The role of lithium battery coating materials on batteries

Market overview

The lithium battery coating material is small and firm

The lithium battery coating process can improve the properties of the polyethylene-based film. Coating nano-materials such as ceramics or using organic materials on polyolefin separators makes the coated separators have the advantages of high thermal stability, Related companies Top 5 battery separator companies. low thermal shrinkage, and high wettability with electrolytes, and the lithium battery coating process has been paid more and more attention. lithium battery coating modification attaches the functional coating to the surface of the separator with an adhesive to improve its thermal stability.

For the thermal stability test of boehmite coated on polyethylene film, when the temperature is heated to 170 degrees, the diaphragm has undergone obvious deformation, the lithium battery coating film has almost no shrinkage, and the lithium battery coating process can improve the shortcomings of low melting point and poor safety of the separator.

For the comparison before and after PVDF coating on the polyethylene film, the polyethylene film presents the typical dendritic microporous structure of the wet separator. After the surface is coated with PVDF organic particles, a PVDF coating layer is attached to the polyethylene film to form a A large number of micropores increase the electrolyte retention rate, which is beneficial to the reduction of the internal resistance of the lithium battery and the improvement of the discharge power.

The edge lithium battery coating of the pole piece is of great significance to the safety and yield of the battery. Materials such as boehmite can also be used to coat the pole pieces of lithium battery cells to improve the safety performance and yield of lithium batteries. Taking BYD as an example, its latest blade battery will use boehmite material to coat the edge of the battery cell pole piece. The pole piece lithium battery coating can be applied to the positive and negative electrodes of the battery, respectively:

1) Coating of the edge of the positive pole piece:

Since the positive pole piece is generally smaller than the negative pole piece, the edge of the wide side of the pole piece is prone to burrs during cutting. Once the seperator is pierced and the negative pole is touched, the battery will be short-circuited.

The surface of boehmite is smooth, after coating, it can fill the edge of the positive electrode, making the cut surface smooth and burr-free. In the industry, CATL took the lead in using boehmite for positive edge coating, which has formed a demonstration effect, and has been successfully introduced into downstream battery factories such as BYD and EVE.

2) Edge coating of negative pole piece:

The surface of the negative electrode is rough, and after coating with ultra-small particle size boehmite, the pores of the negative electrode become uniform, which can improve the wettability of the electrolyte and make the lithium ions more smooth during the charging and discharging process. Negative edge coating has not yet become mainstream, and it is currently used in ATL consumer batteries.

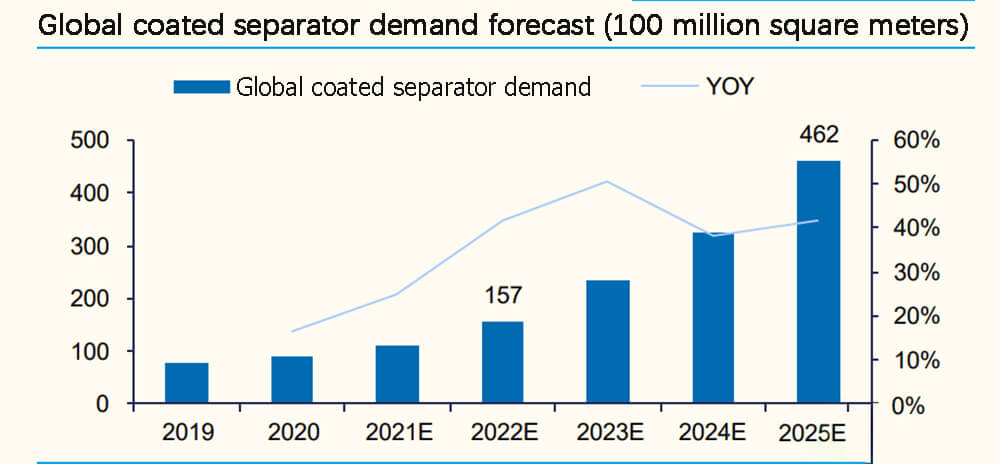

Global coated separator demand forecast

The penetration rate of the coating film of the battery factory is improved

The permeability of lithium battery coating film in battery factory is improved, and water-based lithium battery coating has the advantage of low cost

The lithium battery coating ratio of separator is more than 70%, which has basically penetrated into mainstream battery factories. According to the data, the proportion of coated seperators in China in 2019 was 53%, a rapid increase from 37% in 2015, and it is expected that the proportion has increased to more than 70%.

At present, ternary power batteries have basically all adopted seperator lithium battery coating technology, and the coating ratio of LFP batteries is about 60%, and the application of coating technology is gradually increasing; in the field of consumer batteries, seperator lithium battery coating is mainly used in high-end fields such as 3C batteries . Global mainstream battery companies such as CATL, LG New Energy, Panasonic, BYD, EVE, and China Innovation Aviation have generally adopted separator lithium battery coating technology.

Water-based lithium battery coating has the advantage of low cost and has occupied the mainstream market. The demand for coated separators in downstream battery plants is driven in two ways:

1) Cost-driven: Considering the cost-effectiveness, it is generally used in lithium iron phosphate batteries, small power batteries and energy storage batteries.

Driven by cost, water-based lithium battery coating processes with cost-effective advantages account for about 70% of the lithium battery coating market.

2)Performance-driven: mainly used in high-end ternary or consumer batteries, requiring high energy density per unit area or volume, and the lithium battery coating film can sufficiently ensure battery safety. Generally, oil-based lithium battery coating and oil-water mixed coating are used, which can ensure heat resistance, liquid absorption, air permeability, and thinness of the seperator at the same time, but the price is higher than that of separate water-based coating.

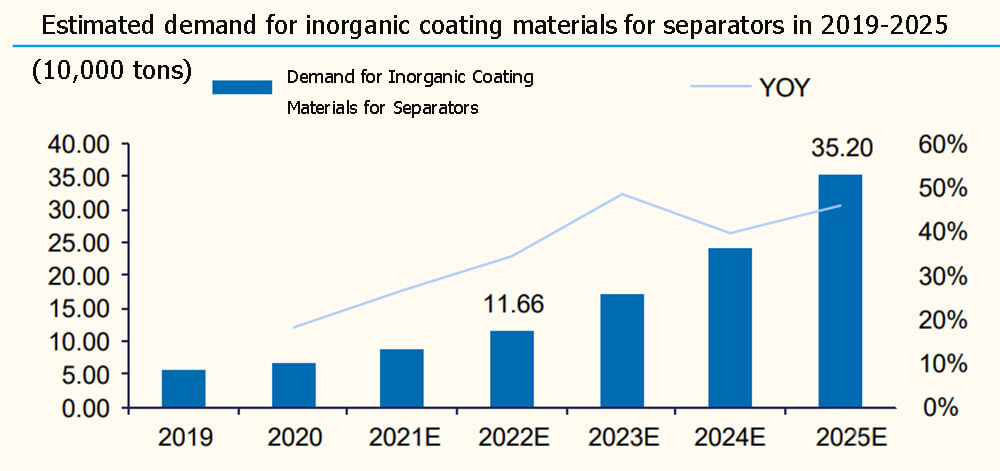

The proportion of inorganic coating material in the coating material is 90.32%. Among the coating materials, the inorganic coating with boehmite and alumina as the main coating materials is more mature than the organic coating and organic-inorganic hybrid coating technology represented by PVDF and aramid. Better tensile strength and thermal shrinkage while lower cost and better economic viability.

In 2019, according to data, China’s lithium battery inorganic coating materials accounted for 90.32% of the coating materials.

The performance of coating type is related to battery safety

A variety of coating structures are available to meet different battery requirements. The current mainstream coating methods in the market include the following six:

1) Single-sided single-layer inorganic coating, the coating process is to coat one side of the seperator with ceramic particles (boehmite, alumina) with a thickness of about 2um, which is currently the mainstream in the market;

2) Double-sided single-layer inorganic coating, the application ratio of coating film in many countries is relatively high;

3) Double-sided single-layer organic & inorganic coating, the choice of organic lithium battery coating materials are PVDF, aramid fiber, PMMA, and the current application ratio is PVDF. Since water can cause damage to almost all cathode materials.

Especially for high-nickel positive electrodes, lithium dissolution is very serious, which will lead to an increase in the pH value of the slurry and a decrease in capacity. When coating, generally, the end of the separator near the positive electrode is coated with organic matter and an oily solvent, and the end of the separator near the negative electrode is coated with inorganic substances. with water-based solvents;

4) Single-layer double-layer organic & inorganic coating. This lithium battery coating process coats a layer of inorganic substances on one side, followed by a layer of organic substances. The advantage of double-layer lithium battery coating is that the lithium battery coating of organic substances on inorganic substances can prevent inorganic substances. material powder falls off;

5) Double-sided double-layer organic & inorganic coating;

6)Double-sided single-layer organic & inorganic mixed coating, the lithium battery coating process mixes ceramic particles in PVDF melt.

Estimated demand for inorganic coating materials for separators in 2019-2025 (10,000 tons)

The key performance indicators of coating materials are closely related to the safety of lithium batteries. In the evaluation criteria of inorganic coating materials, purity, magnetic foreign matter, median particle size, etc. are the core indicators.

Among them, the control of magnetic foreign matter affects the probability of the self-discharge phenomenon of lithium batteries, which is related to the safety performance of the battery, and the median particle size determines the charge and discharge efficiency of the battery.

