Global LFP materials - looking back to 2021 and looking forward to 2022

In terms of growth drivers

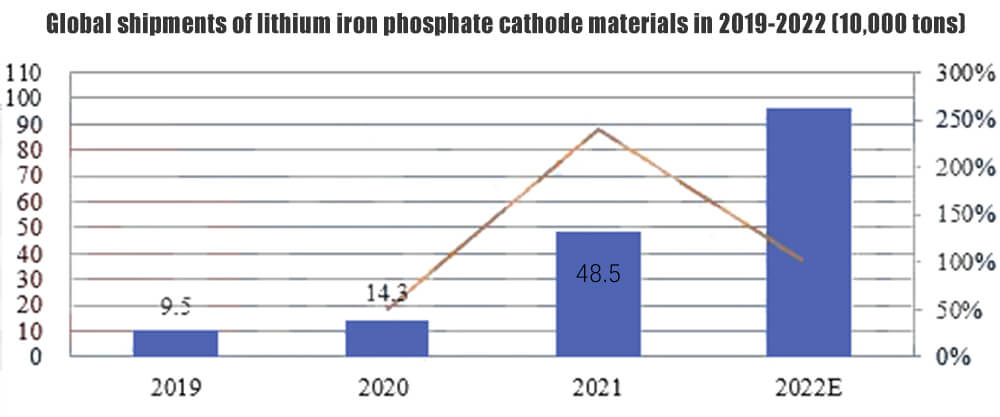

Tthe main reasons for the rapid growth of lithium iron phosphate cathode material shipments in 2021 are:

1) China’s power battery shipments were 226GWh, of which iron-lithium power battery shipments exceeded 117GWh, and iron-lithium power battery shipments increased by over 250% year-on-year. Here are TOP 10 Lithium iron phosphate power battery manufacturers.

2) Under the pressure of the carbon trading market, the global energy storage lithium battery shipments will be 70GWh in 2021, an increase of 159%, and the lithium iron phosphate route will account for over 50%. More than 70%; China’s energy storage lithium battery shipments will be 48GWh in 2021, and the lithium iron phosphate route will account for about 98.5%.

3) Driven by the rapid growth of the power and energy storage battery market, China’s lithium iron phosphate lithium battery shipments will be 171GWh in 2021, a year-on-year increase of 242%;

4) With the advancement of power battery technology and the structural innovation of lithium iron phosphate battery packs, the cruising range of vehicles equipped with lithium iron phosphate batteries generally reaches 400-600 kilometers.

5) The low-temperature performance of lithium iron phosphate batteries continues to improve, the advancement of lithium iron phosphate battery technology, the advancement of thermal management systems, and the gradual popularization of heat pump air conditioners have improved the low-temperature endurance of vehicles equipped with lithium iron phosphate batteries.

6) The price of upstream raw materials has risen sharply, and the pressure on car companies and power battery companies to reduce costs has increased, and lower-cost lithium iron phosphate batteries have partially replaced higher-cost ternary lithium batteries.

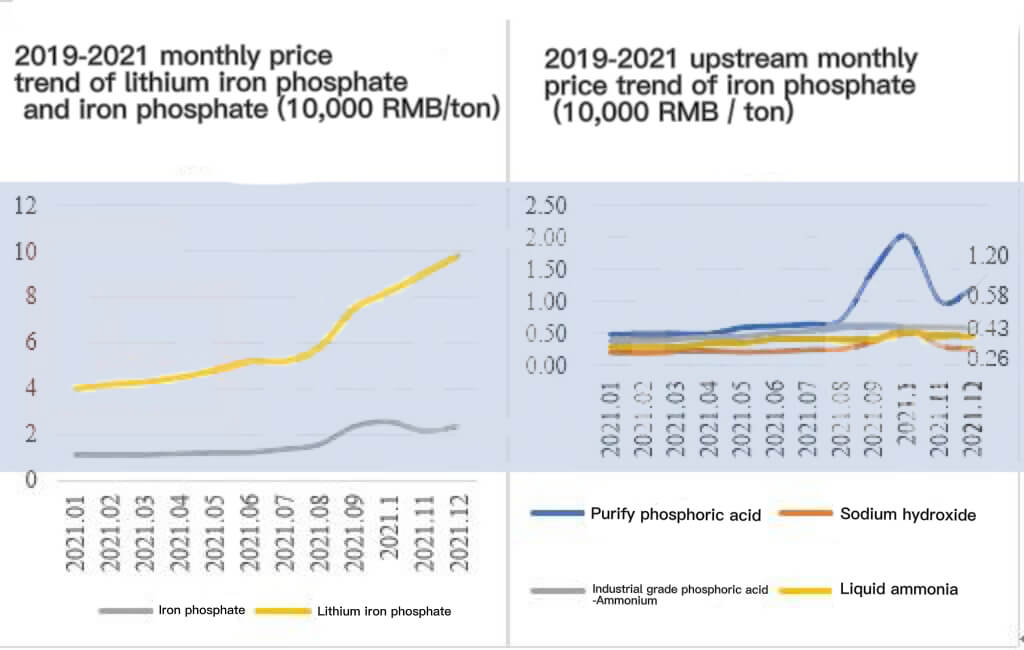

Lithium iron phosphate and iron phosphate price trend

The price of lithium iron phosphate cathode materials will increase as a whole in 2021, with an average increase of over 100%. The main reasons are:

1) Upstream raw materials are in short supply and prices are rising, boosting the cost of lithium iron phosphate:

① The price of battery-grade lithium carbonate increased from 53,000 RMB per ton at the beginning of the year to 270,000 RMB per ton at the end of the year

② The price of industrial grade monoammonium phosphate has risen from 3,800 RMB per ton to 5,800 RMB per ton

③ The cost of by-product ferrous sulfate has risen from close to the freight to 500 RMB/ton

④The price of purified phosphoric acid has risen from 5,000 RMB/ton to 12,000 RMB/ton

2) The demand for lithium iron phosphate cathode materials has increased significantly, and the high-quality lithium iron phosphate cathode material enterprises are full of production, resulting in tight production capacity and supply, driving up the price of lithium iron phosphate materials;

3)The expansion cycle of iron phosphate is long: the expansion cycle of iron phosphate is 12-18 months, and the expansion cycle of lithium iron phosphate is 6-8 months. price.

