CATL battery swapping business scale and outlook

In the first year of 2022, CATL’s wholly-owned subsidiary – Times Electronic Services – held its first press conference, officially releasing its battery swap service brand EVOGO and its combined battery swap overall solution.

It is reported that Times Electric’s battery swap solution includes three major products: battery swap block, quick swap station and APP. Among them, the chocolate battery swap block is a mass-produced battery specially developed by the company to realize shared battery swap, which can be adapted to 80% of the models developed on pure electric platforms that have been launched in the world and will be launched in the next three years. At the same time, the battery swap service was first launched in 10 cities.

CATL has long planned to enter the battery swapping market

In fact, even though the news of CATL’s entry into the swap battery is quite surprising, considering the series of previous actions of CATL, CATL’s choice is planned. As early as 2019, CATL, together with Hello Travel, Ant Financial, etc., launched an electric vehicle battery swap brand serving electric two-wheeled vehicles——Xiaoha swap battery, and this is the first time it has introduced a swap battery Exploration and experimentation by service.

And one year later, in 2020, as the third largest shareholder, CATL and NIO Automobile, a leading electric vehicle company, jointly established Wei Neng Battery Assets Company. Through this cooperation, CATL has begun to accumulate beneficial experience in operating battery banks and battery swap models.

Entering 2021, CATL has accelerated its battery swap strategy. Not only completed the establishment of the business operation subject of the EVOGO battery swap brand – “Time Electric Service”, but also reached business cooperation related to battery swap with Guizhou Provincial Government, Sichuan Development and other partners.

In the commercial vehicle battery swap market, CATL already has a place and its partners include Beiqi Foton, Shaanxi Automobile, FAW, Dongfeng, Yutong and many other well-known leading commercial vehicle companies. The data shows that in the field of commercial vehicles, CATL has occupied more than 80% of the battery swap market.

Under the appearance of a high share of commercial vehicles, China’s new energy passenger vehicle market is even more attractive. After all, China’s new energy passenger vehicle market is obviously stronger both in terms of scale and potential.

The data shows that in 2022, the sales volume of passenger vehicles in China will reach 26.864 million units, a year-on-year increase of 3.8%, of which the sales volume of new energy vehicles will reach 6.887 million units, a year-on-year increase of 93.4%, and the market share will reach 25.6%.

Therefore, under the continuous favorable policies, on the basis of the huge development potential of the new energy vehicle market, coupled with the accumulation of previous experience and deep cultivation of technology.

CATL is bound to continue to expand the application scenarios of the battery swap model in the field of passenger vehicles, and this can also achieve CATL’s ultimate goal of selling more batteries to a certain extent.

CATL electric vehicle battery swapping scale

However, industry insiders believe that the purpose of CATL entering the battery swap market is not just battery sales. From a larger perspective, its real purpose is to become the creator of a unified standard. As we all know, the specifications, models, interfaces, parameters, etc. of the power battery packs of various car companies in the current market are different.

At the same time, due to the variety of standards, it is difficult for existing battery swap stations to serve different brands, resulting in the singleness of car brands and car battery swap services. For example, the NIO battery swap station only supports NIO vehicles, and Aodong New Energy mainly provides battery swap services for BAIC’s operating vehicles.

The “chocolate battery swap block” launched by CATL is trying to break the barriers between batteries and models, through the promotion and implementation of unified standards, the impact of customized research and development on the cost of vehicle companies can be reduced, thereby saving a lot of costs for car companies to develop new cars.

At the same time, since battery swap involves the layout of the entire industrial chain such as the disposal of decommissioned batteries, it is a typical asset-heavy model of “large investment, long cycle, and slow return”. The vast majority of car companies often do not have the financial strength to build their own battery swap stations, nor can they promote the battery swap model.

Take NIO as an example. Excluding operating costs, the construction cost of a single battery swapping station is 1.5 million to 2 million RMB (the second-generation battery swap station). As of January 31 this year, NIO had a total of 1,313 battery swap stations. Considering that the construction cost of the first-generation battery swap station is about 3 million RMB per seat, NIO has invested close to 3 billion RMB in the construction of the battery swap station.

In terms of scale, as one of the top 10 power battery companies in the world, CATL obviously has an advantage in entering battery swap. In 2022, the total installed capacity of power batteries in China will reach 294.6GWh, a year-on-year increase of 90.7%. In 2022, the cumulative output of power batteries in China will be 545.9GWh, a cumulative year-on-year increase of 148.5%;

The installed capacity was 294.6GWh, a year-on-year increase of 90.7%. Among them, CATL topped the list of domestic power battery companies with a loading capacity of 142.02GWh, accounting for 48.2%.

Of course, behind the advantages of CATL, there are also unspeakable secrets. At the moment when power batteries are difficult to achieve technological breakthroughs, its so-called CATL-one status is not indestructible.

Since the current technical uniqueness has not yet appeared, it is not yet known how long CATL’s large-scale advantages can be maintained when many car companies are looking for new outsourced battery suppliers or even build their own battery factories.

Under such circumstances, expanding the battery swap business is not only the best way for CATL to gradually transform from a battery supplier to an energy service provider, but also an early layout for it to deal with future business development bottlenecks.

With the help of the promotion of the battery swap model, CATL has the opportunity to form a closed loop of the battery life cycle value chain from R&D, manufacturing, use to recycling, which is conducive to increasing added value.

Limitations of battery-swapping mode

However, everything has pros and cons. Even though on the surface, CATL’s battery swap road seems to have a bright future, there are still several problems that cannot be ignored that restrict its development. On the one hand, it is still unknown whether car companies can pay for the unified standards formulated by CATL.

