Home » lithium ion battery knowledge » Current status and development of European batteries

Current status and development of European batteries

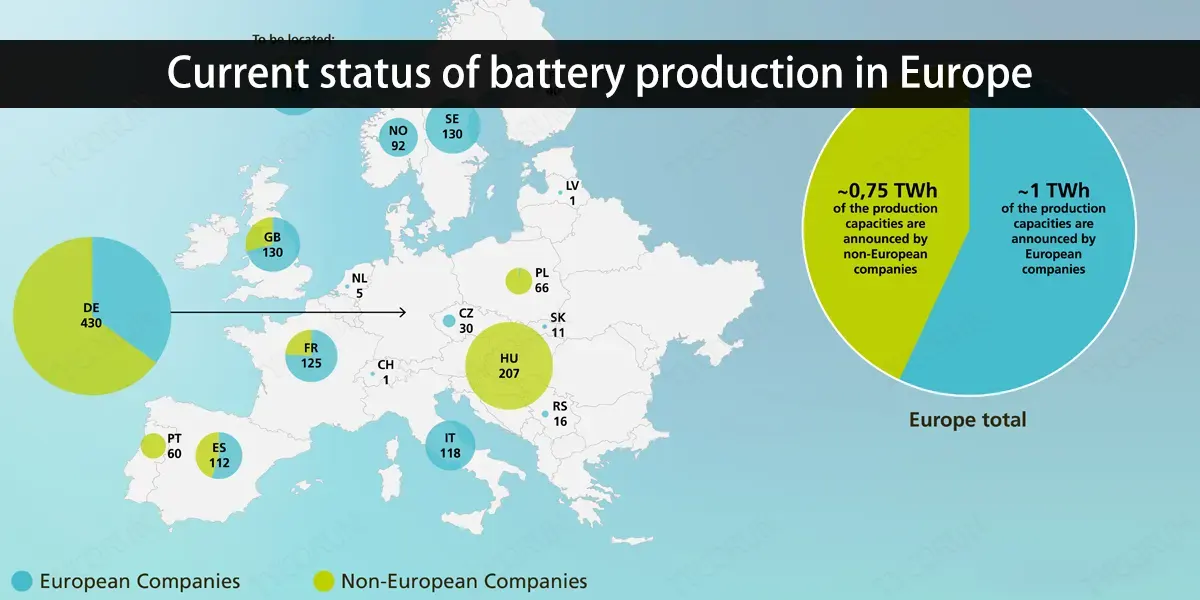

Current status of battery production in Europe

Batteries are the focus of recent European industrial policy. The EU proposal sets multiple goals, requiring that by 2030, at least 10% of key raw materials should come from the EU every year; at least 40% of key raw materials should be processed in the EU; and at least 15% of raw materials need to be recycled. Key raw materials needed for batteries such as graphite are among the requirements.

In addition to setting local manufacturing proportion targets, Europe has also launched a number of incentive measures for the battery industry. In December 2023, the European Union and the United Kingdom announced that they would postpone the tax exemption policy for mutually imported electric vehicles for three years, leaving more time for the local battery industry to grow.

However, the actual situation is not optimistic.

Many institutions and foreign media have noticed that U.S. industrial subsidies are causing the outflow of European battery companies. Data indicate that Europe’s share of global lithium-ion battery investment will drop from 41% in 2021 to only 2% in 2022. At present, many European battery companies have expressed their intention to expand in the United States. These include star companies such as Swedish battery manufacturer Northvolt and Spanish electrical company Iberdrola.

Although Europe has paid more and more attention to the development of the local battery industry in recent years, so far, the scale of subsidies allowed by the EU member states is still generally low, and the scale of private investment expected to be driven is also relatively insufficient, making it difficult to have immediate results on the battery supply chain.

Since the United States provides relatively high subsidies to local battery manufacturers, many battery manufacturers pay more attention to the US market when making production layouts.