In the evaluation criteria of organic coating materials, the molecular weight distribution, crystallinity, mechanical properties and magnetic foreign matter content of particles are the core indicators.

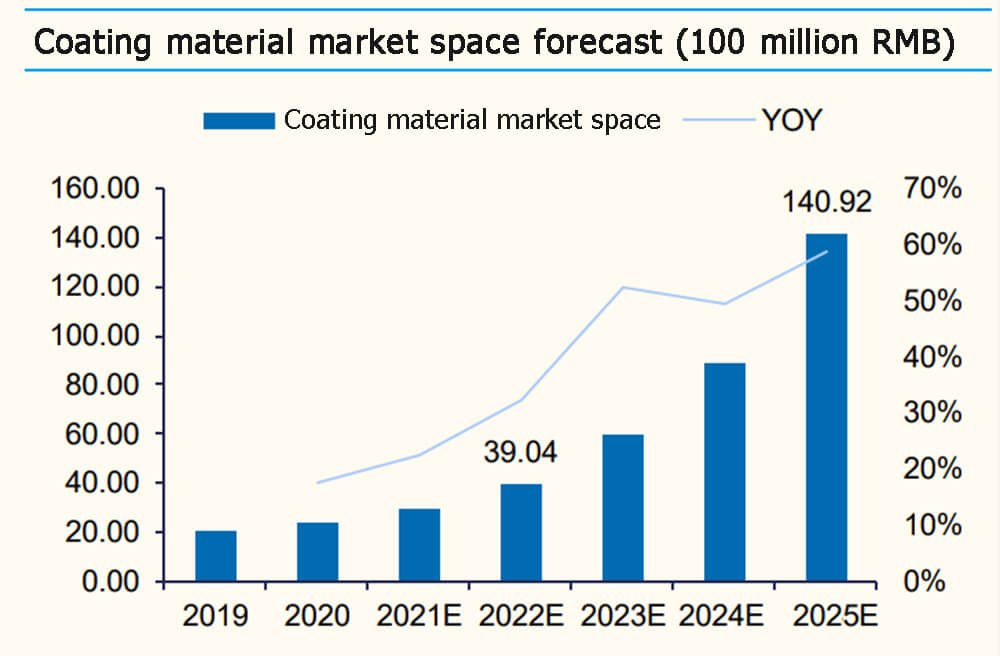

Estimated market space for lthium battery coating materials

The market space of coating materials is expected to exceed 14 billion in 2025. Considering the different proportions of different lithium battery coating structure types in the market, it is assumed that in 2022, double-sided single-layer lithium battery coating (inorganic) / double-sided single-layer or single-sided double-layer lithium battery coating (organic & inorganic) / single-sided single-layer lithium battery coating Layer lithium battery coating (inorganic)/other lithium battery coatings (organic & inorganic) accounted for 9%/19%/67%/5% respectively.

Assuming that the total global demand for lithium batteries in 2022/2023/2024/2025 is 693/1078/1531/2231GWh, under the 70% lithium battery coating film yield rate, the corresponding global demand for coated separators is 157/236/326/46.2 billion square meters, respectively. , the annual compound growth rate is more than 40%, the corresponding demand for inorganic coating materials for seperators is 11.66/17.32/24.17/352,000 tons, and the corresponding demand for organic coating materials for seperators is 1.64/2.62/4.34/7.46 million tons;

Assuming that the single GWh consumption of pole piece edge coating is 50 tons, the pole piece edge coating penetration rate is 51%/58%/67%/77%, and the corresponding pole piece edge coating material requirements are 1.76/3.14/5.12/8.59 tons.

Assuming that the average price of inorganic coating materials is 19,000-20,000 RMB/ton, the average price of organic coating materials is 70-90,000 RMB/ton, and the price of pole piece edge coating materials is 19,000-20,000 RMB/ton.

According to estimates, the market space for coating materials in 2022/2023/2024/2025 will be 39.04/59.52/88.84/1.4092 million tons respectively, with an annual compound growth rate of over 50%.

Coating material market space forecast

Coating material cost analysis 1: The cost of coating materials can be divided into raw material cost and processing cost. Among them: the cost of raw materials includes the purchase cost of coating materials such as boehmite, alumina, PVDF, PMMA, aramid, and additives such as thickeners, dispersants, and adhesives.

Processing costs include labor, energy, and depreciation costs involved in water-based or oil-based processing, depending on the choice of solvent. Separate analysis of raw material cost and processing cost.

Coating material cost analysis II: raw material cost structure analysis. By comparing the raw material cost structure of boehmite, aramid fiber, and PVDF, it is concluded that the cost of boehmite raw materials accounts for the largest proportion of manufacturing costs, and the long-term cost reduction space is better than other materials.

1) Boehmite: Referring to Estone’s 2021 announcement “Reply Opinions of Issuers and Sponsors (2)”, the manufacturing cost of boehmite accounts for 35.6%, and the proportion of raw materials/fuel power is 38.2%/26.2%, respectively. Considering that China’s boehmite manufacturing has just started, the manufacturer’s construction in progress has turned into a large amount, resulting in a substantial increase in depreciation expenses.

In addition, the production efficiency of the new production line has yet to be optimized at the initial stage of production, and the unit cost of the product will rise. We believe that there is a large room for depreciation and labor costs in the boehmite manufacturing costs.

2) Aramid: Referring to the 2020 financial report of Taihe New Materials, the raw material of aramid fiber accounts for 67%, the manufacturing cost/fuel power ratio is 20.3%/12.7%, and the cost of aramid raw material is relatively high. At present, China’s leading company For example, Taihe New Materials reduces the cost of raw materials, labor and energy consumption through self-production of acyl chloride, increasing purchase volume, old production capacity, and reducing investment density; it is expected that the comprehensive cost of aramid materials will continue to decline.

3) PVDF: Referring to the 2021 financial report of HEC, PVDF raw materials account for about 62.9%, and manufacturing costs/combustion power account for 20.3%/20.5%, respectively. In the next 1-2 years, the price of PVDF is expected to remain high, mainly due to the fact that R142b is subject to the national limit, and it is difficult to obtain energy assessment and EIA, and the new production capacity in 22-23 is limited;

At the same time, lithium battery-grade PVDF requires more than 20-30 evaluation indicators, and ordinary PVDF only has about 3-5. According to the listed company, only 30% of PVDF is in line with battery grade. But in the long run, considering that the manufacturing cost of the main PVDF material R142b accounts for more than 47%, and the current PVDF profit margin is above 60% (according to the caliber of 150,000 RMB/ton of seperator coating material), we believe that the long-term PVDF cost will decrease .

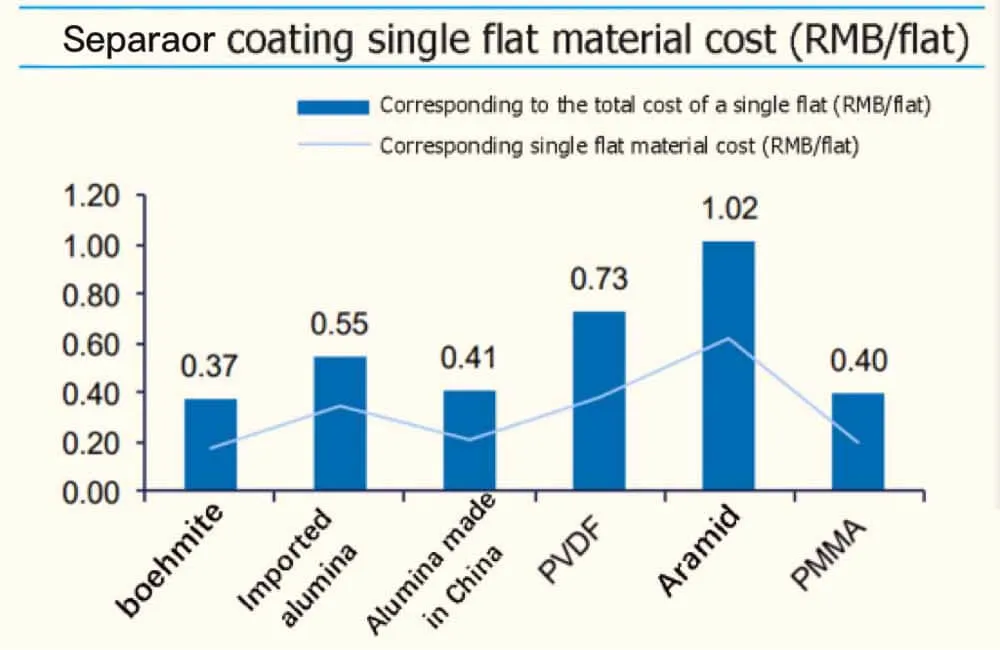

Separator coating single flat material cost

Coating material cost analysis three: processing cost structure analysis. Processing costs include water-based processing costs or oil-based processing costs, depending on the choice of solvent. Water-based processing is less difficult. The lithium battery coating material is mixed with water at room temperature to form a suspension, while oil-based processing requires melting organic matter in a solvent at high temperature, during which the polymer undergoes glass transition to an elastomer, which is no longer available. It is a rigid substance, and the process is more complicated and difficult to control than water-based processing.

