Lithium battery test equipment industry - a comprehensive analysis

Industry driving background

The demand side of the soaring order increment and the supply side of battery test equipment production capacity to form a supply and demand gap.

Lithium battery production process is complex, battery quality and safety requires high precision and high stability of battery test equipment supply, high-quality battery test equipment manufacturers are scarce.

Battery test equipment industry chain

Battery test equipment upstream raw materials competition is sufficient, equipment companies have strong bargaining power; downstream mostly lithium battery suppliers, core equipment vendors have strong bargaining power, non-core equipment vendors bargaining power is weak; in terms of the competitive landscape, market concentration is gradually increasing.

Battery test equipment full industry chain diagram

Battery test equipment industry overview

Lithium battery test equipment refers to the equipment for manufacturing lithium batteries through an orderly process of producing raw materials such as positive and negative electrode materials, diaphragm materials and electrolyte, which corresponds to the production process of lithium batteries. Lithium battery has various forms such as cylindrical battery(such as 18650 battery, 32700 battery), square battery and soft pack battery, whose production process is different, but the manufacturing process is roughly the same.

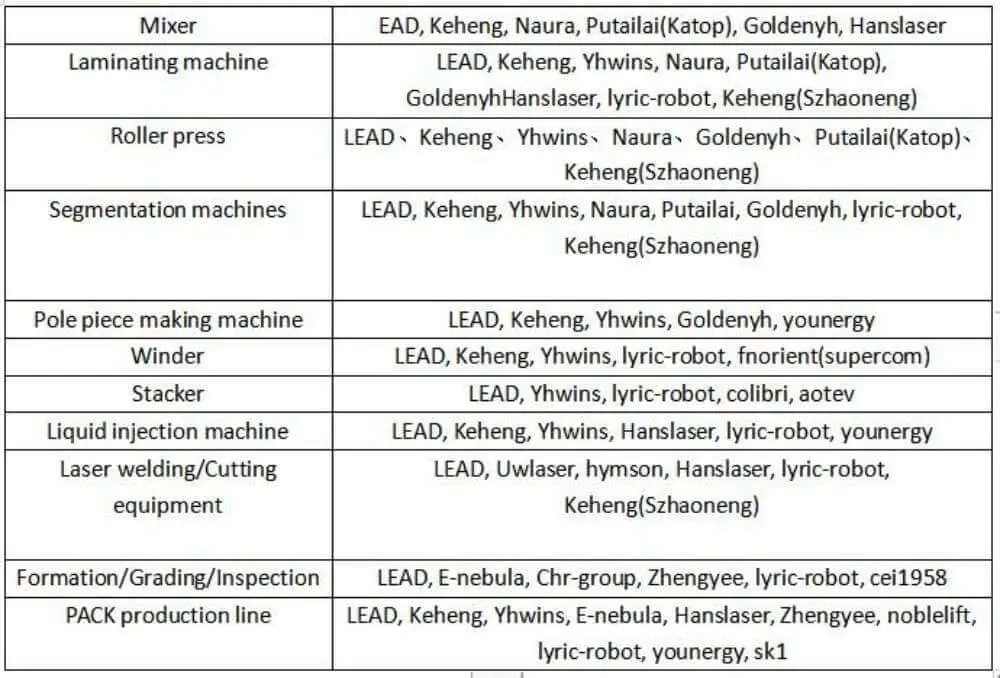

Lithium battery production process includes the front section of the cell process (pole production), the middle section of the cell process (cell production), the posterior section of the cell process (chemical formation and grading), as well as the module and battery pack (PACK) process, the corresponding battery test equipment is divided into the front section equipment, middle section equipment, posterior section equipment, PACK equipment, etc..

The front and middle section processes have formed the functional structure of the battery cells, and the battery cells are activated through the posterior section process to produce stable and safe battery products through testing, sorting and assembly. The posterior section stage mainly refers to the completion of the activation, testing and quality determination of the battery cells, including the formation of the battery cells, grading, testing, sorting, PACK, etc.

From the point of view of the value distribution of the industry chain, the front section of the equipment is more competitive, net profit margin of about 10%; middle section of the equipment net profit margin of about 20%, the posterior section of the equipment related to battery safety and the highest technical requirements, so the customer viscosity is high, the competitive pattern is better, net profit margin of about 30%, profit accounted for the overall battery test equipment industry up to 40-50%.