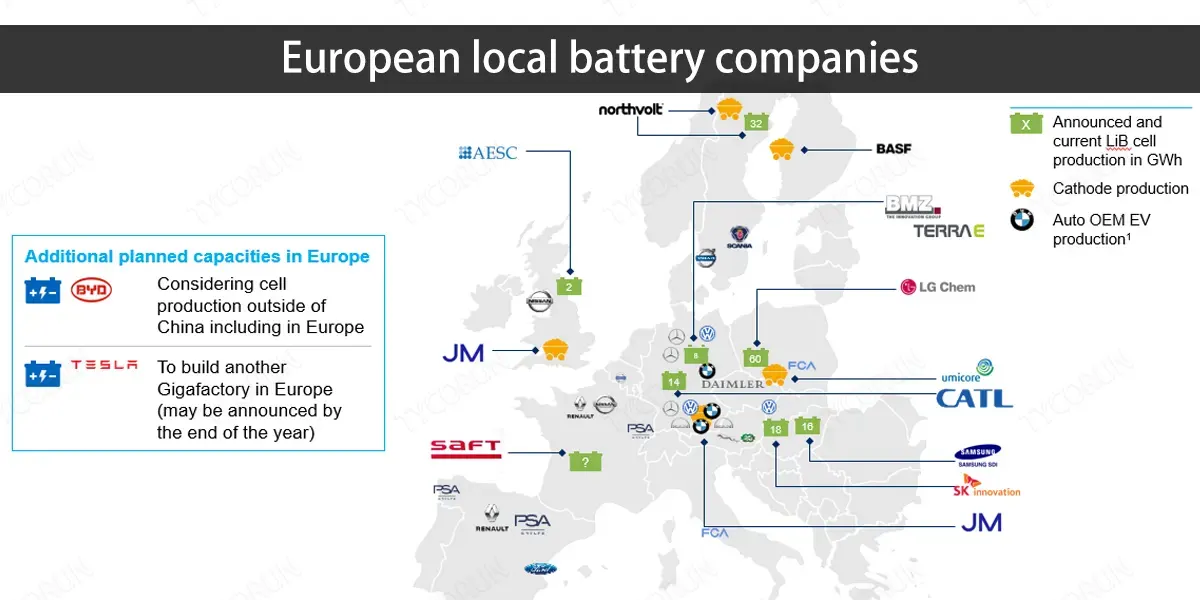

European local battery companies

Shortcomings in the supply of raw materials are also plaguing local European battery companies. The research report said that EU and UK electric car manufacturers currently have access to only 16% of the lithium, cobalt and nickel required for target production in 2030.

Europe is already “miles behind” in the global competition for raw materials for electric vehicle batteries. EU member states are completely dependent on imported processed lithium from some third-party countries such as Chile, the United States, China and Russia.

The overall development progress of the European battery industry is less than expected. Including Northern Water, a number of star startups in the battery field have encountered major difficulties, with delays in shipment plans and slow ramp-up of production capacity, and industry confidence has been hit.

A report stated that more than two-thirds of the lithium-ion battery production projects originally planned in Europe are at risk of being delayed, curtailed or canceled.