Through calculation, the processing cost of water-based lithium battery coating is about 0.2 RMB/sq.m., of which labor/energy consumption/depreciation accounts for 40%/40%/20%, respectively, and there is little difference between lithium battery coating materials. We focus on analyzing the processing cost of oil-based lithium battery coating. The processing cost of PVDF lithium battery coating is about 0.35 RMB/sq.m, and the processing cost of aramid fiber coating is about 0.4 RMB/sq. The difference between the two is mainly reflected in the higher labor cost of aramid fiber (0.28 RMB/ flat), accounting for 70% of the total processing cost, PVDF labor cost is about 0.2 RMB/ flat, accounting for 57%.

At present, China’s aramid coating has not been mass-produced, and the lithium battery coating process has been monopolized by other companies for many years. China’s aramid coating has higher requirements on workers’ skills and experience, and the corresponding labor costs are relatively high; with the accelerated development of aramid Chinese production, we It is believed that the proportion of labor costs will decrease, which is expected to improve the overall cost of products.

Coating material cost summary: Optimistic about the long-term cost advantage of boehmite. According to the above analysis, the processing cost of water-based solvents with boehmite is lower (0.2 RMB/sq.m, and the processing cost of oil-based solvents is 0.35-0.4 RMB/sq. Consumption costs account for more than 60% of raw material costs), we believe that the low-cost advantage of boehmite will remain in the medium and long term.

Aramid coating currently accounts for a large proportion of raw material costs and labor costs (56%, 29%). We believe that with the continuous advancement of Chinese production, this cost will continue to improve. In addition, the solvent contained in the aramid fiber solution provided by the aramid fiber factory to the lithium battery coating factory is expensive for the environmental protection treatment of the downstream seperator factory. At present, Taihe New Materials has the intention to cooperate with the seperator factory on solvent treatment. For the delivery of aramid materials, such costs are expected to improve, and the cost performance of aramid fibers will gradually be reflected, enhancing the price competitiveness of products.

Inorganic coating market

Inorganic coating has many benefits

In inorganic coating materials, the application ratio of alumina & boehmite is high. Inorganic lithium battery coating is more mature than organic coating and organic-inorganic hybrid coating technology, and the tensile strength and thermal shrinkage rate of inorganic coated separators are better, and the cost is lower, and the economic feasibility is better.

Inorganic lithium battery coating materials can improve the insulation of the separator, reduce the short-circuit rate of lithium batteries, and at the same time improve the yield and safety, and occupy a dominant position in various coating materials.

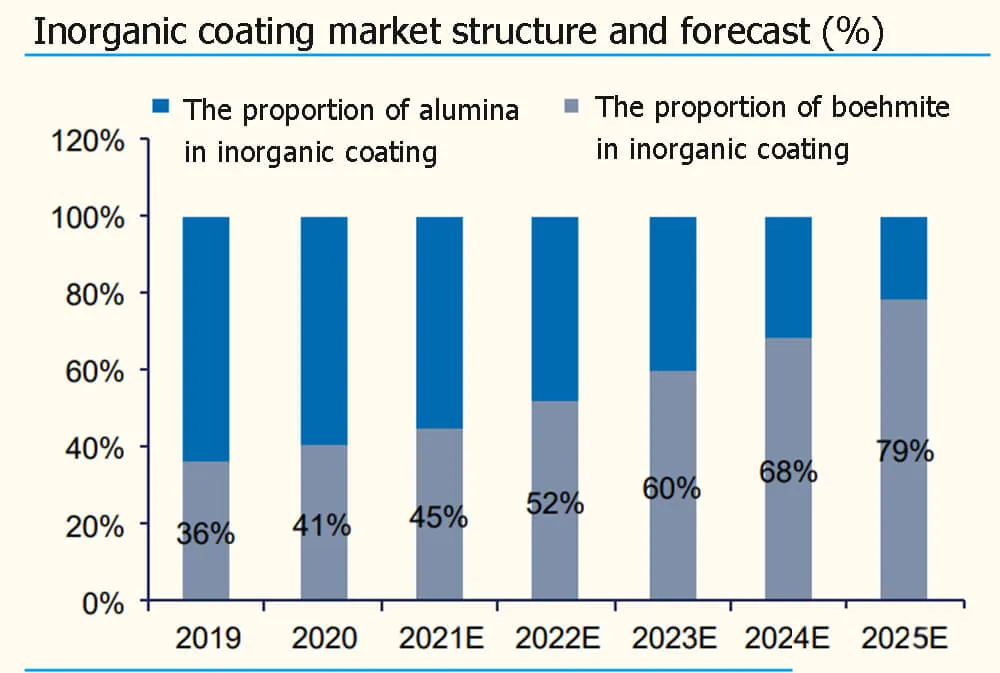

Among inorganic coating materials, boehmite and alumina occupy the main market, and the share of boehmite has been increasing in recent years. At the same time, some downstream battery factories are doing raw material change certification with car companies, and use boehmite as a lithium battery coating to replace alumina;

In 2020, boehmite accounted for about 41% of the inorganic coating market, and we expect the boehmite share to increase to 52%/60%/79% in 2022/2023/2025.

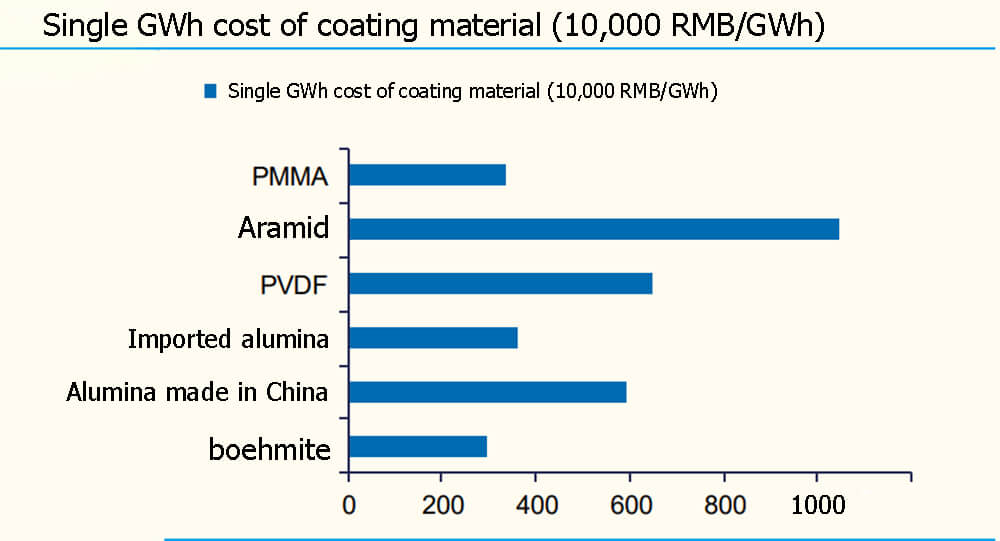

Single GWh cost of coating material

Boehmite has excellent cost performance and can replace alumina

Boehmite has absolute advantages over alumina in performance indicators. As a ceramic coating material, alumina can significantly improve the comprehensive performance of polyolefin separators, but alumina has problems such as high hardness, high cost, and serious wear on equipment, which affects its use as a ceramic coating material in batteries to a certain extent. seperator applications.

As a new ceramic coating material, boehmite has the characteristics of low hardness, low cost, and less water-soluble sodium ions, which can make up for the shortcomings of alumina as a coating material for polyolefin separators.

1) Areal density: The areal density of alumina is 3.9g/m2, and that of boehmite is only 3.05g/m2. The application of boehmite will significantly reduce the total weight of the ceramic coating and the manufacturing cost of lithium batteries.

2) Specific surface area & water-soluble Na+: The specific surface area of boehmite is 5m2/g, which is lower than 6.3m2/g of alumina, and the content of water-soluble Na+ of boehmite (0.002%) is significantly lower than that of alumina (0.036 %), which can reduce the absorption of water and have a positive impact on the improvement of the electrochemical performance of lithium batteries.

3)Mohs hardness: The Mohs hardness of alumina is 9, which is 3 times that of boehmite. Boehmite can reduce the impact of ceramic coating materials on lithium battery coating equipment, thereby reducing equipment loss costs.

The boehmite coating film has more excellent mechanical properties. The lithium battery separator needs to have a certain mechanical strength to prevent safety problems caused by the failure of the separator. The polyethylene separator coated with boehmite has higher tensile strength and better fracture than the polyethylene separator coated with alumina. elongation properties.

In addition, the separator coated with boehmite also has better puncture strength and peel strength. In conclusion, compared with alumina, boehmite has better mechanical properties.

The virgin polyethylene seperator undergoes significant heat shrinkage at 130 degrees, and the coated seperator retains its original state without deformation. When the temperature was raised to 170°C, the alumina-coated separator also shrunk greatly, while the boehmite-coated separator hardly changed in size.

Boehmite has more excellent thermal stability, mainly because the boehmite ion coating and the matrix separator have better interfacial bonding force, so that the boehmite coating acts as a supporting framework to resist the melting shrinkage of the polyethylene film at high temperature .

The boehmite-coated membrane has better electrolyte lyophilicity. In lithium batteries, the electrolyte is the carrier for lithium ions to migrate before the positive and negative electrodes. The electrolyte is mainly stored in the micropores of the seperator. The amount of electrolyte that can be stored by the micropores of the seperator is called the liquid absorption rate of the seperator.