The front section equipment is represented by the coating machine, the middle section equipment is represented by the winding machine, and the posterior section equipment is represented by the formation and grading equipment.

Lithium battery test equipment is non-standard customized equipment. In the case of large-scale expansion of power battery production capacity, manufacturers with the ability to supply on a large scale are limited, and the current shortage of capacity in the industry, battery test equipment has entered the seller’s market.

Front section equipment: pole piece making

The goal of the front section process production is to complete the manufacturing of anode and cathode electrode sheets.

This process mainly includes mixing, coating, roller pressing, slitting, production, lug forming and other processes, which is the foundation of lithium battery manufacturing.

Coating is the core part of the front section process, and its advanced level directly affects the chemical performance and yield of the finished battery.

From the perspective of the market pattern, the core front section equipment for lithium battery manufacturing, represented by the coating machine, has long been monopolized by Japanese and Korean companies in terms of technology and market (Toray Japan, Inoac Japan, Hirano Japan, etc.)

After 2015, leading Chinese battery factories pushed back coating equipment to catch up with the highest international level, and companies such as szhaoneng, katop, Yhwins, and Areconn stood out.

Then szhaoneng was acquired by Keheng, katop was acquired by Putailai, and Areconn was acquired by Yhwins. The top three market shares, katop, szhaoneng and Yhwins, have a concentration of over 50%.

The current localization rate of China’s coating machines has reached 70% to 80%, but the main choice for rapid expansion of high-end production capacity is still international products.

| Company | Coater share | Update remarks |

| Katop | Coater share | Main coating machine, acquired by Putaila |

| Yhwins | 20%-30% | Coaters account for 13% of revenue |

| Xinyuren | 15%-20% | Core product is coater ovens |

| Szhaoneng | 15%-20% | Coater as core product, acquired by Keheng |

| Shining-automation | 10%-12% | Coater as core product |

| Areconn | 8%-10% | Coater as core product, acquired by Yhwins |

Competitive landscape of coating machine equipment in China

Middle section equipment: cell manufacturing

The goal of the middle section process is to complete the manufacturing of the cells. This is essentially an assembly process, where the electrodes made in the previous process are assembled in an orderly manner with the diaphragm electrolyte, etc.

Considering the requirements for processing speed, processing accuracy and product yield, the middle section equipment has the highest technical difficulty and barriers to entry.

The middle process of the pouch cell mainly includes winding or laminating, welding, electrolyte injection and other processes.

The equipment involved includes winding machine, laminating machine, welding machine, drying equipment, automatic liquid injection machine, etc.

The cell making process of lithium battery is currently dominated by winding equipment, and winding is the core part of the middle process.

The tension control, auto-deflection technology and winding speed of the winding machine are the key indicators to judge the advanced degree of the equipment.

At present, the market share of Chinese winding machine enterprises in the high-end field has gradually expanded to about 80%, and at the same time, driven by the concentration of power battery manufacturers, the market share of winding machine is also becoming more and more concentrated.

Data shows that the top five companies in China lithium winder market share in 2021 account for more than 90% of the market share. LEAD, Yhwins, Greensun-tech, geeum, supercom, and colibri are the leading companies in the industry.

Among them, LEAD has a market share of more than 60%, with obvious competitive advantages, and its customers include top 10 lithium ion battery manufacturers in China such as CATL, BYD, and other leading international battery factories like LG Chemistry, Tesla; Yhwins has the earliest whole-line supply capability. These two are the leading companies of battery test equipment in China.

Posterior section equipment: electrochemical link

The post-processing process is an essential process in the production of lithium ion batteries. After the post-processing, the lithium ion battery can reach the usable state and its safety can be guaranteed.

The posterior section equipment includes cell activation detection and battery packaging process.Cell activation detection technology mainly includes cell formation, grading detection, etc. The battery packaging process includes testing, sorting, series and parallel combination of the single battery, and testing the performance and reliability of the assembled battery.

The posterior section equipment is mainly composed of charge and discharge equipment, voltage/internal resistance testing equipment, sorting equipment, PACK production line, automatic logistics equipment and corresponding overall control software of the system.

