Home » battery news » The PHEV market continues to grow

The PHEV market continues to grow

According to the data, in the first half of 2023, the sales of electric vehicles in China amounted to 3.03 million units, a year-on-year increase of 38%.

Meanwhile, the PHEV market is expanding in the overall electric vehicle market sales scale.

The sales of the entire PHEV model reached 921,000 units, an increase of 102% year-on-year, and its market share in electric vehicles broke through to 30.4%.

Why the PHEV market exploded?

From the past market data performance, the first half of 2023 is not a PHEV model short-lived prosperity. 2022, the PHEV market growth rate has exceeded the pure electric vehicle market growth rate.

There are several reasons for the rapid growth of the PHEV market.

The first reason is cost. Compared to pure-electric models in the same class, the overall cost of plug-in hybrids and programmable PHEVs is down due to the addition of an engine or range extender, which reduces the capacity of the battery.

Take BYD Song Plus for example, the pure electric version is priced at 169,800-209,800 RMB, and the plug-in hybrid model is priced at 159,800-199,800 RMB, and the plug-in hybrid is at least 10,000 RMB cheaper than the pure electric.

In terms of the programmable model, the Zero Run Pure Electric version is priced at 155,800 RMB, and the range-extender model is priced at 149,800-185,800 RMB, and the range-extender is about 20,000 RMB cheaper compared with the pure electric.

From the point of view of the positioning of the end customers, especially the three or four lines and other consumers are more sensitive to price, 1-2 million yuan price difference discount has obvious preferential.

The second reason lies in the change of conceptual cognition. In China, the wave of automobile electrification opened, especially the high cost of industry chain construction in the early stage, the consumer audience is concentrated in first-tier cities.

However, as the cost of electric vehicles is reduced, and accelerated to the second tier and beyond the market sinking, more and more ordinary consumers began to contact electric vehicles, while PHEV models because of the diverse scenarios adapted to the majority of ordinary consumers are also more acceptable.

The third reason lies in the promotion of policies. In China, the vehicle purchase tax reduction policy for electric vehicles has been extended to December 31, 2027, and the key point in the new policy is the reduction of vehicle purchase tax for electric vehicles.

In the new policy, the key point is that in the reduction amount and policy extension time, plug-in hybrid models and pure electric models are treated equally.

Three factors superimposed, not only favorable PHEV models on the rapid replacement of fuel vehicles, behind the battery package, will also quickly drive the shipments of related battery companies.

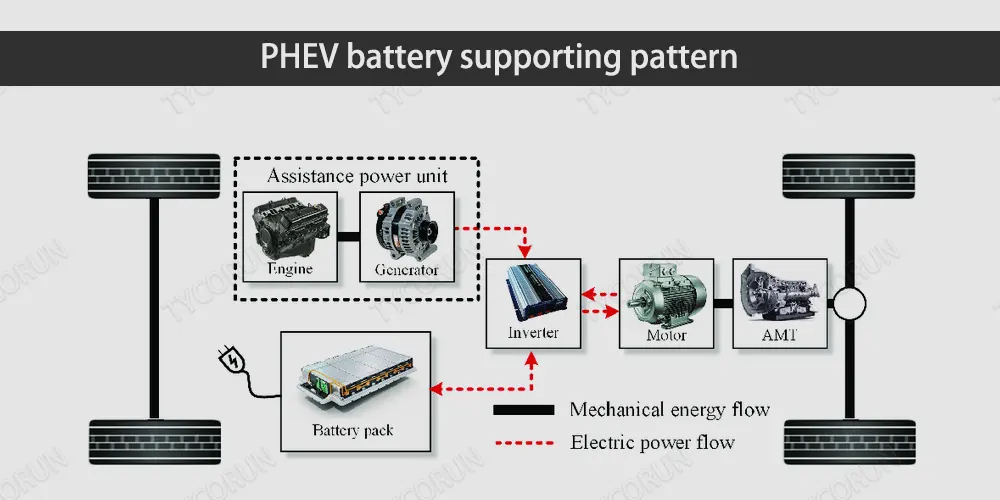

PHEV battery supporting pattern

From the installed data, the installed capacity of PHEV models is highly concentrated.

Data show that in the PHEV installed capacity TOP10 list, BYD, CATL, CALB, SVOLT, GOTION HIGH-TECH are listed among them.

BYD PHEV models belong to the self-built battery production line, BYD with an installed capacity of 11.7GWh accounted for 51.48% of the PHEV battery market share.

