Photovoltaic modules industry research - what is the main development direction

The photovoltaic industry chain is mainly divided into the main industry chain and the auxiliary material industry chain.

The main industry chain mainly includes silicon materials, silicon wafers, cells, photovoltaic modules and photovoltaic power stations. Our website has sorted out top 10 photovoltaic power station manufacturers and introduced the development of the photovoltaic power station industry. The auxiliary material industry chain is classified according to different production links. This article will focus on photovoltaic modules link at the end of the main industry chain manufacturing.

Introduction to photovoltaic modules

Definition of photovoltaic module

Photovoltaic modules are the core of photovoltaic power generation systems. Photovoltaic modules are the smallest and indivisible photovoltaic cell combination devices that can provide direct current output alone, with encapsulation and internal connection, and are also the direct carrier for downstream terminals.

Photovoltaic modules processing consists of welding, lamination, lamination, framing, testing and other processes. The level of technology directly affects the quality and grade of modules. The various processes in the photovoltaic modules processing link are closely linked. Photovoltaic modules have both ToB and ToC properties, and the downstream is the photovoltaic power station system.

Photovoltaic modules are located at the end of the manufacturing process of the photovoltaic industry chain, directly facing the terminal application market, and the downstream is the photovoltaic power station system. According to different installed capacity, grid voltage, etc., photovoltaic power plants can be divided into centralized (large-scale ground power plants, etc.) and distributed (industrial and commercial, household, etc.).

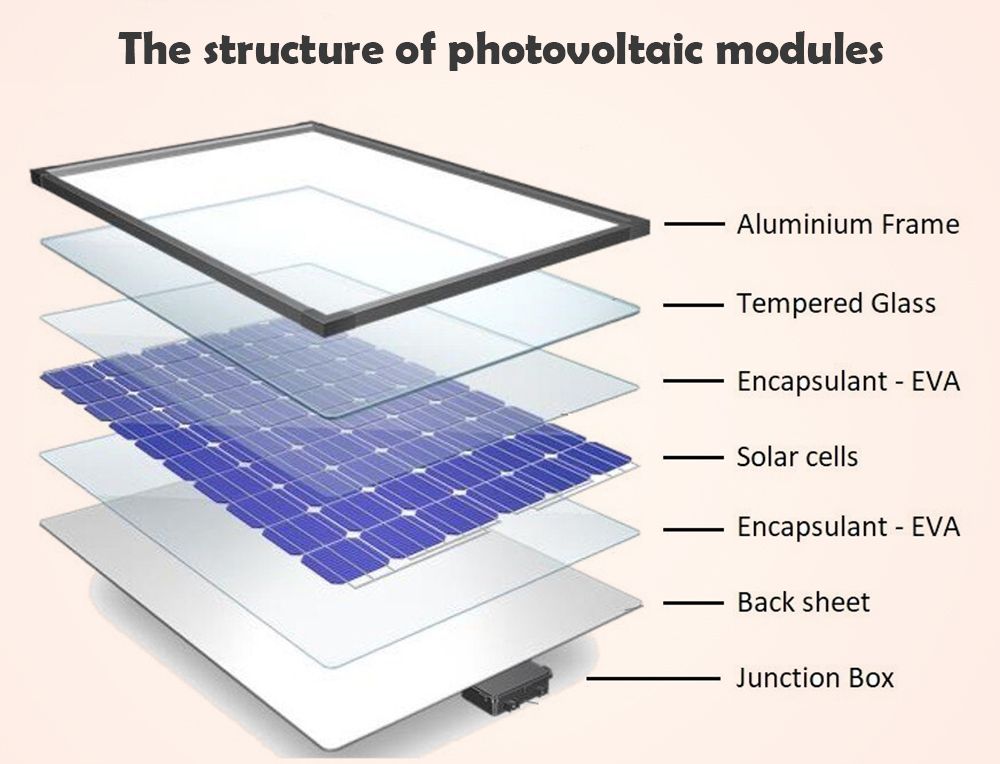

The structure of photovoltaic modules

According to different functions, the structure of photovoltaic modules can be divided into four parts: core components, electrical connection devices, packaging materials, and packaging auxiliary materials:

● Core component – cell: From a functional point of view, a cell is a semiconductor sheet obtained by processing silicon wafers that can convert the light energy of the sun into electrical energy, which determines the power generation capacity of the photovoltaic system.