The PE base film coated with aluminum compound showed better affinity with the electrolyte. Compared with alumina, the liquid absorption rate of the boehmite-coated separator was higher, reaching 187%, while the PE base film and alumina The liquid absorption rates of the coating films were 126% and 144%, respectively. In the hydrophilic contact angle test, the PE separator has poor affinity with water, and the contact angle is greater than 177 degrees. Better performance.

Inorganic coating market structure and forecast

Boehmite is a more cost-effective alternative to alumina. Water-based slurry is used for inorganic materials, and its cost can be roughly divided into slurry cost + manufacturing cost, where slurry includes ceramic material, water, binder, dispersant, and thickener; manufacturing cost includes labor, energy consumption, depreciation .

According to estimates, the cost of ceramics, labor, energy consumption and depreciation accounts for a large proportion of the cost of single-level ceramic coating materials, accounting for about 45%, 18%, 18%, and 9% respectively.

At the current price, the unit costs of boehmite and alumina are not much different: according to the unit prices of boehmite, imported alumina, and Chinese alumina are 2.0, 3.5, and 19,000 RMB / ton, respectively, the unit cost per flat is 0.37, 0.55, 0.41 RMB/sq.

Among them, the material cost per flat is 0.17, 0.35 and 0.21 RMB/sqm respectively, and the manufacturing cost is about 0.20 RMB/sq.m., including processing, equipment depreciation and other expenses.

Considering that the advantages of boehmite in performance indicators are stronger than that of alumina, and the cost difference between the two is small, we believe that boehmite has a higher comprehensive cost-effectiveness and is a substitute for alumina.

The effective production capacity of boehmite is limited

The effective production capacity of boehmite is limited, and the market is slightly in short supply.

The manufacturing process of boehmite is complex, and there are only a handful of companies that master the core process. Not all boehmite can be used as battery separator. The real boehmite is pure γ-phase, with irregular crystallization and uniform particle size distribution, which can obtain ideal ceramic coating.

The manufacturing process of γ-boehmite is complex and difficult, requiring precise control of the process parameters of the production process, reducing the introduction of magnetic foreign matter, and in-depth understanding of the raw material feeding amount, reaction parameters, reaction temperature, reaction flow and other processes, and the technology is currently mastered worldwide. few companies.

According to the data, there are currently more than 20 boehmite manufacturers in China, and only a few companies such as Anhui Yishitong Material Technology Co., Ltd. and China Aluminum Zhengzhou Nonferrous Metals Research Institute Co., Ltd. have been able to industrialize application Boehmite products for lithium battery ceramic separators.

The release of effective production capacity is less, and the supply and demand of boehmite are tightening. According to our calculations, the boehmite supply and demand gap (supply-demand) in 2021/2022/2023 is -0.25/-0.18/0.29 million tons, and the global supply only slightly exceeds the demand;

The single-quarter supply-demand gap in 2022 Q1/Q2/Q3/Q4 will be -0.02/-0.03/-0.05/-0.08 million tons, respectively, because most of the global effective supply in 2022 will come from E-Stone, and E-Stone’s production capacity release will be concentrated. In the second half of the year, we expect boehmite to be in short supply.

Estimated market space for boehmite

In 2025, the boehmite market space will exceed 6.6 billion, with a compound annual growth rate of 60%. The specific calculation process is as follows:

Assumptions 1) The permeability of boehmite in inorganic coating materials in 2022/2023/2024/2025 is 52%/60%/68%/79%, respectively; 2) The permeability of boehmite in the edge coating material of positive pole piece It is 100% (boehmite coating on the positive electrode began in the Ningde era. Before that, the positive electrode plate was not coated. At present, according to feedback from the industry chain, the positive electrode coating is 100% boehmite); the coating on the edge of the negative electrode is not large-scale. Regardless of its market share.

It is estimated that: in 2022/2023/2024/2025, the global demand for boehmite for lithium battery coating materials (including separator coating + pole piece coating) is expected to be 7.33/12.67/20.46/34.39 million tons; 2022/2023/2024 / In 2025, the boehmite market space is expected to reach RMB 14.67/25.10/40.13/6.676 billion, with a compound annual growth rate of over 60%.

Global Boehmite Supply and Estone Shipment Estimate.

Single-sided inorganic coating conforms to the mainstream market demand, and boehmite is the most flexible in demand.

With the increase of energy density requirements of lithium batteries, the thickness of the separator tends to be thinner and thinner. The single-sided inorganic coating can not only meet the requirements of the thin coating film but also ensure the safety performance of the battery. At the same time, the coating cost is the lowest, which is in line with the lithium battery industry chain. cost reduction needs;

According to estimates, the market share of single-sided inorganic coating is expected to be over 60%. Considering that boehmite has obvious advantages over alumina in terms of performance indicators and cost performance, it will replace alumina. We believe that boehmite is the most flexible coating material in lithium battery coating materials in the future, and the growth rate is expected to increase. above 60%.

High-concentration slurry is expected to be introduced into the market

The integration of boehmite powder and slurry is the future development trend. In 2016, Estone took the initiative to promote the slurry solution to customers. Due to the strict requirements of the battery cell for the manufacturing process, customers hope to purchase powder by themselves to master more production links for slurry preparation and accumulate knowledge in the lithium battery coating process. -how.

In recent years, boehmite powder has developed to the current level of 10,000 tons, and its application has continued to be stable. Downstream customers have proposed that boehmite suppliers directly provide high-concentration slurry to reduce powder packaging and mixing processes. Process links to reduce costs.

Slurry integration barriers are higher. The integration of boehmite slurry requires that the content of magnetic foreign matter in the slurry reach the same level as that of the powder. At the same time, the integration system directly grows boehmite crystals in the liquid. The process control of the transformation and morphology of boehmite requires a long period of time. accumulated experience.

In addition, due to the different solid content of boehmite slurry required by different downstream customers, it is necessary to match different lithium battery coating processes, which is higher than the direct supply of boehmite powder.

Slurry integration reduces costs and improves efficiency, saving energy redundancy in the industrial chain. Slurry integration can improve the manufacturing cost of boehmite producers, and there is no need to re-dry the liquid boehmite slurry into boehmite powder during the process, which saves a lot of energy consumption.

In addition, since the products sold by the integrated slurry are liquid, it can save external packaging materials such as plastic bags, trays, etc., and at the same time avoid the costs of manual handling, dismantling and cleaning of packaging materials for downstream customers. According to Estone, the launch of boehmite slurry In order to save industry chain costs and enhance product competitiveness, we expect downstream customers to fully benefit from the launch of slurry integration, and the penetration rate of slurry will continue to increase.

Estone

The world’s leading boehmite enterprise, deeply bound to CATL.

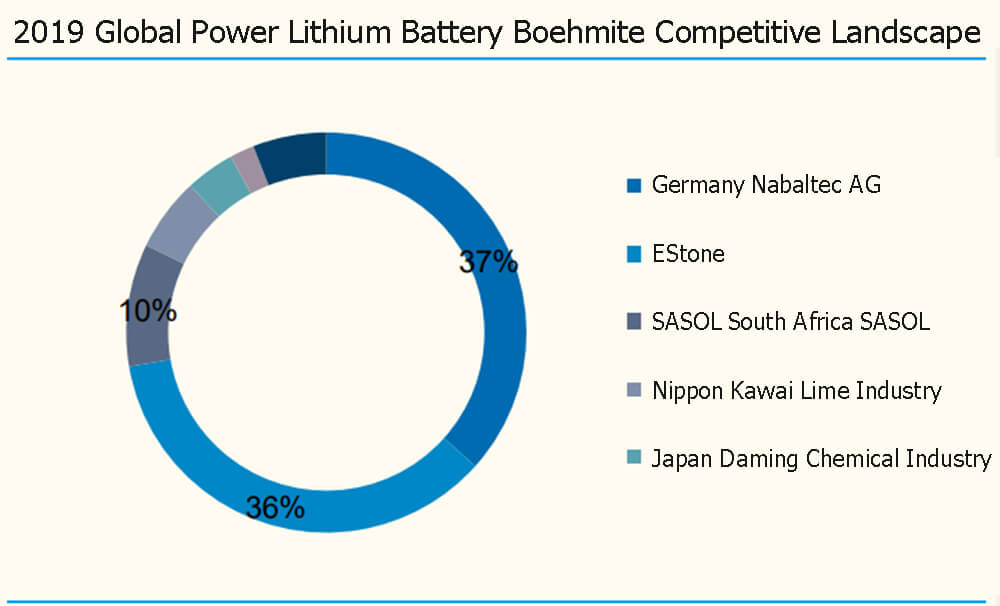

The share of boehmite is the first, surpassing the former global leader. In 2019, Estone and Germany’s Nabaltec AG have a combined market share of over 70%, accounting for 36%/37% respectively; in 2021, Estone will become the world’s leading boehmite.

Global Power Lithium Battery Boehmite Competitive Landscape

1) Estone: According to data, in 2021, the company’s global share of boehmite will exceed 50%, ranking first in the world. The products are mainly used in power lithium batteries.

2) Germany Nabaltec AG: The company was established in 1994, and its main products are aluminum hydroxide and alumina. In 2019, its global share was 37% (36% for Estone), making it the leading boehmite in the past.

