Home » energy storage system » China energy storage industry report in 2023

China energy storage industry report in 2023

Energy storage refers to a series of technologies and measures that use chemical or physical methods to store the generated energy and release it when needed.

Energy storage technology has a wide range of applications, including power systems, communication base stations, data centers, UPS, rail transit, artificial/machine intelligence, industrial applications, military applications, aerospace, etc., and the potential demand is huge. In 2023, the energy storage industry in China and the world also achieved huge growth.

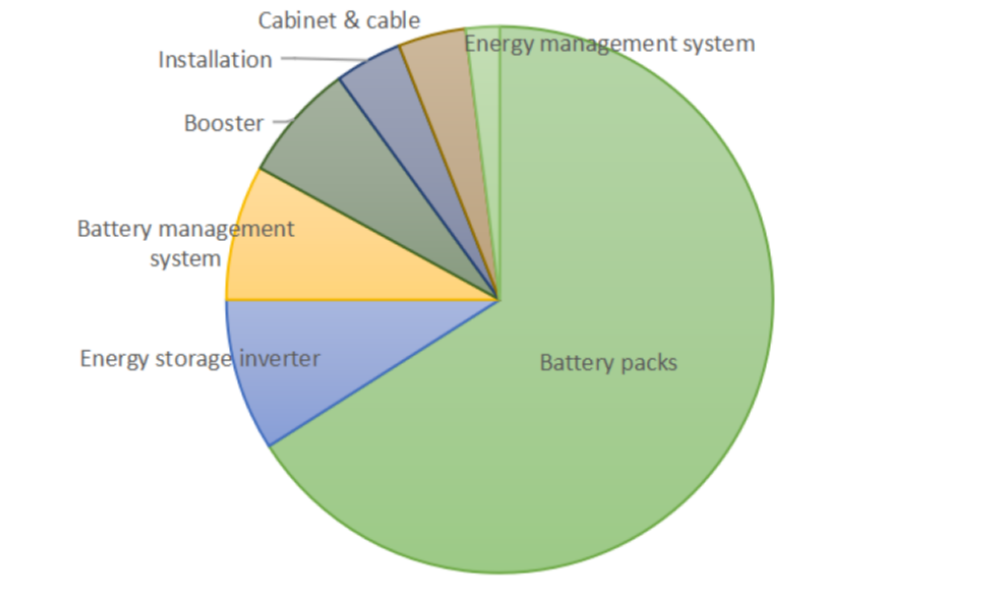

Components of energy storage system cost

A complete electrochemical energy storage system is mainly composed of a battery pack, battery management system (BMS), energy management system (EMS), energy storage converter (PCS) and other electrical equipment.

The battery pack is the most important component of the energy storage system. The battery management system is mainly responsible for battery monitoring, evaluation, protection, and equalization. The energy management system is responsible for data collection, network monitoring, and energy scheduling. The energy storage converter can control the charging and discharging process of the battery pack, to convert AC to DC.

The cost of the battery pack is the main cost of the electrochemical energy storage system and the main link in the future industrial chain technology iteration and cost reduction. In a complete electrochemical energy storage system, the cost of the battery pack accounts for up to 67%, followed by the energy storage inverter at 10%, and the battery management system and energy management system account for 9% and 2% respectively.

