Lithium two-wheeler industry in China in Q1 2022 - sales increase by 21.6% YoY

Lithium electric two-wheeled vehicle industry operation tracking

According to data, the sales volume of electric two-wheelers in China in 2021 reached 53.375 million units, up 16.5% year on year, and the sales volume of lithium two-wheelers reached 9.287 million units, up 22.6% year on year, with a penetration rate of 17.4%. For more information, check out our Top 10 two-wheelers battery manufacturers.

In 2021, the growth rate of other two-wheelers and battery swapping market is fast, thus driving the overall market growth, but the growth rate of lithium two-wheelers in 2021 is not as expected, mainly due to:

1) The price of key raw materials for lithium batteries has risen since 2021, leading to the price rise of lithium batteries and weakening the competitive advantage of lead-acid batteries;

2) The development of shared bike market, which contributed to the major increment of lithium electric two-wheeler, slowed down. In 2021, the management of shared bike launch was tightened, and the launch of shared bike dropped sharply.

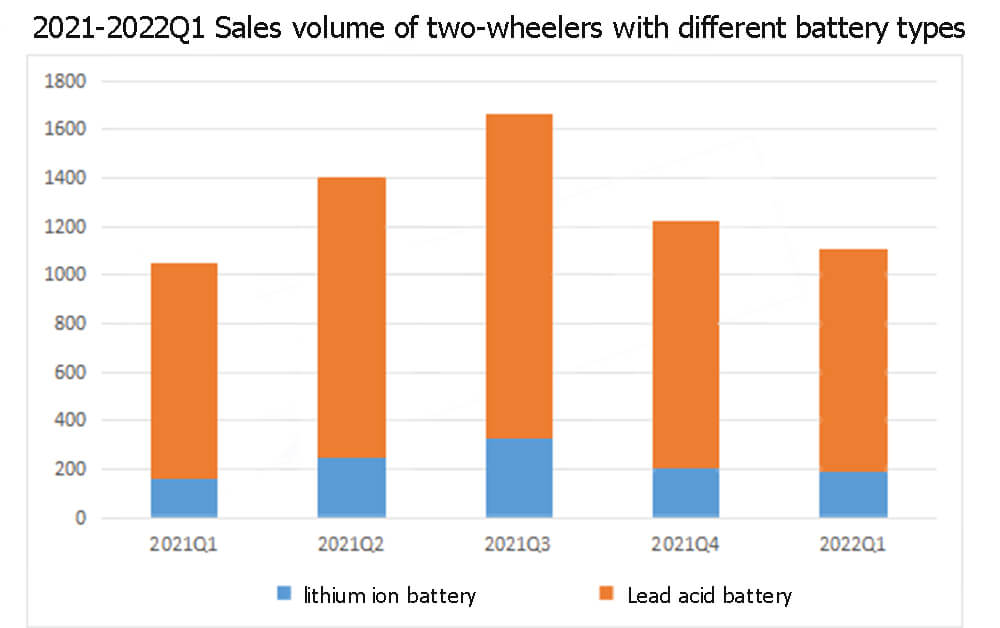

2021-2022Q1 Sales volume of two-wheelers with different battery types (10,000 units)

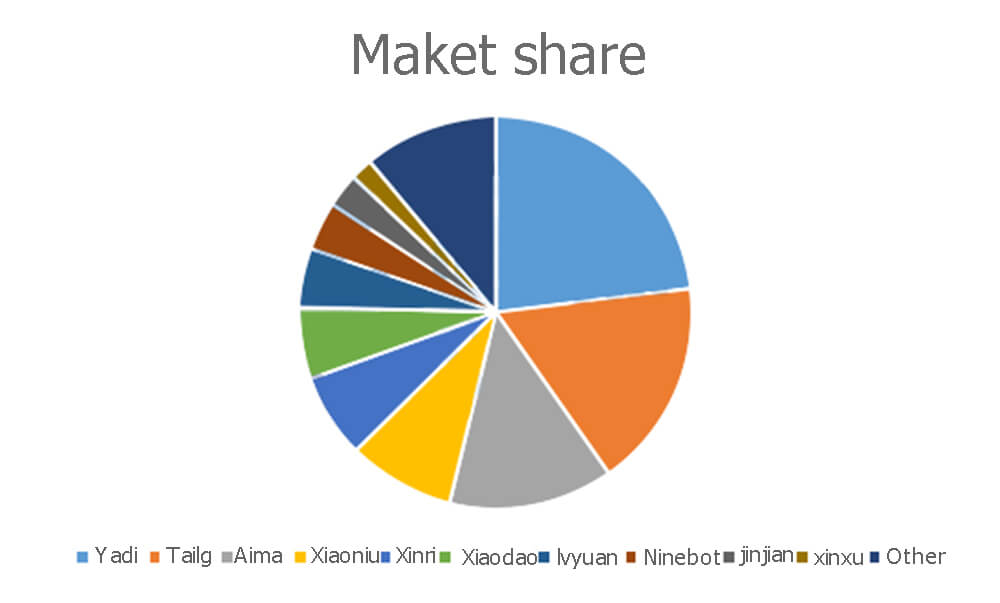

In the first quarter of 2022, the sales volume of electric two-wheelers in China reached 11.073 million units, up 5.7% year on year, among which the sales volume of lithium two-wheelers reached 1.861 million units, up 21.6% year on year, and the penetration rate reached 16.8%. From the perspective of competition pattern, the total market share of Q1 top10 enterprises reached 88.9%.