3) Chinalco Zhengzhou Research Institute: The company is a major boehmite manufacturer in China. Its products are mainly used in the field of catalysts and flame retardants, and a small amount is used in the coating of power lithium battery separators; in 2018, the company’s boehmite share was 5% , fell slightly to 2% in 2019.

The core layout is boehmite, and the revenue and profit grow steadily. Estone’s main business includes lithium battery coating material, electronic communication functional filling materials, low-smoke halogen-free flame retardant materials, and its revenue in 2021 will account for 78.27%/15.71%/6.02%, respectively, of which lithium battery coating materials are mainly Mu Stone.

The gross profit margin of Estone’s lithium battery coating products in 2021 is 42.67%. According to Estone’s prospectus, in the first half of 2021, the company’s net profit increased significantly and the growth rate was greater than the increase in operating income, mainly because the company’s production and sales scale increased and the scale effect further appeared. In addition, the company continued to promote cost reduction management, and the comprehensive gross profit margin increased compared with the same period of the previous year. It is expected that the gross profit margin is expected to continue to improve as the company’s product scale steadily increases.

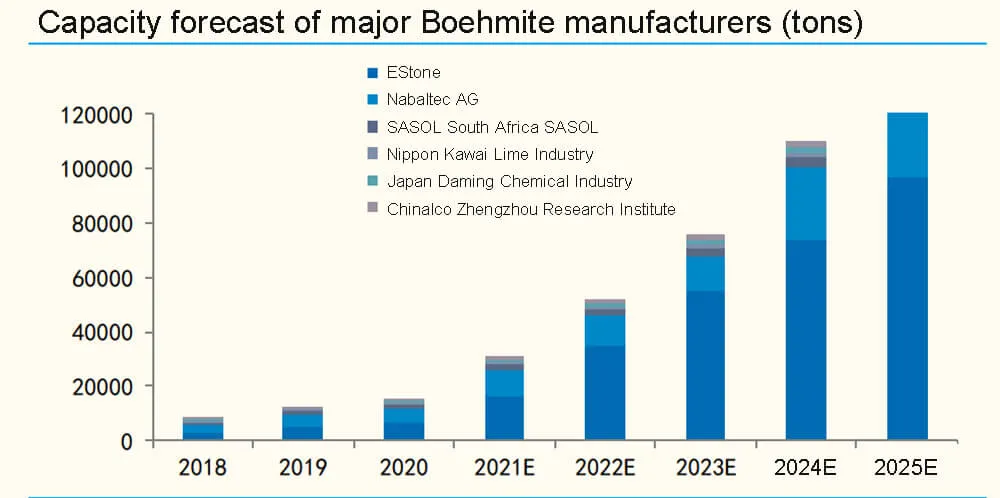

Estone’s boehmite production capacity is expected to reach 50,000-60,000 tons by the end of 2022. In 2018/2019/2020, the company’s lithium battery coating (mainly boehmite) production capacity is 2973/4121/8149 tons; in 2021, the company’s production capacity is nearly 20,000 tons, and it is expected that the production capacity will reach 50,000-60,000 tons by the end of 2022.

Estone still has an active plan to expand boehmite production in 2023. We estimate that the boehmite production capacity in 23/24 will be 100,000/140,000 tons respectively, far ahead of other boehmite producers in the world.

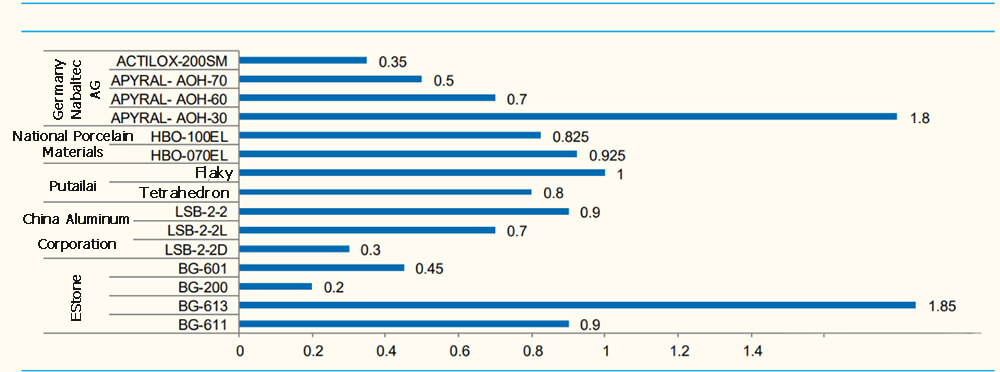

Estone boehmite has outstanding performance in technical indicators. Compared with the APYRAL series boehmite products of Nabaltec, Germany, and the HBO boehmite products of Chinalco Zhengzhou Research Institute, Yistone BG series boehmite products are more prominent in technical indicators.

According to Estone’s prospectus, the company’s boehmite products can achieve a level of <5 pieces/kg of magnetic foreign matter, which is generally recognized by high-quality customers in the industry. CATL commented on it, “Estone’s magnetic foreign matter is well controlled. Boehmite can achieve a single-digit level, and Estone’s magnetic foreign object control technology is an international leader.”

Capacity forecast of major boehmite manufacturers

Estone is the core supplier of boehmite in CATL. Estone is the core supplier of boehmite products in CATL. In 2019, CATL accounted for 42.45% of the final downstream customer revenue of Estone’s lithium battery coating materials.

In addition, the company has entered the supplier system of many leading lithium battery manufacturers such as New Energy Technology (ATL), Guoxuan Hi-Tech, Tianjin Lishen, Xinwangda, etc. The company cooperates with lithium battery separator manufacturers such as Putailai, Xingyuan Materials , Enjie shares, etc. have established long-term cooperative relations.

In the international market, customers from other countries such as Samsung SDI and W-Scope have made it clear that they will increase the purchase of Estone’s boehmite. In addition, Estone is also connecting with customers such as South Korea’s SKI.

Deploy core patents and build a craft moat. Estone has a number of patents related to boehmite manufacturing, involving powder particle size control, morphology control, alumina softening, magnetic foreign matter detection, ultra-fine ion cleaning technology, ultra-fine powder surface nano-coating technology, fluidized bed airflow Grinding iron-free crushing technology, etc.

As of December 31, 2020, the company has obtained the preparation technology of boehmite, the preparation technology of Low-a high-purity alumina for memory packaging, the preparation technology of Low-a high-purity alumina, the fluidized bed jet mill iron-free pulverization technology, the light 11 invention patents and 9 other utility model patents, including the preparation technology of spherical silica and the water bath-hydrothermal linkage synthesis of ultrafine flower-shaped calcium borate flame retardants.

At the same time, because the company has a lot of technical know-how about materials, such technical know-how is not suitable for patent application in a short period of time.

Organic coating market

The price of PVDF is high, and the replacement logic is clear

Iteratively high battery energy density leads to the demand for organic coating

Battery energy density iteratively drives organic coating demand. The choice of lithium battery coating is a comprehensive choice between firmness & breathability, heat resistance & liquid absorption:

1) Firmness vs. Air permeability: Ceramic inorganic substances have good air permeability, but they do not have adhesive properties. Glue is needed to stick the inorganic substances on the seperator. If the product quality is not good, powder removal may occur, resulting in uneven lithium battery coating, causing a safety hazard in the battery.

Organic substances are soft and have good adhesion. PMMA, PVDF, etc. themselves are glues, which can effectively solve the problem of firmness, but the corresponding air permeability is poor, so the method of mixing with inorganic substances is generally adopted, taking into account the firmness and air permeability.

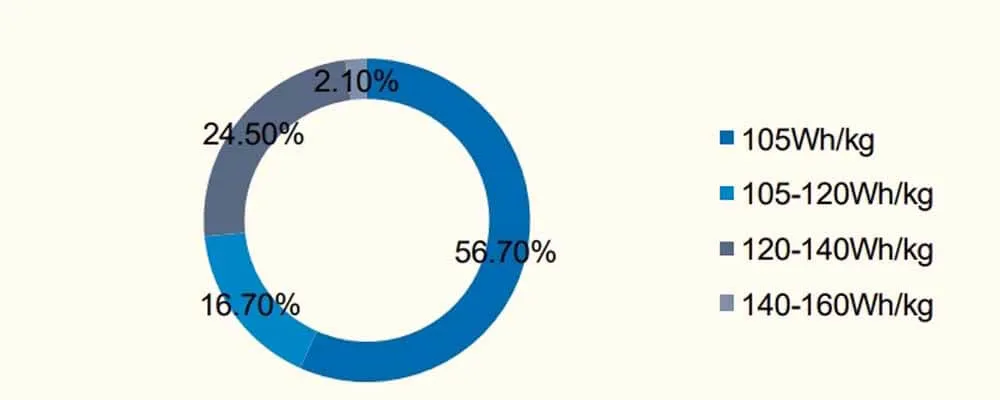

Energy density distribution of battery systems in 2019

2) Heat resistance vs liquid absorption: The heat resistance of ceramic inorganic substances is higher than that of organic substances, but their liquid absorption performance is weaker than that of organic substances, and organic substances have excellent electrolyte compatibility. Have

The organic matter is melted in the oily solvent, and the lithium battery coating can be as thin as about 1µm. At the same time, the organic matter has good electrolyte compatibility and improves the battery energy density. With the ternary, high nickel and other high-end battery production capacity that pursues high energy density Further release, we expect the demand for organic lithium battery coating materials to continue to grow.