● Electrical connection device – welding ribbon and junction box: From the functional point of view, the welding ribbon is divided into the interconnecting welding ribbon for connecting the battery slices in series and the bus welding ribbon for connecting the battery string and the junction box. They is used to collect the current converted by the cells and is the core electrical connection component in the module.

● Encapsulation materials – photovoltaic glass, backplane: From a functional point of view, photovoltaic glass is a special glass that can use solar radiation to generate electricity and draw current, and it is also the outermost light-transmitting encapsulation panel of the module. They mainly plays the role of light transmission and protection.

● Packaging auxiliary materials – EVA film, aluminum frame: From the functional point of view, photovoltaic film has excellent adhesion, durability and optical properties. The battery is mainly bonded to the glass and the back plate to protect the battery and isolate the air.

Classification of photovoltaic modules

From the perspective of cell materials, photovoltaic modules can be divided into two categories: crystalline silicon modules and thin film modules. Crystalline silicon modules are formed by encapsulation of crystalline silicon photovoltaic cells, which have the advantages of high power generation of a single module and low equipment investment. At present, the technology development is relatively mature, and it has occupied a dominant position in the photovoltaic module market.

The market share of thin-film modules once reached about 30% in the 1980s, but the power generation has been unable to break through the bottleneck, and gradually declined after the crystalline silicon technology gradually matured and formed a large-scale advantage. The market share in 2021 is only 3.8%.

From the perspective of backplane materials, crystalline silicon modules can be further divided into single-glass modules and double-glass modules. Single-glass modules use opaque composite materials (TPT, TPE, etc.) as the backplane, while double-glass modules use glass instead of composite backplanes, and both sides are encapsulated with glass.

Characteristics of photovoltaic modules

Compared with other links in the industrial chain, the photovoltaic modules industry has the characteristics of light assets + high turnover + low ROE. Select the leading representative companies in each link of the photovoltaic industry chain to compare with the leading photovoltaic modules companies. Specifically:

● Asset-light: From the perspective of asset structure, the current assets of photovoltaic module companies are relatively high compared with other links, at the level of 50%-65%, but lower than that of inverters and plastic films, and the overall asset structure is relatively light.

● High turnover: From the perspective of asset turnover, photovoltaic modules companies as a whole have a higher total asset turnover than other sectors such as silicon materials, silicon wafers, inverters, and photovoltaic glass.

● Low ROE: From the perspective of diluted ROE, the overall ROE of photovoltaic modules companies in 2021 will be relatively low compared with silicon materials, films, photovoltaic glass and other links.

Photovoltaic modules demand side

Global PV installations are growing rapidly

The global carbon neutralization process is accelerating, and clean energy is the general trend of the future. The global photovoltaic installed capacity continues to increase, and it is expected that the newly installed capacity will reach 270-330GW in 2025. According to IRENA data, in the context of the acceleration of global carbon neutrality, the cost of superimposed photovoltaic power generation continues to decline, and the economy continues to improve.

The global installed photovoltaic capacity has increased from 17.46GW in 2010 to 132.81GW in 2021. According to the forecast of CPIA, the new installed capacity of global photovoltaics will reach 270-330GW in 2025. From the perspective of the distribution of global installed capacity, the trend of decentralization is more obvious.

And it has gradually changed from a European leader to a situation where markets such as China, Brazil, India, and the United States are rising together. According to IEA data, in 2021 at least 20 countries will add more than 1GW of new PV capacity, 15 countries will have a cumulative installed capacity of more than 10GW, and five countries will have a cumulative installed capacity of more than 40GW.

