers in China.

With the continuous increase in the shipment of new energy vehicles, the installed capacity of power batteries is increasing year by year, and the potential lithium salt recovery volume formed after the scrapping of in-service power batteries is considerable.

The life cycle of power batteries is about 5-8 years. The new energy vehicle batteries sold in 2017-2019 will gradually reach the end of life. The recycling end of used lithium batteries will initially contribute to the lithium supply.

In the future, with the increase of the number of new energy vehicles, the lithium salt output contributed by the recycling field of waste lithium batteries will increase rapidly.

It is predicted that the global lithium resource recovery will be about 33000 tons of LCE in 2022 and 91000 tons of LCE in 2025, with an average annual CAGR of about 40.23%.

According to the forecast, the effective capacity of global lithium resources will increase by 50.71% year on year in 2023, with the fastest growth in lithium supply.

In addition to some incremental contributions from traditional lithium resource producing areas such as South America, Australia and China, the production of new mines in Africa and the development of lithium battery recycling also released some lithium supply.

Quarterly analysis of global lithium supply

In 2022Q4, the new capacity of global lithium resources will be centralized. In terms of time dimension, in 2022Q1-Q3, the new capacity of global lithium supply is relatively small.

Most of the new lithium supply capacity will be put into operation in 2022Q4, and the corresponding effective capacity will be formed in 2023. Therefore, in 2023, the effective capacity of lithium supply in the world will grow fastest.

In terms of regional structure, Australian mines and South American salt lakes contribute most of the world’s new capacity in lithium supply, while China’s new capacity is dominated by salt lake capacity and lithium mica capacity.

In 2023Q1, there will be more new capacity and less effective capacity in lithium supply. It is predicted that most of the new capacity of global lithium resources will be released in 2022Q4, but the effective capacity will be released in 2023Q2.

The proportion of battery industry in lithium downstream demand structure will gradually increase

In the global lithium resource demand structure in 2017, the battery industry accounted for 46%; In 2021, the battery industry will contribute 74% of the global demand for lithium resources, and the downstream demand structure of lithium resources will be further optimized.

According to the forecast, from 2022 to 2025, the total global shipments of power batteries, consumer batteries and energy storage batteries will be 701.54, 1055.35, 1497.81 and 2035.51 GWh, respectively, and the corresponding lithium carbonate demand will be 47.76, 71.19, 100.42 and 1353100 tons of LCE respectively.

With the development of new energy vehicles and energy storage industry, the proportion of battery industry in the downstream demand structure of lithium will gradually increase. Here are the top 5 energy storage battery companies in 2022.

Suppose that from 2022 to 2025, the share of power battery industry in the downstream demand structure of lithium will be 70%, 77%, 81% and 84% respectively, and the inventory demand will be 1.5 months. From 2022 to 2025, the global lithium salt demand will be 76.76, 104.01, 139.48 and 1812200 tons of LCE.

Lithium supply will be relatively loose after 2023

In 2022, the industry of lithium supply and demand will be tight, and the lithium price is expected to continue to operate at a high level.

It is expected that after 2023, the new lithium salt capacity will be gradually implemented, and the output of lithium battery recycling terminal will be gradually released. The lithium supply will be relatively loose, and the lithium price will fluctuate downward.

From the perspective of the annual supply and demand gap, the global lithium supply and demand pattern will tend to be loose in 2023, and there is a risk that the lithium price will fall back at a high level.

By quarter, the overall lithium supply and demand of the industry will be further tightened in 2022Q4 as the new capacity still needs to climb.

In 2023Q1, due to holidays in China, the accumulation of lithium will become normal. However, since this accumulation is more seasonal, the reference to 2022Q1 will not have a direct impact on lithium prices. The pressure on lithium price mainly comes from 2023Q2.

Although the demand gradually returns to normal after the Spring Festival, the newly added capacity in the early stage has gradually completed climbing, the pressure on lithium supply release is increasingly evident, and the downward pressure on lithium price increases.

Therefore, to measure lithium price fluctuation from the perspective of lithium supply and demand, the key variable is that there will be a large number of new capacity at the end of 2022, corresponding to the relatively loose lithium supply in 2023Q2, and the downward risk of lithium price will increase.

However, looking back on history, it can be found that the transformation of new capacity from landing to effective capacity in lithium supply is still subject to multiple factors.

Unexpected possibility of lithium supply

Factors causing delay in production of lithium supply project

The factors that may cause the lithium mine project to be delayed in production and thus affect the lithium supply are mainly divided into three categories:

● The publicity schedule is optimistic

● Impact of government approval such as environmental impact assessment

● Epidemic impact

To sum up, although many projects will be put into production at the end of 2022 and the beginning of 2023 according to the announcement plan, considering the above factors, the progress of capacity construction may not be as expected.

Lithium supply faces multiple factors

According to previous production experience, no matter the newly established capacity or the mature capacity, its production process may be affected by various accidental factors. In the lithium supply , the output is often difficult to meet the guidance requirements:

● Extreme weather impact

The capacity of salt lakes in South America is mostly concentrated in the lithium triangle area. The infrastructure in this area is relatively backward, and the ability to withstand natural disasters is poor.

The lithium supply is obviously affected by extreme weather. For example, in March 2015, heavy rain in Chile and northern Argentina caused floods, SQM’s Atacama project stopped production, and FMC products were blocked.

● Impact of government policies

Changes in the policies of the South American governments on foreign investment and product prices may also have a negative impact on the global lithium supply. For example, the Argentine customs established the lowest reference price for lithium exports in June 2022, which will disturb the global lithium salt price market.

● Lack of skilled labor

Australia is a sparsely populated country. In the process of lithium resource development in Western Australia, there is often a shortage of skilled workers, and the output is not as expected.

● Epidemic impact

Australia and other places face the repeated impact of the epidemic. When the epidemic is serious, normal mine development activities are forced to slow down or even stop.

In 2023, due to the centralized release of a large number of new capacity, there will be some downward pressure on lithium prices. However, in the process of lithium resource capacity construction and output in lithium supply release, there are multiple adverse factors such as epidemic impact and labor shortage.

If these adverse factors have a substantial impact on the lithium resource capacity release in 2023, the lithium supply in that year will be lower than expected, and the lithium price may remain high.