Organics have limitations in high temperature resistance and mechanical strength. The thermal stability of the separator is not significantly improved by lithium battery coating the organic matter alone, and the safety of the battery cannot be well guaranteed. Generally, the organic matter and the inorganic matter are mixed and coated, or combined with the inorganic material lithium battery coating.

Compared with PE-based membranes and alumina/boehmite-coated membranes, the PVDF-coated membranes have lower contact angles and show better electrolyte affinity. Meanwhile, the PVDF-coated membranes have a porosity of 61.4%. , better than inorganic coating membrane, mainly PVDF organic coating can provide additional pore channels for electrolyte, which can significantly improve the liquid absorption rate of separator.

In addition, the interconnected and porous surface morphology of the PVDF coating improved the ionic conductivity of the coated membrane, which was higher than that of the inorganic coating. The single PVDF coating film also has shortcomings, its tensile strength and elongation at break are not as good as those of the ceramic coating film, mainly because the mechanical strength of the organic polymer is affected by the crystallinity, and the semi-crystalline (55.93%) nature of PVDF leads to Its tensile strength cannot be significantly improved.

Complementary functions can be formed by the combined lithium battery coating of organic and inorganic materials. Organic materials lithium battery coating include PVDF, PMMA, aramid, etc., which have high adhesion, liquid absorption and liquid retention capabilities, and can effectively reduce the internal resistance of the separator and improve the electrochemical performance.

Due to the limitations of PVDF and PMMA, such as their own heat resistance and air permeability, organic substances are generally combined with inorganic substances. Common combinations include double-sided multi-layer coating, single-sided multi-layer coating, and single-sided mixed coating.

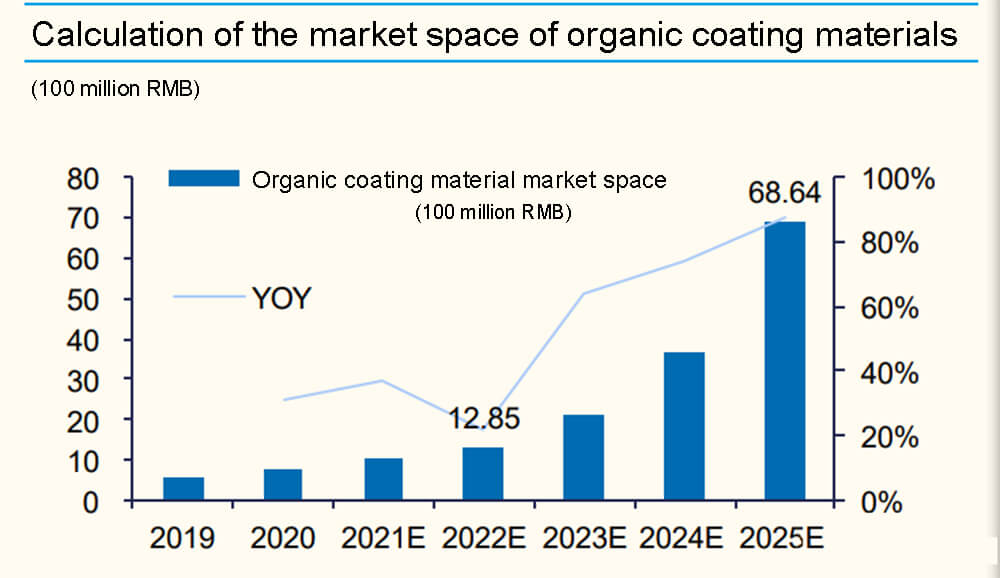

Market space calculation of organic coating materials

The market space for organic lithium battery coating material is expected to be nearly 7 billion in 2025. Considering the substitution relationship between aramid and PVDF in organic materials, it is assumed that:

1) In 2022/2023/2024/2025, the application proportion of PVDF in organic coating will be 57%/52%/48%/44%, and the proportion of PMMA will be 36%/37%/37%/35% respectively , the proportion of aramid fiber is 7%/10%/15%/21% respectively;

The reason is that considering the high price of PVDF, PMMA will replace PVDF in the short term, but due to the poor physical properties of PMMA itself, its share is expected to decline later; Pulling down, it is expected that the share of aramid will increase for a long time;

2)The average price of organic material lithium battery coating is 7.46/7.24/7.24/7.49 respectively, and the price is the price-weighted average of PVDF, aramid and PMMA. We estimate that in 2022/2023/2024/2025, the global market space for organic lithium battery coating materials will be 12.85/21.05/3.662/6.864 billion, respectively, with a compound annual growth rate of over 60%.

Calculation of the market space of organic coating materials

PVDF prices remain high

PVDF prices remain high, aramid & PMMA form an alternative

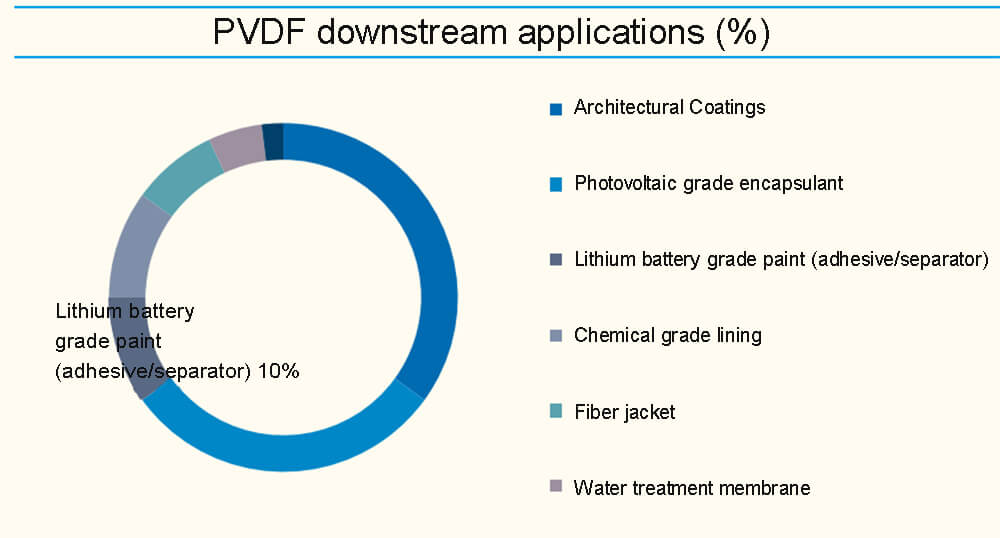

PVDF&PMMA are the current mainstream organic materials lithium battery coating . At present, PVDF and PMMA occupy the main organic lithium battery coating material market, which is expected to account for about 62%/33% respectively, and aramid fiber accounts for about 5%.

Considering that the market price of PVDF will further rise, and the various properties of aramid materials show obvious advantages, and PMMA shows obvious cost performance, it is expected that the proportion of PVDF will continue to decline;

With the further breakthrough in the production process of aramid materials in China, some manufacturers in China have achieved large-scale mass production. We expect that the market share of aramid materials will continue to rise; due to the poor heat resistance of PMMA due to its physical properties, we expect In the short term, PMMA will replace part of the amount of PVDF, but its long-term application in separator coating is limited.

The price of PVDF remains high, and the replacement logic of aramid & PMMA is clear. PVDF is a traditional organic lithium battery coating material with low internal resistance, high (thickness/porosity) uniformity, good mechanical properties, and good chemical and electrochemical properties.

Driven by the dual demand for downstream lithium batteries and photovoltaics, coupled with the dual control policy restrictions, the supply gap of PVDF has continued to expand since 20q4, and product prices have continued to rise.

According to information, the current price of battery-grade PVDF has risen from the previous 90,000 RMB/ton to about 400,000 RMB/ton, of which the price of seperator-coated PVDF is 100,000-200,000 RMB/ton. We believe that the mid-term price of battery-grade PVDF will not see a downward trend. Compared with materials such as aramid and PMMA, they will lose their cost-effectiveness and will be replaced in the future.

Aramid is currently the only organic material that can be individually coated. Due to the good consistency and no particles of aramid, the lithium battery coating is very thin between 1μm-2μm, while PVDF mixed lithium battery coating is usually above 2μm (PVDF+ceramic), the lightness of aramid is currently not available in other materials.

In addition, according to reports, the heat-resistant temperature of aramid fiber reaches 400 degrees, and the heat shrinkage is less than 5% at 180 degrees. It is not flammable and explosive, and meets the needs of high-end batteries. It is currently the only lithium battery coating that can maintain high performance without inorganic materials. of organic materials.

Under the trend of PVDF price increase, the cost performance of aramid fiber is prominent. Aramid as a lithium battery coating outperforms PVDF. Aramid fiber has a low weight, and the density is only about 1.44g/cm3, the lithium battery coating can be very thin;

At the same time, due to the limitation of heat resistance, PVDF/PMMA needs to be coated with inorganic substances. The lithium battery coating thickness is above 2mu, and the thermal resistance of aramid fiber is 400 degrees. The safety performance of the battery can be guaranteed by lithium battery coating alone. Therefore, the lithium battery coating thickness is It can be controlled at about 1um-2um.