2022Q1 Top 10 lithium electric two-wheeler sales

Operation of shared motorcycle industry

In 2022Q1, according to the data of qidian research institute, the concentration of the TOP3 in the competition pattern of shared electric bikes is over 60%. In the future, with the improvement of the government’s requirements for the operation qualification of shared electric bikes and the implementation of the bidding system, CR3 will continue to improve, and the local government will control the number of shared electric bike operating enterprises within 3-5.

The market share of shared bikes is expected to surpass that of shared bikes by 2025 as people’s travel requirements continue to rise and the urbanization rate continues to rise.

(1) Market trend: The concentration of competitive pattern of shared motorcycles will continue to improve, but at the same time, it will maintain a long tail pattern in the long term. Mainly due to the serious protection of local areas, regional shared bicycle operators have strong profitability, and the relationship with local governments is deeply bound, so it is difficult to eliminate all of them in the short term.

② Policy trend: 2020 is the first year of shared electric bikes, excessive delivery brings pressure to municipal management, a number of cities issued relevant regulations, control the total size of delivery, the implementation of tender delivery management, it is expected that within 1-2 years, the policy will form standardized management of the industry, the growth of the industry slowed.

(3)Investment trend: With the stricter government regulation, the investment heat of the industry decreases. In 2021, the investment amount of the head enterprise decreases greatly compared with the previous year, and the investment of the industry will grow steadily in the future.

Two-wheel vehicle battery swapping industry operation

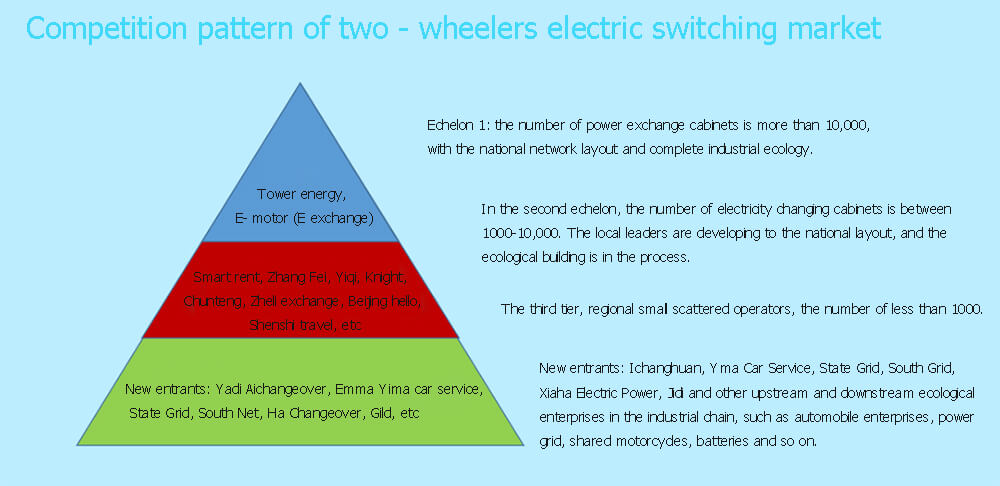

At present, two-wheel vehicle electrical exchange is in the early stage of development, and various enterprises are stepping up their market layout to seek first-mover advantage and developing the battery swapping staion business model to seize the market, and the industry competition is increasingly fierce.

In recent years, many enterprises and capital are optimistic about the prospects of the two-rotation electricity market, such as CATL, China Tower and other large enterprises as well as Tencent, Ali, Ant Financial, Meituan and other Internet giants have entered the market, start-up companies continue to emerge, competing to develop the electricity market.

In the first echelon: the number of battery swapping station is more than 10,000, with the national network layout and complete industrial ecology.

In the second echelon: the number of battery swapping stations is between 1000-10,000. The local leaders are developing to the national layout, and the ecological building is in the process.

In the third echelon:regional small scattered operators, the number of less than 1000.

New entrants: Ichanghuan, Yma Car Service, State Grid, South Grid, Xiaha Electric Power, Jidi and other upstream and downstream ecological enterprises in the industrial chain, such as automobile enterprises, power grid, shared motorcycles, batteries and so on.