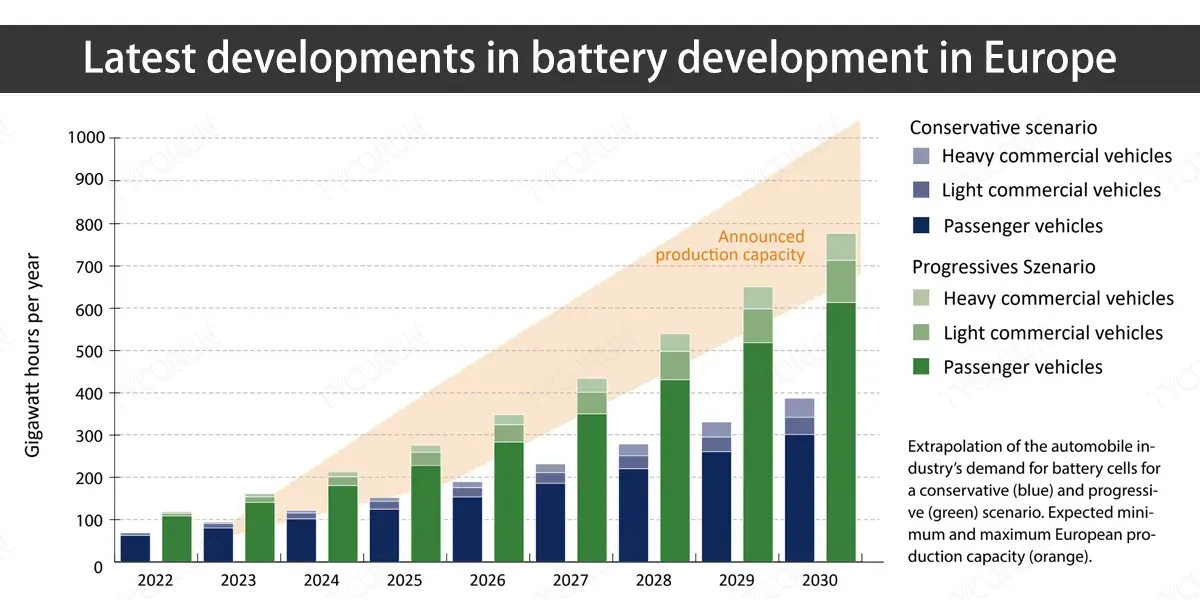

Latest developments in battery development in Europe

Founded in 2016, Northvolt is the most well-known local battery manufacturer in Europe. It has received investment from well-known institutions such as Volkswagen Group and Goldman Sachs Asset Management.

Northvolt officially announced that it has successfully developed sodium-ion batteries. Officials stated that this sodium-ion battery is composed of a hard carbon anode and a Prussian white cathode and does not contain lithium, nickel, cobalt and graphite. Its energy density exceeds 160 Wh/kg. However, the company did not disclose other technical indicators such as the cycle life of the battery.

Northvolt claims that this sodium-ion battery is safer, more cost-effective and sustainable than traditional ternary lithium battery or lithium iron phosphate batteries. Ternary batteries and lithium iron phosphate batteries are the two main types of lithium batteries.

Compared with traditional nickel cobalt manganese (NMC) and iron phosphate (LFP) batteries, its sodium-ion battery is safer and lower cost because it uses minerals such as iron and sodium that are more common on the market as raw materials.

Sodium-ion batteries use sodium salt as the electrode material. Compared with lithium-ion batteries, sodium-ion batteries have the advantages of abundant resource reserves, low cost, and fast charging, but they lag behind lithium-ion batteries in terms of energy density.

According to Northvolt’s plan, its first-generation sodium-ion batteries will be mainly used in the field of energy storage, and it plans to release sodium-ion batteries with higher energy density in the future to achieve applications in the field of electric vehicles.