According to PVDF/aramid fiber: 1. The price per ton is 100,000 RMB/200,000 RMB respectively; 2. The lithium battery coating thickness is 1.5um/1.5um respectively, the cost of PVDF/aramid fiber per flat is 0.73/1.02RMB/ flat. According to the sensitivity test results, when the price of seperator grade PVDF rises to 200,000 RMB/ton, the cost of maintaining the current lithium battery coating thickness will exceed that of aramid.

PVDF downstream applications

Taihe New Materials

The Chinese-made aramid fiber replaces the leader, and double barriers build an industrial moat. The global aramid industry has a market capacity of more than 120,000 tons, of which both meta-aramid and para-aramid can be used in lithium battery separators. According to Taihe New Materials, the substitution of meta-aramid fibers in China has been basically completed, and para-aramid fibers are in progress.

Taihe New Materials is one of the three largest aramid fiber manufacturers in the world. It took the lead in realizing the industrialization of meta-aramid fiber and para-aramid fiber in China. The current production capacity is 7,000 tons and 4,500 tons respectively. It has the largest output and has long been a leader in China.

Aramid has high barriers:

1. Technical barriers: long R&D cycle, high production process requirements, and large investment amount;

2. Market barriers: long certification cycle, long promotion cycle and long profit cycle. Taihe New Materials realized the pilot test of aramid fiber in 2008, completed its industrialization in 2011, and achieved profitability in 2017.

The main business structure is pure and the profitability has improved significantly. Taihe New Materials specializes in the R&D, production and sales of high-performance fibers such as spandex and aramid. The leading products are Newstar spandex, Taimeda meta-aramid, Taipron para-aramid and its upstream and downstream products;

In 1H21, the company’s spandex/aramid fiber accounted for 63%/36%, respectively. In the first half of 2021, the company’s aramid fiber product revenue was 767 million RMB, yoy+82%, gross profit margin was 42.02%, year-on-year +7.14pct; the company’s product demand was strong, production and sales increased significantly compared with the same period last year, and profit increased significantly year-on-year.

Break the international monopoly and increase the production capacity of aramid. The aramid fiber industry has extremely high production process and technical barriers. Taihe New Materials realized the industrialization and production of meta-aramid fiber and para-aramid fiber in 2004 and 2011 respectively, breaking the international monopoly. At present, the total production capacity of aramid fiber is 11,500. ton/year, ranking third in the world.

In October 2021, the company announced that it will continue to increase the construction of para-aramid and meta-aramid. It is expected that the company’s para-aramid and meta-aramid production capacity will both exceed 20,000 tons in 2024, and the total total production capacity will exceed 40,000 tons. Judging from the current capacity planning of global aramid manufacturers, Taihe New Materials has surpassed Teijin of Japan, and its long-term production capacity ranks second in the world.

Double Elephant Shares

High-end PMMA produced by bulk polymerization, leading the world in capacity expansion.

PMMA is expected to replace PVDF in water-based lithium battery coating applications. PMMA, commonly known as plexiglass, is polymerized from MMA monomers. The world’s mainstream PMMA manufacturers all use the bulk production technology, which can be used in high-end fields such as automobiles, electronic appliances, medicine, and light guide plates.

Among them, the optical-grade PMMA process technology is difficult and the cost is high. Before that, there was not much production capacity in China. With the acceleration of the Chinese production process of PMMA, and the leading enterprises have improved the manufacturing process to solve the problem of high internal resistance of the PMMA coating film.

According to industry chain research, some head seperator factories in China have used PMMA as a substitute for PVDF in water-based coatings. Previously, problems such as the increase in internal resistance of batteries caused by PMMA coating have been solved in the base film link, and the downstream feedback has been good.

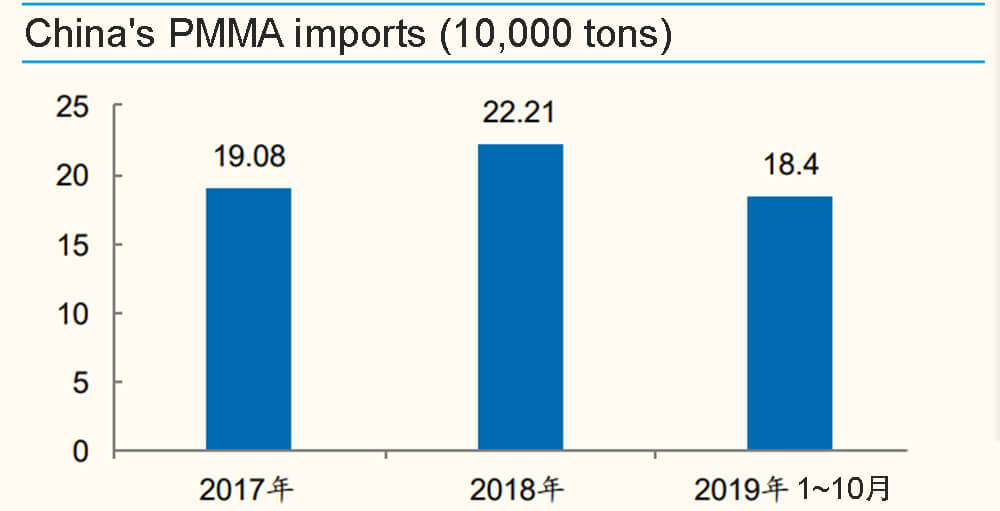

China’s PMMA imports

High-end PMMA is still mainly imported, and Chinese-made enterprises are actively expanding production. High-end optical-grade PMMA products have a large market demand. At present, the market share and production capacity are mainly controlled by several international chemical giants. China still needs to import in large quantities every year (Double Elephant Co., Ltd. “Annual Production of 300,000 tons of Optical Grade PMMAMS New Materials Investment Agreement”).

According to the research center, companies in China that can achieve mass production of optical-grade PMMA at this stage include Shuangxiang Co., Ltd., Wanhua Chemical, etc., and the current scale is below 100,000 tons per year. Among them, Vientiane Co., Ltd. announced in March 2021 that it will invest 1.8 billion RMB Construction of a 300,000-ton optical-grade PMMA/MS project.

The business is purely PMMA, and the operating income maintains high growth. Double Elephant is a leading company in China’s optical grade PMMA industry. In 2019-1H21, Shuangxiang’s PMMA revenue was 6.46/7.21/340 million RMB respectively, a year-on-year change of -5%/12%/-3.97%, respectively. The fluctuation in revenue was mainly due to the impact of the epidemic.

In 2020, the company’s net profit attributable to the parent company is 40.8997 million RMB, a year-on-year increase of 35.06%, mainly due to the increase in operating income and net profit of optical-grade PMMA industry chain products. PMMA accounts for about 50% of the company’s total revenue. The company’s main business is pure, and it is expected to fully benefit from the performance elasticity brought about by the growth of PMMA.

High-end PMMA produced by bulk polymerization, leading the world in capacity expansion. PMMA production technology mainly includes three processes: suspension polymerization, solution polymerization and bulk polymerization. At present, only bulk polymerization method can produce high-end PMMA products. Only Shuangxiang and Wanhua Chemical have the bulk method in China, with a total production capacity of 160,000 tons/year.

Among them, Double Elephant has announced to expand the PMMA/MS project of 300,000 tons/year. It is expected that the company’s optical-grade PMMA production capacity is expected to reach 380,000 tons/year in 2023, ranking among the top in the world. PMMA produced by solution polymerization and cracking can only be used in the low-end market, and there is currently a surplus of low-end products in China.

Lithium battery coating material supply chain

Shifting the industrial chain to China to help local suppliers

The coating industry chain shifts to China

seperator coating plants have covered mainstream lithium battery coating materials & processes. At present, various lithium battery coating film manufacturers have covered mainstream lithium battery coating materials, including boehmite, alumina, PVDF, etc., and some seperator factories also have the ability to self-produce & coat PMMA. Although the lithium battery coating film factory already has the aramid lithium battery coating technology, the aramid material has not yet been applied to the battery on a large scale.

According to feedback from the industry chain, aramid lithium battery coating involves the use of patents. Currently, only a few seperator factories in China have aramid lithium battery coating patents, which is one of the reasons that restricts its development. In the future, with the acceleration of the production process of aramid materials in China, and the expiration of other country’s patents such as DuPont and Teijin, the penetration rate of aramid in lithium battery coating is expected to continue to rise.