Judging from CATL EVOGO’s first partner, FAW Bestune, companies that are willing to attach to it are often companies with relatively backward battery technology. At the same time, since power battery-related technologies are still the core selling point of many electric vehicles, relatively advantageous car companies will not easily give up their own core technologies and sunk costs that have already been invested.

In addition, the current technology including battery performance is still the core competitiveness of a new energy vehicle, which is often linked to the positioning, price and brand of automotive products. Once the battery technology and standards are unified, car companies will inevitably face the problem of huge product differentiation.

On the other hand, if CATL’s expectations are realized, how to ensure the battery swap experience is also one of the problems. Unlike NIO, which only targets its own models and other battery swap platforms for the public travel market, CATL EVOGO wants to target a wider range of C-end individual users who are relatively more experience-oriented.

Considering that CATL’s “chocolate battery swap block” can be adapted to passenger cars from A00 class, B class to C class, users of different models naturally have very different tolerances for the convenience of battery swap. How to ensure that the battery swap experience is not fragmented will be a major problem facing EVOGO.

And draw attention to the swap battery market of the entire new energy vehicle. We can intuitively find that there are still no companies that have achieved profitability in the battery swapping business, not to mention that with the development of fast charging technology, the time gap between charging and battery swap is also shortening.

As for the moment, although it is still unknown whether CATL can achieve another breakthrough in corporate performance by virtue of its entry into the battery swap field, but whether it is the policy-oriented market trend or the flocking companies – since 2022, including SAIC, Geely Automobile, GAC Group, CATL and GCL Nengke and other OEMs, and new energy industry chain giants have joined the tide of battery swap one after another.

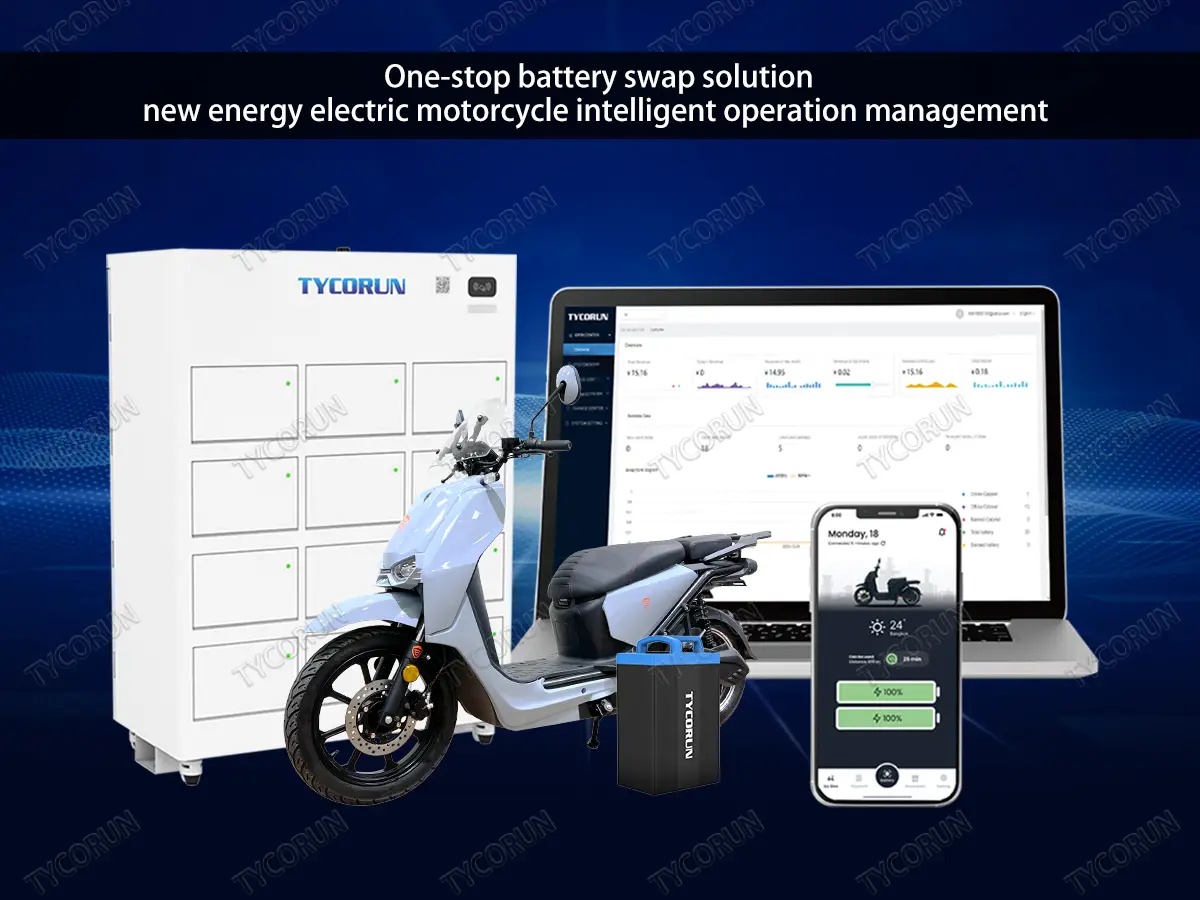

All these seem to prove a fact: Behind the battery swap model is a brand new blue ocean market, waiting to be tapped by many car companies. Not only electric vehicles, but also heavy trucks, ships, motorcycles, etc. have opened the battery swap mode, especially motorcycle battery swapping. There are already many battery swap companies in many regions in Southeast Asia.

Including TYCORUN ENERGY odm lithium ion battery pack manufacturer, if you want to know more about motorcycle battery swap products, or the profit model of motorcycle battery swap, etc., you can click the product picture below to enter the product page for free consultation and free quote.

72V/60V/48V battery swapping station with 12 ports for electrical motorcycle batteries