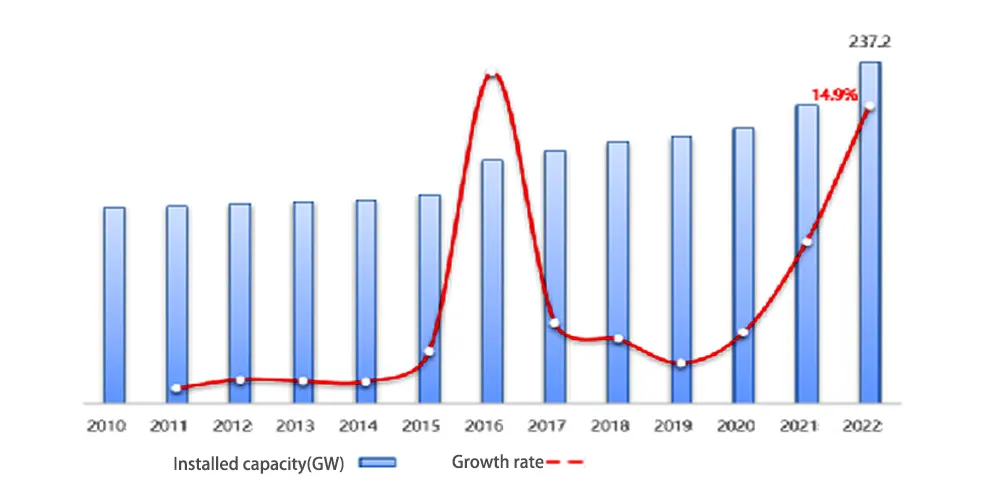

Rapid growth of the global energy storage market

By the end of 2022, the cumulative installed capacity of power storage projects in operation around the world was 237.2GW, with an annual growth rate of 15%. After the global cumulative installed capacity exceeded 200GW in 2021, it continued to maintain a high-speed growth trend in 2022.

Since 2022, the global energy supply and demand pattern has entered a stage of adjustment, and more and more countries have listed energy storage industry as a must to accelerate the clean energy transformation. In 2022, the installed capacity of new power storage projects put into operation around the world was 30.7GW, a year-on-year increase of 98%, of which the scale of new energy storage projects reached 20.4GW.

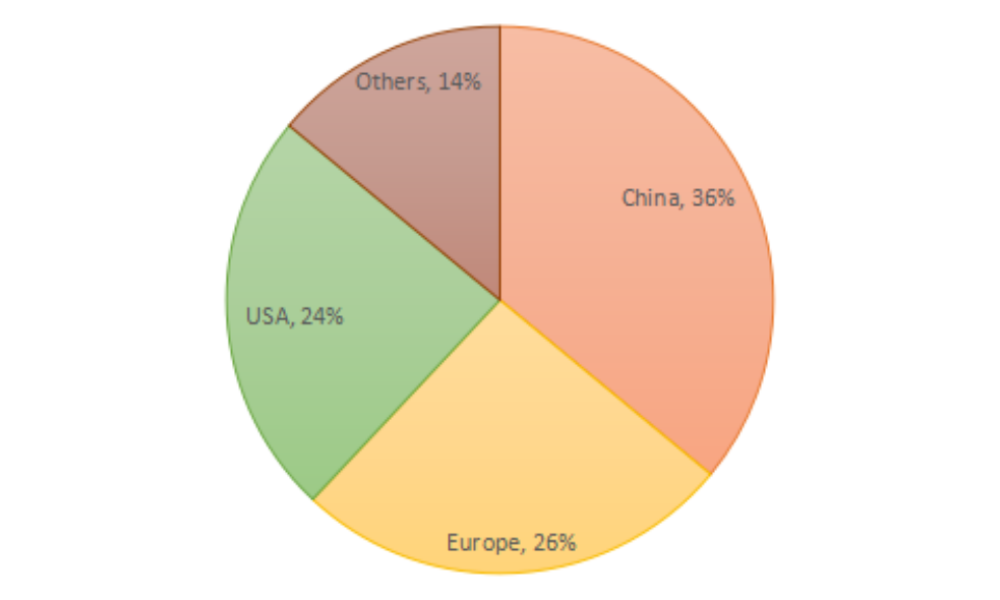

In 2021, the total installed capacity of new energy storage industry in China, the United States, and Europe accounted for about 80%, and in 2022, the total installed capacity of new energy storage in these areas accounted for about 86%, and the concentration increased by 6%, continuing to lead the global energy storage industry market development.

Among them, the Chinese market accounts for 36%, mainly based on off-meter energy storage, and the current demand mainly comes from the mandatory policy constraints of China’s new energy allocation and storage. It comes from the rigid demand for the construction of the local old power grid.

The European market accounts for 26%, and Europe is dominated by user-side energy storage, and the main demand comes from solving household electricity problems.