Competition pattern of two – wheelers battery swapping market

At the same time, driven by the dividend of the power exchange market, yadi, Aima, Xinri, Tailing, Luyuan and many dealers in the electric bicycle and accessories industry, as well as Xingheng Power Supply, Xupi, Hongqiao Group, Zhongtianhong Lithium and Far East Foster and many other lithium enterprises have also set foot in the power exchange business. The industry has developed rapidly and the competition in the industry has upgraded. Before that, we have listed Top 10 electric motorcycle battery swapping companies in China.

Market analysis of lithium batteries for two-wheelers in China

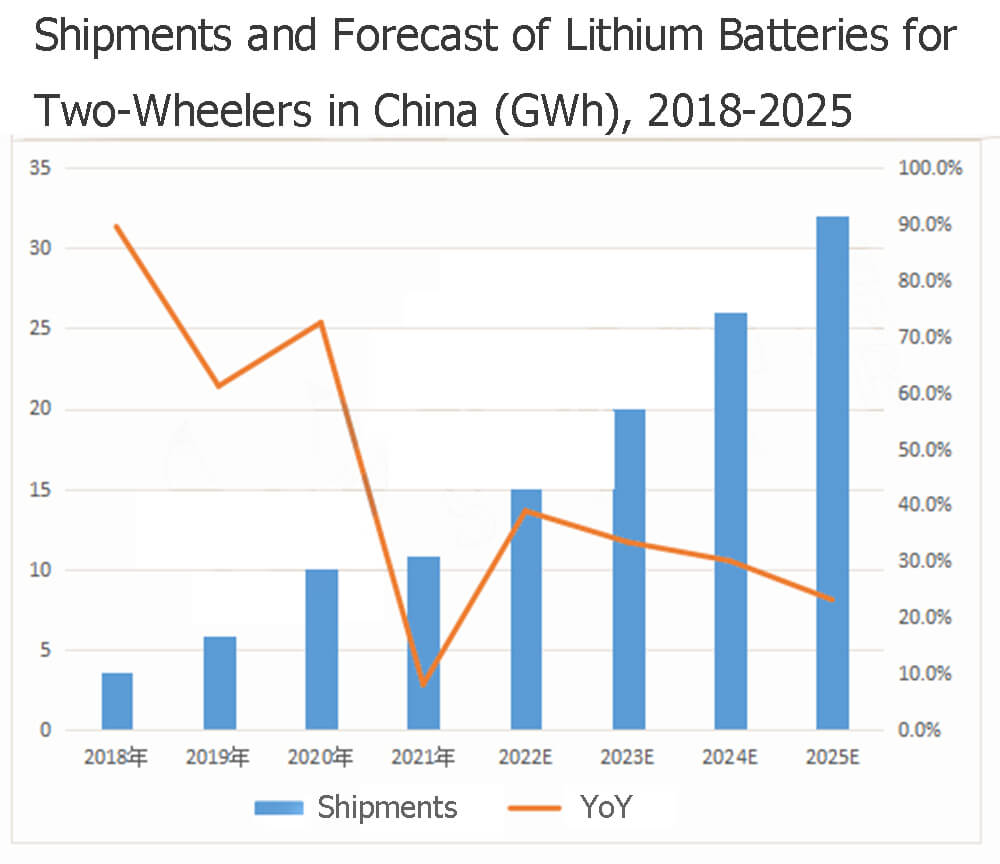

Data showed that shipments of lithium batteries for two-wheelers in China in 2021 were 10.8GWh, up 8% year-on-year. In 2021, the other countries two-wheeler and battery swapping market grew rapidly, which drove the overall market growth. However, the growth rate of lithium two-wheeler in 2021 was lower than expected, which is a cliff decline compared with the growth rate of over 72% in 2020. The main reasons are as follows:

1) The price of key raw materials for lithium batteries has risen since 2021, leading to the price rise of lithium batteries and weakening the competitive advantage of lead-acid batteries.

2) The development of the shared bike market, which contributes to the major increment of lithium two-wheelers, slows down. In 2021, the management of the shared bike launch will be tightened and the launch of shared bikes will decline sharply;

3) The phenomenon of “lithium changing to lead” in sales channels is serious, and the sales of lithium electric models in terminal sales are not as expected.

At present, the penetration rate of lithium batteries is still relatively low, mainly because Chinese consumers of electric two-wheelers are more price sensitive, and the price of lithium batteries is often higher than that of lead-acid batteries, but the difference is gradually narrowing.

With the gradual improvement of industry standardization and standardization, as well as the reduction of the cost of 72 volt 50ah LifePO4 battery and the acceleration of the replacement of lead acid, in the long term, the general trend of electric two-wheel lithium electrification will not change, and it is expected that the shipments of lithium batteries for two-wheel vehicles in China will reach 32GWh by 2025.

Shipments and forecast of lithium batteries for two-wheelers in china (GWh), 2018-2025