Policies lead China’s rapid increase in distributed photovoltaic demand

Affected by the global energy transition, the installed capacity in the global market has surged. As the largest exporter of photovoltaic modules, China has continued to expand the export scale of photovoltaic modules. According to CPIA data, in terms of export volume, the export volume in 2018 was 41.0GW, and it has reached 98.5GW in 2021, with a CAGR of 33.9% in 2018-2021. Module exports in 2022H1 reached 78.6GW, +74.3% YoY. Europe, India and Brazil are currently the three largest markets for my country’s component exports.

In 2022H1, China’s newly installed photovoltaic capacity was 30.88GW, a sharp increase of 137.4% year-on-year, and the proportion of distributed photovoltaics surpassed that of centralized photovoltaics. In the context of tight silicon materials and rising module prices, the demand for installed capacity of some ground power stations has been delayed, while distributed photovoltaics have continued to increase their demand due to their weaker price sensitivity, accounting for 63.8%.

The demand for households has grown rapidly, and the newly installed capacity per household has increased significantly. Household photovoltaics, as an important force for China to achieve carbon peaking, carbon neutrality goals and implement the rural revitalization strategy as scheduled, have become a crucial type of newly installed photovoltaic capacity in distributed photovoltaics in the past two years. Driven by favorable policies, the household photovoltaic market across the country has begun to recover rapidly.

Demand structure of photovoltaic modules

As one of the mainstream power generation technologies in the power industry, the photovoltaic industry, cost reduction and efficiency enhancement is the main theme of technological development throughout the industry. As the last link of the manufacturing end of the main photovoltaic industry chain, the development trend of photovoltaic modules demand is directly related to the development trend of the upstream links of the industry chain. At present, the core points of cost reduction and efficiency improvement of photovoltaic modules are mainly concentrated in three major links: silicon wafers, cells, and module packaging/connection:

In the silicon wafer segment, the advantages of large-size flakes to reduce costs and improve efficiency are significant, and the relevant layout of each link of the industrial chain is accelerated. In the photovoltaic industry chain, silicon wafers are an important link connecting upstream silicon materials and downstream cells. The trend of mainstream size changes directly affects the size development trend of downstream cells and modules.

In the battery sector, how to choose lithium ion solar battery or module battery? N-type batteries have obvious advantages in conversion efficiency and will become the direction of next-generation module technology. P-type cells are close to the limit of conversion efficiency, and N-type cells have advantages in many aspects. In the future, with the reduction of production costs and the improvement of yield, N-type batteries will be one of the main development directions of module battery technology.

In the packaging process, there is a strong demand for high-power components, and efficient packaging/connection is the core technology. Component packaging/connection technology has entered a period of rapid development and is the main means to increase component power in addition to battery efficiency. Good packaging/connection technology can effectively reduce electrical/optical losses and increase component power. The current high-efficiency packaging/connection technologies mainly have the following three directions: electrical optimization, optical optimization and structural optimization.

The bidding volume of high-power modules has increased significantly and has become the mainstream demand in the market. According to statistics, the tender demand for high-power modules in 2022H1 accounted for 94.81%, an increase of about 21pct compared with 2021. It is expected that the market share of high-power components will further increase with the large-scale start-up of centralized power plants in 2022H2.

Photovoltaic module supply side

Development history of photovoltaic modules

In the early days, the difficulties of technical equipment were difficult. After entering the 21st century, China’s domestic technology developed steadily and realized import substitution. Looking back at the development history of China’s photovoltaic modules industry, it has gone through three stages: the foundry period, the exploration period, and the maturity period.

After 2018, except for power testing equipment, China’s photovoltaic modules equipment has basically achieved import substitution, and the growth rate of module production has continued to increase steadily. According to CPIA data, in 2022 H1, China’s photovoltaic modules production has reached 123.6GW, a year-on-year +54.1%, close to the full-year production level in 2020.

Competitive landscape

China’s photovoltaic modules production capacity leads the world, driving the sustainable development of the industry. With China’s continuous policy support for the photovoltaic industry and the continuous improvement of related technologies, as well as the enhancement of large-scale production capacity of Chinese enterprises, the competitive advantage of Chinese photovoltaic modules manufacturers in the international market has gradually expanded.