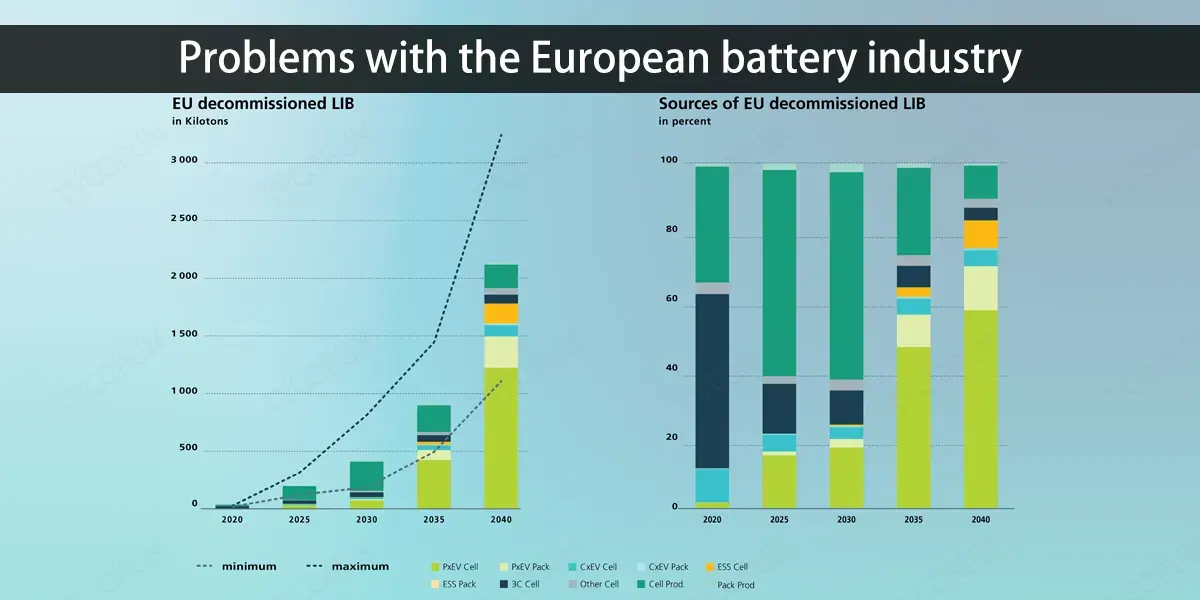

Problems with the European battery industry

There are multiple internal and external reasons behind the problems in the European battery industry.

The European battery industry faces internal structural challenges. By 2025, Europe will lack 800,000 skilled workers, and the costs for companies to obtain energy, land and government licenses are high. In addition, Europe currently produces only 1% of key raw materials for batteries, and is still far from self-sufficiency.

The EU faces a series of difficulties that cannot be ignored in developing its local battery industry chain. In all aspects, including the mining and refining of key raw materials, the production of key battery components, and battery processing and assembly, the domestic battery industry chain in Europe is quite fragile.

In terms of the mining and refining of key raw materials, European countries have very limited local reserves of cobalt, nickel, manganese and graphite, and have almost no control over overseas mining. In terms of the production of key battery components, European countries have limited access to production processes, labor skills, and equipment.

Manufacturers and production costs do not have an advantage; in terms of battery processing and assembly, EU countries are also at a relative disadvantage in terms of technology and cost. Many shortcomings are difficult to make up for in a short period of time.

Europe, as a long-term gathering place for the global automotive industry, has increasingly seen inherent constraints in the process of electrification transformation. European automakers’ attempts at electrification are not too late. For example, BMW launched its first mass-produced electric model, the i3, in 2013, almost at the same time as Tesla launched the Model S.

However, Europe has long-term doubts about the transformation of the automobile industry, which directly affects the development progress of Europe’s new energy industry chain. At present, there are not enough types of manufacturers on the European electric vehicle “track”, making it difficult to form an industrial chain covering the entire chain and key nodes. In addition, there is a lack of representative companies such as Tesla to efficiently cultivate the new energy industry chain, including batteries, so the competitiveness of the industry chain is relatively insufficient.

Europe has always faced the challenge of lack of coordination among countries and difficulty in fully tapping the potential of the internal large market. In recent years, Germany, France, Italy and other countries have competed to formulate R&D and investment plans in the local battery industry chain. However, there has always been a lack of effective coordination in implementation, making it difficult to form synergy, resulting in a waste of resources and difficulty in taking advantage of economies of scale.

External competition has also squeezed the European battery industry.

Many battery companies now believe that applying for funding in Europe is complicated and slow. Existing EU funding is a patchwork of inadequate, uncoordinated and complex programmes, and focuses primarily on research and development rather than large-scale production. These projects and funding are not enough to drive Europe’s green transition.

Under the current new pattern of the global battery industry, the European battery industry has limited resources to expand production. The squeeze from the U.S. battery industry and policies will further affect the development space of the European battery industry.

Related information: Top 10 lithium ion battery manufacturers in France, Top 10 battery manufacturers in Germany, Top 10 battery manufacturers in Spain