Competitive landscape of lithium iron phosphate cathode materials and iron phosphate enterprises

Hunan Yuneng has ranked first in the industry for two consecutive years, and its market share has further increased to 25% in 21 years. The market share of TOP5 in 2020 is 83%, and the market share of TOP5 in 2021 is 64%, and the market concentration has decreased due to:

1) In the first half of 2016-2020, affected by the subsidy policy, the demand for lithium iron phosphate cathode materials almost stopped growing, and the competition was fierce. Many lithium iron phosphate material enterprises stopped production or went bankrupt, and the market concentration was improved;

2) Beginning in the second half of 2020, the demand for lithium iron phosphate cathode materials has increased significantly, and many lithium iron phosphate cathode material companies that have stopped production have resumed production, which has caused new competitors to enter the lithium iron phosphate cathode material industry, and lithium iron phosphate cathode materials. There are more material companies and the industry concentration is reduced.

3)The head lithium iron phosphate cathode material enterprises have insufficient production capacity, the head power battery enterprises have invested in lithium iron phosphate cathode material enterprises, and actively introduce new lithium iron phosphate cathode material suppliers to squeeze the share of the head lithium iron phosphate cathode material enterprises.

Competitive landscape of iron phosphate enterprises

From the perspective of the market share of the industry’s leading enterprises, the TOP3 market share in 2020 will be 65%, the TOP6 market share will be 86%, and the TOP3 market share will be 56% in 2021, and the TOP6 market share will be 81%. The market concentration has decreased, and the market share of TOP4-6 enterprises has increased. The reasons are:

1) The iron phosphate production capacity is insufficient, and the high-cost production capacity can be restarted, squeezing the market share of the leading enterprises, and the industry concentration has decreased.

2) The capacity utilization rate of TOP3-TOP6 enterprises has been improved, and the market share has remained unchanged.

3)Under the background of insufficient production capacity, the market rate of tail enterprises has been improved.

Lithium iron phosphate batteries will maintain the cost advantage over ternary lithium batteries at least in the short to medium term. Indonesia does not allow laterite nickel ore tailings to be buried in the deep sea, which will increase the smelting cost of laterite nickel ore, which will increase by 1500-2000 US dollars in the future. Cost per ton of nickel metal.

In addition, phosphorus and iron resources are more resource safe. Indonesia promotes the localization of the new energy industry chain, which may ban the output of nickel-cobalt intermediates and high-nickel matte, and promote part of the demand in the Chinese market to shift to lithium iron phosphate batteries.

Estimated features of China lithium iron phosphate and iron phosphate market

1) Lithium iron phosphate materials are driven by the growth of the power and energy storage market and become the mainstream of the market, and the market share of lithium battery cathode materials is expected to exceed 50%; In China’s power lithium battery market, lithium iron phosphate batteries are expected to account for more than 60%.

2) Driven by the price increase of lithium carbonate, the price of lithium iron phosphate is expected to exceed 150,000 RMB/ton.

3) Lithium iron phosphate production capacity and iron phosphate production capacity are rapidly released, and lithium iron phosphate cathode materials have changed from insufficient high-quality production capacity to overcapacity of lithium iron phosphate and insufficient supply of raw materials. Iron phosphate production capacity is expected to turn from insufficient to surplus in mid-2022.

4) Part of the lithium iron phosphate production capacity will be cleared due to lack of raw materials.

5) The market share of ammonium iron phosphate will increase steadily.

6) The industry concentration of lithium iron phosphate cathode materials is expected to increase.

7)The lithium iron phosphate cathode material production lines of a number of phosphorus chemical and titanium dioxide enterprises will be mass-produced.

Estimated features of the global lithium iron phosphate material industry chain

1) The global proportion of lithium iron phosphate power batteries has further increased. It is expected that the global power battery shipments will reach 650 GWh in the whole year, of which lithium iron phosphate power battery shipments will be 260 GWh.

2) Global energy storage lithium battery shipments are 125GWh, of which the proportion of lithium iron phosphate routes will continue to increase.

3) Lithium iron phosphate materials and lithium iron phosphate power batteries are expected to usher in large-scale exports. The core patent of lithium iron phosphate cathode materials will expire overseas in March 2022, which will reduce obstacles for the overseas promotion of lithium iron phosphate batteries.

Through on-the-spot investigation of major lithium iron phosphate cathode materials, iron phosphate material enterprises, and supporting enterprises in the country, combined with face-to-face interviews with leaders in the lithium iron phosphate cathode material industry, a large amount of first-hand information was collected, and the “2022 China Lithium Iron Phosphate” was written. Cathode Materials Industry Research and Analysis Report.

This report conducts a more detailed research and analysis on the development characteristics, main products, shipments, output value, future market development trends, etc. of China’s lithium iron phosphate cathode materials and iron phosphate industry in 2021. The development trend of materials and iron phosphate materials is predicted.

We hope to provide accurate and valuable reports for investors, industry insiders, securities companies and those who want to understand China’s lithium iron phosphate cathode material and iron phosphate material industry through actual investigation and research. Here Top 10 lithium ion battery manufacturers must be helpful to you.