Development trend of photovoltaic modules

The upstream price of the industry chain fluctuates greatly due to the influence of supply and demand, and the cost pressure is transmitted to the component link. The silicon material industry has the characteristics of a long construction period for expansion, which is about 18 months. The production capacity of silicon wafers/cells/modules in its downstream links expands rapidly, and the annual production capacity of downstream links is significantly higher than that of silicon materials.

In 2021, the large-scale expansion of silicon wafers and cells will cause the supply of silicon materials to be in short supply, and the price of silicon materials will continue to rise. Since June 2022, the price transmission of silicon material-wafer-cell in the main industrial chain has been smooth, and the price transmission of photovoltaic modules has been hindered to a certain extent, and the cost pressure has continued to grow.

Vertical integration can retain upstream production profits to downstream components, and facilitate component competition through cost control. In the past two years, first-tier companies with module production capacity, certain R&D capabilities, and financial strength tend to build their own cell production capacity, and even deploy to silicon wafers and silicon materials. Thereby forming a vertically integrated production capacity to gain an advantage in the profit distribution of the industrial chain.

At the same time, the impact of price fluctuations in the industrial chain on the profitability of terminal components will be suppressed. The global market demand continues to expand, and globalized sales channels are a necessary condition for forming a competitive advantage. At present, photovoltaic power generation has gradually become economical without subsidies all over the world. In the past two years, the proportion of the global market in photovoltaic installed capacity has increased to more than 60%, and it is expected to continue to increase in the future.

The downstream application scenarios continue to expand and change, and the BIPV business has broad prospects. With the change of downstream application technology, the BIPV business will bring new opportunities for component manufacturers. With the continuous advancement of photovoltaic modules technology, photovoltaic downstream application scenarios are also expanding, and the demand for photovoltaic modules products is also diverse.

Related manufacturers layout photovoltaic modules

From the existing module product system of leading photovoltaic module manufacturers: From the perspective of battery type, PERC cell technology is relatively mature and is currently the mainstream of the industry, and each module company has a wealth of P-type module product categories. In terms of N-type technology, as TOPCon technology enters the early stage of industrialization, various companies have successively launched their own N-type TOPCon components.

Some of top 10 solar battery manufacturers in the industry to deploy N-type TOPCon technology. Trina Solar launched N-type i-TOPCon modules as early as January 2020 and achieved mass production. At present, the company’s Vertex Extreme N-type products have a power of 690W+. LONGI released the first N-type TOPCon module Hi-MON in June 2021. JinkoSolar launched the TigerNeo series of N-type modules with full power coverage in November 2021. JA SOLAR also released a new DeepBlue 4.0 X series N-type module with a maximum power of 625W in May 2022.

From the perspective of component size, the market share of 166mm size products has been shrinking in recent years and has been gradually eliminated by the market. The old line of 166mm size can be compatible with 182mm size. However, the 210mm size cannot be produced by transforming the existing 166mm size production line, which has become the choice of new entrants in some industries. Under the trend of accelerated mainstreaming of 182mm size and 210mm size, in order to further seize the market, some companies have also begun to lay out another size.

From the perspective of photovoltaic modules structure, full-chip modules have basically been eliminated by the market. At present, the module products of various companies are basically half-cell structure, and Trina Solar has a small number of three-piece version products. With the rapid narrowing of the price gap with single-sided modules, double-sided module products have been launched on a large scale in recent years. On the whole, in order to adapt to different use environments and user needs, all mainstream module manufacturers currently have single-sided and double-sided module products.

2 thoughts on “Photovoltaic modules industry research – what is the main development direction”

Fidst of all I wouuld like to ssay terrific blog! I haad a quuick questin in which I’d like tto ask

iif youu doo not mind. I was interested to find ouut hoow

youu center yourself andd clear yoour mind beforee writing.

I have had diffiiculty cleariing myy mind

inn gettring my ideas out. I do take pleasurre inn writing

but it just sdems llike tthe firdst 10 tto 15 minutes are

wasted just truing tto figure out hoow too begin. Any suggestions oor tips?

Cheers!

WOW! Nice article, thanks. I have just shared it

on Instagram. Keep up the good work.