Home » Battery Materials » Power battery data for August 2021, are there potential risks ?

Power battery data for August 2021, are there potential risks ?

Monthly power battery data for August

There are three ways to interpret the data.

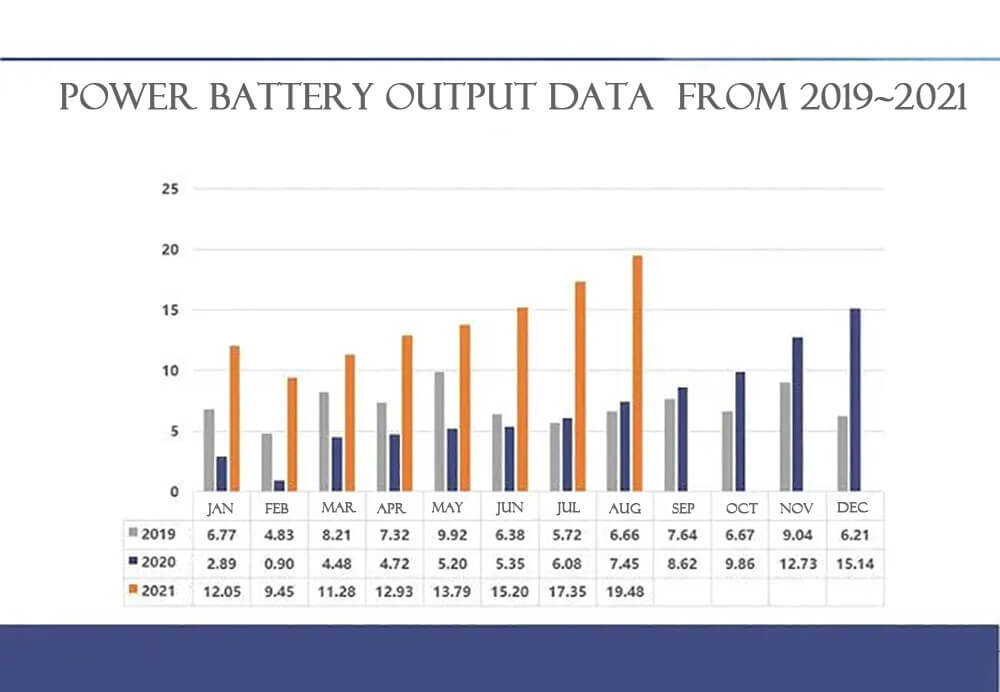

In terms of output, in August 2021, China’s power battery output totaled 19.5GWh, up 161.7% year on year and 12.3% month on month. The output of ternary battery was 8.4GWh, accounting for 42.9% of the total output, with a year-on-year growth of 91.5% and a sequential growth of 4.8%. The output of lithium iron phosphate battery was 11.1GWh, accounting for 56.9% of the total output, with a year-on-year growth of 268.2% and a sequential growth of 18.8%.

From January to August, China’s power battery output totaled 111.5GWh, up 201.0% year-on-year. The total output of ternary battery was 53.2GWh, accounting for 47.7% of the total output, with a year-on-year growth of 137.2%. The total output of lithium iron phosphate battery was 58.1GWh, accounting for 52.1% of the total output, up 301.8% year-on-year.

As a result, August was the fourth consecutive month that the output of lithium iron phosphate batteries exceeded that of ternary batteries, and the gap between the two batteries appeared to widen. From the actual data, from January to May, the annual output of lithium iron phosphate battery has already exceeded the ternary battery.

In the following June to August, the phosphorus output of ternary battery is lower than that of lithium iron acid battery. Therefore, we can fully predict that the annual output of lithium iron phosphate batteries in 2021 will exceed ternary batteries!

In terms of loading capacity, in August 2021, the loading capacity of power batteries in China was 12.6GWh, up 144.9% year on year and 11.2% month on month. Ternary batteries totaled 5.3GWh, up 51.9% year on year, down 2.1% month on month; A total of 7.2GWh of lithium iron phosphate batteries were loaded, up 361.8% year-on-year and 24.4% quarter-on-quarter.

From January to August, China’s power battery loading capacity totaled 76.3GWh, up 176.3% year-on-year. The total loading volume of terpolymer battery was 40.9GWh, accounting for 53.6% of the total loading volume, up 111.2% year-on-year. The total loading volume of lithium iron phosphate battery was 35.2GWh, accounting for 46.2% of the total loading volume, up 338.6% year-on-year.

Shipments of lithium iron phosphate batteries surpassed those of ternary batteries for the first time in July, and the gap continued to widen in August.

In terms of enterprise concentration, in August 2021, a total of 38 power battery enterprises in China’s new energy vehicle market achieved vehicle assembly, 5 fewer than the same period last year. The power battery loading capacity of the top 3, top 5 and top 10 power battery companies were 9.6GWh, 10.5GWh and 11.6GWh, accounting for 76.3%, 83.9% and 92.7% of the total loading capacity, respectively. From January to August, a total of 54 power battery enterprises in China’s new energy vehicle market have achieved vehicle loading, 5 fewer than the same period last year.

The power battery loading capacity of the top 3, top 5 and top 10 power battery enterprises is 54.9GWh, 63.9GWh and 69.9GWh, respectively. Accounted for 71.9%, 83.7% and 91.6% of the total vehicle load respectively. In August, the TOP15 enterprises in China’s power battery loading volume were CATL, BYD, Gotion high-tech, avic lithium, Svolt energy, fueneng technology, tafel, xinwangda, giwei power,EVE, penghui energy, resen battery, huading guolian, REPT energy, DFD

Among them, CATL’s power battery loading market share reached 51.7%. And Guoxuan High-tech exceeded The Aviation Lithium, to the top three position. However, with a power battery capacity of 0.69GWh and 0.62gwh respectively, the gap is not that big, so the battle for third place is likely to be very close in the coming months. Hive Energy moved up to fifth place.

In the first eight months of this year, the TOP15 enterprises in China in terms of power battery loading are CATL, BYD, avic lithium, LG new energy, Guoxun high-tech, Yiwei lithium energy, honeycomb energy, fueneng technology, tafel, javiv power, risen battery, penghui energy, xinwangda, ruipu energy and duofudo.

Will capacity expansion of power battery bring risks?

Consistent with the data, in the first half of the year, ningde times, byd and other TOP10 battery companies have announced plans to expand production of lithium batteries. Some in the industry are concerned that aggressive battery capacity expansion poses a greater risk of technological change, which could lead to mass obsolescence. And the current power battery industry technology path is single, there are also certain risks.

The expansion of power batteries has also affected the upstream material industry chain. For example, the price of lithium carbonate has risen from 38,000 / ton last year to 90,000 / ton. Electrolyte VC additive is also in short supply, and many enterprises have begun to snap up raw material VC.

Why the battery shortage at the same time?

Although companies are expanding, there is a shortage of batteries in the new-energy vehicle sector. As we mentioned in an article “Will power battery be sold out?“a few days ago, this power battery shortage is actually a structural supply-demand imbalance caused by “insufficient high-end capacity and excess low-end capacity”. The capacity of the battery enterprises can not be effectively released.

At the same time, most of the current power battery companies only focus on a few specific technology paths, such as lithium iron phosphate and ternary lithium. Such expansion of production capacity, once the supply of raw materials is difficult, the stability of the entire industrial chain will be affected.

Therefore, in the future, we should continue to promote technological progress, develop diversified power battery technology, give more development opportunities to second-tier battery manufacturers, so as to effectively release capacity and alleviate structural shortage.