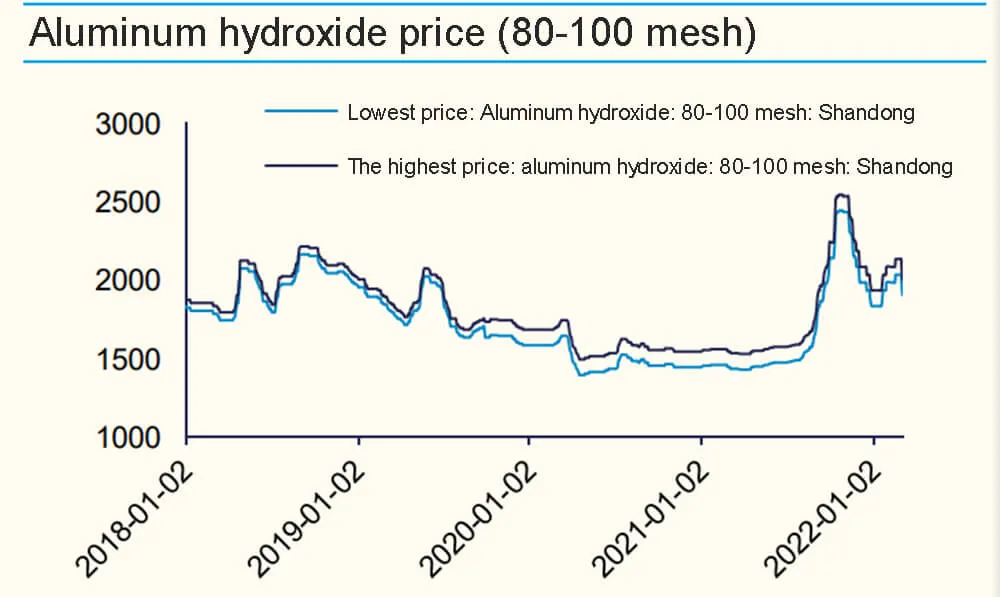

Aluminum hydroxide price

The transfer of the seperator industry chain to China will benefit local lithium battery coating material suppliers. Judging from the purchase of separators by battery factories in recent years, almost all Chinese battery factories are equipped with local separators, and the purchase of coated films by battery factories in other countries has decreased significantly, and the overall separator industry chain has shifted to China.

In order to save transportation costs and additional losses caused by the deformation and deterioration of lithium battery coating materials during transportation, the industry chain tends to purchase local lithium battery coating materials, which is expected to gain Chinese lithium battery coating material suppliers. The current situation of Chinese lithium battery coating material suppliers is as follows:

1) Boehmite: Estone and Chinalco Zhengzhou Research Institute are the main Chinese boehmite suppliers, of which Estone’s share of boehmite in CATL, EVE, and Guoxuan Gaoke is expected to exceed 70%; other Chinese boehmite producers Including Jidun new materials and national porcelain materials, the scale is currently small.

2) PVDF: China’s seperator-grade PVDF suppliers include Dongguang, Sanaifu, Fonolin, Sinochem Lantian, Putailai, etc., and cathode PVDF suppliers include Fonolin, Dongyue Group, Sinochem Lantian, etc., among which Sunshine is the PVDF supplier of CATL.

3)Aramid: Aramid for lithium battery coating has not yet started in large-scale production in China. At present, China’s aramid supplier is Taihe New Materials. The company has established an aramid lithium battery coating research group, which is jointly promoted with Enjie and Xingyuan.

4.2 Boehmite supply chain: raw materials have been localized, and seperator coating applications account for a high proportion

The raw materials are localized in China, and the cost is improving year by year. The upstream boehmite is aluminum hydroxide, the content of which is >99%, the auxiliary materials are pure water (deionized water, soft water), and the boehmite raw materials are ordinary chemicals, which have been completely produced in China.

From 2018 to 2020, the price of aluminum hydroxide showed a slight fluctuation and decline. Until mid-2021, the price began to climb to around 2,000 RMB/ton, mainly because the upstream aluminum price continued to rise.

As far as specific companies are concerned, the purchase price of Estone’s aluminum hydroxide particles (aluminum hydroxide processed products) from 2018 to 2020 was 3917/3946/3436 RMB/ton respectively. The slight increase in the unit purchase price in 2019 was mainly due to the improvement of the products by the suppliers. Performance pricing has been slightly improved, and the suppliers of Estone Aluminum Hydroxide Particles are China Aluminum New Materials and Luoyang Zhongchao New Materials.

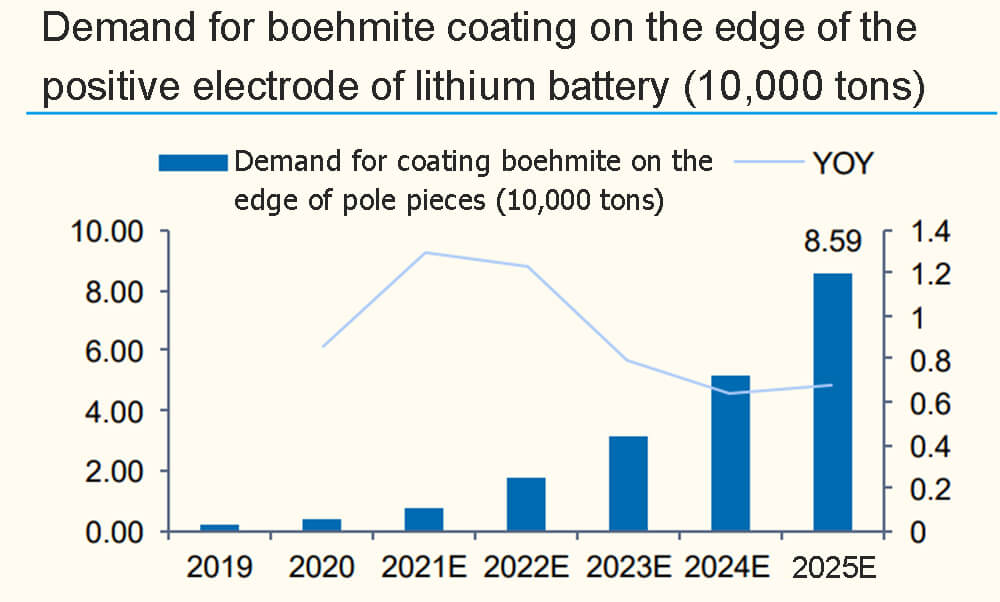

Demand for boehmite coating on the edge of the positive electrode of lithium battery

The downstream applications of boehmite are mainly lithium battery separator and pole piece lithium battery coating. The downstream applications of boehmite are mainly used for power lithium battery separator and pole piece lithium battery coating, and the downstream applications are mainly new energy vehicles.

According to estimates, the downstream demand for boehmite in 2021 will be 93.5%/6.4%/0.1% for lithium battery separator coating/positive pole piece edge coating/negative pole piece edge coating respectively. Currently, boehmite is used for lithium battery separator coating. Applications account for the largest proportion.

According to estimates, in 2022/2023/2024/2025, the demand for lithium battery coating materials on the edge of the positive pole piece will be 1.76/3.14/5.12/85,900 tons, and the boehmite penetration rate in this field is 100%. We predict that the downstream demand for boehmite lithium battery separator coating/positive electrode edge coating/negative electrode edge coating will change to 87.6%/9.9%/2.5% in 2025, and the demand for electrode edge coating will increase.

Discussion on future trends of lithium battery coating

The seperator needs to take into account safety and lightness, and aramid has long-term growth potential.

Aramid coating will become mainstream in the future

It is the future development direction of the seperator to enhance the safety performance of the seperator while being thinner and lighter. We believe that in the future, the seperator will be thinner and lighter, and the thermal stability and magnetic foreign matter control safety performance will be improved:

1) Thinner seperator: The thinner the seperator, the smaller the internal resistance of the battery, which can leave more space for positive and negative electrode materials, and can reduce the probability of component dislocation during processing. At the same time, the thinner seperator is also more suitable for thinner and smaller high-end digital products.

Separator Thin and light composite lithium battery is the industry development direction of increasing energy density and more and more high-end digital battery applications. At the current technical level, reducing the thickness of the separator is one of the most effective ways to improve the energy density of lithium batteries.

2) Improved thermal stability: Double-sided coating can effectively enhance the puncture resistance of the lithium battery separator, and improve the heat resistance of the lithium battery separator, so that the heat resistance temperature of the lithium battery coating is increased from 130 degrees to 150 degrees, which effectively improves the separator. security.

3) Reduction of the content of magnetic foreign matter: The content of magnetic foreign matter can directly affect the safety of the battery. The control of magnetic foreign matter has become the main technical barrier of the industry and an important research direction to further improve the quality of boehmite.

Estone’s next-generation seperator material research and development direction is nano-boehmite. According to Estone’s announcement, the company’s next-generation boehmite products are positioned in nanoscale sizes, which can further reduce the existing 2-3µm lithium battery coating thickness to 1µm and below,it can be used for ultra-thin membrane lithium battery coating, the material size is significantly smaller than the current boehmite material, and the tensile strength and puncture resistance of the membrane can be maintained under the condition of reducing the lithium battery coating thickness.

Influence of separator product performance on battery performance

(-1/0/1 for negative correlation/no correlation/positive correlation)

Aramid considers safety and lightness, and will become the mainstream in the future. Aramid has good consistency and no particles. The lithium battery coating is very thin between 1μm and 2μm. It is the only organic material that can be coated alone without inorganic materials to maintain high performance. It has, we think it is the most excellent separator lithium battery coating material at present.

However, according to estimates, the current cost of aramid lithium battery coating per flat is about 1.02 RMB/sqm, corresponding to a single GWh cost of about 10.49 million RMB, and boehmite is only 0.37 RMB/sqm, corresponding to a single GWh cost of about 2.96 million RMB. The performance is enough to meet the basic requirements of lithium battery separators. Aramid is not cost-effective at this price, and is currently only assembled on a small number of high-end batteries that pursue high energy density.

We judge that if the price of aramid fiber is reduced to less than 50,000 RMB/ton in the future with the acceleration of the localization process of aramid in China, and the lithium battery coating thickness is within 1μm, it may become the mainstream lithium battery coating material.

To learn more about battery separator companies, visit Top 5 wet process separator companies and Top 5 dry process separator companies.