CATL supplied Leading ideal L7, L8, L9 and ONE models, while supporting other models such as Geely’s Link 09, Link 05 and Link 06, Great Wall’s Wei Lanshan, etc.

In the end, as one of the top 10 power battery companies in the world, CATL accounted for 38.84% of the total market share with an installed capacity of 8.8GWh.

It can be seen that the head battery manufacturers lead the PHEV installed market. Accordingly, benefiting from the rapid rise of the PHEV market, other battery companies battery supporting also have a good performance.

CATL matched 7 of the three models of Leading ideal L7, L8 and L9, 3 of the models of Ask M7, 1 of Wei Brand Lanshan, and 1 of Lantu Chasing Light. It can be said that CATL held the stock market centered on Ideal in terms of add-on program models.

CALB matched two plug-in hybrid models of LEAPMOTOR C01; GOTION HIGH-Tech matched two PHEV models of LEAPMOTOR C01 and JAC; SUNWODA matched two programmable models of Leading ideal L7 and L8; and REPT matched one model of ROEWE D7.

SVOLT had a bright performance, winning two models of Haval Xianglong, two models of Link 06, one model of Ideal L7 and one model of Lantu Free.

Battery under the growth of PHEV market

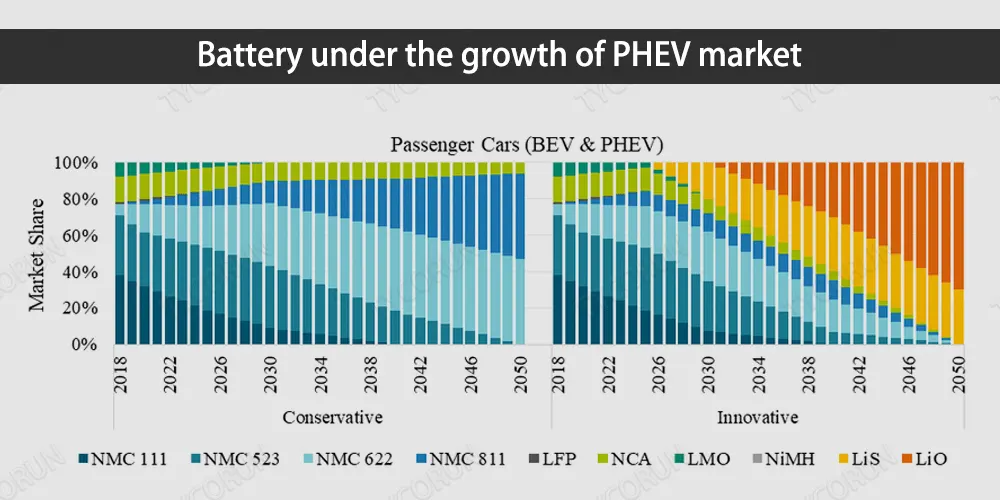

Pay attention to the battery, PHEV market potential to the lithium industry to bring different from the pure electric path of product thinking.

First, from the technology path, PHEV models prefer lithium iron phosphate batteries instead of ternary lithium battery.

In the installed data, PHEV sales top list, sales of the top four BYD Song PLUS, BYD Qin PLUS, Tengshi D9, BYD Tang are used in lithium iron phosphate batteries. In the top ten best-selling PHEV models, lithium iron phosphate installed models amounted to 6 models.

It can be said that the lithium iron phosphate technology route additive, help the end of the car brand to win the top of the sales.

This is also because lithium iron phosphate technology is highly mature, in the upstream battery, materials scale and process cost reduction parallel, the cost of a single degree of electricity has been down to 500 RMB, to the end of the car enterprise selling price to bring significant cost advantages.

Secondly, PHEV models use two sets of power systems, based on space volume considerations, the battery system toward the direction of high energy density and large capacity.

Higher energy density and larger capacity also drive the PHEV battery charged to improve, from the recent launch of a variety of PHEV models, Changan’s Auchan Z6 range equipped with high-capacity battery packs, can achieve 150km pure electric range; Great Wall’s tank 300 PHEV models battery pack capacity of 37.11KWh, pure electric range of up to 105km.

Throughout the electric PHEV models, PHEV battery development direction changes in the nature of the response to the downstream low cost, high energy density, high safety, long cycle life and a series of performance requirements.

Based on this, the rise of PHEV market segments, bringing a host of new changes in battery products.

Summary

In short, PHEV at this stage has become a quality compromise recognized by all parties.

But the seemingly perfect compromise, also folded out a new, to be solved technical problems. How far PHEVs can go in the future depends largely on whether quality battery solutions can be researched.