The International Energy Agency predicts that the global installed capacity of energy storage industry will increase by 56% in the next five years, reaching more than 270GW by 2026. It is estimated that by 2030, the global renewable energy generation will increase 13 times, of which solar and wind power will increase 10 times. With the dominance of renewable energy generation, energy storage technology will play a vital role in it.

In the future, under the joint progress of battery solution and new energy technology, energy storage industry will play a very important role in the future power structure, responsible for the flexibility adjustment of the power grid. It is predicted that by 2050, the cumulative installed capacity of global energy storage will reach 1676GW/5827GWh, and the global investment in the next 30 years is expected to reach 662 billion US dollars.

New energy storage scale growth

New energy storage refers to the energy storage technologies other than pumped storage. New energy storage includes gravity, lithium battery, sodium battery, lithium polymer battery, flow battery, compressed air, etc.

New energy storage is a key link in the construction of a new power system. It can play an important role in supporting power supply, improving system regulation capabilities, and ensuring the safety of power grid operation. It has multiple and multi-time scale application scenarios.

From 2016 to 2020, the installed capacity of global new energy storage projects increased from 0.7GW to 4.7GW, with an average annual compound growth rate of 46.54%. In 2021, the new energy storage industry in the world had the largest new commissioning scale, and it exceeded 10GW for the first time, reaching 10.2GW, which is 2.2 times the new commissioning scale in 2020, a year-on-year increase of 117%.

In 2022, the new scale of new energy storage put into operation in the world exceeded 20GW for the first time, reaching 20.4GW, twice that of the same period in 2021.

In 2022, the newly installed capacity of lithium batteries in the world exceeded 7GW for the first time, and there have been dedicated large-capacity batteries with a single capacity of 560Ah developed for energy storage in the market.

In addition, projects with compressed air energy storage, liquid flow batteries, sodium-ion batteries, flywheels and other technical routes have also made breakthroughs in scale, and their application modes have gradually increased.

By the end of 2022, the cumulative installed capacity of new energy storage industry in the world has reached 45.7GW, with an annual growth rate of 80%. Among them, lithium-ion batteries maintained an absolute dominant position with a proportion of 97%, with an annual growth rate of more than 85%, and its cumulative installed capacity in the new energy storage industry increased by 3.5% year-on-year.

Energy storage market Status in China

In 2022, newly installed capacity of power storage projects in China has reached 16.5GW. Among them, the new installed capacity of new energy storage was 7.3GW/15.9GWh, the power scale increased by 200% year-on-year, and the energy scale increased by 280% year-on-year.

From the perspective of regional distribution, China is the market with the largest proportion of new energy storage industry projects in the world in 2022, accounting for as high as 36%, which also makes China the first in the world for the first time.

Judging from the proportion of China’s new energy storage industry’s installed capacity in 2022, lithium-ion battery energy storage technology accounts for 94.2%, still in an absolute dominant position, and the proportion of new compressed air energy storage and liquid flow battery energy storage industry technologies are respectively 3.4% and 2.3%, accounting for a significantly fast growth rate.

In addition, various energy storage industry technologies such as flywheels, gravity, and sodium ions have also entered the stage of engineering demonstration. By the end of 2022, the cumulative installed capacity of power storage projects in China has reached 59.8GW, and the cumulative installed capacity of pumped storage has fallen below 80% for the first time. New energy storage continues to develop rapidly.

New energy storage installed

By the end of 2022, the cumulative installed capacity of China’s new energy storage industry exceeded 10GW for the first time, reaching 13.1GW, a year-on-year increase of 128%.

In the first half of 2023, China’s new energy storage industry continued to develop at a high speed, with 8.0GW/16.7GWh of new capacity put into operation, exceeding the level of new capacity in 2022 (7.3GW/15.9GWh).

The new projects put into operation were mainly concentrated in June, and the scale of those put into operation in June reached 3.95GW/8.31GWh, accounting for 50% of the total scale of those newly put into operation in the first half of the year. The second half of the year will continue to maintain a rapid growth trend, and it is estimated that 15-20GW of new installed capacity will be added in the whole year of 2023.