Charging and discharging equipment is the core of post-processing, and testing the sorting PACK equipment is necessary.

The posterior section equipment of lithium battery is difficult and has high value.

The substitution effect of China’s posterior section equipment is obvious, and its equipment has been globally competitive, and it is the first to realize localization in China.

In the field of lithium posterior section equipment, the charge-discharge equipment of CHIR-Group and the detection equipment of E-nebula are ahead.

Posterior section process:

| Production process | Process introduction | Major equipment suppliers in China |

| Formation | harge activation and capacity measurement | LEAD (Titans), Chr-group, E-nebula, Repower |

| Grading | Testing of battery electrical performance index and capacity and grading | LEAD (Titans), Chr-group, E-nebula, Repower |

| Inspection | Visual inspection, Internal structure inspection | EAD (Titans), Chr-group, E-nebula, Zhengyee, Unicomp |

| Assembly (Pack) | Automated production line assembly | Keheng (Yucheng Automation), Huazhongcnc (jmzszy), LEAD, junyi-auto |

| Logistics automation | Logistics and warehousing automation | nti56, LEAD, chinaconveyor |

In 2021-2025, the international leading battery factory will start a new production capacity cycle. In 2023, CATL and other six leading global battery factories plan to add 600GWh production capacity. It is expected that the corresponding new equipment investment is about 194.5 billion yuan, among which the posterior section equipment market space is about 50 billion yuan.

Market pattern of battery test equipment

In the early stage, lithium-ion battery equipment market was mainly occupied by Japanese and Korean enterprises, including Koem (Korea), Toshiba, Fuji, Toray, Hirano, Kaede, CKD and other companies. The main products include coiling machine and coater.

The products of international merchants are refined and have a high degree of automation, but the price is relatively high, and the applicability of raw materials in China is poor.

| Company Name | Region | Established | Main Products | |

| Foreign brands | Koem | Korea | 1987 | Winding and assembly machines |

| CKD | Japan | 1943 | Winding machine | |

| Kaido | Japan | 1959 | Winding machine | |

| Fuji | Japan | 1951 | Coater | |

| Hirano | Japan | – | Coater | |

| Toray | Japan | 1926 | Coater | |

| Toshiba | Japan | 1875 | Coater | |

| NS slitter | Japan | 1946 | Slitting machine |

In recent years, along with the development of China’s lithium battery industry, its battery test equipment business technology, capital, scale have been able to develop rapidly, has emerged LEAD, Yhwins, Goldenyh, Chr-group, E-nebula, Uwlaser and other companies.

On the whole, most of the best lithium battery equipment products of Chinese manufacturers focus on the middle and posterior process links. The middle battery assembly and welding, the posterior formation, grading, testing and packaging links are arranged by most companies, while the front pole piece manufacturing equipment is rarely involved by companies.

Among battery test equipment manufacturers in China, there are few platform companies capable of supplying equipment in the whole industrial chain. The leading companies in the industry have basically completed the production layout of the whole industrial chain of battery test equipment.

Due to the continuous consolidation of technological advantages, there is still room to improve the concentration of this market in the future.

In the case of unit GWh equipment investment decreasing year by year, the gross profit margin of high-quality battery test equipment manufacturers is still higher and relatively stable compared with downstream battery factories and Oems, which proves that the bargaining power of high-quality equipment manufacturers is improving under the technology iteration and deep binding.

As Japanese and Korean battery leaders Samsung, LG, and Panasonic accelerate production expansion, demand for domestic equipment companies is expected to soar. However, Japanese and Korean equipment enterprises are relatively small in volume, and their self-sufficiency rate and R&D investment are relatively weak, so the capacity bottleneck is very obvious and it is difficult to keep up with the rapid technological iteration speed.

Battery test equipment itself is an automatic equipment in the battery production process, but the equipment itself depends on the assembly of skilled technical workers, so a strong supporting labor force is very important. Chinese equipment is far superior to Japanese and South Korean equipment manufacturers in terms of product price, performance and service consciousness.

It is expected that the penetration rate of Chinese-made equipment in Japanese and South Korean battery companies will gradually increase, and Chinese equipment manufacturers will have a large global market space in the future.