Northwest China is an important area for project deployment in China’s energy storage industry, which will drive the rapid growth of the new energy storage industry. As of the end of June 2023, the cumulative installed capacity of new energy storage industry projects in Shaanxi, Gansu, Ningxia, Qinghai and northwestern Xinjiang has reached 5.00GW/11.25GWh, and nearly 70% of the installed capacity is from Ningxia and Xinjiang.

The compound growth rate (2017-2022) of the five provinces in the past five years has reached 109%. In the first half of 2023 alone, the newly installed installed capacity in five provinces and regions reached 1.82GW/4.705GWh.

Energy storage lithium battery shipments

In 2020, the shipment of energy storage lithium batteries reached 16.2GWh, a year-on-year increase of 70.53%. In 2021, China’s energy storage battery shipments was 48GWh, a year-on-year increase of 196%.

Among them, power energy storage battery shipments was 29GWh, a year-on-year increase of 4.39 times compared to 6.6GWh in 2020. The strong growth is mainly due to the soaring installed capacity of overseas energy storage power stations and the policy support of wind and energy storage in China.

In 2022, the shipments of energy storage lithium batteries continued the strong growth momentum of the previous year, with annual shipments reaching 130GWh, a year-on-year increase of 170.8%.

It is estimated that by 2025, China’s energy storage lithium battery shipments will reach 58GWh, and the market size will exceed 55 billion RMB. Among them, the cumulative shipment of lithium batteries for power storage, which is the main application field, will exceed 60GWh.

Energy storage application scenarios in China

The energy storage industry has rich application scenarios, which can be mainly divided into three categories: power supply side, grid side and user side. There are many types of demand scenarios for energy storage industry on the power supply side, including grid-connected renewable energy, power peak shaving, system frequency regulation, etc.

Grid-side energy storage mainly plays a role in supporting power supply, improving system adjustment capabilities, and supporting a high proportion of new energy to be sent out, so as the role of replacing the investment in power transmission and distribution projects.

The user-side energy storage is mainly used for self-use of power, peak-valley price difference arbitrage, capacity electricity fee management, and improvement of power supply reliability.

In 2022, the application scenarios of China’s energy storage industry were dominated by new energy distribution and storage and independent energy storage on the grid side.

(1) New installed capacity:

In 2022, the proportion of newly installed capacity in various application scenarios remained basically unchanged, with the highest proportion of power supply side at 49.24%; followed by the power grid side, accounting for 43.13%; the proportion of user side was the smallest, which was 7.63%.

(2) Cumulative installed capacity:

As of the end of 2022, the cumulative installed capacity of electrochemical energy storage power stations that have been put into operation in China was mainly distributed on the power supply side, accounting for 48.4%; followed by the power grid side, accounting for 38.72%; and the user side accounted for 12.88%.

(3) Specific scenarios:

Power supply side: new energy distribution and storage is the main application scenario, accounting for more than 80%, and other scenarios account for less than 20%;

Grid side: independent energy storage solutions account for nearly 90%, substations and other application scenarios accounted for about 10%;

User side: industrial and commercial energy storage applications accounted for about 42%, and other scenarios accounted for about half of the proportion.

In 2022, Inner Mongolia, Xinjiang, and Gansu were the main implementation regions for renewable energy allocation and storage; Ningxia, Shandong, Hunan, and Hubei mainly developed independent energy storage, benefiting from the promotion of demonstration projects in the energy storage industry, and the demand for renewable energy allocating were mainly met by leasing energy storage capacity.

In 2022, China’s new energy allocation and storage utilization rate was low, with a utilization factor of only 6.1%, which was lower than the average equivalent coefficient of electrochemical energy storage projects of 12.2%. Mandatory allocation of storage is still the main factor driving the growth of installed capacity.

In addition, due to the high cost of lithium batteries in 2022 and the uncertainty of the business model of the energy storage industry, the mandatory allocation and storage policies of new energy in various provinces were still the main driving force for the installed capacity in 2022.

From the perspective of provincial requirements, the mandatory allocation and storage requirements of major provinces in China were 10-20% of the installed capacity of new energy, and the continuous charge and discharge time was 2-4h.